JHVE Photo

Investment Thesis

Conagra Brands Inc.New York Stock Exchange:CAG)’s sales growth is expected to turn positive in FY25 due to YoY decline and sequential recovery. Moreover, the company’s strong execution in terms of innovative product launches should help it gain market share and drive growth. Revenue growth. The company is also well positioned to capitalize on consumer acceptance and usage of the frozen food category due to its quality, convenience, and superior relative value.

On the margin front, the company should benefit from operating leverage from recovering production volumes, cost-cutting measures, and productivity initiatives such as connected shop floor plans. The company’s shares are trading at a discount to historical averages, and I believe there is potential for rerating if the company returns to growth next year. An attractive valuation, combined with improving earnings guidance and favorable margin expansion prospects, makes CAG stock worth buying.

Revenue Analysis and Outlook

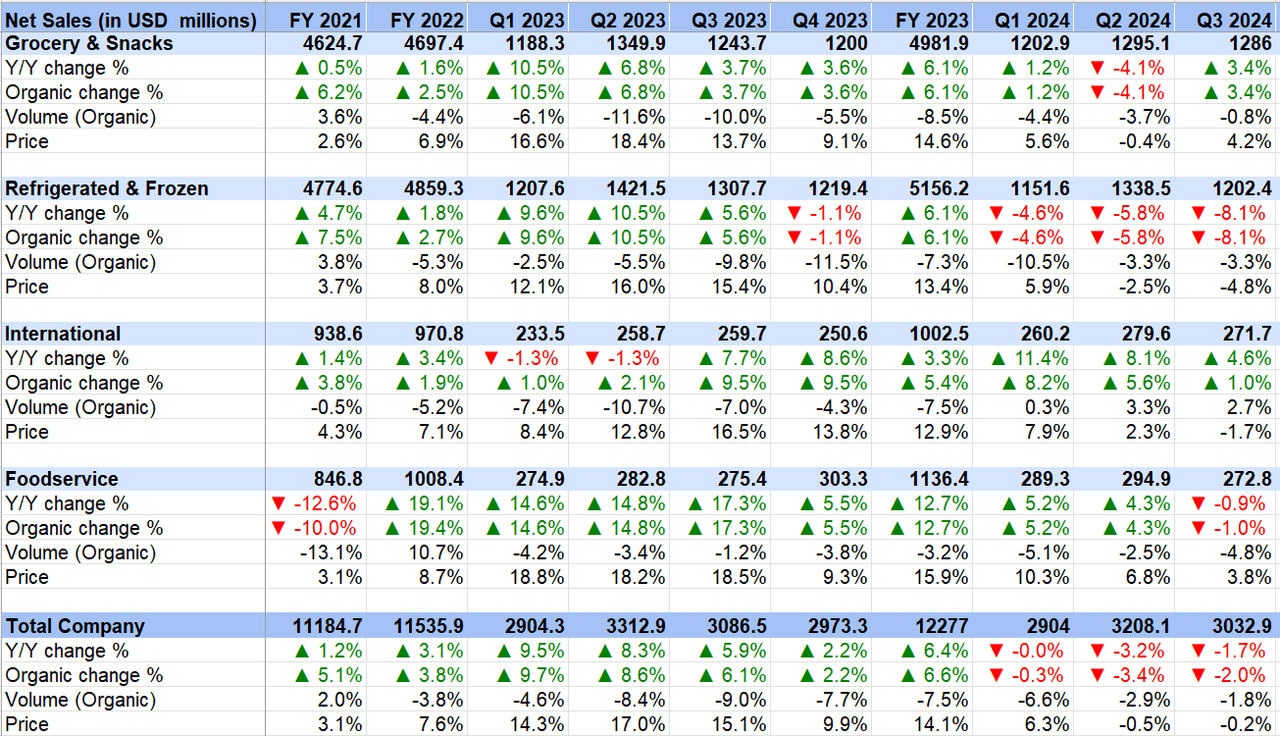

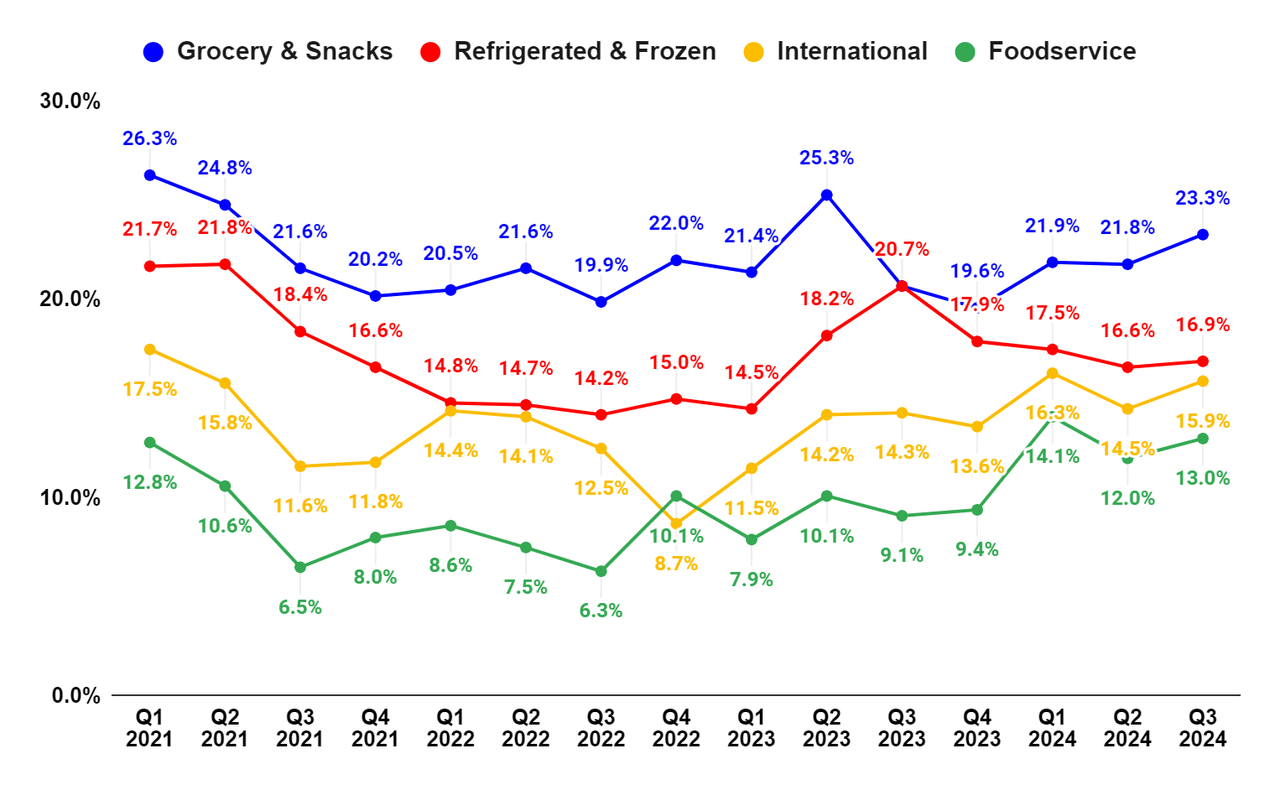

After experiencing robust growth between FY21 and FY23, driven by significant price increases, CAG’s sales turned negative in FY24 as consumers cut spending on discretionary items amid continuing inflationary pressures, resulting in lower volumes.

The company’s net sales for the third quarter of 2024 were $3,032 million, down 1.7% year over year. Excluding the favorable impact of foreign exchange of 0.3%, organic sales were down 2% year over year, driven by a 1.8% decrease in volume due to weaker industry-wide consumption trends and a 0.2% unfavorable price/mix impact primarily due to strategic trade investments during the quarter.

On a segment basis, Food & Snacks net sales increased 3.4% year over year behind a favorable price/mix effect of 4.2% driven by favorable brand mix and the benefit of inflation-led pricing implemented in the prior year. Organic volume decreased 0.8% as industry-wide consumption trends continued to be weak.

