Shutter 2U

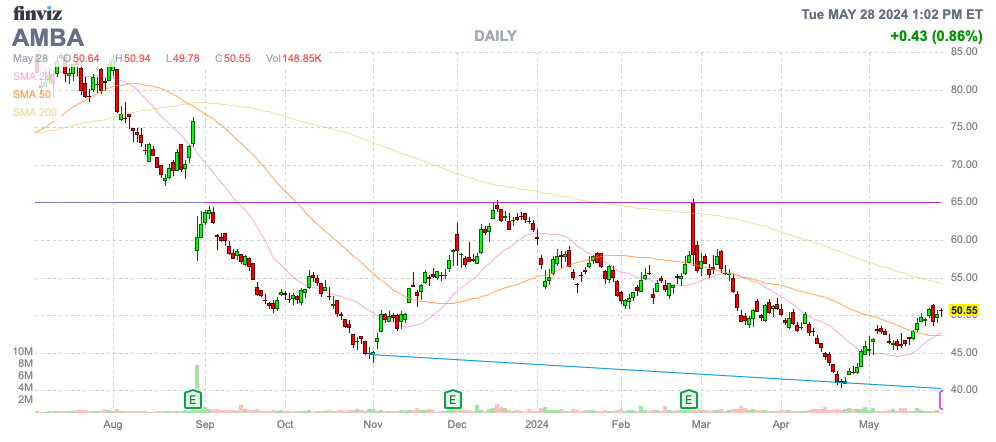

Ambarella (Nasdaq:Amba) made a lot of promises in its new quarterly report, but the semiconductor company doesn’t have a consistent track record of delivery. Its most recent potential was a strong backlog in the automotive sector, but the company has already moved into AI inference. Chip sales plummeted. Investment Thesis The stock is trading near the lows as we expect a cyclical recovery in the business, so we remain somewhat bullish on the stock.

Source: Finviz

Turnaround Quarter

Ambarella has a history of chasing the next trend without maintaining sustained growth leadership over multiple years and cycles. The company reports: Weak fourth quarter performance The figures were released in February, and as of May 30, here are the forecast numbers for Q1 FY2025:

- Earnings per share: -$0.31

- Revenue: $54 million (down 13% year-over-year)

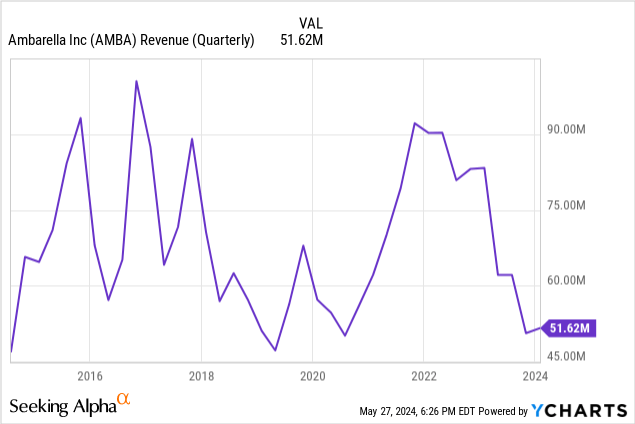

Quarterly revenue is expected to increase by more than $2 million from a low of just above $50. Revenues for the third quarter of 2024 fell to $15 million to $20 million. Last year, IoT revenues were down 40% year over year, and automotive was down 14%, resulting in just $15 million to $20 million in quarterly automotive revenues. The harsh semiconductor industry last year didn’t help, but Ambarella is working on autonomous vehicles and AI inference technologies, which should lead to sustained growth.

Unfortunately, despite the company’s vast history of high-performance vision chips, which are in demand for everything from drones to automobiles, Ambarella has not been able to sustain growth: Quarterly revenue topped $90 million in 2015 and recently hit that level in 2022, before falling again to $50 million since.

Analysts’ consensus forecast is for revenue to bounce back to about $60 million in the second quarter and reach nearly $70 million by the end of fiscal year 2025 in January. The company’s shares have been posting strong gains, hitting $100 a share in early 2023 on the rise of the auto industry, after the company last year discussed its auto division reaching $2.3 billion.

As in the past, any stock gains will stall once cyclical sales plateau, and investors will want to hear some explanation from management about the sustainability of this bull cycle.

For the stock to really move higher, Ambarella needs to see second-quarter sales exceed $60 million and get back on track to post quarterly sales above $70 million. 2024 Q4 Financial Results AnnouncementCEO Fermi Wang seemed to confirm his confidence in the analyst consensus forecast:

First of all, our guidance does not expect us to hit $70 million in any quarter. We believe we will see growth this year, and we are confident in our Q1 guidance. But overall, when you look at what the Street is projecting, we think it’s reasonable. And we feel good about our current Q1 and Q2 guidance, given our customer demand and bookings. Of course, bookings are not as strong in Q3 and Q4, but the momentum is there.

The average selling price of the new CV5 chips is $30-40, compared with the high teens for the CV2 chips. Chip makers stand to gain more by selling more content. Qualcomm (QCOMThough the company has achieved the global lead in AI inference chips, Ambarella has not instilled confidence in the market that it can beat the chip giants in the mass market.

The automotive backlog is a good example of a business that has four to five year order growth. Ambarella discussed a deal with an automotive customer. XPengrams (XPEV), but the company is actually unable to deliver sustainable sales growth.

Not cheap

Ambarella has unrealized potential, but its stock price tends to trade in part on that potential. The company’s current market cap is $2 billion and its earnings run rate is $200 million, or nearly 10 times sales.

Consensus estimates call for sales to rebound to $250 million this fiscal year and reach $320 million in fiscal 2025. Ambarella shares are trading at six to eight times those sales targets, which is arguably aggressive for a semiconductor stock that is generating sales near the lowest levels in the past decade as demand for semiconductors surged.

The semiconductor company has a cash balance of $220 million, but is expected to be losing money for the next few years, so don’t expect Ambarella to finally hit a home run with AV or AI.

Moreover, the small semiconductor company has struggled to achieve profitability recently due to sluggish revenues: Its guidance for first-quarter revenue of $54 million and gross margins of 62% translates into gross profits of just $33.5 million.

The gross profit target is well below the operating expense target of more than $46 million. Ambarella would need to increase quarterly sales by more than $10 million to cover its expenses with gross profit, but the company has indicated that quarterly sales of $70 million are more likely.

remove

The key takeaway for investors is that Ambarella looks poised for its next upswing, fueled by a recovery in semiconductor demand and promising sales growth in the automotive and AI sectors. While the chip company is unlikely to deliver on all of its big promises for its computer vision chips, Ambarella shares could surge again. Investors should just lock in profits and not bet on a sustained rise in Ambarella sales.