Jasmina 007

Investment Thesis

StoneCo’s investors (Nasdaq:Stone) is in trouble in 2024. Its shares have fallen by about a quarter since the start of the year. The selloff was mainly triggered by its “disappointing” latest earnings report. But in my analysis, STNE’s first quarter results were strong across all key metrics and were held back only by unfavorable currency fluctuations. Despite foreign exchange headwinds, the company’s profitability is expanding rapidly. Additionally, management has a strong long-term outlook, and I believe this optimistic outlook is supported by several important fundamental factors. Valuation is also very attractive. Overall, I give STNE a Buy rating.

Company Information

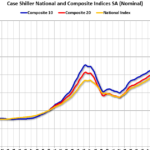

StoneCo is a Brazilian fintech company focused primarily on micro, small and medium-sized enterprises (MSMBs). STNE operates through two business segments: financial services and software.

STNE’s latest presentation for institutional investors

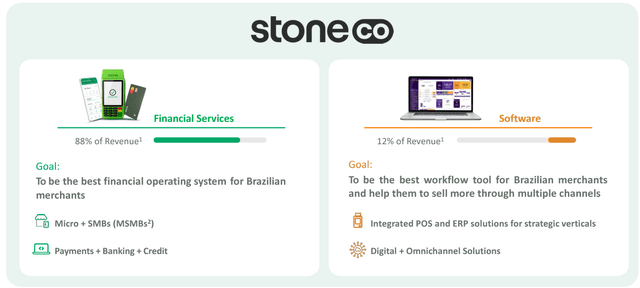

Through its Financial Services division, STNE offers payments, digital banking and credit solutions. Its Software division sells POS and ERP solutions, Customer Relationship Management (CRM), engagement tools, e-commerce and Order Management System (OMS) solutions for a range of retail and hospitality businesses, focusing on both SMEs and large clients. The company offers its solutions under three brand names: Linx, Stone and Ton.

STNE’s latest presentation for institutional investors

Finance

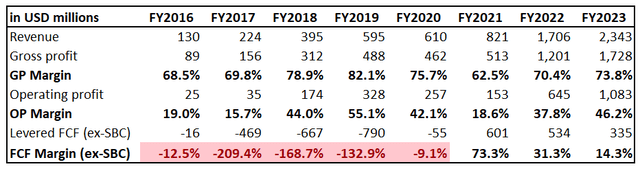

Long-term trends in financial performance are very important to me because they help me understand the strength of the business model and the consistency of management’s performance. From this perspective, StoneCo’s business model appears to be solid and well-executed by management.

Revenues grew at a CAGR of 38% from 2016 to 2023. Gross margins have grown steadily and operating profits have more than doubled as the business has scaled. Free cash flow (FCF) has been consistently positive for the past three years.

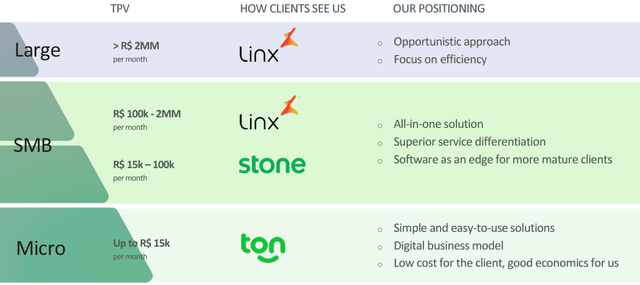

As a result of continued profitability growth and expanding FCF, StoneCo maintains a healthy balance sheet with an outstanding cash balance of approximately $1 billion and moderate debt levels. Liquidity ratios are also strong. Overall, the balance sheet is reasonably strong and StoneCo is well positioned for future growth.

Find Alpha

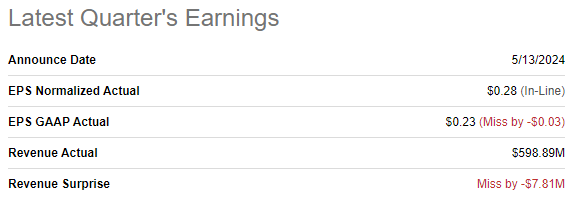

The latest quarterly financial results are May 13The company missed both revenue and EPS expectations. The stock price fell more than 10% after the disappointing earnings report. It was the second consecutive quarter that the company missed consensus earnings estimates.

