Jose Luis Pelaez Inc/DigitalVision via Getty Images

Go Health (Nasdaq:Goko) is a large broker of insurance products, particularly the popular Medicare Advantage plans, where Medicare benefits are provided by private insurers. The company also sells Medicare Supplement plans and GoHealth also serves other insurance product lines. Here’s a basic overview of the business model: Consumers looking for the Medicare plan that best suits their needs can be faced with an overwhelming amount of choice, with many insurance companies offering different benefit options that can be difficult to compare and contrast. To guide consumers through the process, GoHealth acts as an intermediary between the consumer and multiple insurance partners, and once GoHealth accepts a new enrollment, the insurance company that will underwrite the policy enters into an agreement to pay GoHealth a commission.

Last time I used GoHealth article In November 2023, and my The bullish talking points, to quote my own words, revolved around the following:

New potential investors are presented with a company that is currently generating cash flow from operations, but with a price-to-operating cash flow multiple of just 3.70x over the past year and 3.35x at the median of 2023 operating cash flow guidance of $95 million. . . A price-to-operating cash flow multiple of 6x is close to financial sector levels and suggests a fair value close to $25 per share.

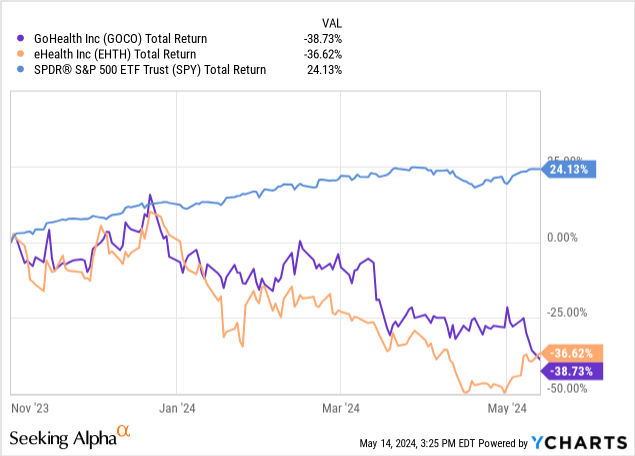

Since writing that review, the company’s stock price has fallen faster than market peer eHealth (Umm…), although I believe that from a fundamental point of view there has been steady and positive development.

I remain as bullish on GoHealth as ever, but expect it will take time for the stock to return to a fair value. On the plus side, I believe the stock is fundamentally overpriced at these levels, providing an opportunity for investors to build positions over time.

Financial Overview

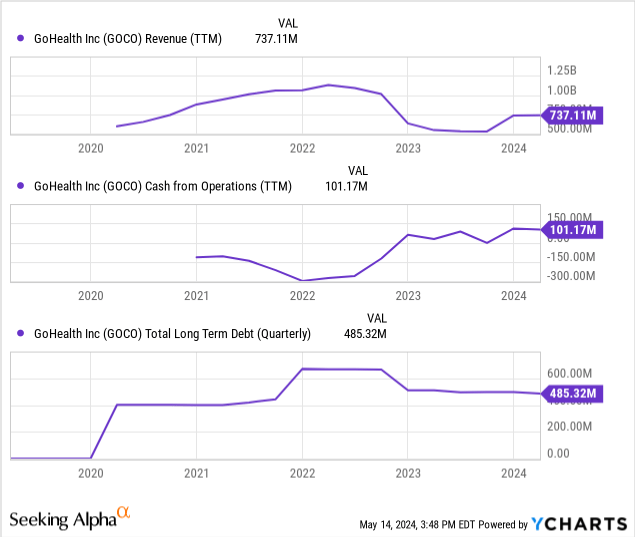

The full year 2023 and first quarter 2024 reports are now available for analysis. Looking at the big picture, we can see that the overall trends we previously liked are still progressing as expected, particularly around positive operating cash flow generation. We’ll get into the more specific numbers below, but first let’s pause and consider the story being told in the next three panels.

