BlackJack3D/E+ via Getty Images

Investment Thesis

I like companies that leverage strong ecosystems because this approach is a powerful combination for creating strong cross-selling opportunities, increasing switching costs for customers, and building sustainable value for shareholders. In this respect, Block, Inc.New York Stock Exchange:Square) is a unique company in that it leverages two ecosystems simultaneously. This creates a significant opportunity for the company to drive strong revenue growth over a longer period of time. The business is resilient to challenges and broad diversification across different revenue streams is also an indicator of strength. The company has ample financial space to continue investing in innovation and differentiation, which will likely help build a bulwark. My valuation analysis indicates that the stock is about fairly valued and this is an attractive opportunity for such a great business. Block is definitely a “Strong Buy” for me. There is a great Warren Buffett quote and it is one of my favorites. The most preferred one.

It’s much better to buy a great company at a fair price than a mediocre company at a great price.

Company Information

Block provides payment and point of sale (POS) solutions to merchants in the U.S. and internationally.

The company’s fiscal year ends on Dec. 31 and has two reportable segments: Square and Cash App. Square serves merchants with a combination of software, hardware and financial products. Cash App is an ecosystem of financial products and services that serve consumers.

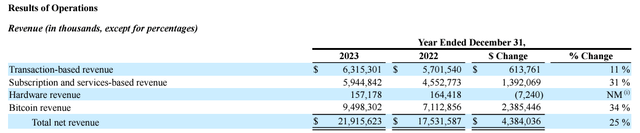

by Latest 10-K reportCash App is the largest segment, accounting for approximately 67% of the company’s total revenue in fiscal year 2023. It is also important to understand the company’s revenue by type, with Bitcoin revenue being the largest.

Finance

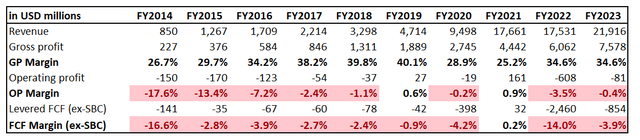

Looking at the long-term trends of a company’s performance, we can understand how the numbers reflect the efficiency and potential of its business model. Over the past decade, Block’s revenue has grown at an astounding 44% CAGR.

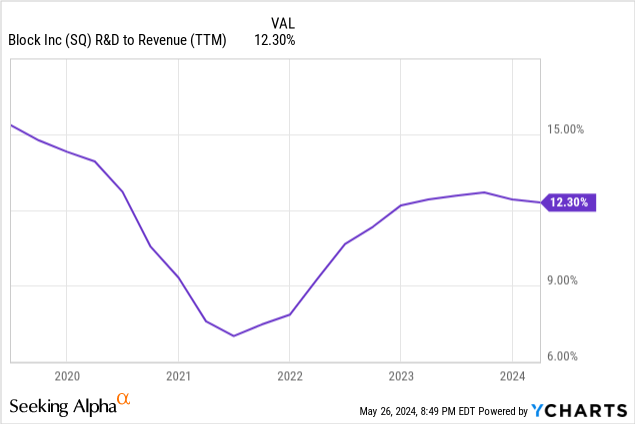

A key factor is that gross margins have improved as the business has scaled, indicating that the business model is economically sound and able to leverage economies of scale. Operating margins and free cash flow (FCF) margins were also showing positive movement before the company significantly increased its R&D spending starting in 2021. The company is investing $2.7 billion in R&D in FY23, which significantly impacted operating margins and FCF margins.

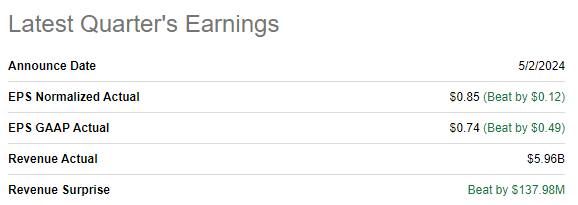

The latest quarterly results were released on May 2nd, and the company beat consensus estimates on both revenue and EPS. Revenue grew 19.4% year over year, and adjusted EPS more than doubled from $0.40 to $0.85. The strength of the EPS was underpinned by a solid improvement in operating margins year over year from -0.12% to 4.19%. Block generated $900 million in FCF in the first quarter, translating to a 15% FCF margin. Even excluding stock-based compensation (SBC), FCF margins look solid, which is around 10%.

Find Alpha

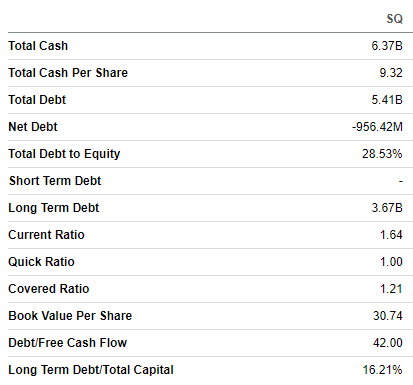

Despite near-zero FCF margins in recent years, Block’s balance sheet is strong with moderate leverage and a net cash position. Liquidity metrics are also in good shape, giving SQ solid financial flexibility to support further expansion and innovation. Like many growth companies, SQ has shown an increase in shares outstanding; however, dilution does not appear to be dramatic as shares outstanding have grown over the past two years from approximately 580 million shares to 617 million shares as of the last reporting date.

