Fink Avenue

Investment Thesis

Since our last report on IBM (New York Stock Exchange:IBM)(Neoe:IBM:CA) in JanuaryThe company’s shares have been sluggish despite beating quarterly revenue expectations largely due to IBM’s recently announced acquisition. “Although strategic, it has not been well received by the market. Contrary to market opinion since our last earnings report, I still maintain a positive outlook on the acquisition and believe the market has misunderstood the potential benefits of the acquisition.”

Nonetheless, IBM maintains its leadership position by aggressively promoting open source AI, which I believe is the most significant open source development since Linux.

I believe these areas are critical to driving growth and maintaining a competitive edge in the rapidly evolving technology industry. Therefore, despite current market sentiment, IBM’s growth remains solidly fundamental. And that work is a key driver of my continued strong buy conviction.

Why I do follow-up interviews

While the market has responded lukewarmly, I believe IBM’s robust growth in its core business areas and innovation in AI and cloud technologies, bolstered by the companies’ partnerships and open source efforts, suggests that IBM is undervalued.

Although IBM’s stock price has trended slightly lower since the last report, the company’s AI innovation and cloud technology will continue to underpin the company’s financial performance going forward.

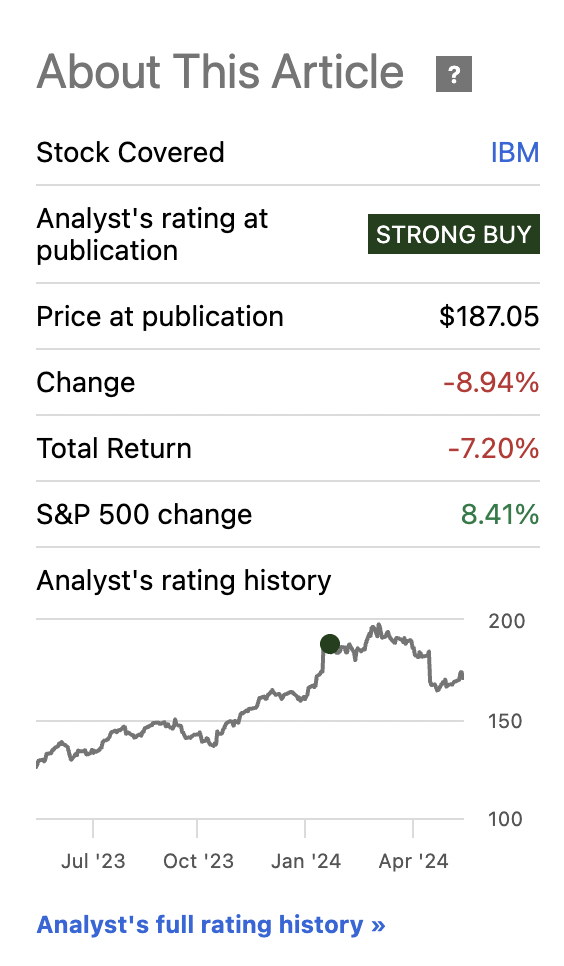

IBM Stock Performance (Seeking Alpha)

In addition, the company is also developing Meta (MetaWe believe that WatsonX’s integration of the Llama 3 model into its AI platform will be of great benefit to us as we more aggressively promote open source AI models in areas such as content generation and business analytics. Llama 3 has been confirmed in testing to have GPT-4 level capabilities, including inference and reasoning, which means that with the release of this new model, open source capabilities could improve significantly from here.

Given these developments, I wanted to write an update showing how the company continues to execute and where the market is not rewarding the company and where interesting opportunities are emerging. The expansion of IBM’s tech stack with AI capabilities through Meta, coupled with continued innovation in hybrid cloud solutions, has me believing IBM is well on its path to future growth.

Open Source is Great for IBM

Open source AI promotes transparency by making code and algorithms publicly accessible, fostering trust among users (in this case, enterprise customers) and encouraging a broader range of developers to contribute to AI development. But experts disagree on what open source AI should look like. Sophisticated And it gets used (I think this is the key).

One reason for this is that such technologies are Expertise Contributions and contributions democratize access to technology. In other words, there is almost nothing to stop its growth. Companies, researchers, and developers around the world will be able to use the technology to Improve Leverage open source AI without the barriers and economic limitations imposed by proprietary systems. Openness accelerates innovation because developers don’t have to reinvent the wheel but can build on existing, openly available foundations.

This is important in areas where proprietary solutions may not provide the functionality needed, or where the cost of such solutions is too high to offset the overhead associated with licensing fees, allowing organizations to scale their AI implementations without additional costs. Open source is important because it allows companies to tailor the tool to their operational requirements by tweaking and adapting the software without the constraints of licensing or proprietary restrictions. Companies can also modify AI to integrate with existing systems, customize it for specific use cases, or improve its capabilities beyond its original scope. FYI, this is how companies have almost always operated. Open source AI will continue to enable companies to do this.

Statement from management

CEO Krishna Claimed “AI’s impact will be on par with that of the steam engine or the internet.”

IBM’s open source AI efforts, such as the development of the Granite model collaboration Collaborate with NASA to create an open source science infrastructure model and strengthen commitment to open source frameworks.

