Simon Scaffer

ARK Innovation ETF (NYSEARCA:arc)teeth Since 2014I hadn’t heard of this fund until Cathie Wood, CEO and CIO of Ark Invest, appeared on CNBC and began touting her fund’s performance.

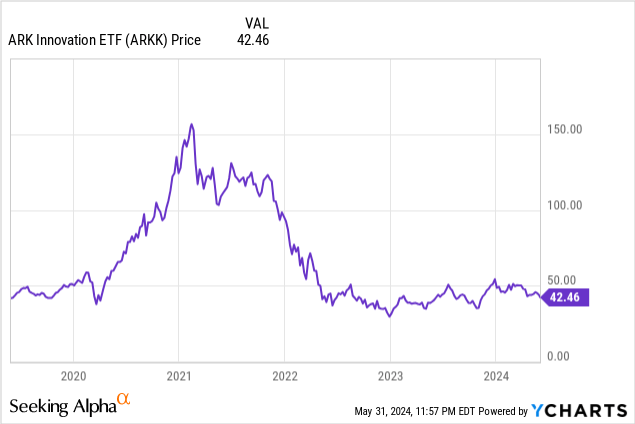

As As you can see below, ARKK’s performance was stellar in the early 2020s but has lagged significantly in recent years as the ETF’s price has fallen.

While I’m not as negative on Woods or ARKK as many other analysts, I do believe investors would be better off allocating their funds elsewhere. Let me dig into the details of the ETF and explain why I’m not bullish on this particular investment.

Risk does not equal reward

As you may know, the ARK Innovation ETF focuses on investing in “disruptive innovation.” Fund Descriptionthe fund said it would invest ARKK invests in products and services that have the potential to change the world. We’ll explain the specific areas the fund wants to invest in later, but this explanation should help investors understand that these types of investments are high risk. The public companies that ARKK invests in have the potential to change the world, but there’s also a high chance they’ll fail.

The simplest way to think about investing is that if you allocate your money to riskier assets, you can expect to get higher returns.

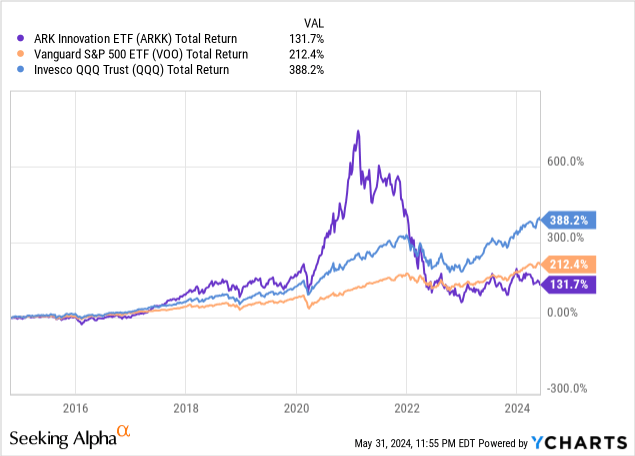

I will compare ARRK’s performance to what I call a low-risk ETF: the Vanguard S&P 500 ETF (Vaux) and Invesco QQQ Trust (Hehehehe), we can see that ARKK has not delivered superior returns.

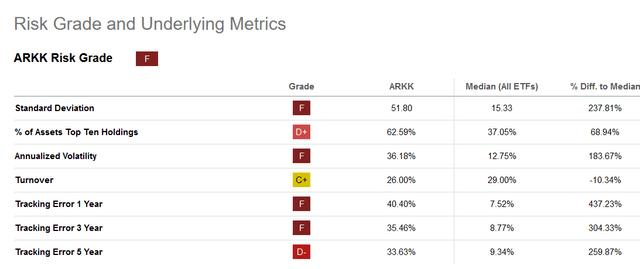

Additionally, a look at Seeking Alpha’s risk grades and related metrics reveals that Wood’s ETF has been given an “F” grade.

Find Alpha

Of these metrics, the one I want to discuss in more detail is turnover. Currently, ARKK has a turnover of 26%, close to the median of all ETFs. Comparing ARKK to the other two ETFs above, ARK has a higher turnover than QQQ, which has a turnover of about 22%, and much higher than VOO, which has a turnover of 2%.

