JHVE Photo

Investment behavior

I Purchase Rating Intuit (Nasdaq:Into) Earlier this year, INTU performed better than expected and demonstrated strong performance in the mid-market segment, so I Earnings growth is likely to accelerate into the high teens. Based on the current outlook and analysis, I recommend a buy rating. A key update to my theory is that I expect further EPS growth going forward, given the strong string of results and very encouraging progress INTU has made with its investments. The share price pullback also makes the potential upside more attractive.

review

INTU reports Q3 2024 Revenue The 23rdrd Revenues in May increased 11.9% to $6.737 billion, beating expectations of $6.644 billion, and pro forma EBIT was $3.702 billion, with a margin of 55%, also beating expectations. $3,602 million. All of our segments showed strength. Small Business and Self-Employed was up 18.7% to $2,387 million, Consumer Group was up 9.3% to $3,653 million, Credit Karma was up 8% to $443 million, and Protax Group was up 3.3% to $354 million. I thought this was a very strong result that validated my view of the business.

However, the market does not seem to like this performance as INTU’s share price fell by over 10%. The reason is that growth in online services for small businesses (including QuickBooks Online (QBO) payroll, QBO Payments, Mailchimp, etc.) is expected to slow from 24% in Q2 2024 to 20% in Q3 2024, and may slow further in FY2025 as the transition of desktop subscriptions (which supported the segment’s performance in Q3 2024) is scheduled to end this year. However, I think the market is overlooking the fact that the overall SMB segment is expected to grow by 18% despite a weak macro environment, and interest rates are likely to fall in 2025 as inflation moves in the right direction. This should turn the current macro headwinds into tailwinds for INTU and support demand.

In addition to the upcoming macro-economic tailwinds, INTU is also putting resources into expanding its solutions to include front-office tools like MailChimp and more premium options like QuickBooks Online Advanced, and we are very positive on these investments given the adoption so far. Take the Mailchimp solution for example. This product continues to show very positive growth rates of 13% in Q3 2024 despite a tough comparison last year due to the price hikes implemented in 2023. QBO also continues to grow in the high teens and shows little signs of weakness in this macro-economic environment. I expect very healthy growth rates to continue going forward and I believe growth could accelerate in FY2025 as INTU benefits from its investment in Generative AI. Generative AI has seen very high adoption rates in both products, with over 300,000 users of MailChimp having access to the latest Generative AI features and 30,000 users of QB using the beta version of these features.

With that out of the way for the bearish points I believe have impacted the stock price, it’s worth a moment to mention INTU’s success in penetrating the upscale market segment, a key driver of growth I identified earlier. To recap, the entire tax preparation market is worth approximately $35B (based on reported Q3 2024 earnings), and of that $35B, $31B is in the assisted category and business taxes (the rest is DIY). This means that with TurboTax’s revenue performance over the past 12 months being approximately $4.46B (most of which is in the DIY segment, which represents nearly 100% of the addressable market), there is little room for INTU to continue to gain share. Therefore, it makes sense for INTU to invest and penetrate the upscale market, and adoption rates there have been very good. So far, they have doubled the number of customers using TurboTax Live Full Assist and tripled the number of customers using the platform for the first time. While this is just the starting point, INTU’s experience with tax procedures and strong brand name in the U.S. meanwhile are confident that they will be able to continue to drive further profits in the U.S., strengthening their marketing, a key focus for management as they make their investments.

Number two, we’ve been visiting with a lot of our customers and partners, and we’re taking a very proactive approach to what we’ve been doing with our platform, what we’re doing with pricing, and what we’re investing in marketing to look to the future. Q3 2024 Conference Call

evaluation

Author’s works

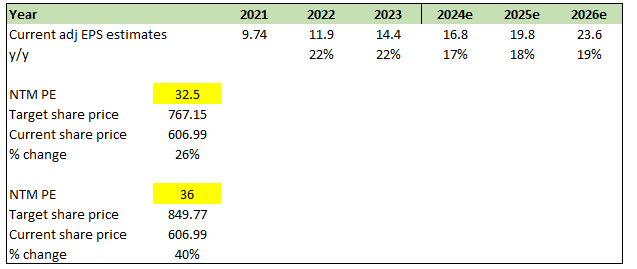

After the share price decline, I believe the upside potential is more attractive today than it was before. Unlike the bears who focus on the fact that online services for small businesses have slowed, I believe the overall results and outlook remain favorable, and management’s increased FY24 EPS guidance is a very positive sign and is consistent with my view that earnings growth can expand into the high teens. In my view, INTU should continue to grow in the high teens due to a potential economic recovery in FY25, increased adoption of Mailchimp and QBO (due to investments in generative AI), and continued push to penetrate the premium end of the tax preparation market.

INTU was trading at a forward PE of 36x before the stock price fell, and with all the positive signs I’m seeing, I believe the stock could move back up to 36x if the company continues to grow in line with guidance and demonstrates to the market that revenue growth can be sustained at high teens levels. At 36x, my target price would be $850, or a 40% upside. However, even if we don’t see an upside rerating, the upside potential is still relatively attractive at the current forward PE of 32.5x.

danger

A further slowdown in online services to small businesses in the coming quarters could provide further evidence that INTU is sensing weak demand and further increase negative sentiment towards the stock. Furthermore, there is no guarantee that the macro economy will recover in 2025. Inflation has proven more robust than expected, and if this persists, interest rates could remain elevated for an extended period of time, which could undermine the health of INTU’s target customer base.

Final thoughts

My recommendation is Buy. Strong performance across all segments and management’s planned EPS accretion for FY24 support the potential for high teens revenue growth. INTU’s investments in generative AI and assistive tax services products should support revenue growth prospects going forward. A possible economic recovery in FY25 also bodes well for future growth. Finally, after the share price pullback, we believe the current valuation offers attractive upside potential even without multiple expansion.