yuelan/iStock Editorial via Getty Images

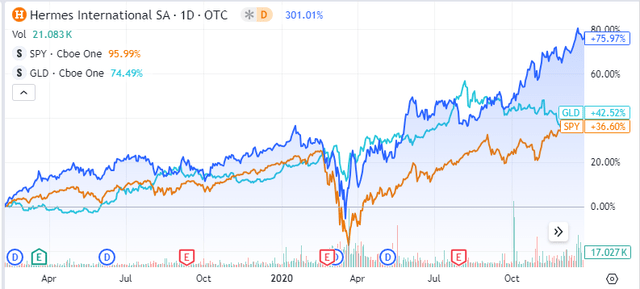

I recently Luxury brand reviews, The main reason is that, if managed properly, these companies can outperform the broader market during stressful times.OTCPK:HESAY) (OTCPK:HESAF)teeth Here’s a good example: below we can see that Hermes was outperforming the S&P 500 before the COVID-19 crisis and remained so even during the most difficult times. Even though gold was outperforming at the peak of the crisis, it didn’t take long for Hermes to overwhelm the other stocks.

Stocks are highly vulnerable to panic, especially since investors tend to flee to liquidity. In the chart above, even gold is hit by that knee-jerk reaction. So it’s hard to find stocks that are immune to market turmoil. Still, I think the following points are important: Investors are increasingly holding stocks whose underlying businesses are increasingly being understood to be resilient to economic stress, and I feel this is the case for well-managed luxury brands.

Business Type

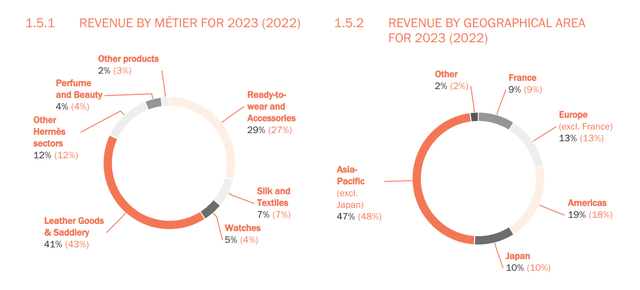

Like other European luxury brands, Hermes Craftsmanship and savoir-faireThe company’s manufacturing technology is born from knowledge of materials and the technology to handle those materials. One of the important pillars of the company’s manufacturing is Systematizing manufacturing technology We also actively train our collaborators on proper sewing and cutting techniques, which means minimizing re-localization of production while exploring the market for vertical integration opportunities.

Distribution, on the other hand, is based on a network of stores, the majority of which are operated by Hermès. The result is an experience that is fully controlled by Hermès: just as Hermès trains its artisans, it also provides rigorous training to its store staff to ensure the right treatment and in-store experience.

Unlike competitors such as Louis Vuitton, Hermes has not adopted a multi-brand strategy: although the company owns other brands, it has focused on expanding its brands into other market segments, such as shoes, fragrances, and watches.

It is important to understand that expanding this business requires careful planning. The company needs to train new craftsmen, source materials or increase production, and expand its stores. The benefit of this effort is that the company is not dependent on third-party manufacturing overseas, reducing counterfeiting and ensuring rarity of its products. The end result is that the company is able to achieve high sales at list price, strengthening the desirability of its brand.

