by Calculated Risk May 28, 2024 1:35 PM

Two important points:

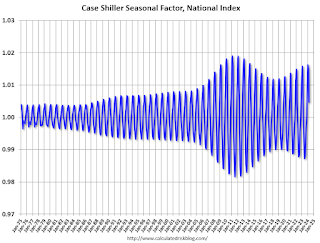

1) Home prices have clear seasonal patterns.

2) The surge in distressed home sales during the housing bubble burst distorted seasonal patterns. This is because distressed home sales (at the lower end) occurred at a steady rate throughout the year, while regular sales followed normal seasonal patterns. This resulted in greater seasonal fluctuations during the housing bubble burst.

Click on the graph to enlarge the image.

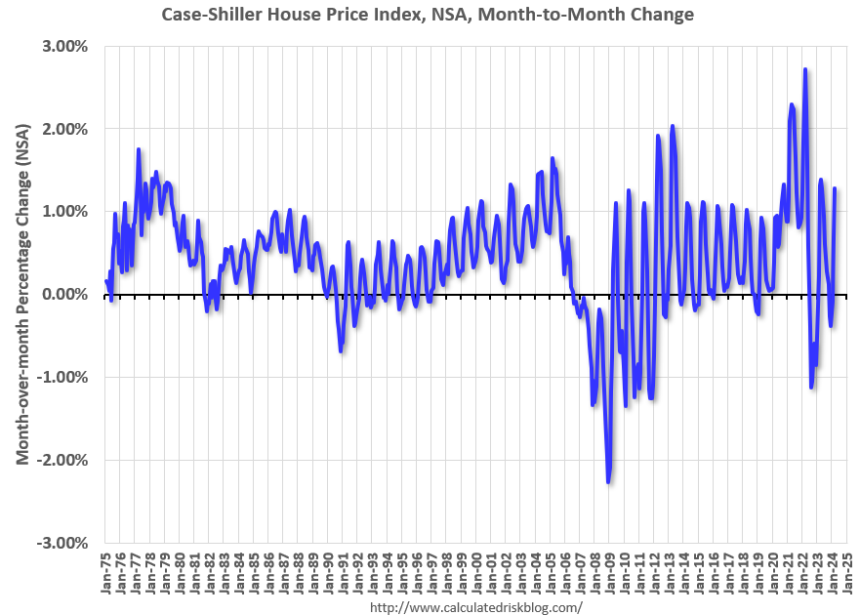

This graph shows the monthly changes in the NSA Case-Shiller National Index since 1987 (through March 2024). The seasonal pattern was small in the 90s and early 2000s and increased as the bubble burst.

Seasonal fluctuations have diminished since the recession, but higher prices due to the pandemic have changed the month-over-month pattern.

Seasonal fluctuations had declined after the recession but have recently increased again, although this time without a surge in bad loan sales.

Using the 2018 and 2019 seasonal factors, home prices rose 0.8% in the first quarter (current factors showed first quarter prices rising 1.2%).