Joseph Kubbes

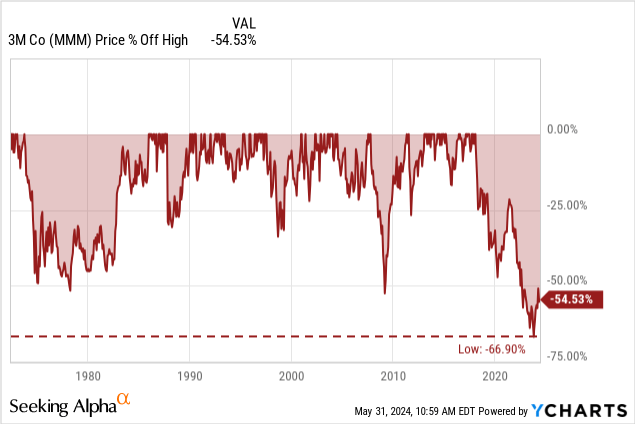

The most disappointing part of my portfolio is 3M (New York Stock Exchange:Hmm) and the position is still down 30%. Of course, this does not include the dividends I have received over the past few years, and positions also need to be taken into account. Solventum Corporation (Solve) I now thought I made a great investment (more on this later) because I purchased the stock at a price clearly below its all-time high, but the stock is currently trading at 55% below its previous all-time high (a few quarters ago the stock was down 67%).

I have held the stock during these difficult times and intend to continue to do so because I believe 3M has good protections around the business and is a good long-term investment. We’ll take a look at the latest on 3M and its healthcare division, which was spun off as Solventum Corp. We’ll also look at the dividend and ultimately decide whether this stock is a “buy”, “sell” or “hold”. First, let’s take a look at the chart.

Technical Photos

My last article The report on 3M was released in early January 2024, and since then, the stock price has actually risen by about 10%, roughly in line with the S&P 500 (spy). I’ve been bullish on 3M in previous articles, but for the most part, the stock has clearly underperformed the broader market, proving that my bullish views were wrong, at least in the short term.

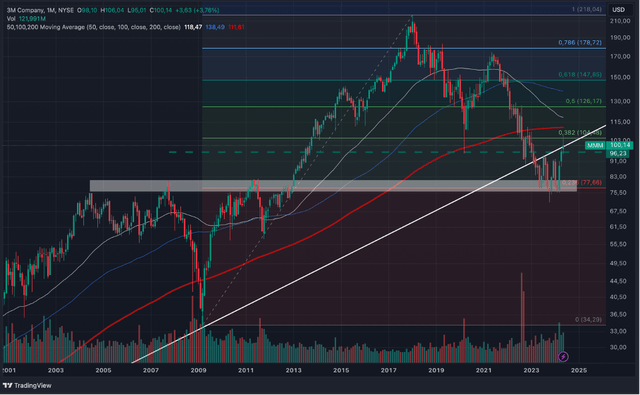

3M monthly chart (TradingView)

However, there is more reason to be optimistic at this point, and looking at the chart, one could argue that 3M may have bottomed out around $75. This bullish outlook is based on two assertions:

- 3M has built strong support levels over the past 20 years. Between $75 and $80, the market reached highs in 2004, 2007, and 2011. And those same resistance levels became support levels when 3M finally rose. And the fact that these are major support levels that have lasted for decades makes this a strong support level overall.

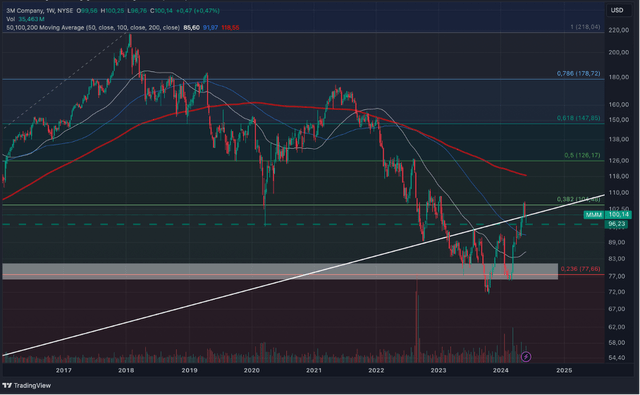

- Looking at the weekly chart, we can see that a bottom structure has been forming over the past few months. In my opinion, we can see an inverse head and shoulders pattern with a neckline of about $95. Recently, the stock has risen above that neckline, indicating that the head and shoulders pattern has completed and the stock is likely to move higher.

