by Calculated Risk May 28, 2024 9:00 AM

S&P/Case-Shiller release Monthly Home Price Index for March (“March” is the three-month average of closing prices for January, February and March).

The release includes prices for 20 individual cities, two composite indexes (10 cities and 20 cities), and a monthly national index.

From S&P S&P CoreLogic Case-Shiller Index hits all-time high in March 2024

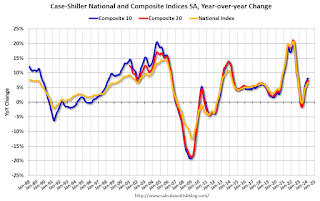

S&P CoreLogic Case-Shiller US National Home Price NSA IndexThe report, which covers all nine U.S. census tracts, 6.5% annual increase in Marchremained at the same rate of growth as last month. The 10-City Composite Index rose to 8.2% from last month’s 8.1% increase. The 20-City Composite Index increased slightly from the same month last year to 7.4%, up from last month’s 7.3% increase. San Diego continued to post the highest year-over-year growth rate among the 20 cities this month, up 11.1% in March. New York and Cleveland followed with increases of 9.2% and 8.8%, respectively. Portland recorded the slowest year-over-year growth rate for the third consecutive month and remains at the bottom of the list, but its March growth rate remained the same as last month’s, at 2.2% year-over-year.

…

The U.S. national index, 20-city composite index, and 10-city composite index all maintained an upward trend from last month, with seasonally unadjusted indexes increasing 1.3%, 1.6%, and 1.6%, respectively.After seasonal adjustment, the U.S. national index increased 0.3% from the previous month, while the 20-city composite index and the 10-city composite index both increased 0.3% and 0.5% from the previous month, respectively.

“This month’s report boasts yet another all-time high,” said Brian D. Luke, head of commodities, real and digital assets at S&P Dow Jones Indices. “Records have been broken repeatedly in both the stock and housing markets over the past year, with our national indexes hitting new all-time highs in six of the past 12 months. During that time, the stock market has delivered record performance, with the S&P 500 hitting new all-time highs for 35 consecutive trading days over the past year.”

“San Diego stands out with an impressive annual growth rate of 11.1 percent, followed by New York, Cleveland and Los Angeles, demonstrating strong demand for urban markets.”

Add emphasis

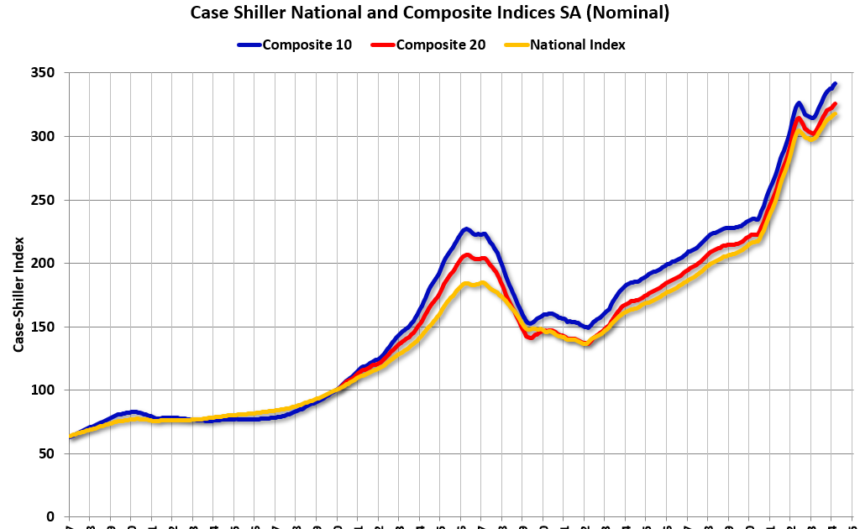

The first chart shows the nominal seasonally adjusted Composite 10 index, the Composite 20 index, and the national index (the Composite 20 index was launched in January 2000).

The Composite 10 Index rose 0.5% in March (SA). The Composite 20 Index rose 0.3% in March (SA).

The national index increased by 0.3% in March (SA).

Composite 10 SA increased 8.2% year over year. Composite 20 SA increased 7.4% year over year.

The national index SA increased by 6.5% year-on-year.

The annual price change was close to what we expected, and we’ll provide more details later.