Mavs 13

March 21, 2024, Seeking Alpha Articles Here is what I have concluded about copper and CPER ETFs:

If copper is on track to challenge its 2022 all-time highs, CPER could be the golden ETF to add. Add it to your portfolio.

After a significant correction from a high of $5.01 per pound in March 2022 to a low of $3.15 in July 2022, COMEX copper futures are trending higher. Copper hit a new milestone this month, hitting an all-time high just below $5.20 per pound for the near-term COMEX futures contract. This achievement highlights copper’s growing importance in the global market. Copper’s trend is upwards, giving the red metal significant upside potential, but the risk of a correction increases as the price rises.

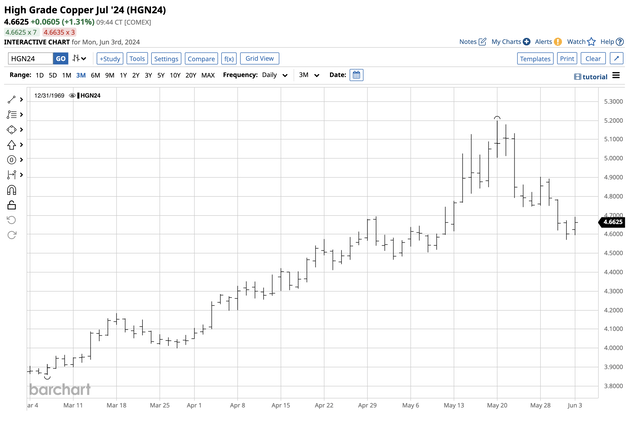

Copper surpasses March 2022 highs

Before 2005, copper Futures on CME’s COMEX division have never traded above the December 1988 high of $1.6495.

Long-Term COMEX Copper Futures Chart (bar graph)

As shown by monthly charts going back to 1971, copper has been making new lows and highs since surpassing its 1988 peak. The last time copper was below $2 a pound was in January 2016. Since October 2020, copper has not traded below $3.

Copper futures reached an all-time high of $5.01 in March 2022 before falling more than 37% to a low of $3.15 four months later in July 2022. Since then, copper futures have continued to make new lows and highs, reaching a new high of $5.1985 in May 2024. At its most recent high, copper was 28.5% higher than its price on March 21, 2024.

Further highs on the way – $6.80+ upside target

Copper’s application in green energy efforts has led analysts at Goldman Sachs to call it “New Oil.In late 2023, Ivanhoe Mines founder and chairman Robert Friedland said he needed $15,000 per tonne of copper to encourage a new mine.

Copper has been in a bull market for nearly two decades, and if the London Metal Exchange’s three-month futures contract rises to $15,000 a tonne, the nearby COMEX futures price would exceed $6.80 a pound, more than 30.7% above its recent high.

As prices rose, the risk of a major correction increased.

Even the most aggressive bull markets rarely move in a straight line. The rally that propelled copper to its latest record high ran out of steam on May 22, and prices plummeted.

3-Month COMEX Copper Futures Chart (bar graph)

The three-month chart shows that July COMEX Copper futures rose to $5.1990 on May 20. On May 22, the price fell by 25.75 cents, or more than 5%. The correction has pushed July Copper futures below $4.60 per pound, with the red metal searching for the bottom it hit in early June.

Technical support on the monthly chart is at $3.53 and $3.15 per pound. The non-ferrous metal is likely to make new lows again.

Three options for direct investment in copper

The scaled-down approach to buying copper during price corrections has been the best for almost two decades. The most direct methods are copper futures and futures options on the CME, and forwards and options on the London Metal Exchange. The three direct investment options are:

- Copper ETF Products: US Copper ETF (NYSEARCA:Medical bills)teeth Portfolio of Copper Futures ContractsInvesco DB Base Metals Fund ETF (DBB) holds true Copper, aluminum, zinc Futures and forwards. Aluminum and zinc tend to follow copper, the leader among the LME metals.

