PM image

Investment Overview

My previous thoughts on investing ( February This year, Paycor HCM (Nasdaq:Pixie) is expected to surpass its FY24 guidance due to recovering demand and strong performance. The market is upscaled, and these should feed into the positive rating. I have downgraded my rating to Hold from Buy as I no longer believe PYCR can grow at the rates I previously modeled. A challenging macro environment and slowing hiring will put pressure on growth.

Third Quarter 2024 Earnings Update

Released 3 weeks agoPYCR reported disappointing revenue growth of 14.1% to $187 million, down 370 basis points from 17.8% growth in 2Q24. This is a big disappointment because we thought 2Q24 would be the start of a recovery. Year-over-year growth in 2Q24 accelerated 160 basis points compared to 1Q24. Adjusted EBIT surprised, however, improving from 14.6% in 2Q20. Q2 2024 growth was 25.5% and Q3 growth was 25.5%, beating the consensus estimate of $45.72 million (PYCR reported at $47.73 million). In terms of guidance, management revised down its recurring and other revenue growth rate to $651 million from the previous midpoint of $653 million, implying a 30 basis point growth rate reduction (from 18.1% to 17.8%).

It was too early to judge his recovery.

I assumed that a strong Q2 2024 would be the start of a recovery, but this was a big mistake. The macro environment seems to be worsening and PYCR will not escape unscathed. Having reexamined my views on the US macro economy, I believe that interest rates will remain elevated for a longer period and will continue to be an impediment to PYCR growth (i.e. growth is unlikely to return to levels above 20% anytime soon). There are three main factors that I see preventing the Fed from aggressively lowering interest rates: (1) inflation remains elevated; (2) the US housing shortage problem is not going to go away anytime soon, so lowering interest rates would only make the problem worse (lower mortgage rates will increase housing demand, which will boost the CPI); and (3) the US economy appears to continue to be strong, so there is little reason for the Fed to lower interest rates.

If interest rates remain high for an extended period of time, companies will continue to face high capital costs and limit budgets for expansion, which in turn limits the ability to hire new employees. This directly impacts PYCR, since part of the growth equation is the number of employees at companies that use their products. PCYR is already feeling this pain, with same-store sales growth continuing to slow and revenue growth expected to remain below 50 basis points in Q3 2024. Notably, management explicitly noted that this weakness continues and could worsen.

The slowing rate of employee growth suggests slower growth going forward.

Another issue for PYCR that will likely limit the rate of revenue growth is slowing headcount growth. Management commented that structural changes to some of the sales teams have led to higher turnover among salespeople. Don’t hire Recover lost personnel. TMC Conference A survey sponsored by JP Morgan stated that employment growth will end in the low to mid teens range, which is below the target of 20% growth. What is important to note is that the trend of slowing employment growth is expected to continue unless a macro shift occurs, such as lower interest rates.

So, as we’ve seen from other companies and in the broader market, we’ve seen that same-source sales have been trending steadily downward for some time, and we’ve seen some signs of potential negative growth recently. 2024 Q3 Financial Results Announcement

The reason management is not hiring more is because they believe they can grow sales by 20% or more with less headcount. While this may be true, I have learned the lesson not to be too confident in expecting a recovery unless there is solid evidence (proven over several quarters). Until this evidence is clear, my view is that a slowdown in hiring indicates management’s lack of confidence that there is enough demand to justify hiring. Remember that it takes a typical sales rep 36 months to reach maturity (according to JP Morgan TMC conference). Not hiring today means management is not confident in the short-term (less than 1 year) to medium-term (1-2 years) outlook.

Red Fox Capital Ideas

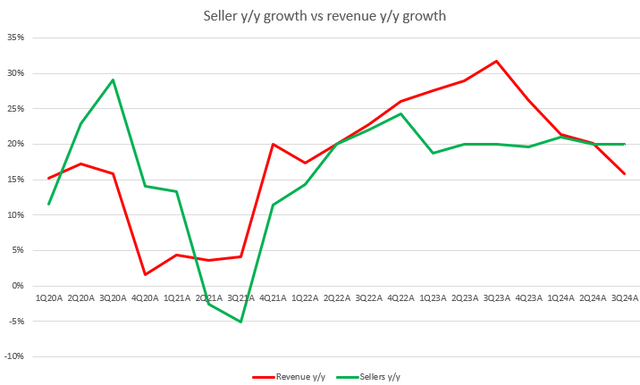

Additionally, if you look at the historical data for PYCR, it’s also a negative indicator of revenue growth. If you plot the year-over-year growth in seller count, you’ll see that it correlates closely with the year-over-year growth of PYCR, at least directionally. So, with PYCR’s employee count growth slowing, I think it’s a very clear data point that growth isn’t going to exceed 20% anytime soon. It also means that growth in the medium term won’t be as strong, since it takes new sellers 3 years to fully mature.

evaluation

Red Fox Capital Ideas

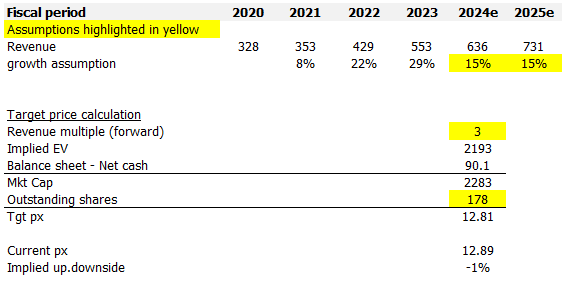

Given my new view on PYCR’s growth prospects, I no longer believe this is an attractive investment. I modeled PYCR using a forward earnings approach and based on my assumptions, I believe PYCR is worth around $13. I no longer believe PYCR can recover to growth of over 20% over the next two years. Rather, I believe growth will be in the mid-teens given the macro environment and slowing hiring. A lower growth outlook also means PYCR can afford to be valued lower. PYCR trades at a discount (3x vs. 4-5x) to talent management and payments peers such as Workday, Paylocity Holdings, Dayforce, and Paycom Software despite having similar growth outlooks (mid-teens), but I do not see a catalyst to close this gap. Therefore, I assume PYCR will continue to trade at its current valuation.

danger

If the economy recovers and management decides to capitalize on this recovery by accelerating seller hiring, growth could exceed 20% sooner than I expect. This would change my entire view on PYCR, as the growth outlook is much better than the current mid-teens percentages. I would not be surprised to see the valuation surge to peer levels.

Conclusion

My view on PCYR is a Hold rating. I was wrong to believe the turnaround was realized. I currently believe a more challenging macroeconomic environment, particularly prolonged high interest rates, will continue to impact PYCR’s customer base. Additionally, PYCR’s slowing employee growth suggests a lack of confidence in short- and medium-term demand. While PYCR is trading at a discount to its peers, I do not see any catalysts to close the valuation gap given revised growth expectations.