Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

introduction

I like commercial REITs. Very strong relationships with residents.Selection property (TSX:CHP.UN:CA) (OTC:PPRQF) I have Loblaw the Main Tenant It has historical ties to the supermarket chain. Choice Properties It was spun out of Loblaws and still has the same majority shareholders. I don’t see why Loblaws would stop leasing assets from its affiliates, and I think the strong ties are a clear positive for Choice Properties. This article is an update of an earlier article. You can read our older Choice Properties articles here.

AFFO continues to grow

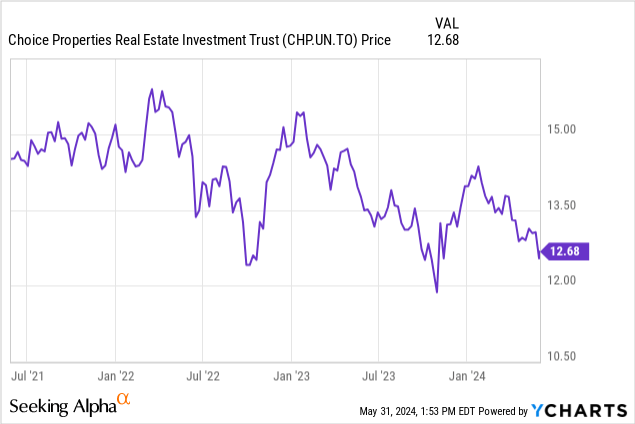

When looking at REITs, I’m primarily interested in FFO and AFFO performance, as these metrics provide a better look inside than, say, net income results. Another key factor and starting point is net operating income. As shown below, Choice Properties’ same-asset NOI increased approximately 2.6% compared to 1Q23, further boosted by the addition of new assets. Increased net worth to C$255 millionThis represents an increase of approximately 5% compared to C$244 million in the first quarter of 2023.

Choice Properties Investor Relations

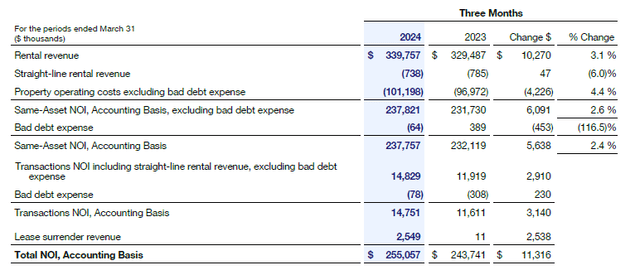

Choice Properties has a firm grip on its financing situation (more on this later in this article), so we were interested to see if the increased NOI would also translate into increased FFO and AFFO. Happily, that was the case, as you can see below, total FFO increased by approximately CAD$10.3 million to CAD$187.2 million. This means that FFO per share was approximately CAD$0.259, and as you can see from the image, despite the slight increase in dividends, the dividend payout ratio actually decreased to the low 70% range.

Choice Properties Investor Relations

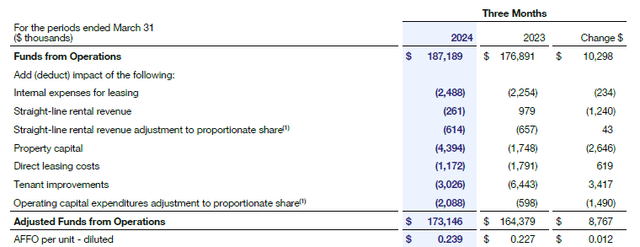

While FFO is important, we’ll focus on calculating AFFO since it includes certain capital expenditures such as tenant renovations. The image below shows the breakdown, but the REIT spent approximately CAD7.4 million on capital expenditures and tenant renovations (which is roughly in line with spending in Q1 2023), while AFFO increased by CAD8.8 million to CAD173.1 million. Divided down to approximately 724 million shares outstanding, AFFO per share is CAD0.239.

