Monty Laksen

Investment Thesis

Axcelis Technologies (Nasdaq:ACLS) is what I first Featured on Seeking AlphaAt the time, the stock price seemed overvalued and expectations were high. Now is a good time to provide a follow-up.

As this analysis shows, Axcelis has not been able to maintain its growth momentum, even though its products remain essential to semiconductor manufacturers. This is due to several factors, including weak demand for consumer electronics and EVs, as well as the company’s limited AI efforts. There is still an opportunity to generate further revenue in the long term, but that is still some way off.

This loss of growth momentum, combined with a limited margin of safety, has led me to maintain my “Hold” rating on the company. In this article, I will provide a brief overview of the business, recent developments, and future outlook. Near future, and evaluation.

Business Contents

We’ve covered how Axcelis makes money in a previous article, and we’ll only briefly explain it here, but for a more detailed explanation, please see our previous article.

Axcelis Technologies Semiconductor chips play a vital role in the semiconductor industry. They are used in a wide variety of electronic products, from personal computers and mobile phones to cars and sensors. Demand for these products is driven by a variety of factors, some of which have more exposure to consumers, while others are driving the explosion in artificial intelligence we are currently experiencing.

Nvidia (NVDA) can design and engineer these chips, but the actual manufacturing process is complex and requires a large investment. That’s why there are pure semiconductor manufacturers. These are called foundries. Axcelis provides these manufacturers with ion mounting and other processing equipment. Without going into technical details, this equipment helps change the electrical properties of the semiconductor, which is a critical process.

This is a highly complex technology that requires years of research and know-how, which is why there are only a handful of large companies in the industry, such as Axcelis and Applied Materials.Amato).

Recent developments and stock price trends

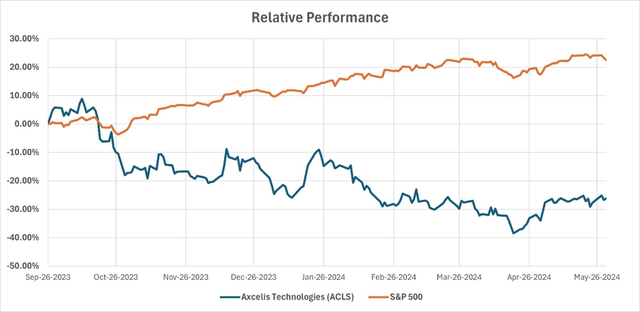

Since our initial analysis on Seeking Alpha, the stock has been trending lower, significantly underperforming the S&P 500 Index, as shown below.

There are a few reasons for this, which we’ll go into in more detail in the outlook section, but in summary, growth opportunities were not realized and the company was left behind in the AI ecosystem.

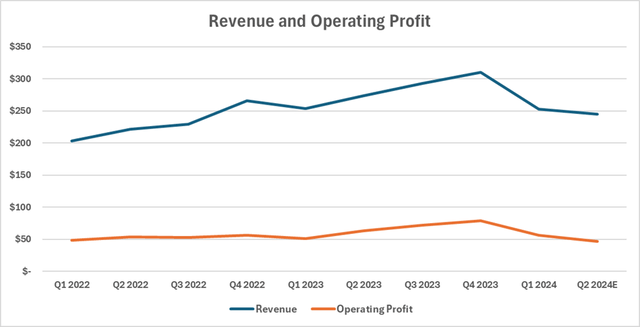

In the most recent quarter (Q1), the company beat EPS and revenue estimates. Revenue was slightly down compared to the same period last year. Management expects Q2 revenue and operating income to be down compared to the same period last year. Below is a chart showing Axcelis’ actual and forecasted revenue and operating income for the quarter.

From the stock chart, it is clear that the growth is not meeting market expectations. Revenue and operating profit in the first quarter were flat compared to the same period last year, but are expected to decline in the next quarter. This is one of the reasons for the stock price decline. In the next section, we will explain why the company’s growth is stagnating.

Near-term outlook

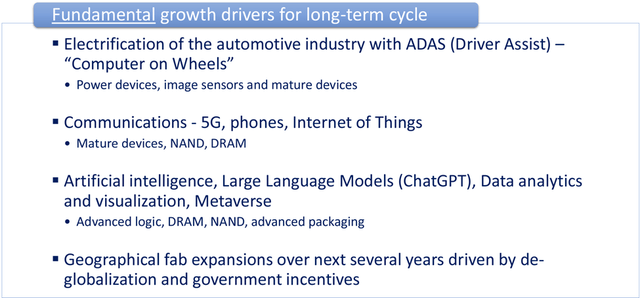

The May 2024 earnings presentation highlights key fundamental growth drivers and can be found below.

May 2024 Investor Presentation

I believe these have the potential to be significant drivers of earnings for the business. However, the key word here is long term. Remember, the longer the earnings forecast horizon, the higher the discount rate the market will (or should) apply. I am confident in the company’s ability to translate these growth drivers into actual earnings, but I am skeptical about the timing.

Let’s take a closer look at each of the above bullet points.

Electrification Automobiles are changing everything from household items to the way we drive. We recognize the business opportunities in technological advances in automobiles, such as EVs and driver assistance systems. However, we also need to recognize the current state of innovators in the automobile industry. Tesla is losing market share In response to Chinese competitors, more traditional players Back to internal combustion or hybridThey are postponing or canceling their EV projects. below pre-pandemic levels and It is predicted to decrease With consumers weakened by persistently high interest rates and inflation, coupled with regulatory hurdles, Axcelis still appears to have a long way to go before it can see any significant improvement in this area.

communication It’s an interesting area to invest in. The potential of the Internet of Things when fully implemented is astounding. We’re upgrading our mobile phones, and 5G is becoming more and more available. The U.S. government Providing incentives for telecommunications companies Invest more and improve the country’s infrastructure. However, This has not been realised so far.High interest rates are holding back this investment, and while it could pick up again if the Fed starts cutting rates, that doesn’t seem likely anytime soon. FedWatchTools The survey showed that 46.5% of the market expects interest rates to fall to just 500-525bps in November 2024.