Find Alpha

As you can see, the company has demonstrated a strong long-term trend in financial performance, and while the recent strength has strengthened my optimism, I want to discuss its future outlook.

The Block’s latest earnings release

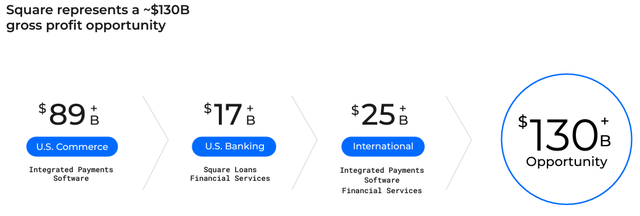

The company primarily targets small and medium-sized businesses (SMBs), so the addressable market is huge. About 44% of the US economyThe company sees a massive gross profit opportunity of $130 billion and believes there is still significant potential for growth.

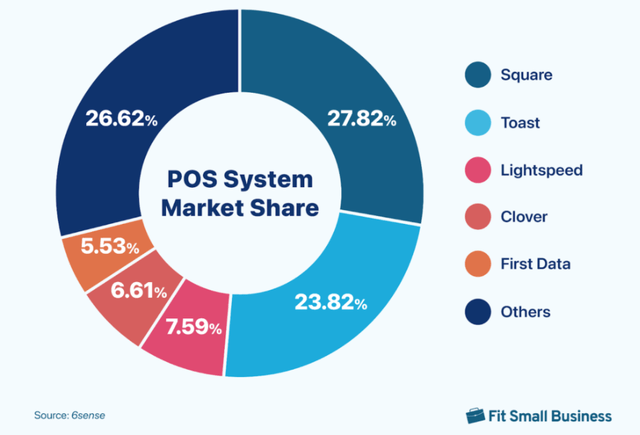

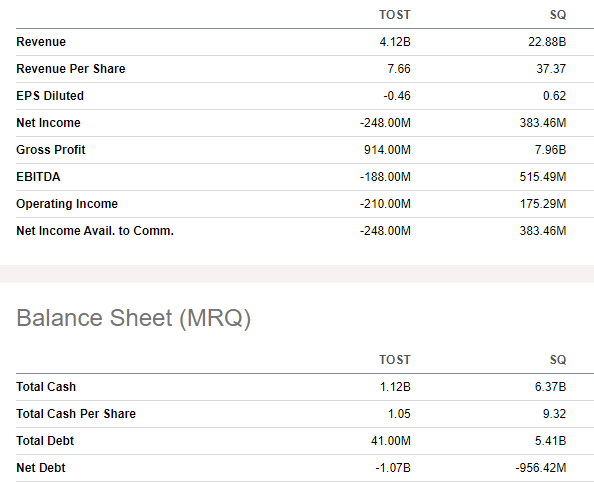

The block is the largest, Approximately 27%Toast Corporation, which boasts the No. 1 share in the POS marketTost) is not far behind with a 24% market share. But when it comes to the scale of the two companies, there is no comparison: Block has over five times higher revenues and much greater potential for reinvestment and innovation. This puts Block in a much better position to compete among these two companies.

Find Alpha

Understanding Brock’s dominance in the cloud POS market is important as the industry is booming. Mordor IntelligenceThe cloud POS market is projected to grow at a CAGR of 24.2%, which is a strong tailwind, especially given Block’s leading position in this niche.

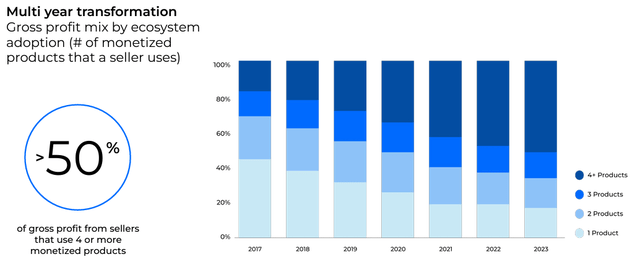

Another strong bullish sign is that each of the company’s segments form an independent ecosystem, which has allowed the company to significantly strengthen its business mix through cross-selling: the percentage of gross profits derived from customers adopting four or more products continues to grow and already accounts for around 50%.

In my opinion, companies build ecosystems to increase cross-selling possibilities and customer switching costs. The bar chart above shows that SQ has been quite successful in pursuing these two tasks.

by Latest 10-Q reportAbout 94% of Square’s revenue is generated in the U.S., with international revenue of less than $400 million in the quarter, meaning there’s a big opportunity for international expansion.

