Joe Raedl/Getty Images News

After approval of the SPAC merger Digital World Acquisition Co., Ltd. and Trump Media and Technology Group, Inc. (Nasdaq:David), DJT (formerly DWAC) stock price soared. This rise was the result of a long This marks the final step in the merger process and reflects the excitement of the company’s investor base to gain ownership of DJT’s flagship product, Truth Social.

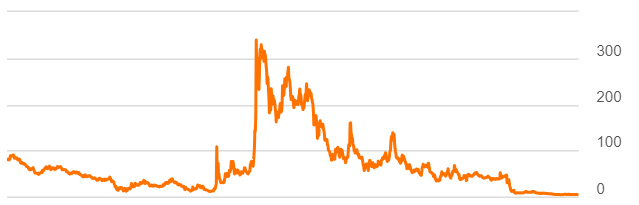

But by all traditional metrics, the company’s stock has been trading at sky-high valuations over the past few months – so high that it’s impossible to reconcile the company’s fundamentals. In my view, the company’s stock is behaving much more like the “meme stocks” that were common in financial markets in the second half of 2020 and have seen a recent resurgence, rather than a stock trading based on fundamentals. This makes it difficult to predict what the stock will be like, even if Truth Social is a big player in the space. Even if it achieves some degree of success, it is unreasonable to expect it to be able to support DJT’s current valuation, and in the long term DJT will likely follow the same path as other companies like QuantumScape (quality assurance) or GameStop (global) experienced a significant drop after opening trading based on valuation based on underlying fundamentals.

evaluation

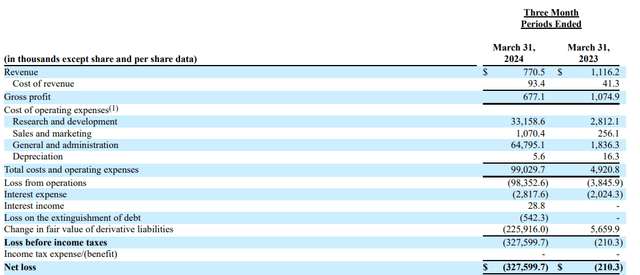

The argument that DJT is overvalued is simple and straightforward: the company is losing money, with an operating loss of over $98 million in Q1 2024. Furthermore, revenue for the quarter was just $770,000, down year-over-year from $1.116 million in Q1 2023.

This modest amount of sales is needed to support a massive market cap of $8 billion, putting DJT’s trailing 12 month price-to-sales multiple at well over 1000x. It’s extremely rare for even ultra-fast-growing companies to trade at such multiples, let alone DJT, which has declining revenues. Needless to say, this situation is nearly impossible to continue. For comparison, let’s look at a much larger and more established player in the social media market: Snapchat.snapSNAP’s annual revenue is roughly 1000 times that of DJT, yet its market cap is only 3 times that of DJT.

To get a rough estimate of DJT’s true value, we can make a quick comparison with X (formerly Twitter), the market leader in the social media space (microblogging) that Truth Social is trying to compete with. Valuation of X’s sharesX is likely worth about $12 billion, which is 50% more than DJT’s current valuation.

If DJT succeeds in becoming the market leader in the microblogging niche of the social media industry (a tough feat, but I’m generously estimating a 10% chance of success), the company will probably be worth slightly less than X today (because X, Threads, etc. won’t just disappear as a competitor). In this scenario, DJT would probably be valued at around $8 billion.

If DJT fails to become the market leader, the network effects that have caused social media to become a winner-take-all industry will likely mean the company will only be worth $500 million. We put this probability at 90%.

A probability-weighted sum would be $1.25 billion. If we apply a discount rate to this, the fair value could be around $800 million, an analysis that assumes we’re probably overly optimistic about Truth Social’s future since it takes at least two to three years to become a market leader in a niche market.

This brief analysis of DJT’s valuation is so conclusive that we won’t go any further into where the valuation doesn’t make sense and will instead answer the question: If fundamentals don’t drive the price, what does?

Factors that determine stock prices

In my view, there are three factors that will affect the price of DJT.

- Some ardent Trump supporters see buying DJT shares as a way to support Trump both financially and emotionally.

- Meme stocks are subject to speculation due to share price volatility and mainstream interest due to their association with celebrities.

- If Trump is re-elected, his communications could be channeled through Truth Social, bringing in a massive influx of users and significantly improving the company’s financial position.

Factor 1 is a very relevant factor to analyze right now for anyone looking to speculatively trade DJT in the short term, but over time interest in buying the stock simply for support purposes will fade. It is unlikely that this group of investors will still be exerting significant buying pressure five years from now, as Trump is unlikely to play a major role in US politics by then (either he will have already served his second term or lost his second election).

Factor 2 may drive prices higher again in the short term, but ultimately, the hype for almost all meme stocks eventually subsides and market forces bring prices back to reality, as is the case with AMC, for example.

AMC stock price (Seeking Alpha)

Factor 3 is more interesting because it poses a long-term threat to DJT’s short-term thesis. But Trump’s reelection is just one of many conditions that must go right for Truth Social to achieve market leadership in the microblogging space. It also needs adoption from mainstream celebrities and advertisers, which is a big hurdle to overcome.

The interplay of these three factors is likely to drive the price of DJT in the short to medium term, and could lead to some interesting and unexpected outcomes. For example, if Trump were to lose the election, factor 3 (his chances of being re-elected) would completely disappear, which would result in a drop in the price, but factor 1 (Trump supporters trying to show moral support for Trump after his loss) could also drive the stock price higher in the short term.

Overall, however, the impact of Trump supporters buying stocks to show their support, and meme stock-like purchases, is expected to wane and fade over the next five years, leaving only company fundamentals to support valuations, which will likely lead to a significant decline in stock prices as outlined in the previous section.

Conclusion

Taking the above into consideration, I expect DJT’s stock price to be significantly lower in a few years than it is today, although the path to get the stock there could involve many big upsides depending on election and court outcomes, as well as the future popularity of meme stocks in the market.

It’s not clear how investors can take advantage of this. DJT’s borrowing interest rates are very high The options market is also distorted because of high demand leading to a lot of short selling, and put premiums are so high that even if the stock price falls sharply, only small profits can be made.

Therefore, investors may be wise to wait for more favorable option prices and borrowing fees before acting on DJT’s short thesis. Additionally, when determining the size of their position and the best way to profit from a stock price decline, investors should consider the possibility of a significant upside along the way.