Gearst

Profitable growth prospects for MOD remain intact thanks to promising 80/20 initiative

Modine Manufacturing Company (New York Stock Exchange:Mods) is another stock that has rapidly been upgraded from small cap to mid cap in just one year.

largely Many of the tailwinds are driven by management’s proactive approach. 80/20 Initiative Introduced in June 2022, it aims to accelerate revenue growth at a normalized five-year CAGR of +8% and expand adjusted EBITDA margin from 7.7% in 2022 to approximately 15% in 2027.

This adds to MOD’s diversified product offering across commercial vehicle, automotive, thermal management in the data center markets and industrial power generation/transmission.

This is certainly an important point, as the boom in EVs and generative AI is driving demand for zero-emission/high-density cooling solutions across multiple platforms, and that’s exactly where MOD specializes.

As As a result, it’s not surprising that MOD reported better-than-expected profits in its fourth-quarter 2024 earnings report. Revenue: $603.5 million (+7.4% compared to the previous quarter/ YoY: -2.3%), and adjusted EPS of $0.77 (+4% quarter-over-quarter and +14.9% year-over-year), with fiscal 2024 figures expected to be $2.4 billion (+4.8% year-over-year) and $3.25 (+66.6% year-over-year), respectively.

Readers need to realize that the top line shortfall is management’s fault. Strategic Sale of

“In Germany, we have three automotive companies that mainly manufacture internal combustion engine parts for the European market, and in the United States, we have two companies that are involved in the coating aftermarket.”

The aim is to cut low-growth, low-profit margin businesses.

This was on top of a decline in Heat Transfer product sales to $433.4 million (down 14.2% year-over-year) due to EU regulatory changes and delayed fiscal 2024 revenue recognition.

Elsewhere, MOD reported strong growth in its most recent fiscal year in its air-cooled segment, which generated $674.18 million (up 4.7% year-over-year), its liquid-cooled segment, which generated $505.63 million (up 4.7% year-over-year), and its data center cooling segment, which generated $288.93 million (up 57.1% year-over-year).

This is due to sustained growth in the industrial/heavy equipment construction/power generation markets, global automotive market, and data center market, with the generative AI boom also driving new top-line growth opportunities.

At the same time, MOD’s bottom line improved significantly with gross profit margin of 21.8% in FY2024 (+4.9 points QoQ, +6.7 points QoQ, +5.3 points QoQ, +1.2 points QoQ) and adjusted EBITDA margin of 13% (+3.8 points QoQ, +5.3 points QoQ, +1.2 …

This proves that management’s 80/20 initiative, further fueled by higher prices and tight operating expenses, is working as intended to drive profitable growth.

Recent acquisitions to capitalize on growing demand for generative AI infrastructure/liquid cooling technologies have resulted in increased debt leverage, Ministry of Defense Balance Sheet The health condition is relatively good.

This comes as the company reports an easing net debt-to-EBITDA ratio of 1.18x in fiscal 2024, following accelerated adjusted EBITDA generation to $314.3 million (up 48.1% year-over-year) and net debt of $371.5 million (up 30% year-over-year). This compares to a leverage ratio of 1.34x reported in fiscal 2023 and a leverage ratio of 2.82x reported in fiscal 2020.

At the same time, despite increased capital expenditures due to increased manufacturing capacity, MOD continues to report increased free cash flow to $126.9 million in fiscal 2024 (up 123.4% year-over-year) and rising margins to 5.2% (up 2.8 percentage points year-over-year), suggesting the company’s ability to be agile in capturing the surge in demand for generative AI infrastructure.

This is in addition to the expected recovery in EV demand from 2026 onwards. Price uniformity Investments in the ICE platform are achieved, borrowing costs ease to pre-pandemic averages, and the macroeconomic outlook normalizes.

MOD appears to be fairly valued thanks to promising management guidance and solid market trends.

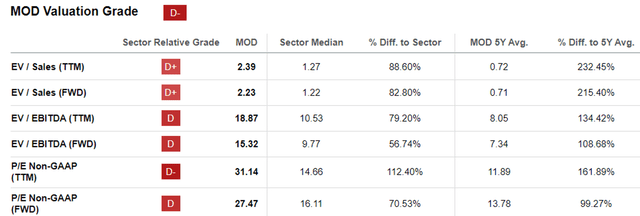

MOD evaluation

MOD has a well-diversified opportunity in both EV/Data Center, so it’s no surprise that the market temporarily gave the company’s shares a relatively premium FWD EV/EBITDA valuation of 15.32x and FWD P/E valuation of 27.47x.

This is up significantly from the one-year average of 11.08x/19.06x, the pre-pandemic three-year average of 6.06x/10.42x and the sector median of 9.73x/15.88x.