3M weekly chart (TradingView)

I am being pretty bullish, but there are two counterarguments to my bullish assertion.

- There is a solid resistance level near the $110 mark, created by the 200-month moving average and the lows of 2014, 2015 and 2020. And we still need to be very cautious until the stock fails to rise above this resistance level.

- There is a second argument, but I’m not sure how valid it is. There is a long-term support line that connects the lows of the early 1980s and the lows of the GFC. This support line was broken in 2023 and can now be considered a resistance level, but stocks have already rebounded from that resistance level. However, if we draw this line a little differently, connecting the various lows of the early 1980s, the picture becomes clearer.

If asked for a definitive opinion, I would say I am rather bullish on 3M, and this is not just because of the charts, but because of the valuation multiple at which 3M is currently trading.

Calculating Intrinsic Value

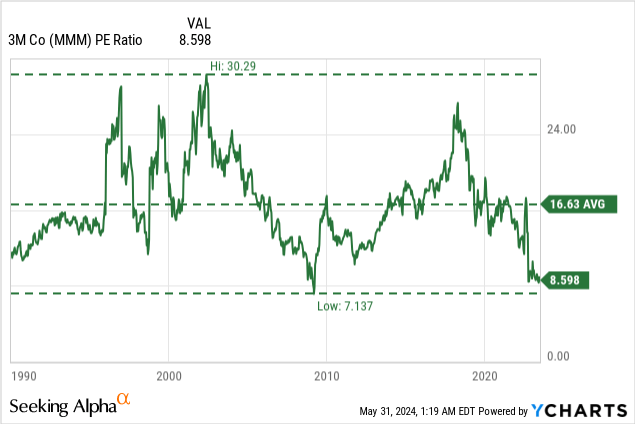

I have long argued that 3M is undervalued, but the stock has not performed very well so far. However, that doesn’t make the argument that the stock is cheap wrong. Looking at the price-to-earnings ratio, 3M is trading near its lowest P/E ratio since 1990. As of this writing, the stock is trading at 8.6 times earnings.

But here’s a word of caution: the P/E ratio is calculated on the last 12 months of data, which includes earnings from the Healthcare division, which is no longer part of 3M. Instead, if we use fiscal 2024 guidance, we get expected earnings per share between $6.80 and $7.30. Using the midpoint of the company’s guidance, the stock is trading at a forward P/E ratio of 13.9x. But while this is no longer super cheap, it’s still a pretty low valuation multiple.

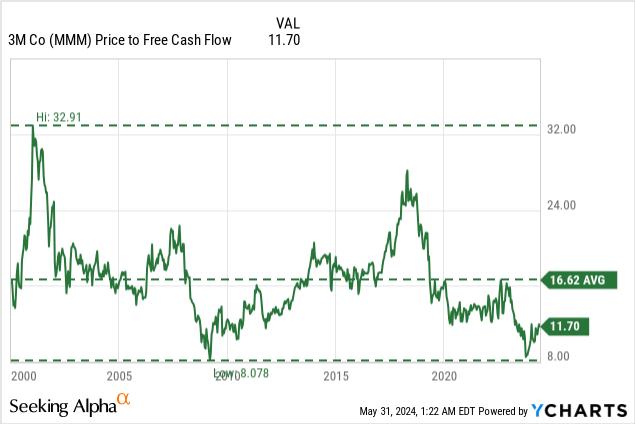

We also see a similar story when we look at the price-to-free cash flow ratio. At the time of writing, 3M’s stock is trading at a P/FCF ratio of 11.7. Of course, it faces the same issue of TTM free cash flow not being the same as FY24 free cash flow. Typically, 3M targets around 100% free cash flow conversion, and with expected earnings per share of $7.05 and 553 million shares outstanding, we can assume free cash flow of around $3.9 billion. This also puts the forward P/FCF ratio at 13.9.

