Richard Drury

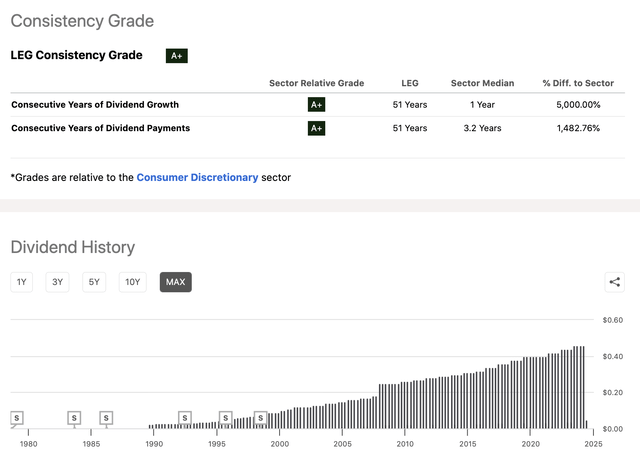

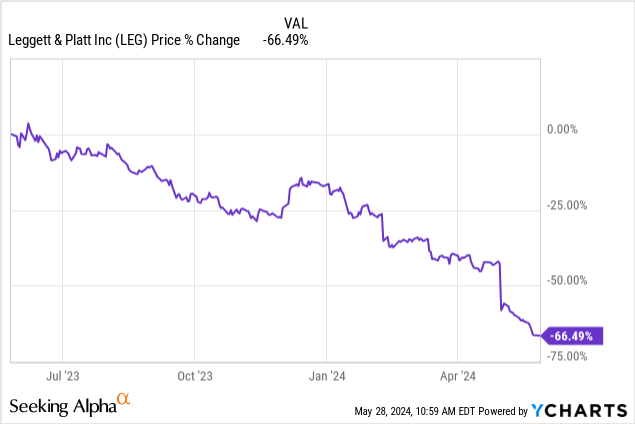

Leggett & Platt IncorporatedNew York Stock Exchange:leg) designs, manufactures and sells engineered parts and products in the United States and abroad. The company has valued its efforts in returning value to shareholders through dividends for over half a decade. The century is recent Cut the dividend The stock price has fallen sharply, dropping to $0.05 from the previous price of $0.46.

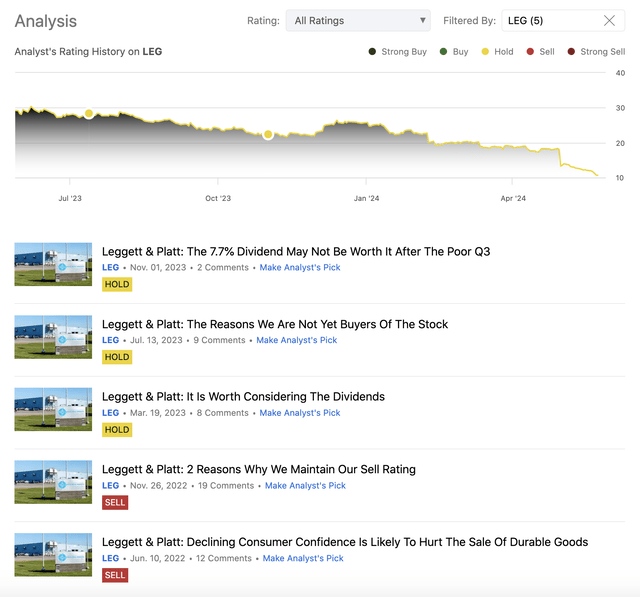

we have Report begins The company was sold in June 2022, initially rated a sell due to expectations of worsening consumer sentiment and declining performance. Repeated The bearish assessment again cites macroeconomic headwinds, declining sales and narrowing profit margins. March 2023We used a multi-stage dividend discount model to value the company’s shares and It is fairly valued. Traditional equity indices support this view, and we have upgraded our rating to Hold, which we have since repeated twice. July 2023 And once November 2023.