Finance

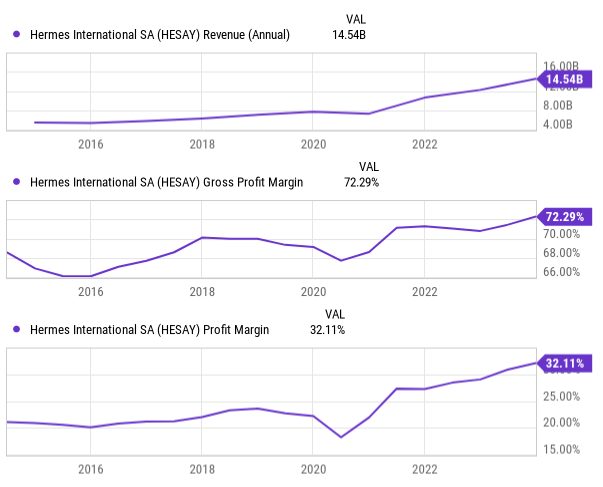

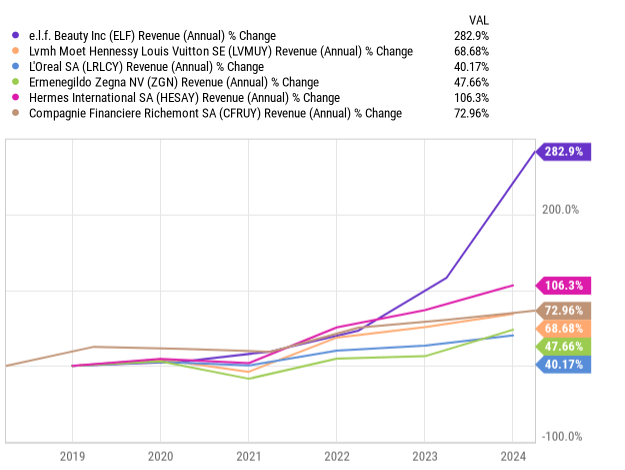

As a result, the company has been able to maintain sales growth while also improving gross margins and profit margins. This may seem counterintuitive, as there is no clear way to scale without adding headcount.

Y Chart

But vertical integration in the right places, while still selling at full price, can be a huge win-win in the long run if executed well, as is the case for Hermes.

The company plans to expand its production units and expand its stores slightly. 2023 ReportThe company said it plans to expand and renovate 20 units worldwide. It is also developing new production capacities in its silk division by opening a new printing line in France. The company plans to open new production units and hire 300 new employees each year in its leather goods and saddlery divisions. This means good prospects for stable revenue and profitability growth.

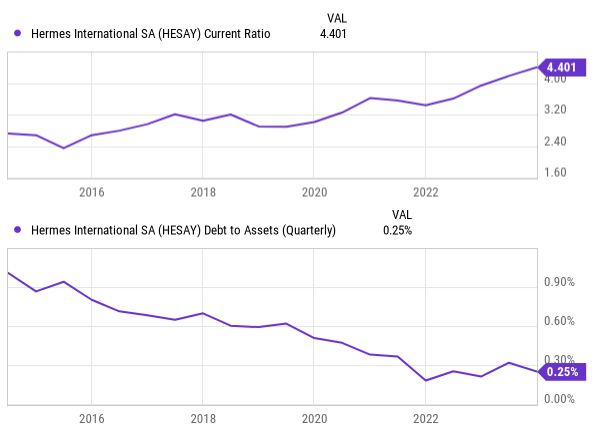

Turning to the balance sheet, the company exhibits a healthy balance sheet. First, the fact that the company has not based its strategy on acquiring other brands means that the company has not resorted to issuing debt and has kept its debt levels very low. Meanwhile, the business is well-run and has been able to organically fund its growth expansion while generating healthy cash flows and steadily increasing its liquidity position.

Y Chart

Evaluation and Risk

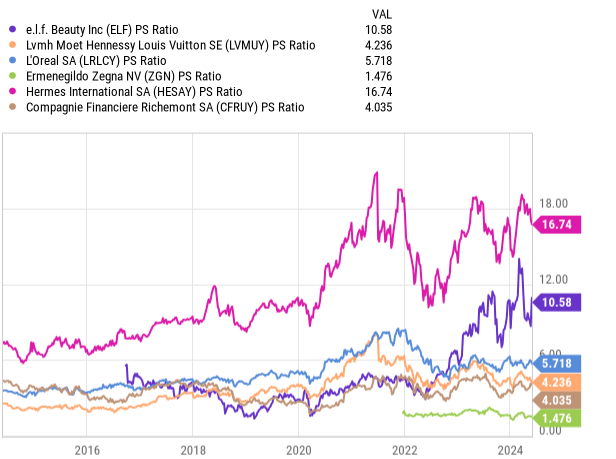

My research reveals a strong business model with very good execution as shown by the financials. Next, we need to compare the valuation metrics with its peers to understand where this company stands relative to others in the industry.

