Nazar Rybak

Front Door Co., Ltd. (Nasdaq:FTDRAmerican Home Shield is trying to navigate a changing macro environment through its flagship home warranty service offering. Though sales volumes are declining, price hikes and cost-cutting efforts are boosting profits.

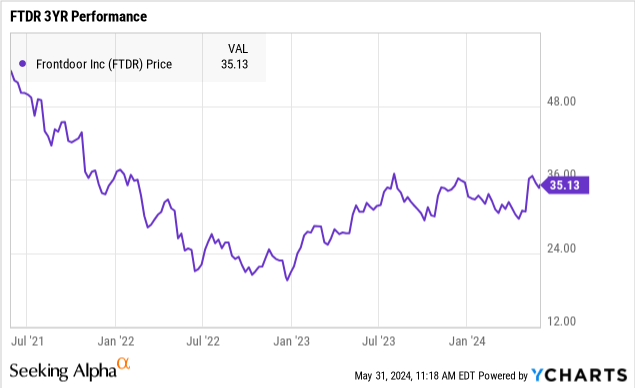

Indeed, financial trends look pretty solid, but the stock remains challenged due to generally poor sentiment toward this market segment. The stock is down about 1% in 2024, missing an upside opportunity. Overall, FTDR is expected to remain volatile until it sees signs of stronger growth trends.

FTDR Financial Overview

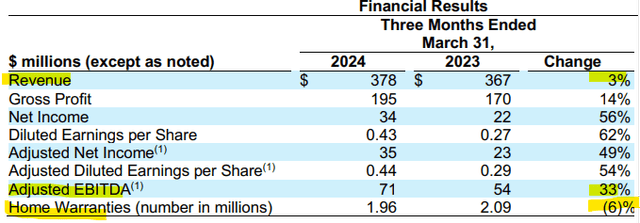

FTDR announced its first quarter results in early May. Non-GAAP EPS was $0.44 This was well above the consensus estimate of $0.20. Revenues were $378 million, up a modest 3% year over year but still above expectations.

Gross profit is It rose to 51% from 46% a year ago as average prices increased 11% year over year, offsetting an 8% decline in total volume.

The company’s cost improvement is evident in adjusted sales and marketing expenses and general and administrative expenses, which declined from the first quarter of 2023. Adjusted EBITDA It reached $71 million, up 33% from the same period last year.

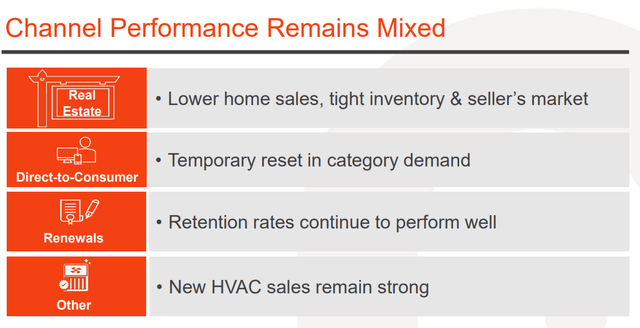

The business environment is complicated. On the one hand, the sluggish housing market is weighing on demand for new home warranties, which historically correlate with real estate sales. Retention rate The company is seeing strong heating, ventilation and air conditioning (HVAC) sales as customers are seeing strong contract renewals.

American Home Shield’s rebranding, which was launched in April along with new marketing efforts, is expected to contribute to a recovery in growth through increased market awareness going forward.

Frontdoor now expects revenue to be between $1.81 billion and $1.84 billion in 2024, which would represent a 2.5% increase at the midpoint compared to 2023. The key move this quarter was the revision of its full-year adjusted EBITDA target to a range of $360 million to $370 million, up from the midpoint forecast of $355 million. The new adjusted EBITDA outlook is about 5.5% higher than last year’s result of $346 million.

On the balance sheet, Frontdoor ended the quarter with $378 million in cash compared to $573 million in long-term debt. Its leverage ratio of 1.1x is stable and well supported by underlying cash flows.

The company has also been active in share repurchasing, buying back $33 million worth of stock through April of this year and $314 million worth of stock since its first share repurchase authorization in 2021.

What’s next for FTDR?

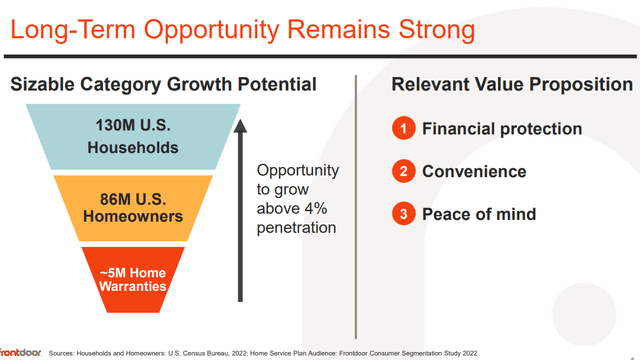

What makes Frontdoor attractive as an investment opportunity is the company’s leadership position in home warranties: Of the 130 million households and 86 million homeowners in the U.S., only 4% or 5 million people have a home warranty, giving Frontdoor control of about 40% of the market.

Naturally, there are opportunities to increase penetration by selling the value proposition of financial protection, convenience and peace of mind. On-demand home services such as via the subscription-based Frontdoor app offer many avenues for monetization.

However, current market conditions make expansion strategies difficult. Pending Home Sales The number of deals signed fell 7.7% year-over-year, the lowest since the pandemic began.

Home warranties are typically purchased when people move, so a strong housing market is understood to be a key driver of the company’s growth. Unless mortgage rates fall significantly, it is unlikely that housing market conditions will improve anytime soon.

Frontdoor’s ability to boost profitability has been successful, but the company’s revenue outlook, which sees sales growth in the low single digits this year, doesn’t inspire much confidence.

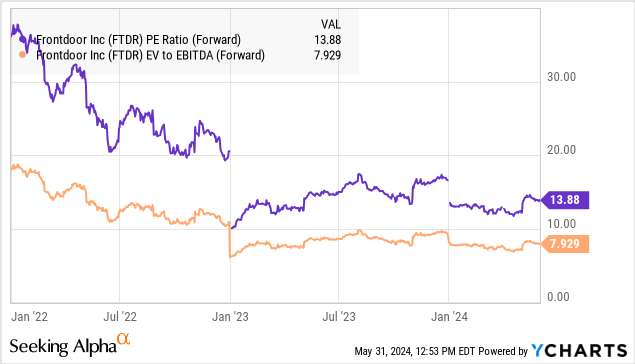

In terms of valuation, the stock is trading at roughly 14 times consensus EPS of $2.53, or 8 times management’s full-year adjusted EBITDA guidance for 2024. While these multiples are reasonable, they don’t necessarily mean the stock is cheap, given the number of uncertainties.

The big risk to consider is that the economy and housing market could worsen further, creating a significant headwind for the company’s outlook. Lower than expected performance over the next few quarters could force a reassessment of profitability for next year and beyond.

Final thoughts

Frontdoor has enough positive factors to maintain a bullish long-term outlook, but some near-term caution is warranted.

We rate FTDR a Hold, which suggests a neutral view on the stock’s direction over the next 12 months from current levels. Watch points include home warranty levels, gross margin trends, and adjusted EBITDA financial metrics.