With the dividend having been cut almost entirely, our “hold” rating, which was based on the assumption of permanent dividend growth, which was an input into our dividend discount model, is no longer valid.

My goal in writing today is to provide my latest thoughts on the company, including a brief explanation of why the dividend was cut, an updated view of the macroeconomic environment including consumer confidence and the housing market, and finally, I will revisit traditional price multiples to gauge company value and explain why the dividend discount model we used previously is no longer very useful.

Quarterly Results

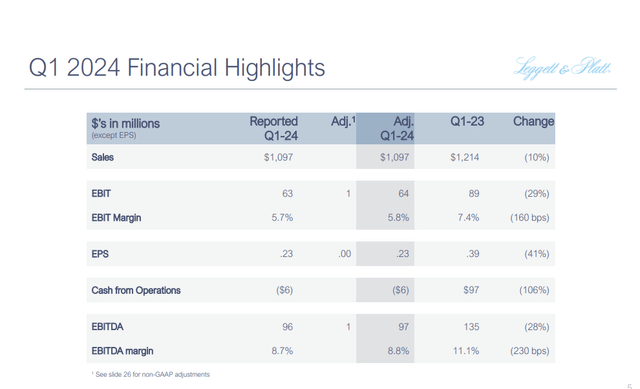

The company: Quarterly results On April 30th, the company released its financial results. There was nothing particularly exciting about the numbers announced. First-quarter sales fell to $1.1 billion, down 10% year over year. EPS plummeted to $0.23 from $0.39 a year ago. Also, 2024 guidance was unchanged, with both sales and EPS expected to decline significantly for the full year.

So let’s dig a little deeper into these numbers to understand what’s causing this performance drop.