In the Refrigerated & Frozen Foods division, sales decreased 8.1% compared to 2017 due to lower sales volume (3.3%) and a negative price mix impact (4.8%). The lower sales volume was driven by continued weak consumption and the lower price mix was primarily due to increased strategic investments in the frozen business.

In the International segment, net sales increased 4.6% compared to 2017, driven by a 3.6% favorable foreign exchange impact and 1% organic sales growth. Organic sales growth was driven by 2.7% volume growth behind strength in Mexico and global exports, partially offset by a 2.7% decrease in price/mix.

Finally, Foodservice net sales decreased 0.9% year over year on a reported and organic basis, driven by a 4.8% decrease in volume due to our focus on reducing or exiting less profitable business in lower priority categories and slower dine-in traffic. The organic sales decrease was partially offset by a 3.8% increase in price/mix.

CAG’s Past Revenue Growth (Corporate data, GS Analytics Research)

Going forward, the company should benefit from easing comparatives over the next few quarters. The company’s organic growth slowed from 6.1% yoy in Q3’23 to 2.2% yoy in Q4’23, then turned negative for the first three quarters of the year. As such, comparisons between the current quarter (Q4’24) and next year are easy. The company’s volume growth is also beginning to become less deteriorating quarter-over-quarter. The sharp price increases over the past few years have negatively impacted volumes. However, I believe volumes will continue to recover quarter-over-quarter as consumers adjust to past price increases, become much more cautious about future price increases, and inflationary headwinds abate. The easing comparatives and quarter-over-quarter volume recovery bode well for the company’s revenue growth going forward, and I expect the company’s growth to turn positive in FY2025.

As the inflationary environment continues to weigh on customers’ wallets, eating at home is in an advantageous position as it is a more affordable option compared to eating out. managementis on average about four times more expensive.

The company should also benefit from innovation and strong execution, which should help it gain share. The company expects to generate approximately $1.6 billion in sales in 2023 from products introduced in the past five years, indicating a successful product innovation strategy.

The company has done a good job of increasing lunchtime consumption through its bowl innovations, and plans to replicate that success with its dinnertime innovations. Explaining the company’s approach at the CAGNY conference earlier this year, COO Thomas McGough said:

“In single-serve meals, our bowl innovations drove category sales. Lunchtime consumption increased. While bowls account for just 25% of category sales, they contributed 60% of the category growth. And this is where the breadth of our portfolio is a real strength. We developed innovation platforms like bowls to leverage the breadth of our portfolio to reach more consumers and gain scale. As a result, we are approaching $1 billion in sales on this platform and, as you can see, we continue to see success with a very impressive lineup of new products in this category segment.

We’re taking a similar approach with dinnertime. Dinnertime is a huge opportunity for us. It’s our biggest dining occasion, but it’s an untapped space for us. Like with bowls, we’re developing our platform and will continue to innovate aggressively across our portfolio. We literally have something for everyone, including our new Healthy Choice Modern Dinner.

At Marie Callender, we are elevating and modernizing traditional dinner staples. For those with big appetites, we are introducing the high-protein Hungry Man Combo and the Marie Callender Duo. Evol has always been at the forefront of modern cuisine, and we will continue to do so with recipes inspired by these dishes. When we look at dinner occasions, single-serve meals are the only way to satisfy this occasion. But there is a segment called multi-serve meals. That is a different business. The growth of this segment is really accelerating. Italian food is the most popular cuisine in America, and we are expanding our line with new Bertolli appetizers and premium Bertolli entrees that are comparable to complete home-cooked meals that feel like they were eaten out. And for those who feed large families, we are modernizing and premiumizing Chef Boyardee and moving it into the frozen category. These are incredible products. Consumers can prepare them for about $2 per meal and in just 15 minutes.

