translator

HSY Stock: Yields surge to 10-year high

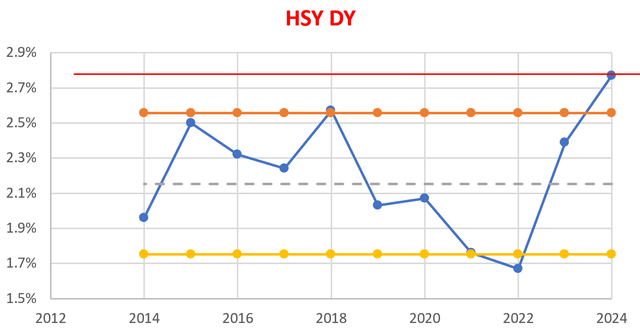

Hershey Company (New York Stock Exchange:HS) recently appeared in our screenings. These screenings feature stocks that regularly pay dividends and currently Dividend yields typically fluctuate between below and above their historical averages. One glance at the chart below will tell you why HSY is at the top of the filtered results. HSY currently has a dividend yield of approximately 2.8% on a FWD basis (shown as the solid red line). In contrast, its historical average dividend yield (shown as the dotted grey line) is only around 2.15%. The current dividend yield is significantly above the average, exceeding the 1+ standard deviation level (shown as the orange line with symbols) as you can see.

When dividend yields are this disproportionate, the first warning sign is The thought that comes to our mind is that dividend payments are unstable and a cut is imminent, but in the case of HSY, we quickly ruled this out.

For readers unfamiliar with the company, HSY is the largest US manufacturer of chocolate and non-chocolate confectionery products. Even if you haven’t heard of the company, you’ve likely heard of (or picked up) their products. The company carries some of the most iconic brands, including Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Kit Kat, and Almond Joy. The company has increased its dividend for 14 consecutive years and continues to pay more. The quarterly common dividend was recently raised 15% to $1.37 per share. As a highly profitable leader in this very fundamental sector, there is little doubt the dividend is safe and highly unlikely to be cut.

However, we see some worrying signs lurking behind the high dividend yield, including an above-average dividend payout ratio, high debt levels, profitability pressures, and slight overvaluation. In the remainder of this article, we expand on these issues and make our case for a HOLD on those grounds.

HSY Dividend: Room for Growth May Be Limited

As we said earlier, we believe the dividend is safe. However, there are some signs that the growth potential over the next few years may be limited. The company has faced profitability headwinds recently (more on this in the next section). As a result, the recent dividend hikes have come at the expense of higher payout ratios and balance sheet expansion.

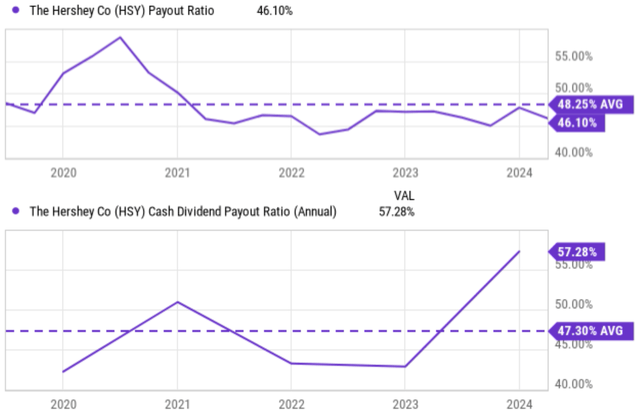

Specifically, the following chart compares HSY’s recent dividend payout ratio (top) and cash dividend payout ratio (bottom) to its historical average. As you can see, the EPS payout ratio is currently slightly below its historical average of 48.25%. However, going forward, Consensus EPS Estimates HSY’s forward earnings are $9.61 per share. Its current quarterly dividend is $1.37 per share, with a dividend payout ratio of over 57%, well above its historical average. The company’s cash dividend payout ratio, shown in the panel below, shows the same. As you can see, the current cash dividend is 57.3%, well above the historical average of 47.3%.

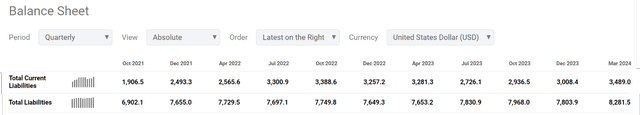

The following chart shows HSY’s current and total liabilities for the most recent quarters. As you can see, both current and total liabilities have increased significantly over the last couple of years. Current liabilities were $1.9 billion in October 2021, and increased to $3.5 billion by March 2024. Total debt increased from $6.9 billion in October 2021 to $8.3 billion by March 2024.