Revenue

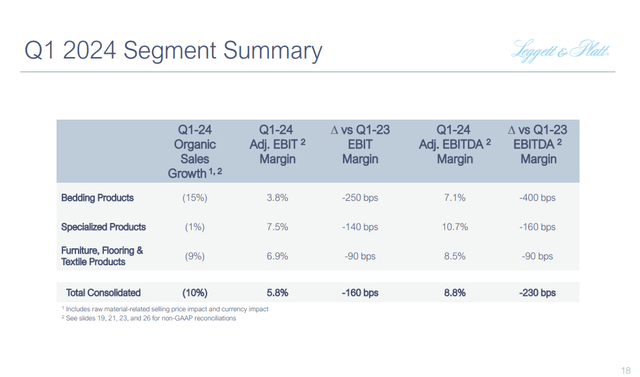

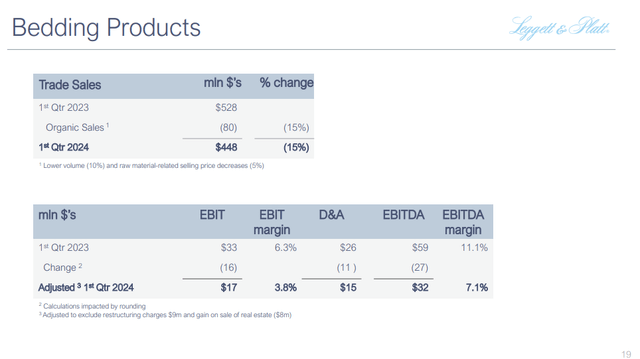

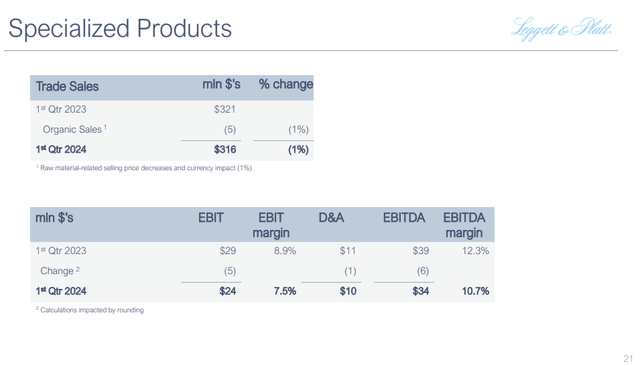

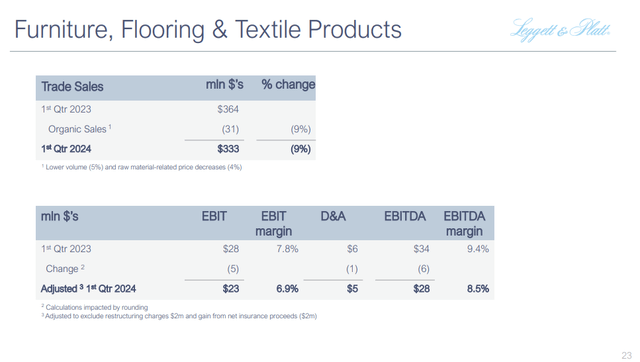

The decrease in sales was driven by lower sales volumes and lower raw material-related selling prices. Despite the decline in raw material-related selling prices, the decrease in sales volumes is a clear indication of worsening demand for LEG’s products. However, we believe that this trend can be explained by broader economic conditions and is not necessarily the result of company-specific issues. It is also important to highlight that all segments performed poorly and organic sales growth was negative, although the bedding products segment was the worst off, with a 15% sales decrease.

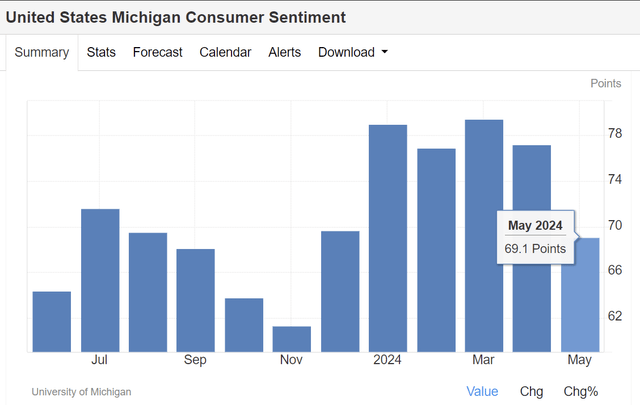

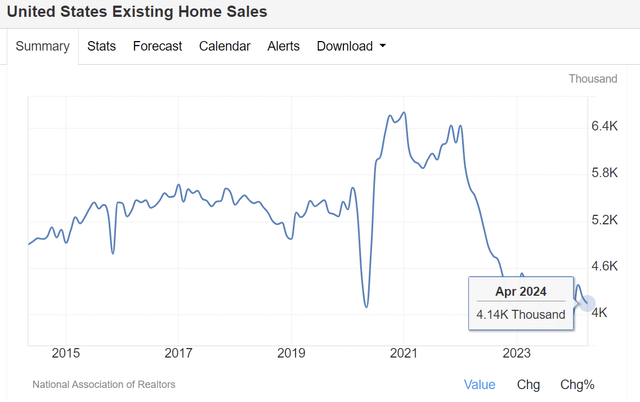

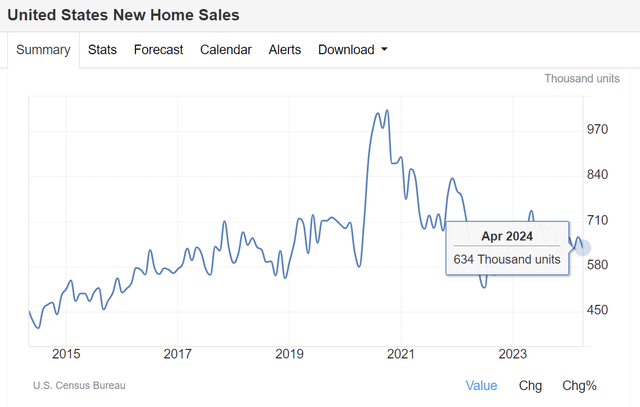

U.S. consumer confidence has remained volatile over the past few months, despite some improvement in the first quarter, and the housing market remains relatively weak, as indicated by both new and existing home sales.