Looking back over the past 12 months, revenue has recovered slightly after a period when the previous management downplayed the growth at all costs mentality. Thus, while revenue was temporarily (and intentionally) trending downwards, during the same period the new management team began to intentionally focus on profitability and reduce costs, especially around customer acquisition costs. As shown in the first two panels, the results are a sort of negatively correlated mirror image: the time when revenue started to decline was roughly the same time that operating cash flow started to increase.

GoHealth has maintained positive or breakeven operating cash flow on a TTM basis for five consecutive quarters through the end of 2023. The total figure is not huge at $101.7 million from Q2 2023 to Q1 2024, but the change in itself is impressive enough given that it had never even come close prior to that.

Similarly, while the company was burning cash in its operations, it relied in part on debt financing, but as operating cash flow turned positive, we can also see that debt is being paid down. Indeed, GoHealth is paying down its debt on an accelerated schedule with additional principal payments, paying $50 million in April and another $25 million in the fourth quarter. This is significant for two reasons. First, the remaining debt is due in 2025, so it needs to be refinanced soon. With no maturities beyond that, refinancing a smaller debt package is viewed as less risky by creditors. Second, GoHealth is currently paying a floating rate that puts the interest rate at about 13%. In the first quarter of 2024, even though the principal balance was lower, it paid about $18 million in interest, about $1 million more than the same period in 2023.

Outlook and assessment

GoHealth’s market cap has fallen by about $100 million since November, but management has outlined an outlook for relatively stable to modest improvement, CEO Vijay Kotte said in concluding his prepared remarks on the company’s first-quarter results. Earnings Report He shared his expectations for next year:

First, we expect claims volume to grow in line with the overall Medicare market. Second, we expect revenue to be flat year over year with margins expanding slightly due to improved operating efficiencies. Finally, we expect operating cash flow to be flat to slightly increasing as we continue to transition to the Encompass model and non-agency revenues.

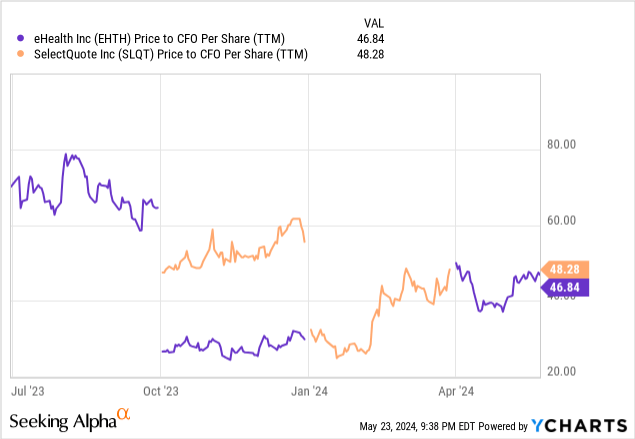

I particularly like the comment about operating cash flow. With a current market cap of just $222 million and a price-to-trading cash flow multiple of just 2.20x, if the forward guidance is maintained, the forward multiple should be the same as it is today.

Is that a good thing? There aren’t many direct comparisons other than eHealth and SelectQuote (SLQT), but with a P/CFO of 2.20x, GoHealth looks like it’s paying cheaply for its cash flows compared to peers at over 45.0x, especially if we assume the quality of those cash flows will sustain in the near term and grow in the long term.

Getting there may be difficult, but given the Baby Boomer demographic and the positive reception that Medicare Advantage programs have received, there’s no doubt that the overall market size will continue to grow for some time to come. As a result, GoHealth is well positioned to continue serving customers for many years to come. As the target demographic expands, there will naturally be a greater tendency to lower average customer acquisition costs, especially given management’s emphasis on efficiency over costly growth.

The company has significant future cash on its balance sheet in the form of fee receivables ($843.1 million in total, broken down into $269.8 million in current assets and $573.3 million in long-term assets), giving it room to grow its operating cash flow.

Risks and mitigating factors

GoHealth has several notable risks, specifically 1) the content of its Medicare Advantage products and their oversight by the Centers for Medicare and Medicaid (referred to as “CMS”), and 2) GoHealth’s leverage position.

