Blackjack 3D

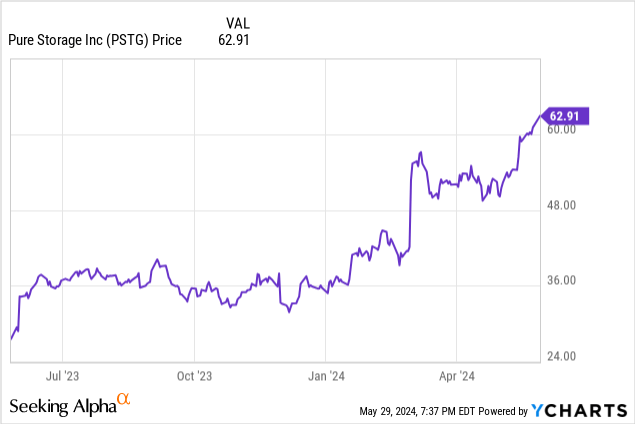

It’s been a disappointing earnings season for growth stocks, but Pure StorageNew York Stock Exchange:Prestige) is bucking the trend.NVDA) accounts for the majority For all the glory of AI, the reality is that generative AI applications require massive amounts of data to run, and therefore storage. Pure Storage, which has completely transformed itself from a commodity hardware provider to a value-added software company, is a huge beneficiary of this trend.

(Nonetheless, the company is sticking to its full-year guidance and remaining conservative, giving it room to deliver more beat-the-expected quarters and earnings growth throughout the year.) That sent the company’s shares up nearly 10% in after-hours trading, nearly doubling Pure Storage’s gains this year.

Pure Storage’s bull case has never been brighter, fuelled by AI

I I wrote a strong comment at the end I invested in Pure Storage in early March when shares were still trading in the mid-$50s. I’ve been a long-and-hold investor in Pure Storage for several years and still maintain my buy recommendation on the stock after the strong price appreciation this year.

Of course, the biggest driver of this year’s cumulative gains is the long-term tailwind that’s beginning to emerge from AI. In the first quarter, the company: New Integration with NVIDIA These essentially help form the backbone of data acquisition in LLMs (Large Scale Language Models). These new products, along with a surge in enterprise interest and investment in generative AI for automation, are driving huge IT spend across the AI ecosystem, of which Pure Storage is also benefiting.

What’s noteworthy here is that while most enterprise technology companies are showing macro-driven weaknesses that are impacting IT budgets, Pure Storage has been able to overcome these headwinds with its new product pipeline.

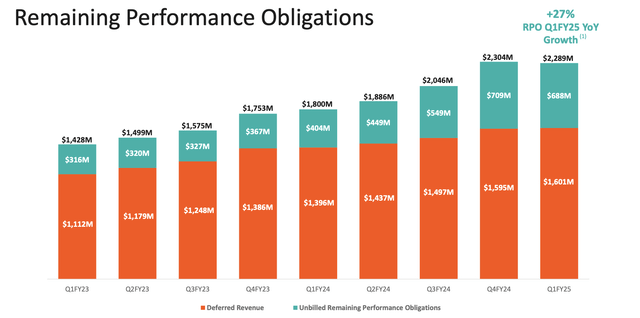

In fact, beyond the revenue growth the company reported this quarter, we note that Pure Storage’s deferred revenue and total RPO (remaining performance obligations) continue to increase, which is a strong indicator of the company’s future growth trajectory.

Pure Storage RPO (Pure Storage Q1 Financial Results Presentation)

As shown in the chart above, RPOs increased 27% year over year during the quarter. Much faster than overall revenue growth (Note, however, that this metric also depends on the length of the contract.)

For first-time investors in Pure Storage, here is my complete Long-term bull market For the company:

-

We have successfully transitioned to a subscription company leveraging the demands of Gen AI. Despite macroeconomic headwinds, Pure Storage continues to grow subscription revenue by more than 20% in FY25, driven by its Generation AI investments. This type of revenue stream is exactly what Wall Street values: a recurring, high-margin revenue stream from returning customers.

-

Massive TAM in the billions across a range of use cases. Pure Storage estimates the TAM at over $60 billion, meaning that the current revenue run rate of about $2.5 billion only represents about 4% of this market. Also note that AI workloads have a myriad of use cases that require vast amounts of data, necessitating many more storage solutions.

-

Paying for what you use is a win-win for both Pure Storage and its customers. Pure-as-a-Service pricing is based on usage, typically priced in GiB/month. Aside from the relatively low minimum commitments, this is a benefit to new customers because it lowers the barrier to entry, allowing them to start using Pure Storage for only the workloads they select. For Pure Storage, this is an advantage because over time these customers can potentially grow into major clients.

-

There is a growing focus on enterprise. What’s more, over 50% of Pure Storage’s revenue currently comes from enterprise clients, with its top 10 customers spending over $100 million annually.

-

Cash flow. Pure Storage generates huge cash flow, but with pro forma operating margins in the low teens percentage range and FCF margins in the mid-single digits, it still has plenty of room to grow.

Let’s hang in there and keep riding the upward trend.