US Consumer Confidence Index (tradingeconomics.com) Existing Home Sales (tradingeconomics.com) New Home Sales (tradingeconomics.com)

In our view, unless there is a significant improvement in the macroeconomic environment, LEG’s financial performance is unlikely to see a significant improvement.

Profitability

Not only the sales figures, but also the company’s profitability looks unattractive. Profitability has deteriorated with shrinking margins in each segment, with the deterioration once again being most pronounced in bedding products.

Bedding products (LEG) Special Products (LEG) Furniture, Flooring and Textiles (LEG)

Going forward, weak demand and a challenging macroeconomic environment mean there are no immediate catalysts that could help improve LEG’s financial performance. Container shortage As we have experienced over the past few months, ocean freight costs may remain elevated in the near term, increasing LEG expenses.

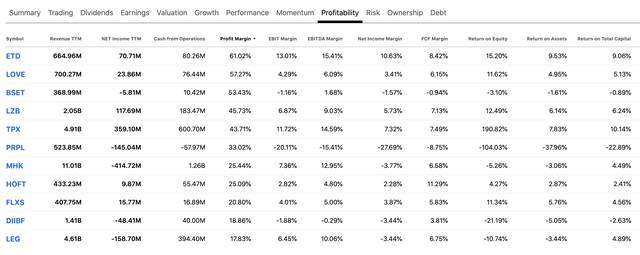

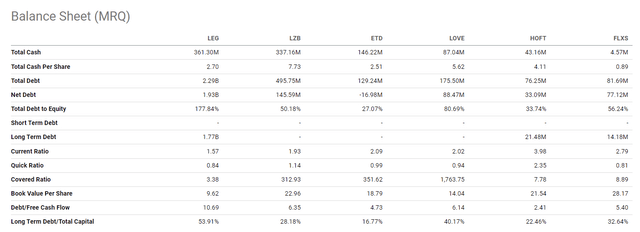

Comparing a company’s profitability metrics with those of its industry peers and competitors can also show that there are much better options within the industry to consider.

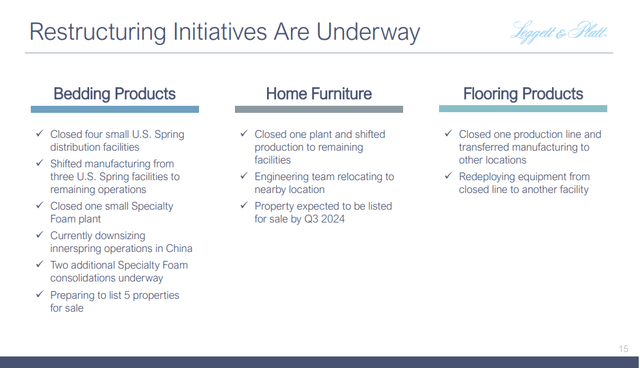

Also, the company’s restructuring is still in progress. Although some progress has been made, significant expenses still need to be incurred in 2024, which will further weaken LEG’s performance in the coming quarters. Looking beyond 2024 and 2025, I would first like to see how the restructuring has actually improved the company before considering investing in the business.

Capital Allocation

While the main discussion about capital allocation has to revolve around dividend cuts, the move is understandable for a few reasons.

Financial performance is suffering and companies need capital to execute their strategies. Since the cheapest capital is internally generated capital, it makes sense to save on dividends rather than debt/equity financing.

Companies want to reduce their debt, which is understandable since their liquidity currently appears to be weaker than their peers. Companies cannot always rely on debt to stay competitive in the long term.

A company’s financial flexibility is also important, especially in the current macroeconomic environment, so reducing debt may help the company stay viable in the long term.