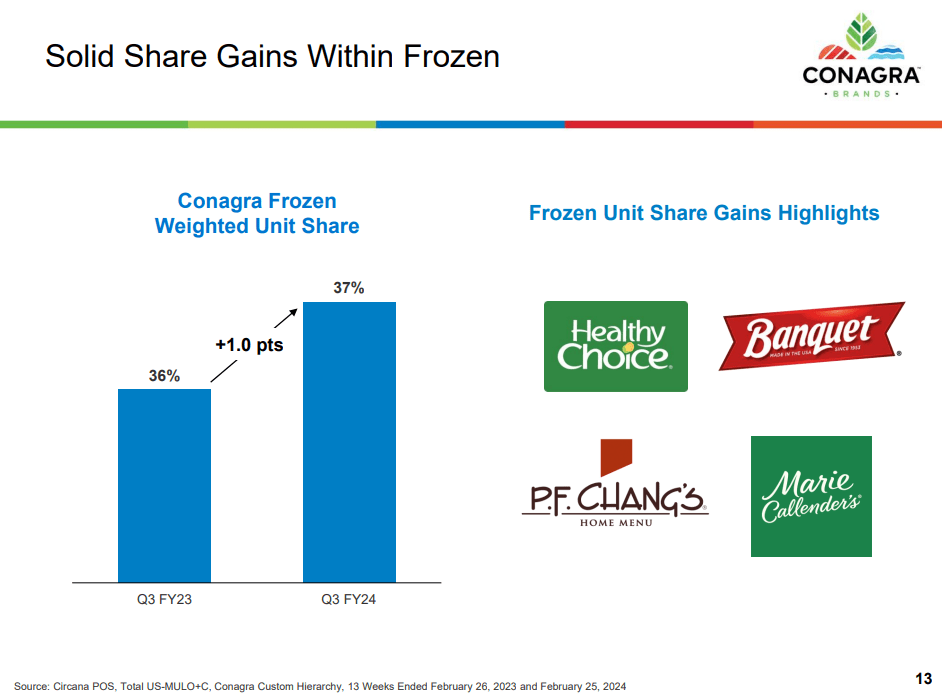

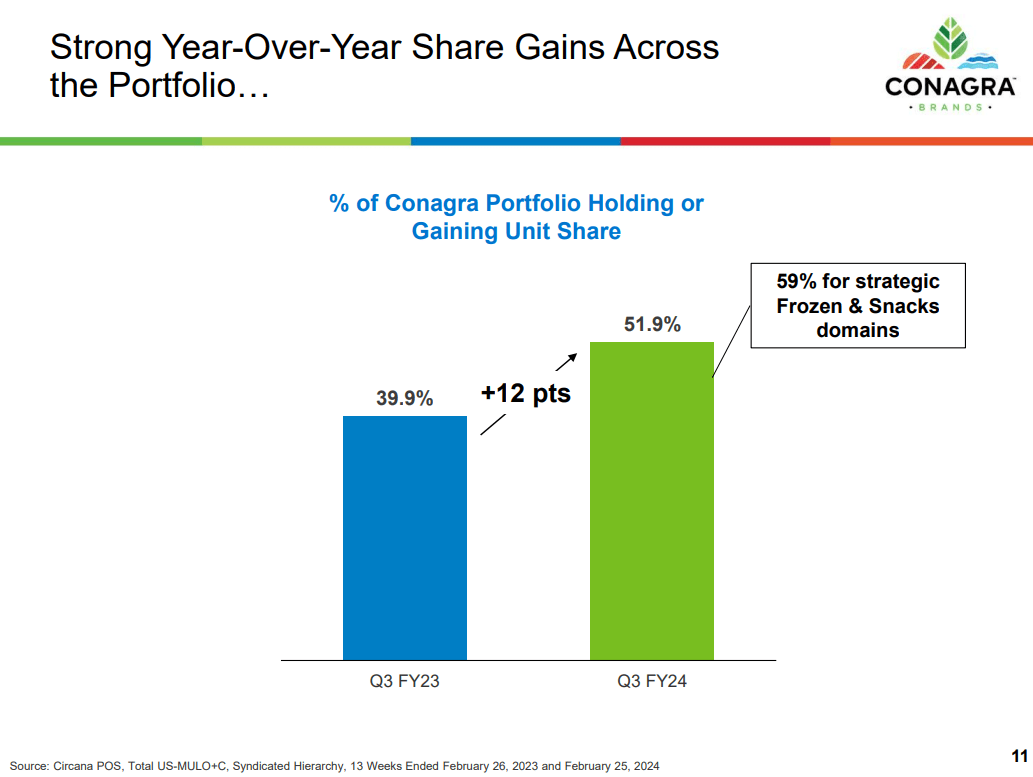

The company’s strong execution has helped it gain market share in the frozen foods category by about one percentage point over the past year, with approximately 51.9% of the company’s portfolio gaining or maintaining unit share in Q3FY24, compared to 39.9% in the prior year.

