Daniel Wright

Carnival shares underperform the market

Carnival Corporation (New York Stock Exchange:CCL, New York Stock Exchange:C.U.K., OTCPK:CUKPF) shares have shown signs of recovery since CCL bottomed in late 2022, but are still well below their pre-COVID 2018 highs. Despite improving investor sentiment, Bargain investors have returned to support CCL, but market pessimism remains evident as investors reassess Carnival’s structural recovery.

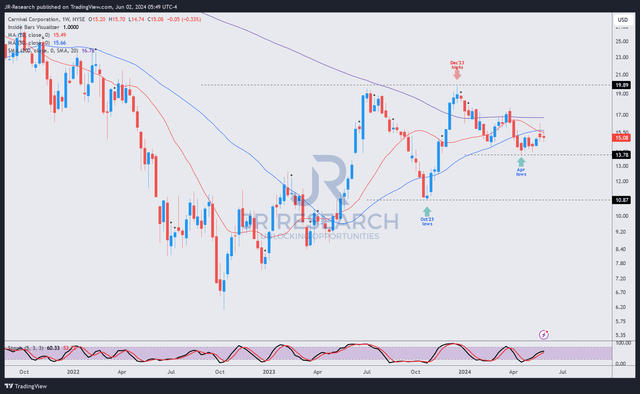

I urge CCL investors to consider taking profits and significantly reducing their exposure. Bearish CCL theory June 2023. I believe this theory is justified as CCL underperformed the S&P 500 (Spocks) (spy) has risen significantly over the past year. CCL stock surged to a high of nearly $20 in July 2023, but then plummeted and proved unsustainable. It spiked again in December 2023 to retest the $20 level, but failed again. As a result, it seems buyers were not confident enough to hold CCL. They took a gamble as they rapidly reduced their exposure at the key resistance zone of $20 for CCL.

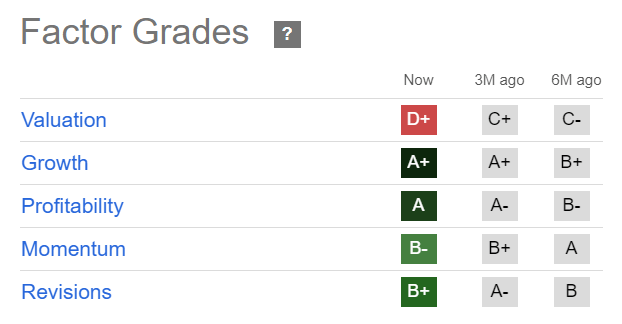

CCL Quant Grade (Seeking Alpha)

Despite CCL’s recent volatility, buying momentum remains strong, as seen in CCL’s Momentum Grade of ‘B-‘. As a result, we expect market sentiment on the CCL recovery thesis to remain solid.

Carnival’s multi-year recovery remains strong

Carnival’s first quarter earnings report The March 2024 announcement confirmed the major cruise operators’ bullish outlook. Net yields increased 17% year-over-year, driven by improved occupancy rates and robust pricing. Carnival’s FY2024 net yield outlook was raised to 9.5%, emphasizing the sustainability of the recovery thesis. Additionally, Carnival experienced broad demand trends across various segments driven by new guest experiences and repeat visits. Combined with the expected arrival of three new ships that will help Carnival meet increasing demand, I believe CCL investors who believe in the multi-year recovery thesis should remain invested.

Celebration Cay (which will include a private beach club and other amenities) is expected to be a strategic growth driver for Carnival and increase its appeal to travelers starting in 2025. As a result, Carnival is feeling more confident about upselling to customers, with management expecting growth opportunities through “increased ticket revenues, onboard spending and reduced fuel consumption.”

Nonetheless, management has refrained from providing any clarity on expected earnings growth in 2025. Therefore, I assess that improved visibility into booking trends and the potential for increased customer spending could strengthen Carnival’s pricing dynamics. With that in mind, this should support Carnival’s ability to continue reducing debt amid a potential return to profitable growth going forward. Cruise Industry’s “Private Island” Portfolio The cruise market is growing as cruise companies look to capitalize on new experiential opportunities, so investors may want to pay close attention to the spillover effects of growth and improved monetization efficiencies in 2025 and beyond.

Carnival expects adjusted EBITDA of $5.63 billion for fiscal 2024, up more than 30% from a year ago. But it expects second-quarter net income to be 10.5%, while net income is expected to normalize to 9.5%. A return to profitability will also help, even as normalization is expected amid tougher comparatives for Carnival. Carnival raises capital more efficiently To repay relatively high debts.

Carnival’s debt burden needs monitoring

Still, investors We remain cautious about Carnival’s balance sheet. The company’s optimal leverage is 3 to 3.5 times, “still higher than the roughly 2 times it was pre-pandemic,” so structurally high leverage could hinder Carnival’s ability to get more aggressive with newbuilding and capture faster demand growth.

Additionally, Carnival’s fiscal 2026 adjusted EBITDA leverage ratio is estimated at 3.6x, which is significantly higher than its fiscal 2018 and 2019 guideline of 1.75x to 2x. As a result, the company’s efforts to further drive growth may be hindered by its structurally debt-heavy financial profile. Accordingly, Carnival is expected to report adjusted EPS of $1.72 by fiscal 2026, significantly below its fiscal 2018 and 2019 guideline of $4.26 and $4.40, respectively.

Should you buy, sell, or hold CCL stock?

CCL Price Chart (Weekly, Medium Term) (TradingView)

CCL price action has been constructive, suggesting that the uptrend recovery is sustained. CCL’s adjusted PER At 15.1x, the stock is roughly 7% below the sector median. When compared to CCL’s solid ‘A+’ growth rating, bullish CCL investors may find current levels relatively attractive.

Wall Street analysts also Strong growth in cruise industry bookings. Recognized for its superior value proposition and attractive economics Cruising Experiences for Consumers Relative to onshore alternatives, CCL’s price action is constructive. Additionally, CCL’s price action supports Wall Street’s optimistic forecasts, which bodes well for CCL investors looking to sustain a multi-year recovery thesis.

With that in mind, I have assessed the $14 level and above as a constructive consolidation zone. A move above this level will be important in maintaining the uptrend continuation thesis for CCL. While I have assessed CCL’s valuation as relatively attractive, strong price action should support additional buying at current levels.

Therefore, I believe my “sell” argument was in line with expectations given how things have played out over the past year, and as mentioned above, given that CCL is trending more favorably, I believe my bullish rating is justified.

Rating: Upgrade to Buy.

Important Note: Investors are cautioned to conduct their due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Always exercise your independent thinking. Please note that unless otherwise specified, ratings are not intended to indicate specific entry/exit timings at the time of writing.

I want to hear your voice

Do you have any constructive comments to improve our paper? Did you find any significant flaws in our findings? Did you spot any important points that we didn’t notice? Do you agree or disagree? Please comment below to help everyone in the community learn better.