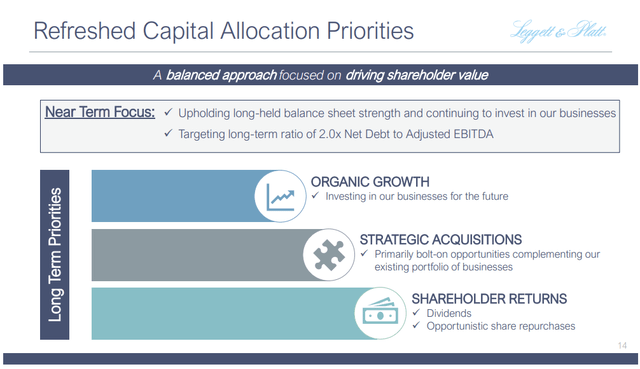

Balance Sheet (SA) Capital Allocation (LEG)

However, LEG’s policy of consistently returning capital to shareholders on a quarterly basis has made it the choice of many dividend and dividend growth investors. This is no longer the case, and the uncertainty surrounding the company’s restructuring and management priorities makes it difficult to say with confidence when and how LEG will once again become an attractive choice for dividend and dividend growth investors.

evaluation

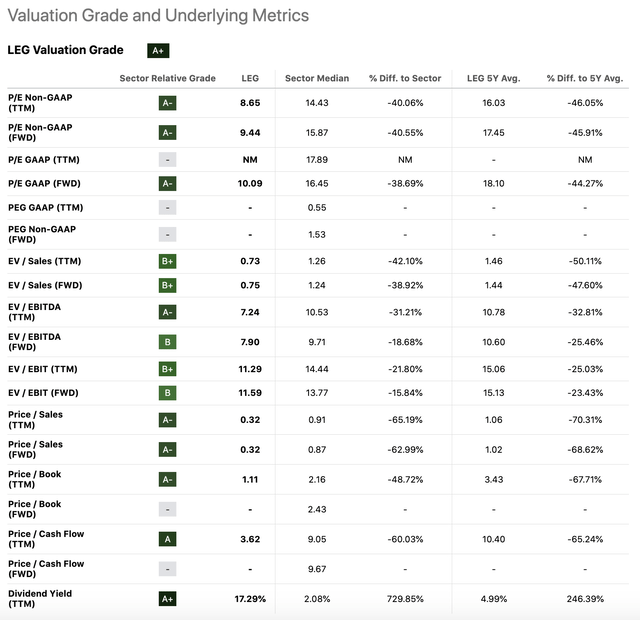

We believe that the previously used dividend discount model is no longer the best tool to value the company’s shares after the recent dividend cut. The company has consistently paid and even increased dividends for over half a century, but a new era has now begun. It can no longer be claimed that the dividend is safe and sustainable. Also, no assumptions can be made regarding the dividend growth rate, since the company is not currently prioritizing dividend payments due to a strategic shift, and it is difficult at this time to predict when and how the approach may change in the future. For this reason, any projections made and any estimated fair values are highly uncertain and probably just meaningless numbers.

For this reason, we believe that a simple comparison of price multiples can provide a more accurate picture of a company’s valuation relative to its peers and its own historical valuation. The following table summarizes traditional price multiples.

Following a significant share price decline over the past 12 months, the company’s shares currently appear to be trading at a significant discount. However, we believe this discount is justified. Declining revenues, a challenging macroeconomic environment, shrinking margins, and uncertainty surrounding the company’s new strategy all support this theory. At this point, we believe any new or continuing investment in LEG shares is merely a speculative exercise not supported by fundamentals.

Conclusion

The company cut its quarterly dividend from $0.46 to $0.05, invalidating our previous assertion that the company was fairly valued based on the dividend and projected dividend growth.

The company’s quarterly financial results are also a cause for concern, with declining sales and shrinking profit margins. The outlook is further weakened by a challenging macroeconomic environment, including deteriorating consumer sentiment and a weak housing market.

The results of the new capital allocation strategy are yet to be seen, and it will require spending significant amounts of money in 2024 and 2025 to complete, which creates a lot of uncertainty in the near term.

While at first glance this valuation looks attractive, it may just be a value trap: our view is that such a discount compared to the industry average and the company’s own historical valuation is due to weak fundamentals.

The company downgraded the stock to “sell” from “hold.”