by Calculated Risk May 29, 2024 1:36 PM

The FDIC Quarterly Bank Profile Q1 2024:

The 4,568 commercial banks and thrift institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported total net income of $64.2 billion in the first quarter of 2024, up $28.4 billion, or 79.5%, from the previous quarter. A significant decrease in noninterest expenses due to several significant nonrecurring items recognized by the large banks in the previous quarter, as well as higher noninterest income and lower provision expenses in the current quarter, contributed to the quarterly increase. These and other financial results for the first quarter of 2024 are included in the FDIC’s latest report. Quarterly Bank Profile It was released today.

…

Asset quality metrics remained broadly strong, with the exception of significant deterioration in the credit card and commercial real estate (CRE) portfolios. Loans 90+ days past due or nonaccrual increased to 0.91% of total loans, up 5 basis points from the prior quarter and 16 basis points from the year-ago period. The quarterly increase was led by commercial and industrial loans and non-owner-occupied CRE loans. Illiquid interest rates on non-owner occupied CRE loans are at 1.59%, currently at their highest level since the fourth quarter of 2013, driven by the large banks’ office portfolios. Despite the recent increase, the industry-wide illiquidity ratio remains 37 basis points below the pre-pandemic average of 1.28%.

Add emphasis

From the FDIC:

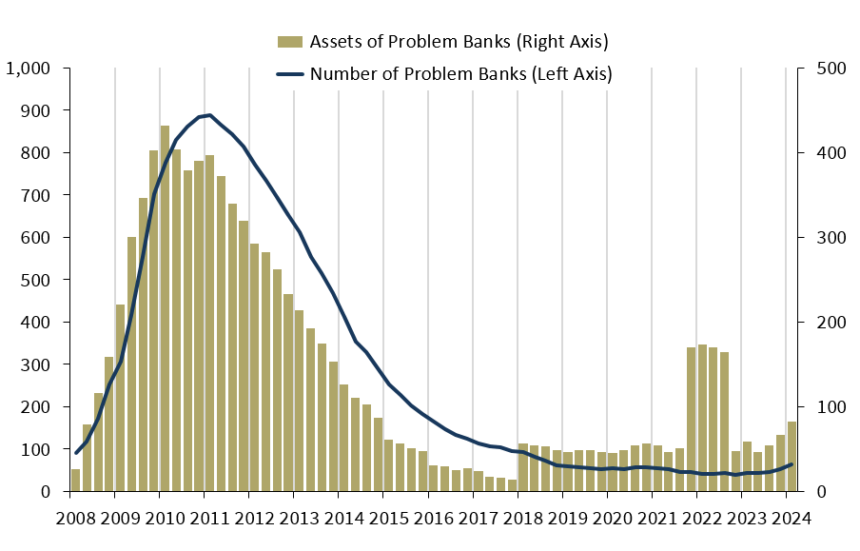

The number of banks on the FDIC’s “problem bank list” increased from 52 to 63. Total assets held by problem banks increased by $15.8 billion to $82.1 billion. Problem banks represent 1.4 percent of all banks, which is within the normal range of 1 percent to 2 percent of all banks in non-crisis periods.

This chart from the FDIC shows the number of problem banks and the assets of problem financial institutions.

Note: The number of problem bank assets increased significantly in 2018 when Deutsche Bank Trust Company America was added to the list. In Q4 2021, an even larger, unknown bank was added to the list, but that bank is now off the problem list.

The recent increase in problem banks appears to be related to office CRE loans.