Artist GNDphotography/E+ via Getty Images

In December I upgrade Zinvee Inc.Nasdaq:GymZIMV turned to buy on the news that Samsung Electronics is selling its spinal implant business to focus solely on dental implants. It reduced its outstanding debt, and as a result the company appeared to be attractively valued relative to its dental implant-focused peers.

So far, my buy recommendation hasn’t worked out, as ZimVie’s stock price has fallen 11% since my last article (Figure 1).

Figure 1 – ZIMV Share Price Down 11% Since December (Seeking Alpha)

The company recently reported its first quarter results, so it’s time to take another look at the company to see if my previous recommendation was correct.

Upon closer analysis, I believe my previous valuation exercise was done too hastily and erroneously indicated that ZIMV was significantly undervalued. The company’s 2024 guidance is: Forward EV/Adjusted EBITDA valuation is approximately 10x, which is roughly in line with ZIMV’s dental implant industry peers.

I remain concerned about ZIMV’s shrinking sales and am downgrading the stock to Hold. I believe the stock will remain range bound until dental implant sales recover sustainably.

Company Profile

ZimVie Inc. is a wholly owned subsidiary of Zimmer Biomet Inc.jibThe new joint venture, ZIMV Healthcare, is expected to launch a joint venture called ZIMV Healthcare Consulting (ZBH) in 2022. The spin-out originally consisted of ZBH’s non-core, low-growth dental and spinal business when ZIMV spun it out in 2022. The spin-out also left ZIMV with over $450 million in net debt. The combination of low growth and high debt was a lethal one, and ZIMV struggled to gain investor support as a standalone company.

However, in December 2023, ZIMV Announced The company is selling its spine business to private equity firm HIG Capital for $315 million in cash and $60 million in promissory notes.

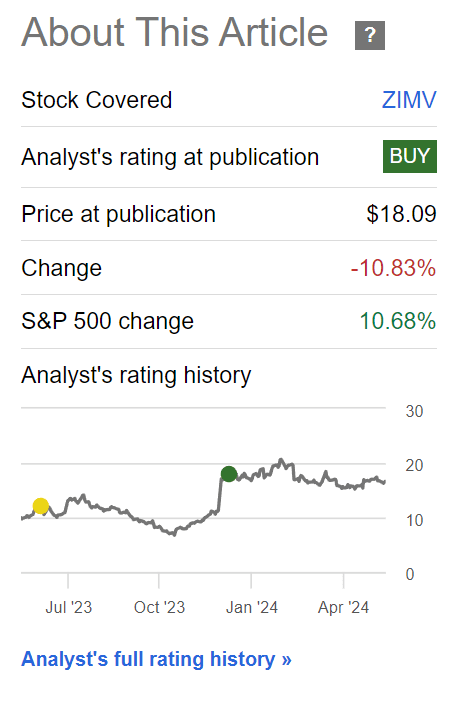

ZIMV appears to have sold its spine business at a high price, with the division reporting revenue of $421 million and operating profit of $38 million in the trailing month, according to the company’s financial statements at the time.

With pro forma net debt of approximately $200 million and 2022 operating income of $93.6 million from the surviving dental business, I estimate that ZIMV is attractively valued, trading at approximately 6x EV/operating income (Figure 2).

Figure 2 – ZIMV segment operating profit, 2022 (company reported)

Performance in 2023 is set to continue declining

In retrospect, I was too early to trust ZIMV’s 2022 financials.

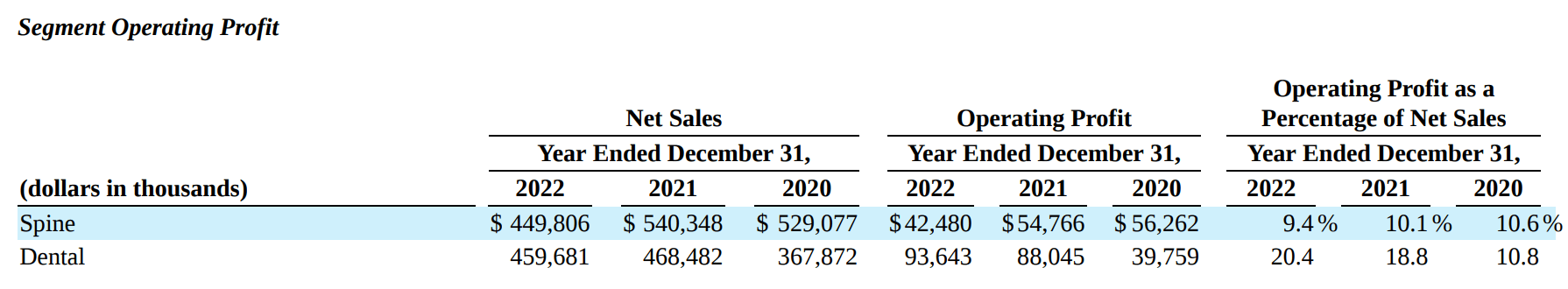

Recall, the primary reason Zimmer Biomet decided to spin off ZinVee was because the spine and dental businesses were mature, low-growth businesses that were unattractive to ZBH’s management. Unfortunately, the dental business has continued to shrink in the quarters since the spin-out, with full-year 2023 revenues expected to be $457.4 million, down 1.3% year over year (Exhibit 3).