There are really two dynamics at play with CMS and Medicare Advantage. The first is something called a “rate notification,” where CMS sets the amount that providers are reimbursed. If a Medicare Advantage plan administered by a private insurer beats that rate, they essentially pocket the difference. This model has been pretty profitable for many years, but the new reimbursement rates are becoming more significant for providers. squeeze The ability of private insurers to make a profit will be in question, and some insurers are likely to withdraw from certain markets.

Second, last month, CMS released a “final rule” updating regulations regarding the relationship between Medicare Advantage plans and certain aspects of compensation to agents and brokers. The full rule, published in the Federal Register, can be found here: hereHowever, the law firm Sidley Austin LLP has a very concise summarySimply put, Medicare Advantage plans were found to be paying a wide range of fees to agents and brokers in addition to commissions, and contractual provisions between Medicare Advantage plan providers and brokers did not always disclose all plan options available to all customers. CMS has determined that this practice is detrimental to American taxpayers and is tightening the rules by clarifying what should and should not be paid to agents and brokers, essentially squeezing endless “administrative fee” claims out of them. To quote from the executive summary (edited for length):

The final rule eliminates management fees and consolidates fee-based compensation into a single cap. Key provisions of the rule include:

- Abolition of separate management fees.

- Caps non-salary compensation for agents and brokers.

- Prohibition of contract terms that prevent objective advice to beneficiaries.

- End of fee reporting.

. . . This change does not distinguish between types of agents or their employment relationships, and is not intended solely to curb fraudulent activity. Some (third-party marketing organizations) pay agents and brokers on a salary basis and therefore are not affected by the cap.

Although GoHealth is a broker that pays its agents, this would be a concern for any broker. Management has studied the issue and believes it is in compliance at this time. Cotte provided detailed and forceful responses to analyst questions on the subject (edited for length, but the entire responses are worth reading in this article): Transcript):

The basic idea here is that CMS places such an emphasis on inappropriate incentives for independent agents and brokers that they may be influenced to create certain health insurance plans or policy types over others based solely on reimbursement amounts. And what’s unique about our GoHealth operation is that agents are generally paid an hourly or monthly salary with very little variable compensation. The variable compensation they receive is not dependent on the health insurance plan. . . We compensate agents who fail to sell or enroll consumers in new insurance by providing peace of mind. The variable for us is not providing new registrations, but providing a service. . . But at the same time, I would say our focus is going beyond the minimum standards established by CMS regulations. IIt’s not about meeting minimum standards. It’s about doing the right thing and offering something different and better for the consumers and the health plans we partner with along the way..

Ultimately, the rules could force sweeping changes in the brokerage industry, but GoHealth appears to be in a favorable position from a regulatory standpoint. Cotte suggested some of its contracts will need to be adjusted. The company has already put in a lot of the necessary groundwork, so he believes any adjustments to how it operates will be relatively minor. That said, this is a good storyline to follow, with legitimate risk factors for investors to be aware of.

Regarding leverage, another big risk factor, GoHealth has $435.3 million in debt due through 2025 (after factoring in a $50 million prepayment made in April), of which $75 million was in repayment as of the end of the first quarter, and the remainder due in the second half of 2025. The good news is that there are no other repayments due, so that’s the bigger picture. The bad news is that the interest rate on this debt is variable, which remains elevated, which could complicate refinancing. Still, because the company has no issues paying down its debt, generating operating cash flow, and prepaying some of the principal, I fully expect GoHealth to be able to refinance next year at lower interest rates than it is currently, especially if cash flow continues to trend positive through 2024. If we are successful in making the additional principal payment of $25 million later this year, the total refinancing amount should be in the range of approximately $335 million, but with operating cash flow expected to be approximately $105 million, we don’t think this ratio is too unreasonable.

Conclusion

While evolving CMS regulations regarding Medicare Advantage may put GoHealth and its peers under increased scrutiny, the bigger story is the delivery of operating cash flow. The valuation here is attractive as the company has a growing, albeit short-term, track record of being able to maintain positive operating cash flow over the past 12 months and management is confident this trend will continue. While recent share price action has been disappointing, I truly believe GoHealth is a hidden gem in the market and view it as a “buy” from a cash flow and debt reduction perspective going forward.