Q1 Download

Let’s take a closer look at Pure Storage’s latest quarterly results. Here’s a summary of their first quarter earnings:

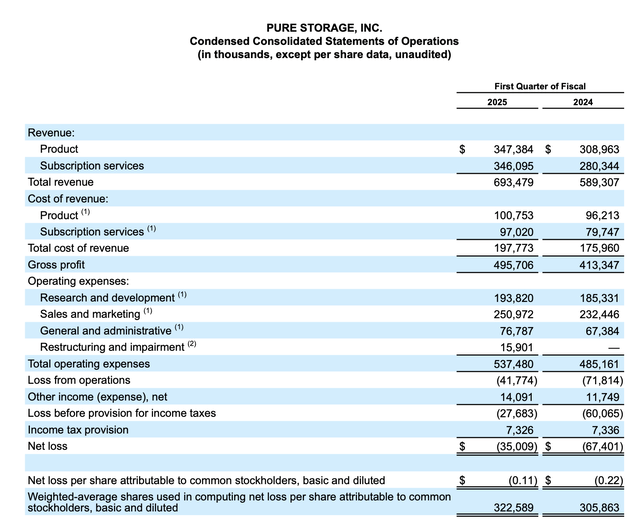

Pure Storage First Quarter Results (Pure Storage Q1 Financial Results Presentation)

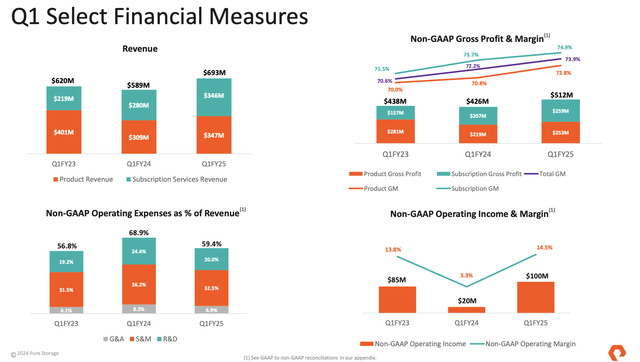

Pure Storage’s revenue grew an impressive 18% year over year to $693.5 million, well above Wall Street expectations of $680.9 million (up 16% year over year). It’s also worth noting that growth accelerated sharply from -3% y/y in the fourth quarter.

Pure Storage’s phasing out of product revenue (and subsequent move to a pure software/subscription model) is part of this distortion; the company faced tougher product sales conditions in Q4 than in the same period last year. However, we note that underlying subscription revenue growth of 23% year-over-year is in line with the 24% year-over-year growth pace in Q4.

Additionally, subscription ARR (annual recurring revenue) also matched Q4’s 25% year-over-year growth rate to $1.45 billion. Continued ARR growth and nearly 30% RPO growth strongly suggest that Pure Storage’s roughly 20% subscription revenue growth rate is likely to be sustained for the foreseeable future.

It’s also worth noting that the more Pure Storage does well selling its subscription products, Evergreen//One and Evergreen//Flex, the stronger the headwinds to revenue growth will be in the near term: the company still sees strength in those products reducing annual growth by 4 percentage points.

Pure Storage also performed well on the revenue side, notably with total gross margins surging 250bps year over year to 73.2%, as shown in the chart below, driven by both underlying improvement in gross margins and a more favorable shift in revenue mix towards subscriptions.

Pure Storage Profitability (Pure Storage Q1 Financial Results Presentation)

Meanwhile, pro forma operating profit margin increased by more than 10 percentage points year-on-year to 14.5%. He points out that Pure Storage, with pro forma operating margins of about 15% and subscription revenue growth of about 24%, is on the verge of meeting the classic “Rule of 40” test for software companies.

Evaluation and key points

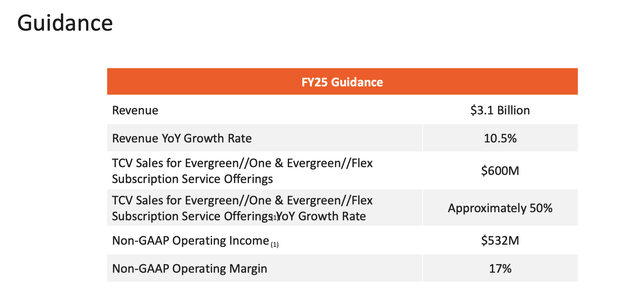

Despite the better-than-expected first-quarter profit, the company maintained its full-year revenue guidance at $3.1 billion, up 10.5% year over year (growth in the mid-teens after factoring in a 4 percentage point headwind from the company’s reported Evergreen//One sales growth). It also maintained its pro forma operating margin guidance at 17%, despite first-quarter operating profit increasing 1.5% year over year.

Pure Storage Outlook (Pure Storage Q1 Financial Results Presentation)

In other words, Pure Storage appears to be gearing up for an upward guidance adjustment in the next quarter.

It’s worth noting that some of Pure Storage’s strength is already priced into its stock price. With shares trading near $68 after the company’s first-quarter earnings, Pure Storage has a market capitalization of about $22.05 billion. That figure excludes the $1.72 billion in cash and $100 million in debt shown on Pure Storage’s most recent balance sheet. The enterprise value is $20.43 billion.

For next fiscal year 26 (Pure Storage’s fiscal year ends in January 2026), Wall Street analysts expect the company to make $3.52 billion in revenue, up 13% from this year’s forecast of $3.1 billion. This gives Pure Storage an earnings multiple of: 6.6x EV/FY25 revenues, 5.8x EV/FY26 revenues.

I still believe there’s more upside, but I don’t want to get too greedy. Pure Storage is $76price target is 6.5x EV/FY2014 (and a P/E of 41 on next year’s consensus EPS of $1.82), be sure to actively monitor this position to avoid missing out on profits before it gets too overheated.