J Studio

Previously featured SoundHound AI Inc. (Nasdaq:Seoun) will acquire NVIDIA’s (NVDA) Stake Disclosure and Voice AI technology Integrate large-scale language models on both cloud-native and hardware-embedded platforms as your own SaaS.

However, the company remains unprofitable, its balance sheet is weakened, and its shares are heavily shorted, which is why I believe there is potential for increased volatility in the near term and why I assigned a “hold (neutral)” rating to it at the time.

Since then, SOUN has already fallen significantly, -52% from its peak in March 2024, significantly underperforming the broader market. Nevertheless, the company’s shares are still trading at a significantly higher price compared to its generative AI SaaS peers, so I’m not sure it’s wise to recommend a “buy” here.

Being a start-up, prone to equity dilution, and As recent acquisitions have impacted the company’s Q1FY24 margins, we believe it would be prudent to wait and see how the acquisitions are executed.

SOUN Continues to Report Strong SaaS Growth

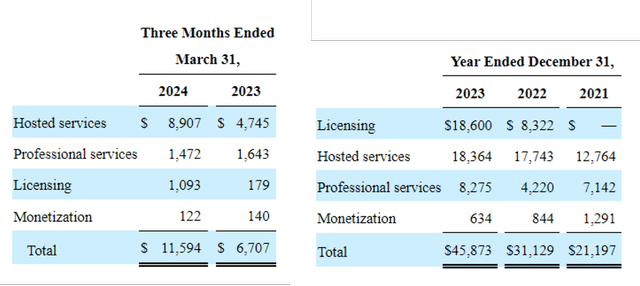

SOUN Revenue Segment

As of now, SOUN has reported better than expected earnings for the first quarter of 2024 on May 9, 2024. Revenue: $11.59 million (QoQ: -32.4%/ Year-on-year increase of 72.9%), adjusted EPS was -$0.07 (inline from last quarter/+46.1% year-over-year).

Much of the revenue tailwind came from accelerated growth observed in the Hosted Services segment to $8.9 million (+58.6% QoQ, +87.7% YoY), driven by revenue recognition from pay-per-use and/or flat-fee subscriptions, further highlighting the stickiness of the Voice AI SaaS platform.

However, despite SOUN’s solid revenue growth, readers should also note that its gross margin in the most recent quarter was a disappointing 65.5% (-11.5ppts QoQ/-6.8ppts YoY), as was its adjusted EBITDA margin of -132% (-111ppts QoQ/-90ppts YoY).

Much of the revenue headwind was due to lower margins in the recently completed call center agent business. Acquisition of SYNQ3 Restaurant Solutions.

Still, we believe things could improve in the medium term, given SOUN’s incremental impact on its automated voice AI technology solutions and diversification into restaurant (including customer service/drive-thru) and fitness businesses.

This builds on the SaaS company’s existing presence in automotive, broadcast and communications platforms across TV, smart and IoT devices.

As such, in its latest quarter, SOUN reported a significant expansion in its multi-year cumulative subscription and reservation backlog to $682 million (up 3.1% quarter-over-quarter and 80% year-over-year), providing insight into its long-term revenue and profitability.

This is in addition to a modest increase in fiscal 2024 revenue guidance to $71 million (up 54.6% year-over-year) from the initial midpoint of $70 million (up 52.5% year-over-year).

Unfortunately, the good news ends here.

SOUN’s high customer concentration poses risks to future prospects – Readers Monitor

Upon closer inspection, Two core customers (highlighted as A and C) accounted for 48% of SOUN’s 1Q24 revenues (up 12pp y-o-y) and have high customer concentration, exposing them to higher risk of contract non-renewal in an increasingly competitive market and/or margin dilution in the event of preferential contract charges.

The recent $137 million recapitalization helped improve the balance sheet by increasing cash equivalents to $211.74 million (up 122.2% quarter-on-quarter and 357% year-on-year), while, of course, the new shares issued for the SYNQ3 acquisition increased the share count to 286.59 million (up 13.37 million quarter-on-quarter and 81.51 million year-on-year).

SOUN’s decline in shareholders’ equity is ongoing as discussed in our previous article, and further dilution is likely in the medium term as free cash flow has not been essentially positive thus far, reported at -$22.05 million in the latest quarter (-58.2% QoQ, -51.4% YoY).

At the same time, stock-based compensation expense also increased significantly to $6.97 million (up 7.5% from the previous quarter and 16.3% from the previous year) as insider equity offerings continued. $2.6 million profit Q1 2024 (+432% QoQ, +253% YoY).

So, is SOUN stock a buy?sell or hold?

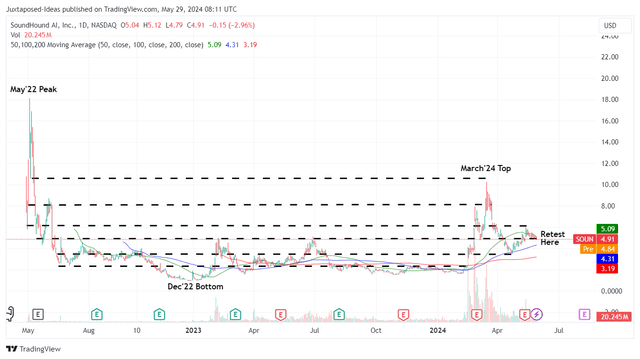

SOUN 2Y Stock Price

For now, SOUN has given back most of the gains gained after its recent Q1FY24 earnings report, and the stock appears to be retesting the previous support level of $4.90.

Still, I’m not sure if it’s wise to add it here.

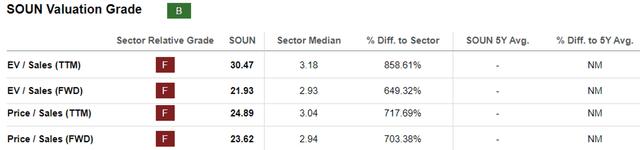

SOUN’s rating

SOUN is still in the cash-strapped startup stage. Negative EPS Looking ahead to FY2025, the only metric we can use to value the stock is FWD EV/Sales of 21.93x, which is significantly more expensive compared to the 2023 average of 10.62x and the sector median of 2.93x.

This is especially true as SaaS companies will need to report consistently high double-digit growth over the next few years to warrant a premium EV/revenue valuation.

SOUN rating by C3.ai (artificial intelligence) is trading at 7.21x FWD EV/sales.B.B.A.I.) at 2.61x, and Palantir (P.L.T.R.) of 16.05x, we can see that SOUN is overextended and offering only minimal margin of safety to interested investors.

At the same time, SOUN continues to record a high short interest ratio of 23.9%, higher than the previous level of 14.6% in March 2024, suggesting further volatility in the near term.

It remains to be seen when the company will achieve operating profitability going forward, or whether the share price will be able to sustain itself at current levels, so holders of this stock will need to be (very) patient.

With more uncertainty ahead, it goes without saying that this stock is only suitable for those with a high risk tolerance.

Repeat the hold (neutral) here.