Choice Properties Investor Relations

The REIT currently pays a dividend of C$0.76 per year, paid in 12 equal monthly installments. 0.0633 Canadian Dollars TrancheThe dividend is well covered, as the payout ratio has fallen to below 80%.

Should we be worried about the balance sheet?

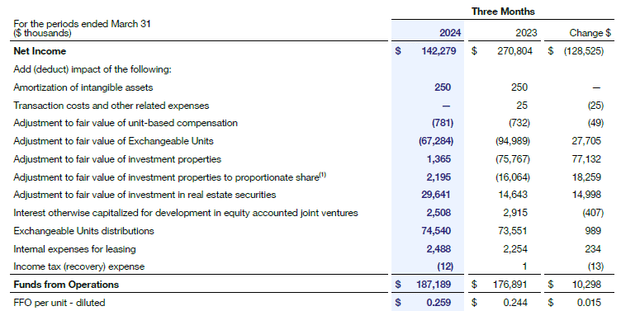

REITs have had to deal with rising interest rates in the financial markets, so I’m very interested to see what the impact may be going forward. I think the worst is over. Obviously REITs will have to deal with rising interest rates, but I think the impact will be relatively mild.

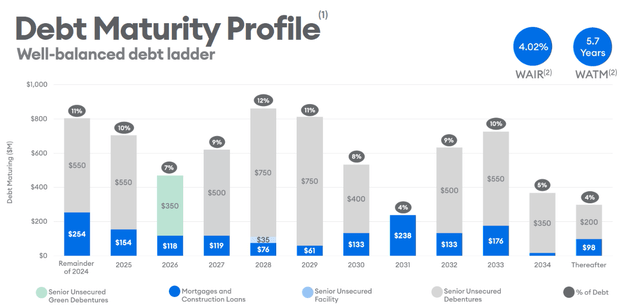

you Please read the followingChoice Properties’ amortization profile is well spread over time, making any increases in its debt costs very palatable.

Choice Properties Investor Relations

Choice Properties recently issued a seven-year note with a coupon of 5.03%, which means that we can reasonably expect the average cost of debt to rise towards the 5% level (although future refinancings may be cheaper than that due to lower benchmark interest rates). With just under C$6.5 billion in debt on the balance sheet, the maximum impact of a cost of debt rising to 5% would be around C$65 million, or C$0.09 per share.

As mentioned above, this won’t happen overnight, but is a multi-year process. Meanwhile, Choice Properties should be able to increase rents at a low single-digit rate per year. And with annual NOI of roughly $1 billion, a 1% annual increase in NOI over the next six years would be enough to cover the entire impact of rising interest rates on its debt.

And with the dividend payout ratio falling below 80% this year, the retained cash flow is Development PortfolioThe REIT is currently actively developing CA$62 million worth of retail assets with expected stable yields of approximately 6.5% and CA$348 million worth of industrial assets with expected stable yields of 7.25%, which could increase FFO by approximately CA$29 million. Of the CA$348 million capex, approximately CA$290 million still needs to be expended.

Investment Thesis

Choice Properties REIT is not cheap, judging by its current earnings multiples. With full-year AFFO expected to be CAD$0.93-0.94 per share (increasing to CAD$0.95-0.96 next year), Choice is currently trading at about 13x AFFO. While not cheap, I believe a certain premium is justified given that the strong ties to anchor tenant Loblaws reduce lease risk. I do not believe Loblaws will stop leasing assets from affiliates, and so far I have not seen any clear corporate governance issues (such as CHP giving Loblaws favorable rents). Therefore, I currently view the strong ties to Loblaws and the family behind Loblaws as a positive.

Meanwhile, the dividend yield has risen to 6% after the recent share price decline, and given the company’s continued strong AFFO performance, it wouldn’t be surprising to see the dividend increase further in the future. However, Choice has been conservative, only raising its dividend by C$0.01 per share per year.

I have a long position in Choice Properties and am buying more into that position at the current share price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.