CAG expands market share in frozen food sector (The company’s third quarter 2024 earnings announcement)

Increased share of CAG’s overall portfolio (The company’s third quarter 2024 earnings announcement)

This improved execution has me optimistic about the company’s growth prospects.

The company is also poised to benefit from increasing consumer acceptance and usage of the frozen food category due to its quality, convenience, and superior relative value. Overall, we expect the company’s revenue growth to turn positive over the coming quarters and are optimistic about its long-term growth prospects.

Margin Analysis and Outlook

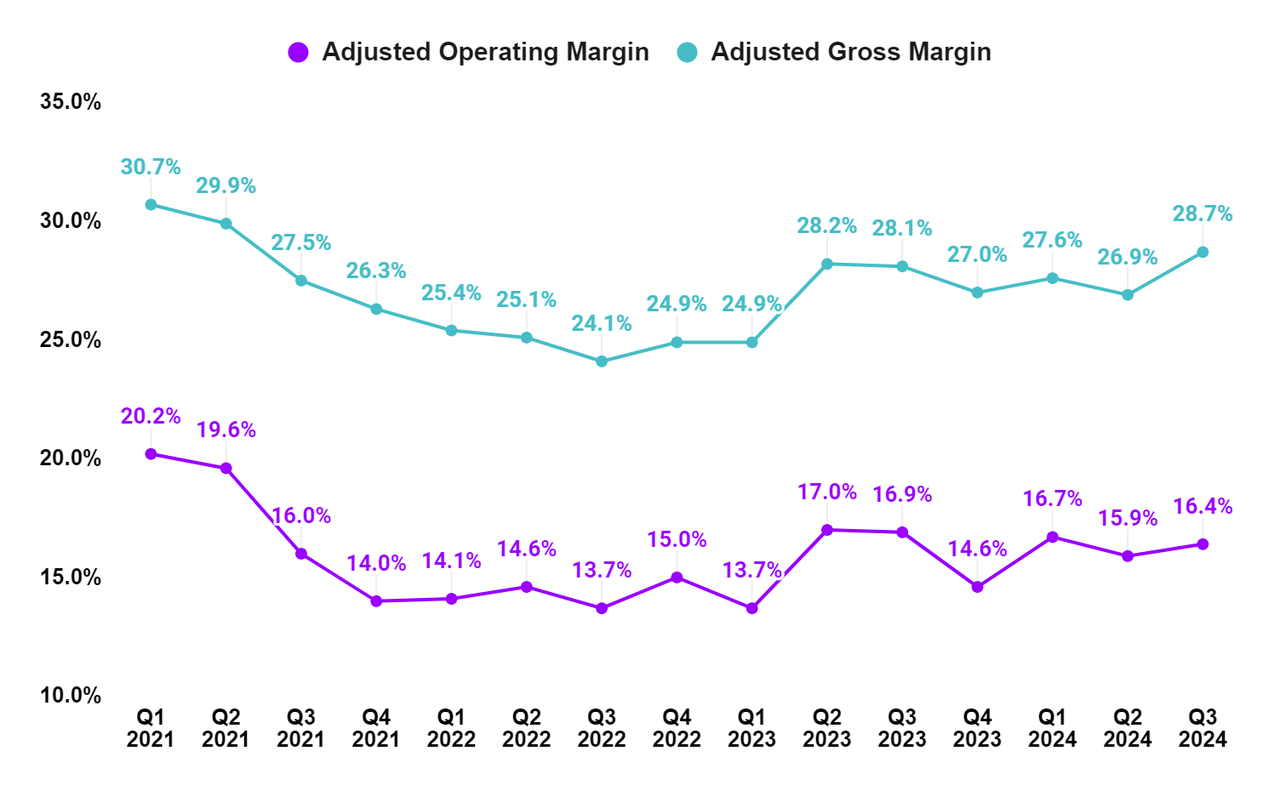

In the third quarter of 2024, the company’s gross margin was favorably impacted by cost savings and productivity improvements, which more than offset the negative impacts of lower organic net sales, moderate input cost inflation, and unfavorable operating leverage. As a result, adjusted gross margin improved 52 basis points year-over-year for the quarter to 28.7%.

