Miscellaneous photos

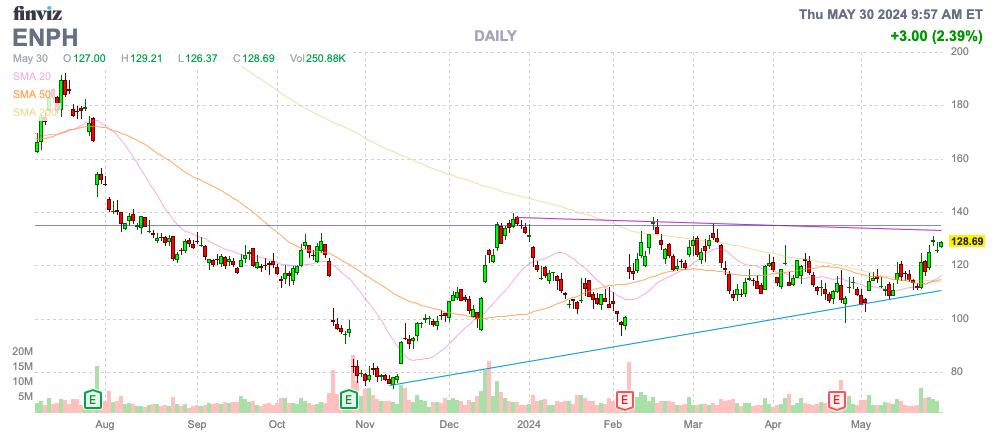

The solar space has gone through a digestion phase and we are finally seeing light at the end of the tunnel. Enphase Energy Inc. (Nasdaq:Enfu) is seeing signs that the residential solar business is starting to pick up in major European countries, The actual demand was much less than expected. Investment Thesis We maintain a neutral rating on the stock as the recent share price rally has been hit by weak selling demand.

Source: Finviz

Turnaround Quarter

Like many sectors, the company has had a turbulent financial past few years. Whether it was the impact of COVID-19 or the Russian invasion of Ukraine, sales have generally been a rollercoaster ride in a fast-moving sector like solar power.

Enphase Energy has been helping customers absorb excess inventory over the past few quarters, which has led to lower shipments to the channel: the company was short hundreds of millions of dollars in shipments each quarter.

of Home energy service companies report weakness Q1 2024 results Revenue fell short of analysts’ targets by $14 million, coming in at $263 million in revenue. The problem is that while Enphase had expected second-quarter revenue of at least $290 million, that forecast was well below the consensus estimate of $346 million.

Importantly, the solar microinverter and battery maker is forecasting a return to growth as channel inventory is reduced: sell-through sales in Germany increased 28%, and IQ Battery’s inventory is now clean, with mid-point sales forecast to increase by $47 million.

Just as important, Enphase Energy remains a profitable business despite a 64% drop in revenue last quarter. The company achieved EPS of $0.35 in Q1 as it cut x costs and maintained high gross margins of 46.2% due to a 5.2% gain from IRAs.

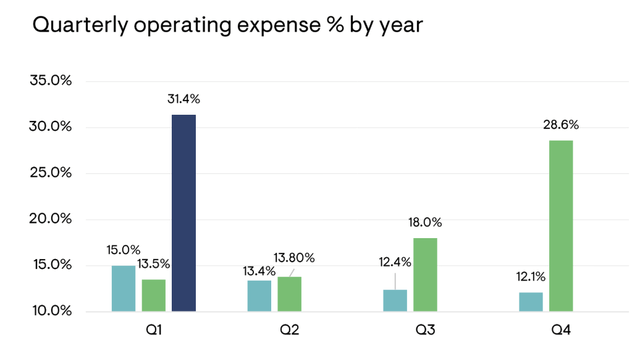

Despite the decline in operating expenses, Enphase Energy’s operating expenses still amounted to 31.4% of revenue, a figure that should fall as revenue grows again, making the home energy services company much more profitable going forward.

Source: Enphase Energy Q1 2024 presentation

Enphase Energy expects second-quarter 2024 expenses to be about $80 million.

Leading the way in rebounding

The biggest problem with the stock is that this recovery is already a bellwether for the business, which is almost impossible considering Enphase Energy already has a market cap of $17 billion and reported quarterly sales of $250 million.

Based on the company’s latest shipment numbers, Enphase Energy’s quarterly business remains in the range of just $400 million, versus a previous forecast of $450 million to $500 million. Second-quarter shipment forecasts are expected to be $90 million below sales demand, primarily due to weakness in microinverters and the California market.

Consensus estimates normalize revenue to $2.2 billion levels in 2025. With first-half sell-through demand pacing at $1.6 billion, the company expects inventory issues to be resolved heading into the second half of the year, suggesting quarterly revenue will rebound to the $400 million+ range.

Enphase Energy is expanding in Asia and Brazil to further deploy its IQ batteries for storage in solar PV systems. While the current market opportunity is significantly larger than in previous cycles, demand has not recovered due to rising interest rates and a significant demand frontloading over the past few years.

The market is actually predicting a strong EPS increase: Enphase Energy only had an EPS of $4.41 in 2023 before its solar inventory issues, but the market expects the company to achieve over $5 EPS in 2025 and reach $6.25 EPS in 2026.

The company’s shares are already trading at 20 times its 2026 EPS target and more than six times its projected revenue of $2.7 billion. The big question is whether demand for solar power will actually surge to previous levels, given that several demand factors, including COVID-19 in the U.S. and Russian energy shortages in Europe, have driven higher demand over the past few years.

Enphase Energy has laid out its base case for a return to growth, but its financial targets for 2026 call for revenue growth nearly 70% above current demand levels. Assuming the residential energy services company can achieve these aggressive recovery targets, its stock is already highly priced, and there is a risk that Enphase will not achieve these targets.

remove

The key takeaway for investors is that Enphase Energy is poised for further upside as energy demand recovers. The company doesn’t see the same level of sell-off demand as expected, even though it is higher than current sales.

Investors can still ride the current bull market but should sell shares immediately. Barclays’ bullish forecast He set a price target of $134 on the stock, which is currently trading near $130.