Nikada/iStock Unreleased via Getty Images

Cornerstone Total Return Fund (New York Stock Exchange:CRFS) is a diversified closed-end investment fund (CEF) focused on value, growth and income.

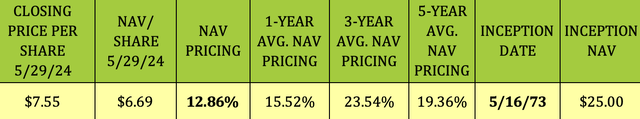

Previous article on CRF January articlesWhen the CRF was on sale That’s a premium of 11.88% to NAV. Since then, CRF has had some ups and downs, increasing in price by 5.7% and paying a monthly dividend of $0.416 per share.

Fund Profile:

The fund’s investment objective is capital appreciation, with current income being a secondary objective. The fund’s investment adviser employs a balanced approach that includes “value” and “growth” investing, seeking out companies with favorable long-term growth characteristics at fair prices, regardless of sector or industry. Valuation and growth characteristics may be considered for purposes of selecting potential investment securities. (CRF site)

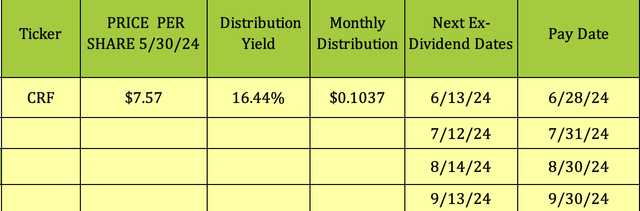

Dividends:

CRF will announce dividends for three months. They are issued at the beginning of each quarter. At the price of 5/30/24, they have a yield of 16.44% and a monthly dividend of $0.1037.

This is lower than the previous monthly dividend of $0.1137 but is consistent with the dividend rate of 21% of the fund’s net asset value. CRF’s managed dividend plan adjusts annually by resetting the monthly dividend per share amount based on the fund’s net asset value on the last business day in October.

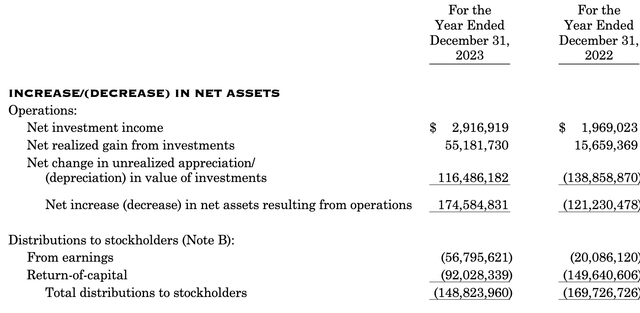

NII increased 48% in 2023 to $2.9 million, while realized net gains nearly tripled to approximately $55 million. Unrealized valuation gains turned from a loss of $139 million in 2022 to a gain of $116 million in 2023. For the year ending December 31, 2023, 57% of distributions came from return of capital (ROC), down from 88% for the full year 2022.

Asset holdings:

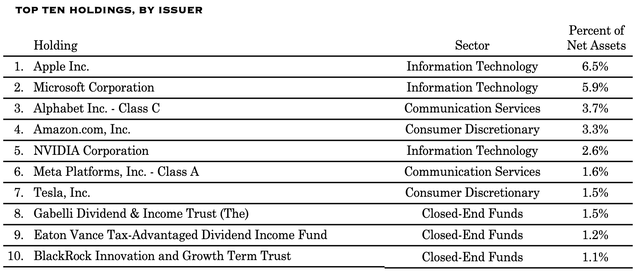

As of December 31, 2023, CRF’s top 10 holdings include most of the top seven stocks, with the percentages remaining largely unchanged compared to September 30, 2023.

However, Adams Diversified Equity Fund, Berkshire Hathaway and Walmart were replaced by positions in Gabelli Dividend & Income Trust, Eaton Vance Tax Advantaged Fund and BlackRock Innovation & Growth Term Trust from the top 10. The top 10 positions made up about 30% of CRF’s portfolio.