However, selling, general and administrative expenses (SG&A), which includes advertising and promotion (A&P), increased 11% year over year for the quarter due to higher incentive compensation and increased investments in A&P.

Adjusted operating margin was 16.4%, down 49 basis points from the prior year as the benefit of gross margin expansion was offset by higher SG&A expenses.

By segment, adjusted operating profit increased 261 basis points year-over-year in Food & Snacks, 161 basis points year-over-year in International and 383 basis points year-over-year in Foodservice. Meanwhile, Refrigerated & Frozen adjusted operating profit declined 385 basis points year-over-year due to higher merchandising and A&P investments and a tough year-over-year comparison as third quarter 2023 gross margin benefited from the timing of inflation-driven price increases.

CAG’s consolidated adjusted gross profit margin and adjusted operating profit margin (Corporate data, GS Analytics Research)

CAG’s adjusted operating profit margin by segment (Corporate data, GS Analytics Research)

Going forward, the company’s margin outlook is favorable. As volume growth turns positive, the company’s margins should benefit from operating leverage. Supply chain constraints and inflation are easing, and the company has successfully taken pricing actions in certain areas where inflation remains a headwind (such as tomatoes in Q3). As such, we expect the company to also benefit from positive price/cost effects.

During its 2022 investor day, management also announced plans to cut costs by $1 billion, and at the CAGNY conference earlier this year said it expects to achieve these savings through supply chain optimization and leveraging digital technologies to improve productivity. One good example of management’s efforts to improve productivity is the connected shop floor. The company is installing sensors on production lines to collect real-time data to drive performance improvements and identify potential sources of material waste.

I believe these cost-cutting measures, coupled with recovering sales volumes, will help the company’s margins expand in the coming quarters.

evaluation

CAG stock price now transaction The stock trades at 11.06 times the consensus EPS estimate of $2.70 for fiscal year 2025 (ending May), and 10.57 times the consensus EPS estimate of $2.83 for fiscal year 2026, which is lower than the five-year average forward P/E. 13.54 timesThe company’s EV/EBITDA (FWD) is 9.86x, lower than its EV/EBITDA of 11.35x over the past five years.

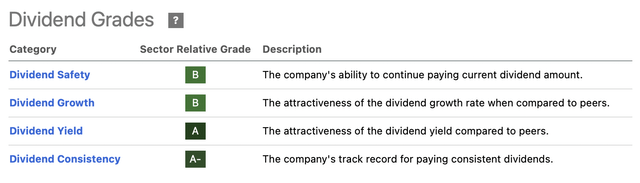

The company boasts a healthy dividend yield of 4.69%. Find Alpha Quant Dividend grade.

CAG Dividend Grade (Seeking Alpha Quantitative Rating)

The company’s valuation multiples are under pressure due to growth headwinds in FY24. However, the company is expected to return to growth in the coming quarters, and there is a good chance that valuation multiples will reprice and move higher. On the plus side, investors can stand to gain by waiting as the company offers a high dividend yield of 4.69%. Hence, I believe CAG stock is worth buying at current levels.

risk

- I expect inflation to moderate, but if it accelerates it could put a strain on consumer wallets and potentially negatively impact prices/costs, thus impacting both volumes and margins.

- If management is unable to implement cost-reduction initiatives, margin improvements may not materialize.

Conclusion

I expect the company’s earnings to turn positive in FY25 owing to shrinking comparable business, sequential volume recovery, market share growth driven by innovation and good execution, and favorable consumption numbers in the frozen foods segment. Margin outlook is also positive owing to operating leverage and cost reduction initiatives. Moreover, valuation is at an all-time low and could well be re-valued as the company gets back on track for growth. Given the favorable growth outlook and discounted valuation, I recommend buying CAG shares.