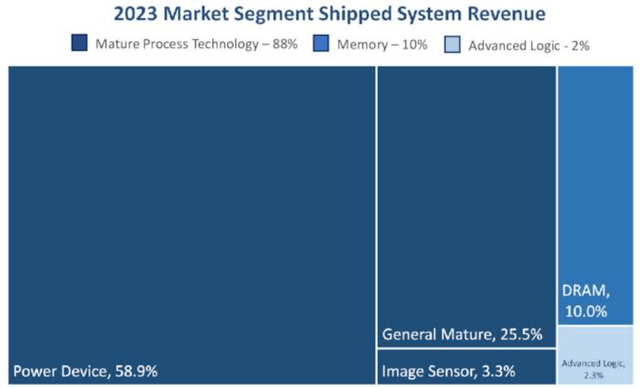

artificial intelligence So far, the story of 2024 is definitely this. We have seen improvements that we thought were impossible. Essentially, these are language models trained on huge amounts of data, and we continue to collect more and more data. That means we need more semiconductor chips for data storage. My concern is twofold. First, I worry that most of the infrastructure investment for AI has already been made. Once enough infrastructure is in place, it will be the AI techniques and machine learning models that make the difference, because the infrastructure is already there. Less investment in AI infrastructure means less investment in semiconductor manufacturing capacity, and therefore in Axcelis’ products. My second concern is that even though this continues to be a high-growth area, Axcelis is not as involved. The chart below shows the market segmentation of the company’s shipped system revenue. Memory chips and advanced logic account for just 12% of sales. The company invests primarily in power devices and general mature products used in consumer electronics and automobiles.

May 2024 Investor Presentation

Finally, it is true that there are plans for a factory expansion over the coming years. One of these examples Intel (International Trade Commission)teeth, of As a Western Hemisphere foundry, Axcelis would be the world’s largest semiconductor equipment manufacturer. More semiconductor equipment would be needed, which would increase demand for Axcelis’ products. But I’m skeptical about the timing of these additional revenues. It will take a long time for Intel and others to build factories and place orders. Intel’s goal of becoming the second largest foundry is by 2030.

Overall, I think the long-term drivers are strong, which is why (combined with the assessment I’ll discuss) this is not a short-term thesis. However, I think these are too long-term and should be discounted accordingly.

evaluation

Let’s get into the valuation part and see what the fair value of this company is.

My initial short-term thesis had a price target of $107. In a follow-up articleI maintained that target but closed out my short position with a hold thesis as the macro environment appeared to be improving. The stock actually fell below that target price and has recovered slightly to $113 as of the time of writing. The target price has only changed slightly since my last analysis.

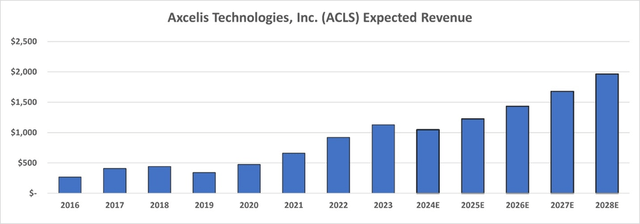

This is a positive scenario, and assumes the company can maintain its post-pandemic revenue growth, except for 2024, where management projects a decline in revenue. This would result in revenues of just over $1 billion in 2024 and nearly $2 billion in 2028. See below.

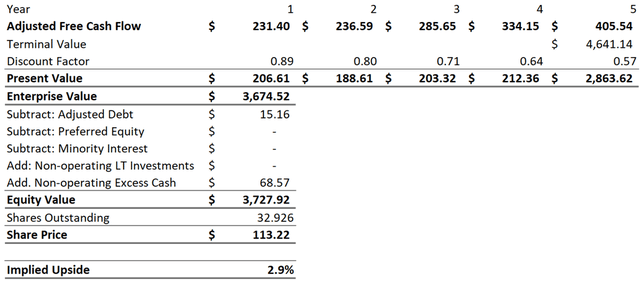

This translates to adjusted free cash flow of $231 million in 2024 and $405 million in 2028 based on my margin, capex, and net working capital changes expectations.

Just to be safe, I separate cash and short-term investments into operating and surplus in my calculations. To calculate operating cash, I use a percentage of revenue, usually 5-10%. This is a rough calculation of how much the company spends on its day-to-day operations for a year. The remainder is surplus cash. This surplus cash is available to shareholders, but not to operating shareholders, because it’s needed for the business.

Using these figures and methodology, the stock is valued at $3.72 billion with a price target of $113.22, which is 2.9% above the current share price as of this writing, providing a generous margin of safety for a purchase.

Conclusion

Axcelis Technologies plays a vital role throughout the semiconductor supply chain, and I believe the company has strong tailwinds that will boost its revenue and profits over the long term, although the timing of these expected revenues is unclear.

The four main areas of long-term growth highlighted by management are all facing challenges. These challenges stem from high interest rates that create an unattractive investment environment, or from demand issues for consumer electronics and EVs. Additionally, the company is not benefiting significantly from the growing demand for data due to developments in AI because it has little exposure to the AI industry.

The company’s shares are significantly cheaper than when I first analyzed them, and while there is plenty of upside potential, there is neither a substantial margin of safety nor any compelling near-term drivers for the stock to command a higher valuation.

As such, I am maintaining my “Hold” rating on Axcelis, and I will continue to track this company and publish a separate analysis if this theory proves no longer valid.