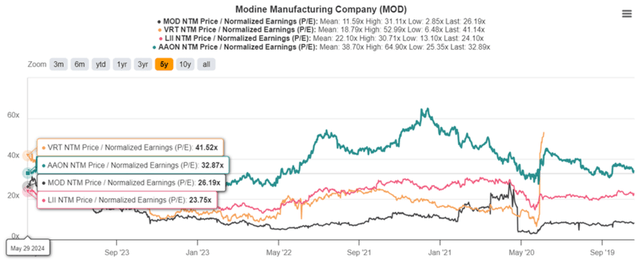

MOD Peer Comparison

Vertiv (Cryptocurrency) at 27.83x/42.86x, while Lennox International Inc.52) at 18.30x/24.42x, and AAON, Inc. (AAON) at 20.97x and 33.97x respectively, it’s clear that the market is generally very optimistic about the outlook.

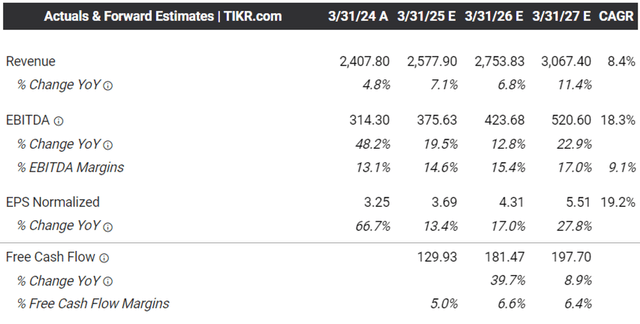

Consensus Forecast

Similar optimism is seen in the raised consensus forecasts, with MOD now expected to generate higher revenue/profit growth at a CAGR of +8.4%/ +19.2% through FY2027. This compares with previous expectations of +5.4%/ +12% and historical growth rates of +7%/ +22.6% from FY2017 to FY2024.

Comparing MOD’s growth forecasts to VRT’s +12%/ +30.3%, LII’s +5.8%/ +12.1%, and AAON’s +9.5%/ +12.2% through 2026, MOD’s FWD P/E valuation of 27.47x also seems reasonable.

Much of the near-term tailwind is due to strong market demand for data center infrastructure in general, which is also reported in the following reports: Celestica Inc. (CLSAThis is particularly true for Super Micro Computer, Inc.SMCI) is a leading supplier of complete server solutions and Liquid Cooling In a new data center.”

This also explains why MOD made a strategic (and fairly timely) move into liquid cooling technology with the acquisitions of Napps Technology in July 2023, TMGcore in January 2024, and Scott Springfield Manufacturing in February 2024.

These tailwinds also contribute to MOD’s strong fiscal 2025 outlook, with revenue growing 7.5% year over year, adjusted EBITDA growing 19% year over year, and adjusted EPS of $3.70 (up 13.8% year over year), underscoring management’s confidence in delivering profitable growth in the future.

Should MOD stock be bought?sell or hold?

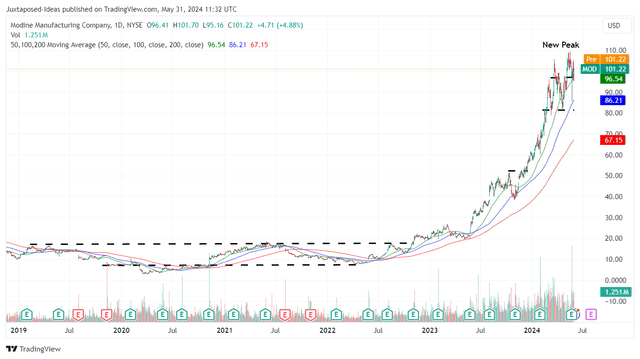

MOD 5Y Stock Price

As a result, it is understandable why MOD has already recorded a new peak while escaping the 50-day, 100-day and 200-day moving averages and establishing a solid support level at $81.

Currently, the company’s shares are trading well above our estimated fair value of $89.20 based on FY2024 adjusted EPS of $3.25 (up 66.6% year over year) and a FWD P/E valuation of 27.47x.

However, with adjusted EPS forecast of $5.51 for fiscal 2026, we believe there remains excellent upside potential of +49.4% against our long-term price target of $151.30.

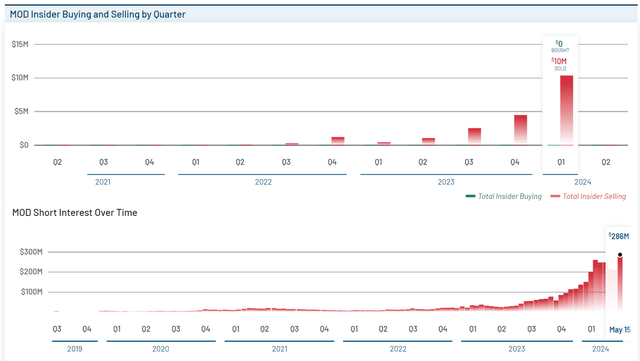

Increase in short selling/insider selling of MOD

Due to the attractive risk/reward ratio and promising long-term generation AI trend, we initiate a Buy rating on Modine Manufacturing Company shares, with the caveat that interested investors should wait for a gradual pullback closer to the previous support level of $81 for an improved margin of safety.

This is because we may see moderate volatility in the short term. Short selling At the time of writing, it continues to grow to 5.13% (+2.44 points from the previous quarter/+4.61 points from the previous year). Insider trading A similar phenomenon has also been observed as executives are more likely to cash in some of their long-term stock options.

Some patience may be wise here.