Chameleon 007

In this article, I will outline my thoughts on where to allocate my funds as summer approaches, and use technical analysis to determine whether it is better to invest in the SPDR S&P. 500 ETFs (NYSEARCA:spy) or Vanguard Extended Market ETF (VXFMost people are investing in SPY. Investing in the S&P 500 IndexThe largest company. VXF investment is Small and medium-sized enterprisesSPY is not the largest company by market cap owned.The technical tools I will use are a monthly price chart using a 10-month Exponential Moving Average (EMA) and a monthly relative strength chart comparing the performance of SPY and VXF.First, I will analyze SPY in isolation.

Chart 1 – SPY Monthly Chart with 10 Month EMA

Looking at Figure 1, The advantage of looking at SPY over a longer period of time compared to its 10-month EMA (blue). Chart 1 shows the past 6 years of price data for SPY. Just by looking at the chart, we can see that holding SPY when it was trading above its 10-month EMA has paid off. I like the 10-month EMA because it is a long-term moving average like the 200-day moving average on the daily chart that many are familiar with. The concept of using my methodology is simple. Anytime SPY is above its 10-month EMA, I am bullish. I want to hold stocks and ETFs that I am bullish on. When price rises above a moving average, I know that price tends to stay above that moving average for a long period of time. I want to continue holding assets that are trading above their long-term moving averages like they are now. The last time SPY rose above its 10-month EMA was in November 2023 and it has been above its 10-month EMA since then. If SPY closes the month below its 10-month EMA, I would consider selling. Any stock or ETF that trades below its 10-month EMA is bearish in my opinion. Note that this simple crossover strategy does not always succeed. There were times, like in October 2023, when the price ended October below its 10-month EMA. This would have been an indication to sell SPY. But that crossover signal turned out to be false and SPY rallied significantly in November 2023. Well, I understand that not all of these signals are correct, so I accept that and move on. I do not know of any system, technical or fundamental, that works all the time. Also, note that with this crossover trading system, you cannot enter at the bottom of a market move or exit at the top of a market move. The purpose of this system is to get to the essence of the price move. Now, Chart 1 shows four things that indicate SPY is bullish. First, SPY is above its 10-month EMA. Second, the 10-month EMA is rising. This is also a bullish sign. Third, SPY closed above last month’s high. Fourth, SPY closed at an all-time high this month. All-time highs are always bullish. Taken in isolation, we would need a close below the 10-month EMA to not be bullish on SPY.

Chart 2 – VXF Monthly Chart and 10 Month EMA

Chart 2 shows VXF on its own, and on its own VXF is bullish. It is trading above the 10-month EMA. The 10-month EMA is also trending up, which is a bullish sign. However, there are some differences between Chart 1 and Chart 2. VXF ended the month up, up 3.48%, but VXF did not finish higher than the previous month. This is not the worst result, but it is a different result than SPY, which closed above the previous month’s close. Also, VXF still has a long way to go before it reaches a new high, which it last reached in November 2021. Chart 2 shows that VXF is heading in the right direction, but that is a clear difference between SPY and VXF. So VXF is bullish because VXF is trading above the 10-month EMA, and the 10-month EMA is also trending up, which is also bullish. On its own, it is safe to hold VXF. Now, let’s look at a relative strength chart to see which ETF is better to own if you had to choose between the two.

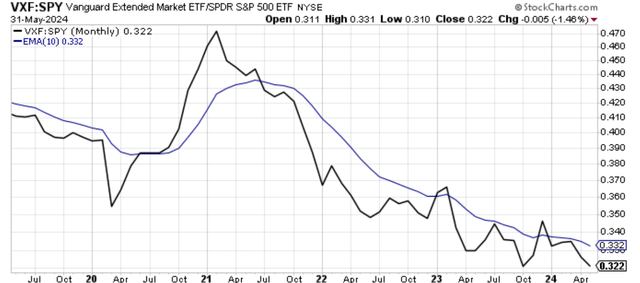

Chart 3 – VXF:SPY Monthly Relative Strength and 10-Month EMA

In my analysis, I think the relative strength chart helps me decide where to allocate my funds. This is an opportunity cost decision. I want to allocate my funds to stocks and ETFs that will outperform the SP500 index. The index is It’s very hard to win, and to outperform an index, you need to have an asset that outperforms the index over a long period of time. The relative strength chart is easy to read. The black line on the chart shows the ratio of VXF’s price performance compared to SPY. When the black line is going down, it means VXF is underperforming SPY during that period. When the black line is going up, VXF is outperforming SPY during that period. From Chart 1, we can see that SPY rose by over 5% in May. From Chart 2, we can see that VXF rose by 3.48% during the same period. VXF underperformed SPY, and we can see that in Chart 3 by the downward movement of the black line in May. In the long term, I like to use the 10-month EMA as a guide. Except for a few instances, VXF has underperformed SPY since January 2021. Holding SPY over VXF has been more profitable since January 2021, and Chart 3 would have helped investors recognize it when the VXF:SPY ratio fell below the 10-month EMA in June 2021. Investors would have been much more profitable to hold SPY from June 2021 onwards than holding VXF from the same date. As I mentioned before, the 10-month EMA is a lagging indicator and you have to accept that you can never enter the market at the exact bottom and exit the market at the exact top, using the 10-month EMA as a guide. The idea is to catch the middle of a significant move. That is how I believe a typical investor can outperform the SP 500 Index. If you look at Chart 3, you can see that the VXF:SPY ratio is below the downward 10-month EMA. In this case, I believe it would be a wise strategy to hold SPY over VXF until VXF can trade above the upward 10-month EMA. At the beginning of the summer, I will hold SPY over VXF. Next month, I will re-examine the charts using the same system and determine if a change in allocation is necessary. Until then, I will be long SPY.