Y Chart

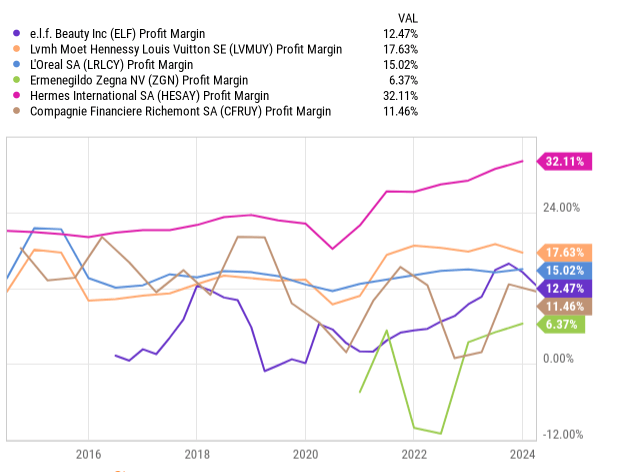

Looking at the price-to-sales multiple, we can see that this company has the highest ratio of all its peers listed. It has a higher price-to-sales multiple than ELF (fairyHermes is expected to grow explosively. In Hermes’ case, growth is good, but not as fast as the currently booming Elf. However, the reason for this is likely due to the difference in profit margins between Elf and Hermes. The French luxury brand boasts a profit margin of over 32%.

Y Chart Y Chart

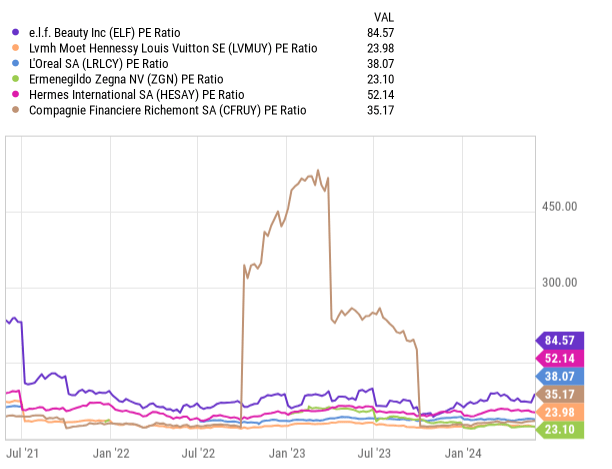

Looking at the price-to-earnings ratio, we see that Elf is the most expensive company and Hermes is the second most expensive. In the case of Elf, it is not surprising that it has a high price-to-earnings ratio since it is in an explosive growth phase and the market has priced that in. In the case of Hermes, it is not surprising that a company with profit margins almost double those of its peers such as Louis Vuitton and L’Oreal also has a high price-to-earnings ratio.

Y Chart

Either way, these multiples are so high they should give us pause. They reflect expectations of near-perfect execution. If Hermès continues to do well, we can look back and say the current price is fair value. But if consumer preferences change for any reason, profitability could decline, and suddenly investors will be questioning whether the current high multiple really reflects the company’s prospects. Digital luxury retail, for example, is an area incumbents are still trying to figure out, and could pose both opportunities and threats.

Additionally, they found that the company would scale slowly because they needed to train employees and source materials, which meant they couldn’t expect explosive growth. It also meant that if the company needed to downsize, they would have to lay off employees they’d spent so much time training.

Conclusion

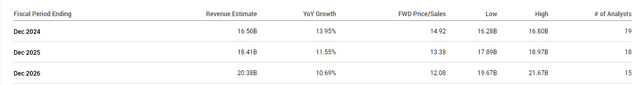

Overall, if the company continues to grow at a healthy clip, I believe it could be valued at $305 billion, or $291 per share, by 2026. That translates to $20.38 billion in revenue, a roughly 30% profit margin, and a multiple of 50 times earnings.

However, given that the company’s market cap is currently close to $248 billion, an expected annual rate of return of around 7% seems quite low, given that there is always a risk that something could go wrong. A more acceptable hurdle rate would be an annual rate of return of around 15%.

That said, I will be keeping a close eye on this company and considering buying shares at or below $191, nearly 20% below the current share price of $235. This would imply an annualized return of about 15% on my target price of $291. Clearly, a company of this quality may never trade at that price again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.