Besides looking at simple valuation multiples, we’ll use discounted cash flow calculations to determine the growth rate that 3M needs to grow at least fairly to be valued. With 553 million shares outstanding, a discount rate of 10%, and free cash flow of $3.9 billion, 3M’s stock would need to grow 3% annually from now until forever to be fairly valued.

Quarterly Results

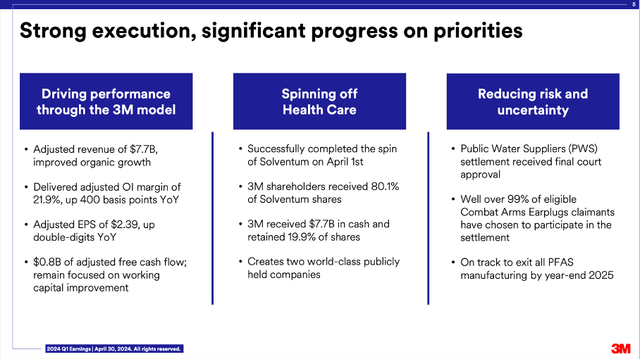

Now, let’s answer the question of whether 3M can grow at least 3% annually and whether its most recent quarterly results provide any clues. First, 3M is It is possible that the number of Revenue and earnings per share again beat expectations, marking the fifth consecutive quarter of beating earnings per share and revenue expectations.

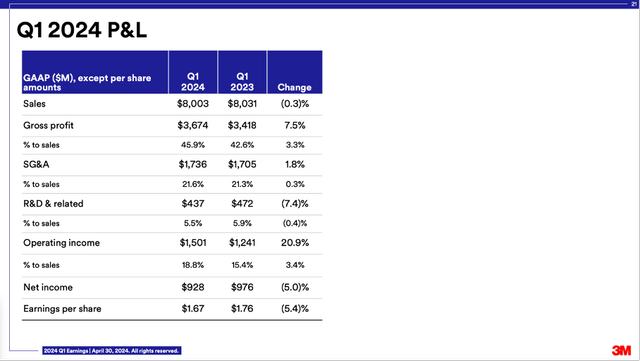

April 30, 2024, 3M For the first quarter, net sales decreased 0.3% year over year from $8,031 million in Q1 2023 to $8,003 million in Q1 2024, while operating income increased from $1,241 million in the same period last year to $1,501 million in the current quarter, representing 21.0% growth year over year. However, diluted earnings per share decreased 5.1% year over year from $1.76 in Q1 2023 to $1.67 in Q1 2024.

3M Q1 2024 Presentation

Adjusted earnings per share also increased 21.3% year over year, from $1.97 in the same quarter last year to $2.39 in the current quarter. Meanwhile, adjusted free cash flow decreased from $946 million in Q1 2023 to $833 million in Q1 2024, down 11.9% year over year.

3M Q1 2024 Presentation

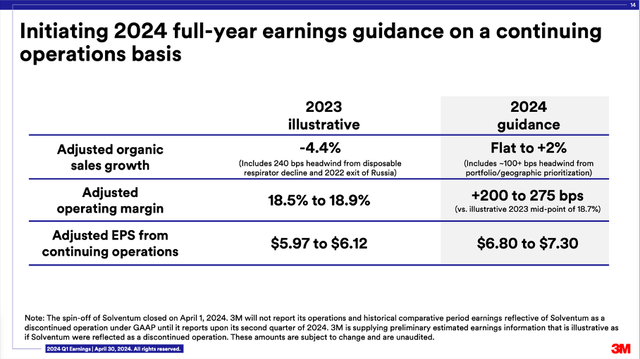

Additionally, we can see guidance for fiscal year 2024. We have already compared the guidance to adjusted fiscal year 2023 performance (excluding the performance of the Healthcare division, which was spun off as Solventum Corporation). Adjusted organic sales growth is expected to be flat to 2%, adjusted operating margins are expected to improve between 200 bps and 275 bps. And finally, adjusted EPS is expected to increase to a range of $6.80 to $7.30.