Find Alpha

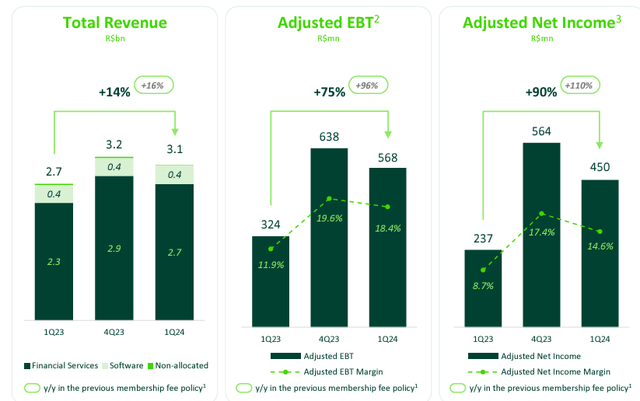

Meanwhile, from a financial performance perspective, the quarter was strong. Revenues increased 9% year over year and adjusted EPS expanded from $0.15 to $0.28. EPS strength was achieved through operating leverage, with key profitability metrics improving year over year. Revenue growth in operating currencies was much better, increasing 14% year over year.

STNE’s latest earnings release

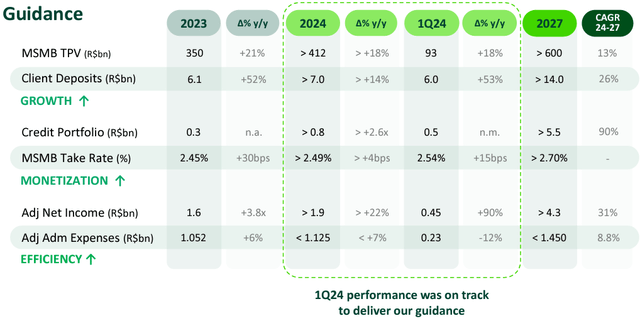

Key operating metrics also showed strong performance: MSMB’s payments customer base grew 33% year over year, total payment volume (TPV) grew 24% year over year, and take rates improved 15 basis points.

Looking at it from an overall perspective, there are some strong reasons to be bullish on StoneCo.

As previously noted, the company’s long-term trends in financial performance clearly demonstrate the strength of its business model. Recent near-100% EPS growth indicates significant potential to exercise operating leverage. Management projects adjusted net income CAGR of 31% between 2024 and 2027, driven by strong TPV and a growing customer deposit base, as well as strict financial discipline.

STNE’s latest earnings release

TPV depends heavily on the health of the overall economy. StatistaThe Brazilian economy (real GDP) is expected to grow at a CAGR of approximately 2% through 2029, which will certainly support STNE’s TPV growth.

In Brazil, Sharp decline in cash usageThis means that demand for fintech services is likely to remain strong and, as an emerging player in the industry, STNE is well poised to benefit.

Finally, Brazil’s e-commerce industry is booming, another positive factor for digital payments. Mordor IntelligenceThe country’s e-commerce market is expected to grow at a compound annual growth rate (CAGR) of nearly 19% through 2029, marking another strong growth opportunity for STNE.