Finally, in addition to focusing on top-line development, management Cost efficiency has begun to take priority Likewise, this signals the company is moving into a new phase of growth where quality growth will be more important than growth at all costs.

Overall, we like Brock’s business model, which leverages two ecosystems simultaneously, creating strong cross-selling potential. The market opportunity is huge, both domestically and internationally. The business mix is diversified across various revenue streams and end markets, which has led to a stable financial performance for the company. This is supported by the fact that revenue did not decline even in a very challenging FY22 and gross margins expanded during this turbulent year.

evaluation

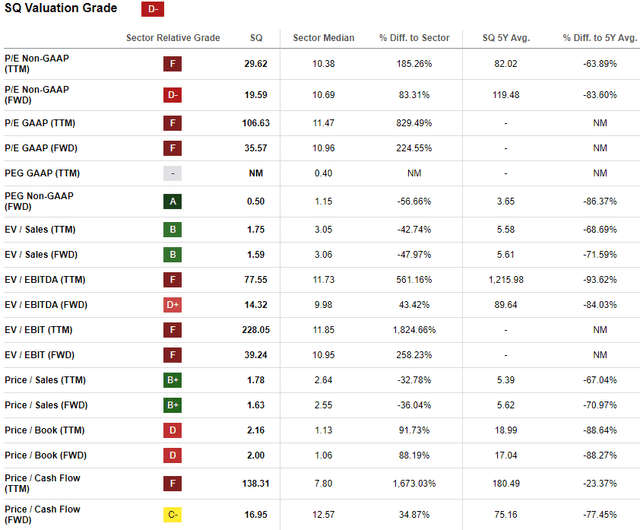

SQ is currently trading several times lower than the 2021 highs it reached during the pandemic-induced stock market frenzy. Despite this decline, its valuation ratio is still very high compared to the sector median. On the other hand, SQ is a company that has shown a 44% earnings CAGR over the past decade, so comparing it to the sector median may not be accurate.

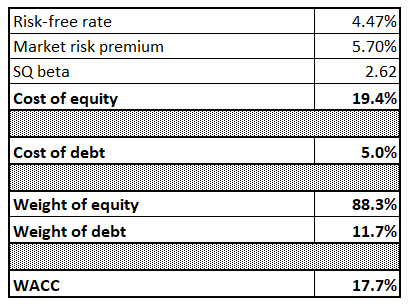

In Block’s case, looking at valuation ratios isn’t very useful, so we need to simulate a discounted cash flow model (DCF). The resources we typically turn to to get a company’s WACC give us very different recommendations on SQ, so we decided to calculate it ourselves.

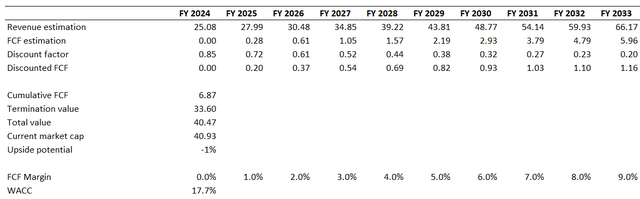

The risk-free rate is the 10-year government bond yield 4.47% At the moment, market risk premiums are at last year’s levels. 5.7%According to SeekingAlpha, the beta version of Block is 2.62The weighting of debt is not significant, so we apply a rule of thumb of 5% for the cost of debt, and since SQ has losses, no tax deductions are applied. Overall, Block’s WACC is 17.7%.

Author’s calculations

Rely on Revenue consensus forecast This has proven to be a sound valuation strategy for me. Moreover, with a projected CAGR of 11%, it doesn’t appear that consensus forecasts are overstating revenue growth. Block’s FCF margins are still hovering near zero, which will be my forecast for the base year. Beyond FY2024, I expect FCF to expand by 1 percentage point annually.

As mentioned above, SQ’s current market cap is very close to the fair value of the company, making SQ nearly perfectly priced.

Risks to consider

SQ’s addressable market is large, so competition in the sector is likely to intensify. Competition in digital payments is already fierce, with several big-name brands, such as Apple Inc., already in the mix.AAPL), Alphabet Inc. (Google), (Google), PayPal Holdings, Inc.Pipple), Visa Inc.Five), MasterCard Incorporated (MassachusettsThe ability to adapt and transform quickly to changing consumer preferences is a key factor in remaining competitive. Differentiating oneself from the competition requires significant investments in research and development and calls for exceptional efficiency from management.

While international expansion is a definite growth opportunity for SQ, it must be understood that doing business internationally increases legal and foreign exchange risks significantly. Furthermore, domestic success does not guarantee international success for SQ.

As a company that handles financial and other sensitive customer data, Block is exposed to significant data privacy and cybersecurity risks. A data breach could damage the company’s reputation and lead to litigation and financial dislocation.

Conclusion

In conclusion, Block is a “Strong Buy.” Block is a great company with great growth potential and strong resilience. The current share price is close to fair value and companies like SQ arguably should be trading at a premium, making it an attractive opportunity.