Return to normal

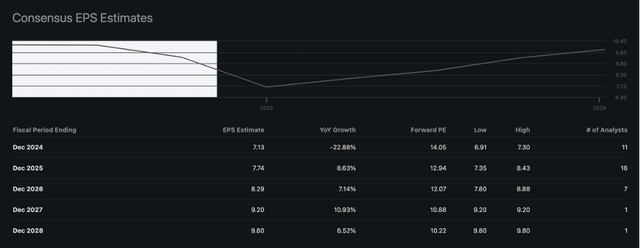

3M expects to see strong double-digit growth in earnings, which will be a strong sign of business returning to normal. From 1980 to 2022, 3M saw revenue grow at a CAGR of 4.20% and earnings per share at a CAGR of 6.51% over 42 years, and we can expect 3M to return to these levels. At least for the next few years, analysts are very optimistic, with analysts expecting earnings to grow at a CAGR of 8.28% between FY2024 and FY2028.

3M EPS forecast (Seeking Alpha)

One of the biggest issues 3M has had over the past few years has been litigation, but a settlement with a public water supplier (PWS) was finally approved by the court and over 99% of eligible claimants for Combat Arms earplugs opted to participate in the settlement. With major litigation no longer being as big an issue, there is optimism that 3M will perform similarly to the past, and sentiment towards the company and stock may change.

3M Q1 2024 Presentation

Going forward, 3M will report into three distinct business segments: Safety & Industrial, Transportation & Electronics, and Consumer. The fourth segment, its Health Care business, has been spun off as Solventum Corporation.

Solventum spinoff

Now let’s look at the Healthcare spinoff. The spinoff created a new business, Solventum Corporation, which began trading on April 1, 2024. On that day, the planned spinoff was completed, with 3M retaining 19.9% of the outstanding shares of Solventum common stock, and the remaining shares being distributed to 3M shareholders. However, Solventum’s performance so far has also been severely disappointing, with the stock price falling to just below $60 after opening at $80 about two months ago. I don’t have the space to dig too deep into Solventum, but it is by no means overvalued, with a forward P/E ratio currently below 10.

dividend

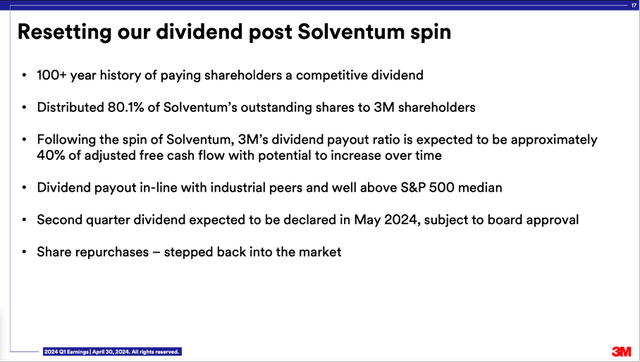

3M also used the Solventum spinoff to reset its dividend policy, but resetting its dividend policy meant a cut to investors. CEO Mike Roman tried to put a positive spin on the cut, but it was still a cut.

As a result, we expect to pay a dividend of approximately 40% of adjusted free cash flow, in line with industry peers and well above the S&P 500 median, with the potential to grow in the future. The company declared its second quarter dividend, approved by its board of directors, in May and is expected to pay it in June. Additionally, following the Spin-off, the company has re-entered the share repurchase market.

3M is now paying a quarterly dividend of $0.70 per share instead of the previous quarterly dividend of $1.51. It would be acceptable for 3M to lower its dividend a bit after the spin-off, and management took this opportunity to ultimately lower the dividend. However, given the struggling business and fairly high debt levels, preserving cash is the right move at this time.

3M Q1 2024 Presentation

Going forward, 3M is targeting a free cash flow payout ratio of 40%, and with expected free cash flow of $3.9 billion, it will pay a quarterly dividend of $0.70 per share and an annual dividend of $2.80, roughly in line with the 40% target dividend payout ratio.

At some point, investors may receive dividends from the solvency, but for the next 24 months or so. The management decided It has decided not to pay a cash dividend on its common stock. Solventum also wants to focus on reducing its debt levels over the next few years.

Conclusion

Despite the dividend cut, I remain optimistic about 3M. While the first quarter results weren’t perfect, the double-digit growth in adjusted earnings per share is a good sign. Moreover, the stock remains significantly undervalued, and the charts provide reasons for optimism. As always, I invest with a long-term time horizon (at least 5 to 10 years) and remain optimistic that I can continue to hold the stock and realize gains in the near future.