Walter Bibikow

introduction

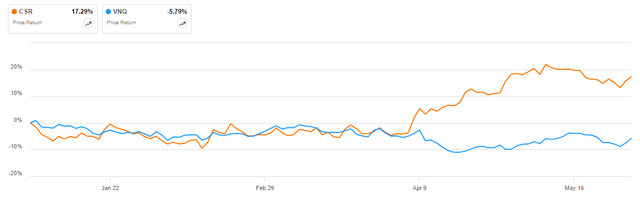

Center space (New York Stock Exchange:CSR) is a Vanguard Real Estate Index Fund ETF (Vietnam) has seen REIT stock prices post double-digit gains so far in 2024, significantly outpacing VNQ’s mid-single-digit declines.

CSR vs. VNQ 2024 (Seeking Alpha)

Going forward, I believe the company will continue to outperform despite somewhat high leverage and declining occupancy rates, with a market assumed cap rate of 7.5%, growing net operating income, and a well-structured debt service profile. Management fees appear to be significantly inflated, therefore, Centerspace could be a potential acquisition target given its attractive valuation and high management fees.

Company Profile

Access all company results hereCenterspace is a residential REIT that invests in 70 apartment communities consisting of 12,883 apartments. The REIT is concentrated in a few states, including Minnesota (52% of total net assets). NOI, Colorado (23%), North Dakota (11% of NOI):

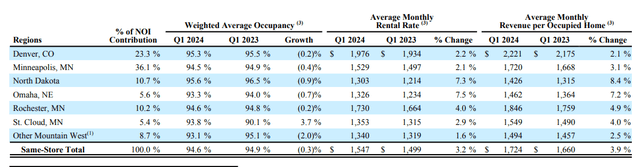

Overview of existing store portfolio (Center Space 2024 Q1 Financial Supplement)

Operational Overview

Center Space reported Occupancy This is 94.6%, down 0.3% year-on-year, which indicates some struggles in the REIT portfolio, but is still a solid performance overall for a residential REIT.

no Development has been extremely strong, with rising rents and declining expenses resulting in a very strong NOI increase of 7.5% year over year. Core FFO In the first quarter of 2024, earnings per share were $1.23, up 15% year over year. Strong core FFO per share was also driven by a lower share count as the company spent $4.7 million on share repurchases in the quarter.

Updated outlook for 2024

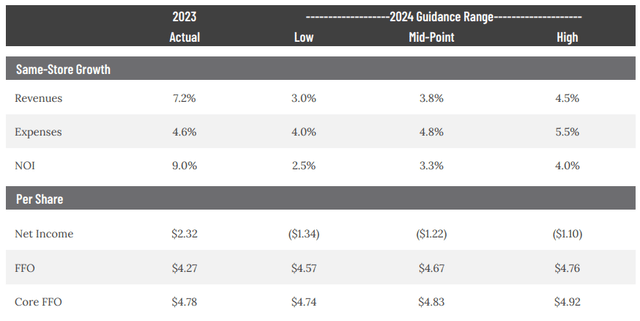

Following a strong start to the year, CenterSpace raised the lower end of its core FFO guidance, now expecting core FFO in the range of $4.74 to $4.92 per share, up 1% year over year.

Updated outlook for 2024 (Centerspace June 2024 Investor Presentation)

The NOI outlook has also been revised upward, primarily due to lower expense growth rates. As a result, NOI is now expected to grow 2.5% to 4% in 2024.

Debt Status

The company plans to begin operations in the first quarter of 2024. Net Debt Net debt is $916 million, implying that net debt represents 44% of the company’s enterprise value. It is also worth noting that the company has preferred stock representing 5% of its enterprise value.

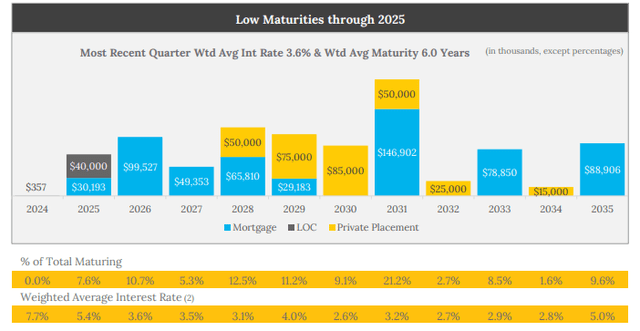

The average cost of debt is 3.6%, with a weighted average maturity of 6 years. Furthermore, only 7.6% of the company’s debt matures before 2025, while 42% of total debt is fixed at interest rates around 3% and matures between 2030 and 2034.

Debt Maturity Summary (Centerspace June 2024 Investor Presentation)

As a result, the company will benefit from a tiered debt maturity structure for at least another six years before it begins refinancing at higher interest rates.

Market Estimated Cap Rate

Centerspace is expected to generate net operating profits of approximately $157 million in 2024, a very attractive figure relative to its enterprise value of approximately $2.1 billion. Market capitalization General and administrative expenses are projected to be approximately $27.75 million, with the administrative overhead burden coming in at 1.3%, which is quite high.

Larger REITs could potentially reduce their management expenses to around 0.8% of enterprise value, suggesting that significant value could be created from an acquisition of Centerspace by a more efficient competitor.

Synergies from acquisitions

As I highlighted in the paragraph above, I believe Centerspace is overspending on general and administrative expenses. AvalonBay Communities (AVB) is the largest residential REIT in the United States by market cap, currently valued at approximately $35.2 billion and reporting general and administrative expenses of just $76 million for 2023. Annual ReportThis represents just 0.2% of the enterprise value spent on general and administrative expenses.

By comparison, CenterSpace spent $20 million in general and administrative expenses in 2023. Annual Reportrepresents almost 1% of the enterprise value. The difference with the 1.3% management overhead charge mentioned above is made up by property management expenses which are not deducted from net operating income.

Overall, given the current share count of 14.9 million shares, I think it’s reasonable to assume that larger peers could significantly reduce their general and administrative expenses, resulting in roughly $10 million in savings to enterprise value, or roughly $0.67 in incremental earnings per share at the common shareholder level.

Considering that Centerspace’s largest shareholders are BlackRock and Vanguard. They hold approximately 17% and 16%, respectively.Opportunistic buyers are less likely to face opposition from shareholders.

I should point out that while there is no concrete evidence that a third party is planning to acquire Centerspace, in my opinion the financial case certainly is there.

risk

The main risk facing Centerspace is its somewhat high leverage of 44% of its capital structure. This is offset by a favorable maturity profile and short-term maturity restrictions. That said, the company has been aggressively buying back shares, further increasing leverage.

Another thing to note is that the company has been increasing rents while occupancy rates have been declining, suggesting that tenants are struggling to keep up with rising rents. If this trend continues, it calls into question the company’s robust NOI growth. This risk is somewhat mitigated by low unemployment rates in the states where the company’s portfolio is concentrated. Minnesota (2.7% unemployment rate) and Colorado (3.7%) are both below the U.S. average of 3.9%.

Conclusion

Centerspace is off to a very strong start to 2024, with NOI up 7.5% year over year due to rising rents and reduced expenses. For the full year, NOI growth is expected to be more modest at around 3.25% as the company catches up on expense spending.

While the market assumed cap rate of 7.5% is very attractive for a residential REIT, the high management fees mean that the full return cannot be returned to shareholders, so I believe Centerspace needs to be acquired by a larger company to realize its full value.

thank you for reading.