- Copper Mining ETF Products: iShares MSCI Global Metals & Mining Producers ETF (choose) holds shares in the BHP Group (BHP), Rio Tinto (Rio), Freeport-McMoRan (FCCX), Glencore (OTCPK:GLNCY), and other major copper producing and refining companies, tend to have share prices that rise and fall with the price of copper.

- Copper producer shares: Companies include PICK ETF, Southern Copper (SCCO), and others provide exposure to copper prices.

Futures and forward contracts offer the most direct exposure to copper, while ETFs and mining stocks are proxies that reflect the path of least resistance for copper prices.

Notable CPER levels – Copper is a bellwether commodity

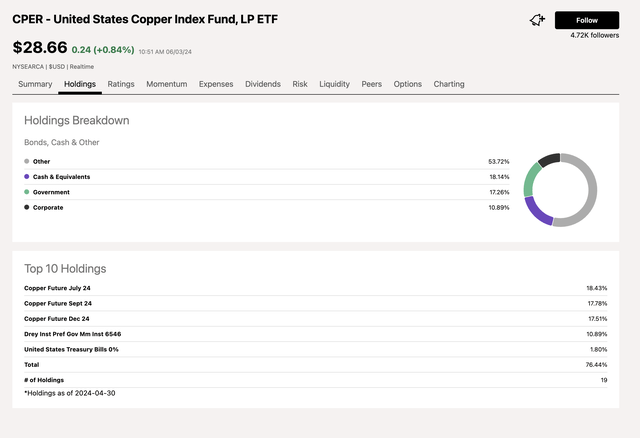

CPER’s main holdings are:

Main holdings of CPER ETF products (Seeking Alpha)

CPER trades $28.66 per share and has $229.19 million in assets under management. CPER trades an average of 292,059 shares a day and charges a management fee of 1.04%.

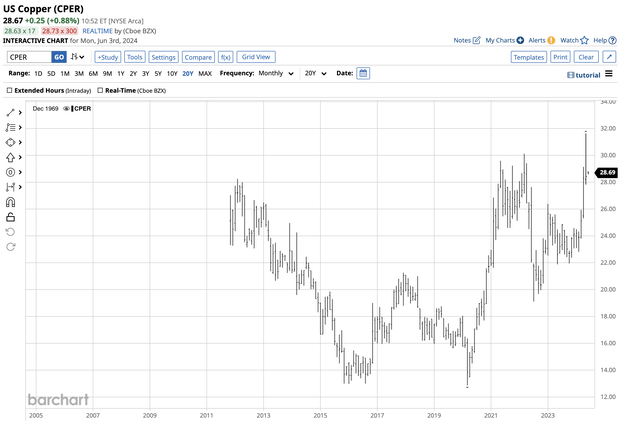

CPER began trading in 2011. The ETF has reflected price movements in the copper futures and forward markets in an excellent way.

CPER ETF Long-Term Chart (bar graph)

The chart shows that the CPER rose to a 2022 high of $30.12 per share as copper futures hit $5.01 per pound. Four months later, the CPER fell 36.55% to a low of $19.11. Most recently, the CPER hit an all-time high of $31.63 as copper hit a new high of around $5.20 per pound.

Copper has lost its upward momentum and identifying the bottom in any market is impossible. However, rising demand from green energy projects, a $15,000 per ton requirement for new production expansion, and a nearly 20-year bull trend suggest the possibility of more bottoms on the way to higher highs. I am buying less copper after the recent correction. It is hard to identify the bottom during corrections because markets tend to fall to irrational, illogical, and unreasonable prices, but the same can be said for the upside. Therefore, the eventual peak for this red metal could be significantly higher than the $6.80 per pound target. I support the CPER ETF, but the only drawback is that it is not a 24-hour trade, so you may miss the highs and lows when the US stock market is not open.