As a long-term investor, I prefer ETFs with low turnover. In his book Investing for Growth, legendary investor Terry Smith of Fundsmith states that one of the 10 golden rules of investing is to trade as little as possible. Smith’s book predates Robinhood.Food) and the advent of zero-fee trading, I still believe Smith’s rule is valid (I’ve checked and Smith still follows it, and his fund’s volume is 10% shareIn my opinion, low turnover is associated with high conviction in the company and better due diligence. I understand that unexpected issues can arise that change the investment thesis, such as management turnover, macroeconomic conditions, new competition in the market, etc. However, Wood and his team seem to be making some strange moves that call into question the fund’s decision-making.

For example, Wood said that NvidiaNVDA) invested in her fund a few years ago, and it was definitely a company that would create “disruptive innovation.” But she wasn’t so sure, so she sold it early, Huge profit potential.

Another example of questionable logic: Wood Purchased She holds a large amount of Uipath stock, one of her major holdings.pathThe day before the company announced its first-quarter 2025 earnings, it cut its stock price from $1,000 to $1,000. The stock price plummeted the day after the company’s CEO resigned. While it’s likely Wood didn’t know about the resignation, it raises questions about the timing of buying the stock.

ARK Invest WebsiteAlthough the goal is 15% annual turnover, Wood and her team are clearly making further changes to the fund, which calls into question the fund’s analysis and filtering process, as well as the fund’s decision-making. I’ve only provided two examples of Wood’s recent activities, but a quick Google search or search within Seeking Alpha will reveal many more examples of decisions that leave investors scratching their heads.

Fund Structure

As mentioned above, the fund is focused on disruptive innovation and has a strong focus on several key areas. These areas include genomics and DNA technology, fintech, robotics, automation, and artificial intelligence.

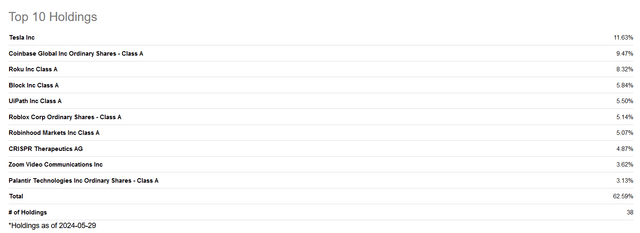

As of May 29th, the fund’s top 10 holdings are as follows:

Find Alpha

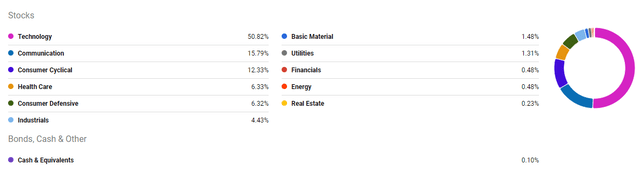

ARKK currently holds 38 stocks, and as you can see from the chart below, its holdings are fairly evenly spread across five sectors.

Find Alpha

I think there is a good chance that one or more of these 38 stocks will be huge winners. But my problem is, given the fund’s turnover and recent performance, I’m not sure Wood and his team have the patience or conviction to hold onto those huge winners. That’s what I would do as an investor, rather than investing in ARKK.

Shotgun Approach

one more Analyst Wood said they are trying to hit as many disruptive areas as possible with a “shotgun” approach, and I agree that that is what ARKK is trying to accomplish, but it hasn’t worked in recent years.

If investors want a similar approach, there are two ETFs that may be better suited for them compared to ARKK: Vanguard S&P 500 ETF (Vaux) and Invesco QQQ Trust (Hehehehe).

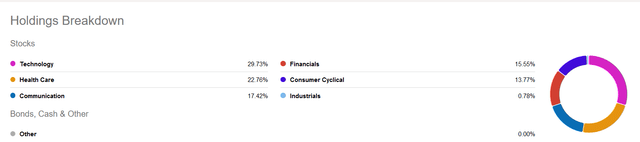

QQQ is a great alternative for investors looking for more risk, but it’s also a somewhat safe investment with a “C+” rating, as seen by Seeking Alpha’s risk metric.

Find Alpha

We believe QQQ can provide investors with the opportunity to gain exposure to many of the disruptive investment thematic categories ARKK is working on, including artificial intelligence, robotics, fintech and automation.