Evaluation Analysis

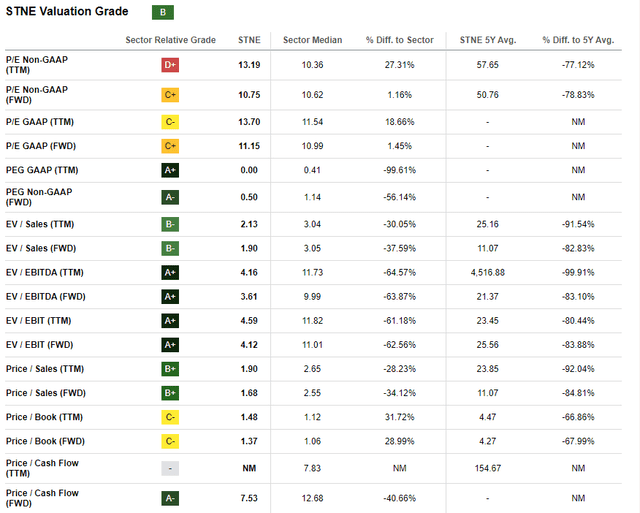

The stock has risen 13% over the past 12 months, and is the largest investor in the iShares MSCI Brazil ETF.E.W.Z.However, this year has been tough for STNE investors, with the stock down about 21% year to date. Most of its valuation ratios are low relative to the sector median and historical averages, giving it a valuation rating of “B.” Finding Alpha Quants It was a well-deserved punishment.

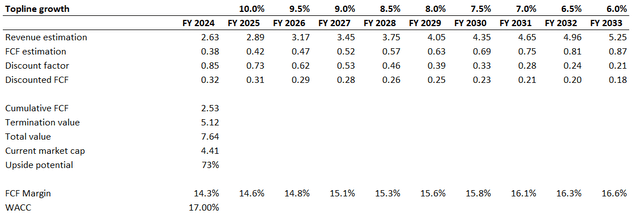

To cross-check what the valuation ratios represent, I simulate a discounted cash flow (DCF) model. Due to the risks I will explain in the next section, I use the recommended WACC of 17%. Guru FocusConsensus Revenue Estimates We expect revenue CAGR to be around 9-10% over the next three years. We assume 10% revenue growth in FY2025, with a forecast slowdown of 50 basis points per year due to growing comparables and deeper fintech penetration in Brazil. We assume an FCF margin of 14.3% in FY2023, with a forecast conservative improvement of 25 basis points per year.

Despite using conservative earnings growth assumptions, STNE’s fair value is 73% higher compared to its current market cap, and we believe the upside potential is attractive.

Risks to consider

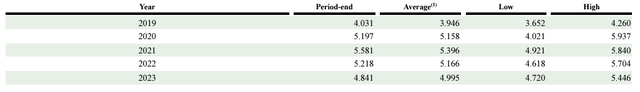

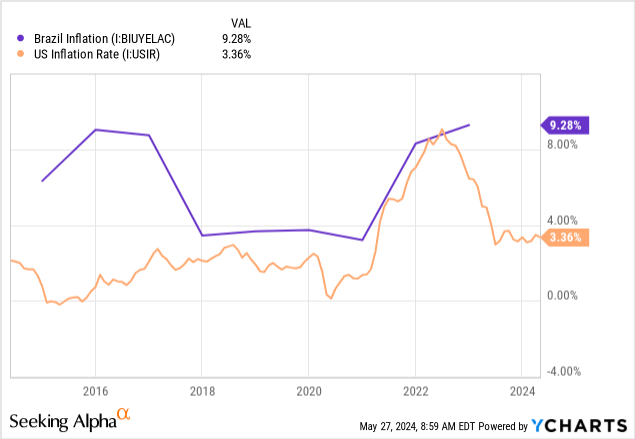

STNE’s operations in Brazil involve several significant risks for investors. As an emerging market, Brazil’s political system is still developing. This could result in sudden changes in regulations that could adversely affect STNE’s business. Brazil is a large exporter of a wide variety of goods. Prices for most goods are subject to volatility, as is the volatility of the country’s currency, the Brazilian Real.

Inflation rates in Brazil are generally higher than in the U.S., causing the local currency to lose value faster over time than the U.S. dollar. Because STNE conducts its operations in Brazilian reals, long-term trends in foreign exchange rates could be adverse to the company.

Investor sentiment towards STNE is much weaker than MELI: MELI has already almost fully recovered towards its 2021 highs, while STNE is nowhere near its peak 2021 levels. Therefore, investors looking for exposure to emerging Brazilian fintechs may continue to bet on MELI rather than STNE, which could be a strong headwind for the stock’s upside.

Conclusion

In conclusion, STNE is a Buy. Valuation is very attractive and outweighs all risks and uncertainties in my view. The company is showing impressive profitability expansion and growth across all key business metrics, which will likely help it maintain consistent earnings growth over the longer term.