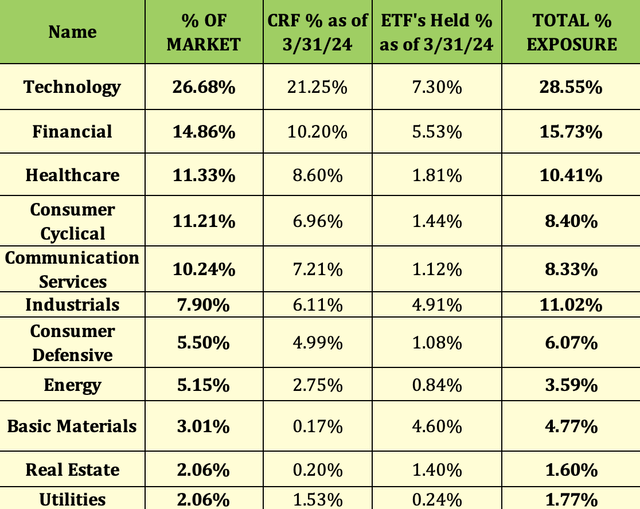

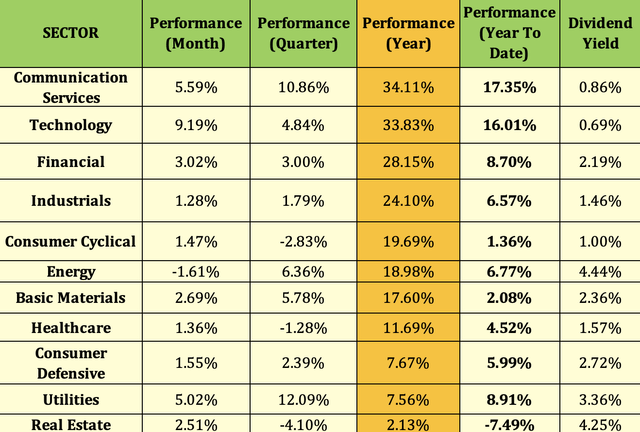

CRF gains sector exposure through direct equity holdings and ETFs. Technology remains the top sector, with Emphasis on technology, finance, industry and basic materialsas of March 31, 2024:

performance:

Communications Services, featuring Alphabet, Meta, and Netflix, has been the best-performing sector over the past year, up 34%, and up 17% so far in 2024. This is followed by Technology, up just under 34% for the year and up 16% so far this year. Financials is up 28% over the past year and up 8.7% in 2024. This is followed by Industrials, up 24% over the past year and up 6.6% in 2024. These four top-performing sectors account for approximately 63% of CRF’s portfolio as of March 31, 2024.

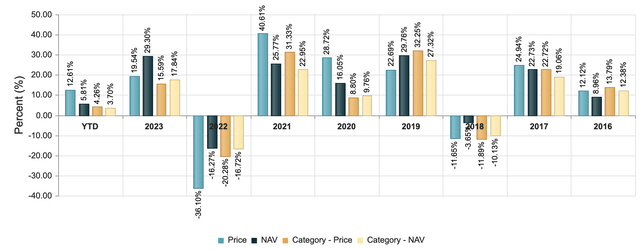

CRF has outperformed the Morningstar US CEF U.S. Equity Category so far in 2024. Price is up 12.6% and NAV is up 4.68%. CRF also outperformed the Morningstar US CEF U.S. Equity Category in 2023, 2020-2021 and 2017.

risk:

A full list of potential risks facing CRF can be found on pages 30-37 of the 12/31/24. Annual report.

“In 2023, the fund’s strong positions in Nvidia, Alphabet and Amazon boosted overall returns. In contrast, the fund’s holdings of Visa and UnitedHealthcare underperformed expectations. Closed-end funds have an elastic impact on fund performance, sometimes adding to performance and sometimes lagging behind, depending on the overall market.” (CRF 2024 Annual Report)

Distribution Risk: As previously mentioned, CRF’s management reassess CRF’s distribution policy each October, which is currently based on 21% of the fund’s NAV. In October 2023, the company reduced its monthly distribution from $0.1137 to $0.1037.

evaluation:

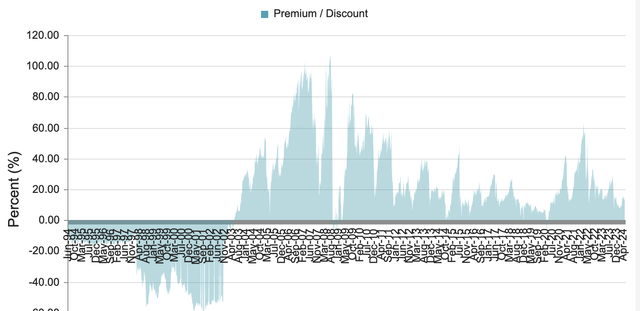

Buying CEFs at a historically larger discount to NAV can be a useful strategy due to mean reversion. CEFs’ daily valuations are calculated at the end of each trading day. CEFs have frequently traded at a premium to their net asset value over the past few years, The five-year average price/NAV premium is over 19%.

At its closing price of $6.69 on May 29, 2024, CRF was trading at a premium of 12.86%. While that sounds expensive, this is a lower premium than the one-, three-, and five-year premiums to NAV of 15.5%, 23.54%, and 19.36%, respectively.

lastly:

I recommend adding CRF to your watchlist and continue to rate it a “Buy” as it approaches a 10% premium to NAV, a level that appears to have delivered good returns over the past few years.

If you are interested in other high-yield investment products, we feature them in our articles every Friday and Sunday.

All tables provided by Hidden Dividend Stocks Plus unless otherwise noted.