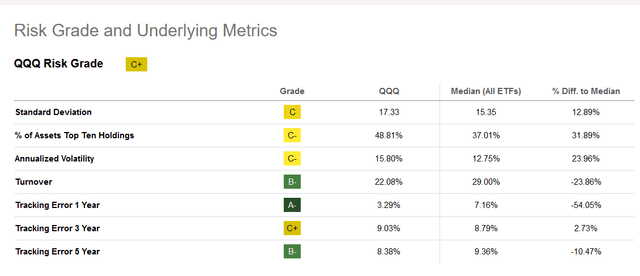

Below are QQQ’s top 10 holdings as of May 30th.

Find Alpha

Despite being a large cap, I am not a big fan of Nvidia.NVDA) and Microsoft (MSFT) will be a leader in areas such as AI.

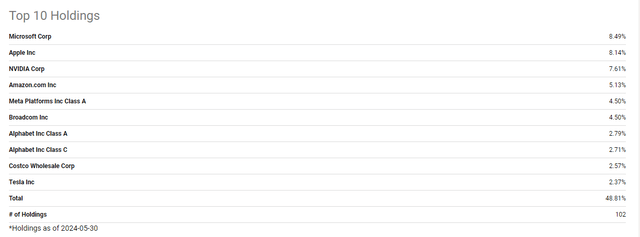

One of the downsides of QQQ is that it is very technical, as you will see below.

Find Alpha

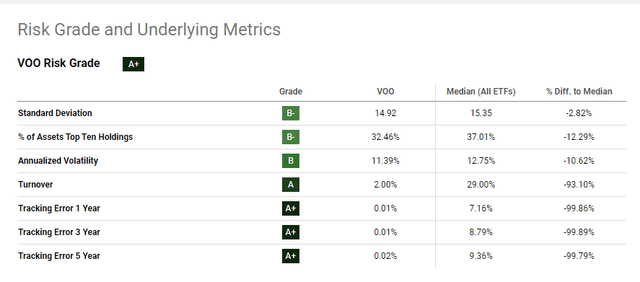

The ETF I personally like to invest in is VOO, and as you can see from Seeking Alpha’s risk index, it’s a much safer option compared to QQQ and especially ARKK.

Find Alpha

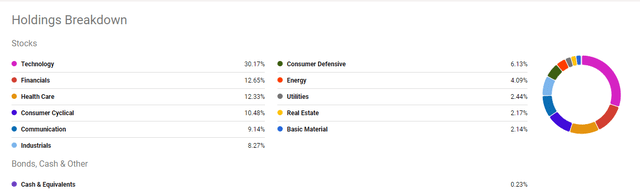

Additionally, while VOO is still around 30% tech, it is much more diverse compared to QQQ.

Find Alpha

My investment style is to put most of my money into risk-averse investments, so VOO is a great choice. As the above indicators show, this ETF has lower risk compared to ARKK, but it offers higher returns to investors. In addition, compared to QQQ, I like that VOO is less biased towards technology.

Bitcoin and thematic ETFs

Trees Bitcoin Bullish And I believe that some of her investments are proxy investments in Bitcoin. Coinbase is clearly a proxy investment and to some extent, Blockchain.Square) and Robinhood (Food) as well. If you believe in Bitcoin, buy Bitcoin itself rather than buying proxies. I have a small portion of my personal capital allocated to Bitcoin.

I think some categories are difficult to invest in. Personally, I think genomics and DNA technology is a particularly difficult investment topic because it’s so early on you don’t know which companies will be successful.arc) is as good as any ETF when it comes to investing in this particular sector.

Additionally, ARK Invest has acquired ARK Autonomous Technology and Robotics (arc) and the ARK Fintech Innovation ETF (arc). These may be good opportunities for investors looking to invest in specific areas. However, I would tend to buy VOO or QQQ rather than one of these specific thematic ETFs.

Conclusion

The ARKK ETF is geared towards higher risk, higher reward investors, but as of recently, returns have not been forthcoming.

I think Wood and the Ark team lack conviction and are struggling to identify a “disruptor” worth holding onto for the long term.

I think there are better funds than ARKK, such as QQQ for investors who don’t mind taking on more risk, and VOO for investors looking for less risk and more diversification.

Investors need to determine their risk tolerance and find specific investments that they can sleep comfortably in.

In my case, I plan to stick with VOO, which is a safer bet, invest in a few quality founder-led companies, and allocate a small percentage of my capital to Bitcoin.