Walter Bibikow

by James Knightley & Francesco Pesole

Why we expect a rate cut next week

Of 26 banks surveyed by Bloomberg, 16 support a 25 basis point rate cut by the Bank of Canada on June 5, while 10 support a 25 basis point rate cut. The BoC will leave the overnight lending rate unchanged at 5%. The market is seeing a similar balance of probabilities, with a 25bp cut currently priced at around a two-thirds chance. Given that the data seems to favor a cut and the BoC has a history of being willing to make bold decisions, we believe they will opt for a 25bp cut at the last moment. It is important to note, however, that BoC officials have not been particularly vocal about a possible cut and may instead use this meeting to set the stage for a July rate cut. Any action at that meeting is now fully priced into financial markets.

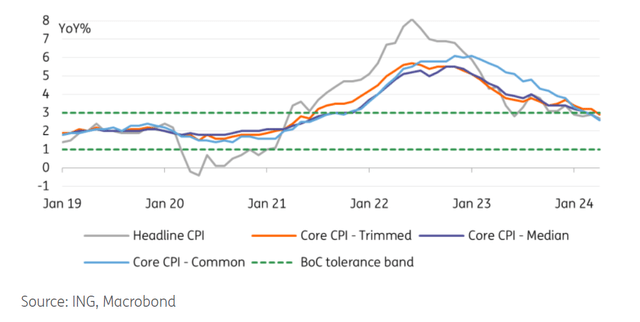

Key to the outlook for a June rate cut is that consumer price inflation has slowed to 2.7% and core inflation is also below 3% year-on-year, meaning both inflation measures are within the Bank of Canada’s comfort range of 1% to 3%. The unemployment rate has risen to 6.1% from a mid-2022 trough of 4.9%, and wage growth is running at just under 5% year-on-year. First-quarter GDP is likely to grow at an annualized rate of just above 2% after a slump in the second half of 2023, but this is mainly due to a 0.5% month-on-month increase in activity in January, a slower 0.2% growth rate in February, and flat growth in March.

Moreover, the effects of tight monetary policy are becoming increasingly visible, with the household debt service ratio hitting a record high of 15% compared to 9.8% in the United States. With unemployment rising, the risk of rising loan delinquencies is very real, which would increase the likelihood of a potential recession. In this regard, it should be noted that a third consecutive month of declines in retail sales at a time when immigration growth is very strong is not a good sign.

Canadian inflation returns to target range

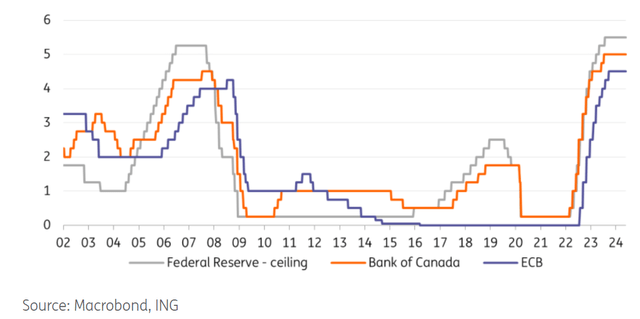

The Bank of Canada should try to avoid being too dovish about future policy

Against this backdrop, we believe the Bank of Canada will opt to cut rates by 25bp, but will likely be cautious about cutting rates too sharply as this could create the impression of a sharp deviation from the U.S. Ultimately, if we are correct and the Bank of Canada implements a 25bp cut on Wednesday, the gap between the federal funds rate cap and the Bank of Canada’s policy rate will widen to 75bp.

This would be the largest gap since July 2019, and if the Bank of Canada cuts rates again in July before the Fed acts (we expect them to cut in September), it would be the largest gap since 2009. This could have an impact on the Canadian dollar, so we expect the Bank of Canada to issue a relatively cautious message on the outlook for further rate cuts. That said, with the Fed expected to cut rates after September, we see room for the Bank of Canada to cut its policy rate to 3.5% in the first half of 2025.

BoC interest rates compared to Fed and ECB interest rates

Canadian Dollar Falls on Crosses

We believe the market is underpricing both the likelihood of a June rate cut and the likelihood of further easing by the end of the year. Despite Canada’s headline and core inflation rates declining faster than expected, the Bank of Canada market remains heavily priced into Fed expectations. As the market has become less dovish towards the Fed, the implied probability of a Bank of Canada rate cut in June has also not exceeded 70/75% throughout April and May, and is now around 65%, or 16bp. Bank of Canada rate cuts are priced in for a total of 52bp by the end of the year, about 20bp higher than the Fed’s cut.

Our view on the BoC has been more dovish than the market for quite some time, leading to our view that the Canadian Dollar will underperform in the coming months. In addition to the large amount of room for dovish rate restructuring (we expect three more rate cuts from the BoC in 2024), the CAD will tend to underperform other commodity currencies if the US data surprises to the downside. If the US data does indeed turn weak, the CAD may perform more closely to the USD than other G10 currencies.

In the commodity exchange market, we expect the CAD to remain weaker primarily against the NZD, AUD and NOK, as the market favors currencies that can count on hawkish central banks. As for USD/CAD, the move should still be primarily determined by the USD, namely the US data and the Fed. We expect the Fed to make its first rate cut in September, and we believe the USD is already trading at pre-US election highs. With this in mind, our base case is for USD/CAD to rise to 1.35 over the summer, despite Bank of Canada easing.

Content Disclaimer

This publication has been prepared by ING for informational purposes only, without regard to the assets, financial situation or investment objectives of any particular user. This information does not constitute an investment recommendation, nor does it constitute investment, legal or tax advice or an offer or solicitation to buy or sell any financial instrument. read more