The company’s commitment to open source AI is evident in efforts and collaborations that foster both innovation and responsible AI development. AI AllianceThe Open AI Alliance brings together over 50 organizations with the goal of building an open community to accelerate the development of responsible AI systems. Our joint efforts to establish a standardized approach to Open AI ensure that advances in AI technology adhere to principles of safety, security, and ethical considerations. The Alliance is focused on building an environment that is aligned with broader societal values and needs.

Recently, IBM CFO James Cavanaugh said: explanation At the J.P. Morgan Global Technology, Media and Communications Conference, the company highlighted that it is experiencing strong annual recurring revenue (ARR) growth, with 8% growth in overall deal volume of $14 billion and $1.25 billion ARR for Red Hat OpenShift. It also highlighted that Red Hat bookings for Q1 2024 increased by more than 40% to highlight IBM’s strong software and cloud services. Open AI is not just a philosophy that IBM is adopting; it’s a business model that is working to drive growth.

evaluation

I believe IBM’s current market valuation may be significantly undervalued relative to the company’s growth prospects and its position in the industry. IBM’s stock is currently trading well below the median P/E ratio for its sector. For example, IBM’s forward P/E (GAAP) is approximately 19.67 The technology sector’s forward earnings multiple is 30.18.

Despite the low P/E ratio, IBM’s EPS forecast indicates solid growth well above the industry average. IBM’s EPS forecast growth is solid, with future growth rates well above the industry average. IBM’s GAAP EPS growth is expected to be 70.53% year over year, while the industry average is just 7.01%. This impressive growth forecast is due to IBM’s integration of AI and cloud computing into its services, as well as its recent Acquisition Companies like HashiCorp are also expected to contribute to accelerating revenue growth and ultimately profits.

With this in mind, IBM’s stock price has significant upside potential even if it were to converge to a value halfway between its current P/E and the sector median. Specifically, an increase from the current Forward P/E ratio to near the median of 24.93 (near the midpoint between 19.67 and 30.18) could drive the stock price up by roughly 27%, calculated based on the direct impact of improving ratios and revaluation on the stock price, assuming steady or improving earnings.

This potential rerating is highlighted by the company’s operational improvements, which in my view may not yet be fully recognized by the market. This, plus the company’s strong projections for EPS growth, puts the company’s profitability, at least for the current fiscal year, on the border of a parabolic trajectory, in contrast to the overall industry performance.

Comparison with previous valuation estimates

Previously, I wrote that I wanted to compare IBM’s forward P/E to Accenture’s, which showed a 48.3% increase at the time.

Since then, I remain bullish on the stock, but see a 27% upside in the near term. Meanwhile, in the longer term, the stock could converge to Accenture’s P/E as the market recognizes that Big Blue is on a true accelerating trend.

Risk 1: PEG

IBM’s current PEG ratio is 4.16 on a non-GAAP basis, which is higher than the sector median of 2.01. This means that the market may be overestimating IBM’s growth prospects relative to its earnings, which we believe is contributing to some of the current concerns that the stock may be overvalued.

Even with this high PEG ratio, IBM’s future earnings per share (EPS) growth is solid, which may ease concerns about the high PEG ratio (that is, if performance meets expectations). Again, the company is expected to deliver solid GAAP EPS growth this year, which I think justifies the high PEG ratio.

Risk 2: Open Source Restrictions

IBM is using open source AI, but not all governments are keen to use it. The EU Law A bill to curb various uses of AI will be passed in March 2024. Open source AI is a technology that allows anyone to download, modify, and deploy AI models without strict oversight. risk This includes the creation of harmful or misleading content, abusive surveillance, and even the development of autonomous weapons and other dual-use technologies that could be used for malicious purposes.

In response to these concerns, the European Union AI Lawis the first comprehensive law of its kind to regulate the development and use of AI technologies across member states. It categorizes AI systems into risk categories, imposes strict requirements on high-risk applications, and promotes transparency and accountability for all AI deployments. For open source AI, this includes documentation and transparency obligations, although some flexibility is allowed for non-profit or research-based efforts.

IBM Announced The company recognizes these challenges and is developing tools and protocols to comply with these regulations and support safe AI development. For example, the company has introduced watsonx.governance, which provides organizations with the resources they need to effectively manage AI-related risks and comply with evolving regulations such as EU AI law. I believe this balanced innovation in AI will be key in advancing the company’s contributions to the AI field by operating within a framework that mitigates potential harm.

Conclusion

I believe IBM is an attractive investment due to the open source AI innovations that are driving the company’s significant transformation and acceleration. While the company’s stock is currently undervalued based on its GAAP forward P/E ratio, from my perspective it presents a unique opportunity for investors. IBM’s potential to leverage its open source efforts will generate significant growth and mirror the impact that open source projects such as Linux have had on the industry.

Additionally, I believe IBM’s recent partnership with Meta to integrate Llama 3 models into its AI products is a critical step in solidifying the legitimacy of open source AI. Llama 3’s generative AI capabilities expand IBM’s technical expertise and position us to lead in high-growth, high-value segments of the technology industry.

IBM’s strategic acquisitions, including the recent acquisition of HashiCorp, should strengthen the company’s commitment to strengthening its cloud and infrastructure services. While I understand that these acquisitions carry inherent risks, they remain important to IBM’s long-term strategy to dominate cloud computing and AI. I remain a strong buy. I am optimistic.