HSY: Profitability outlook and assessment

The root of the issue is pressure on profitability. We expect the business environment to be challenging going forward. The biggest headwind I am concerned about is rising cocoa (an essential ingredient for chocolate products) prices and increasing costs. Given inflationary pressures, geopolitical conflicts, rising fuel costs, and rising labor costs, I don’t see cocoa prices coming down anytime soon. In addition, we also expect additional costs associated with the implementation of a new ERP (enterprise resource planning) system in the coming quarters. Finally, interest expenses should also increase given the current interest rate environment and the increased leverage of HSY that I mentioned earlier.

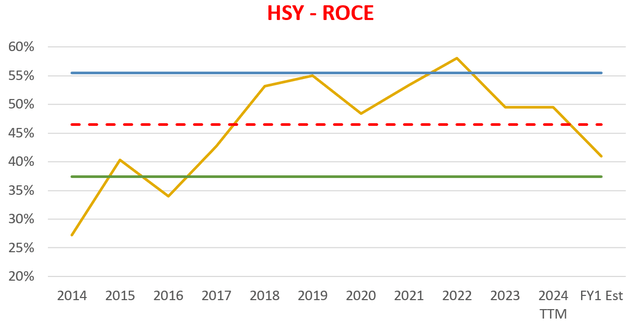

These headwinds are encapsulated in my estimates of Return on Invested Capital (ROCE) and Reinvestment Rate (RR), concepts I explain in detail in my other papers. articleWe now quote HSY’s results in the graph below. As we can see, the company’s ROCE has averaged around 46% over the long term, with a forecast ROCE of around 42% for next year. This is still a very profitable and respectable level compared to its peers (or even higher-profit companies in more attractive sectors such as IT). However, this is well below the historical average, and given the factors mentioned above, pressure is expected to continue.

Finally, on valuation: as a mature company in a stable sector, I believe HSY is a prime example of what Ben Graham calls a “defensive stock.” The wise investorTherefore, we will evaluate the stock according to the so-called Graham’s PER, which is explained in this book.

The Graham P/E is calculated as 8.5 plus 2x the expected annual growth rate. In other words, in Graham’s view, a business that is stagnant and has 0% growth potential should be worth a P/E of 8.5.

My method for estimating HSY’s growth potential involves the ROCE and reinvestment rate (RR) mentioned above. As mentioned above, the ROCE is currently around 42%. The RR is currently around 8%. Therefore, HSY’s organic growth rate is around 3.4% (42% ROCE x 8% RR = 3.4%). Note that this is the actual rate. To get the nominal growth rate, add an inflation escalator of 2.5%. This results in a nominal growth rate of 5.9%. With an expected growth rate of 5.9%, the Graham P/E is around 20.3x (8.5+2×5.9=20.3). At the price as of this writing, the market is valuing HSY at 20.6x FWD P/E with no margin of safety.

Other risks and final considerations

In addition to the risks mentioned above, HSY also faces industry-wide headwinds, such as rising sugar prices, which may put pressure on margins. Furthermore, consumer preferences are rapidly shifting towards healthier options, which may impact demand for traditional confectionery products.

In terms of upside risks, the top priority on my list is the ongoing expansion plans. A new 250,000-square-foot chocolate factory in Hershey, Pennsylvania is expected to be operational in mid-2024. The project is part of a $1 billion investment in HSY’s supply chain network that also includes the addition of 13 production lines and upgrades to 11 existing lines at other facilities in North America. Given HSY’s promising long-term business outlook, I have a positive outlook for these initiatives in the long term. However, I don’t believe the next two or so years will be enough to solve the issues we’ve analyzed in this article.

In conclusion, Hershey may look very attractive with its highest dividend yield in at least the last decade, and given its leadership position in the staple foods sector and very high profitability, I don’t see any threat of a dividend cut.

However, looking more closely, there are some worrying signs. Further dividend growth and earnings growth over the next few years may be limited by rising raw material costs, above-average dividend payout ratios, and rising debt levels (which could be exacerbated by rising or rising interest rates). Finally, Hershey’s current price-to-earnings ratio is close to fair valuation in my assessment and does not adequately price in the headwinds ahead. Given these mixed signs, the direction of the stock over the next 1-2 years is unclear, so I rate it HOLD.