Figure 3 – ZIMV 2023 Financial Performance (Company Report)

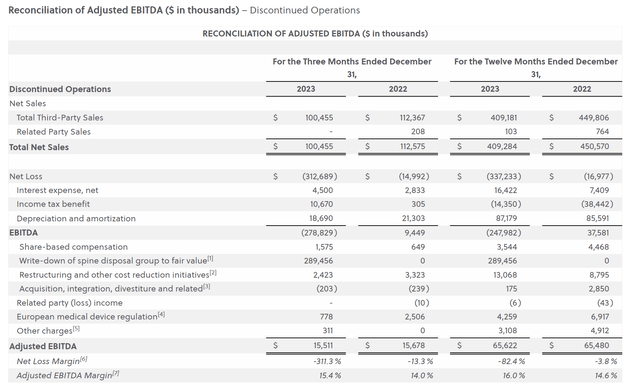

The company saw a surprise net loss of $14.87 per share for 2023 after it had to take a large impairment charge on its spine business, which it classified as a discontinued operation.

Adjusted EBITDA from continuing operations in 2023 was $65.6 million, flat compared to the prior year (Exhibit 4).

Figure 4 – ZIMV 2023 Adjusted EBITDA (Company Reported)

The same will happen in 2024.

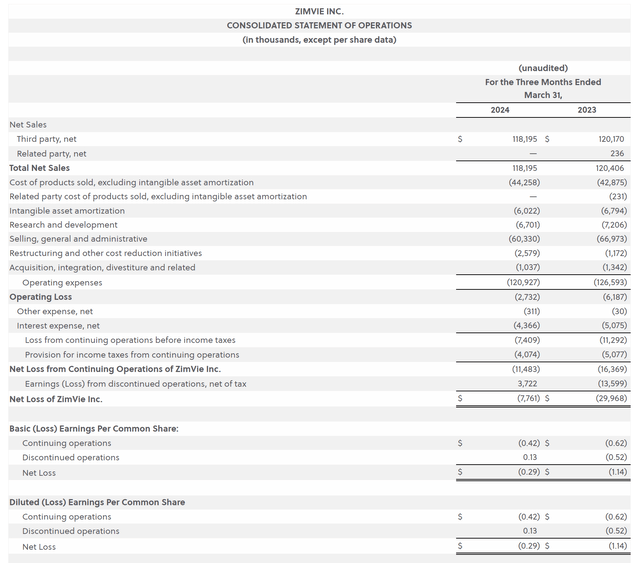

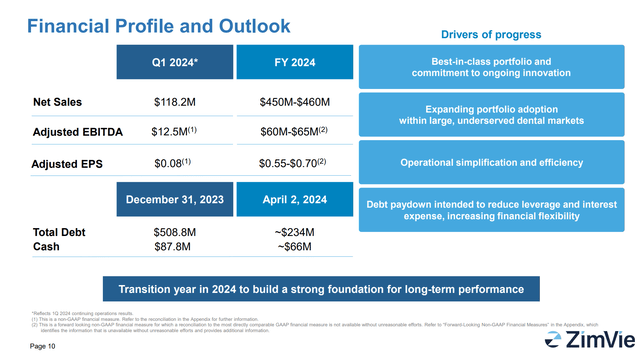

Unfortunately, despite management’s claims of sharpening focus, ZimVie’s financial performance has not improved so far in 2024, with the company reporting first-quarter 2024 revenues of $118.2 million, down 1.8% year over year (Exhibit 5).

Figure 5 – ZIMV Q1 2024 Financial Performance (Company Report)

Net income remained negative at -$0.29/share. Continuing operations lost $0.42/share, but it’s concerning that the discontinued spine business posted a profit of $0.13/share.

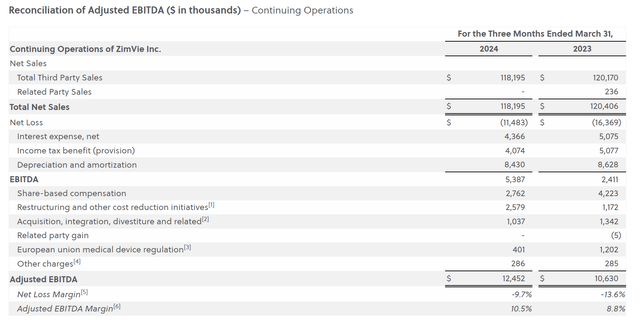

But adjusted EBITDA shows improvement

On the positive side, adjusted EBITDA for the first quarter of 2024 increased 18% year over year to $12.5 million (Figure 6).

Figure 6 – ZIMV Q1 2024 Adjusted EBITDA (Company Reported)

2024 guidance disappoints

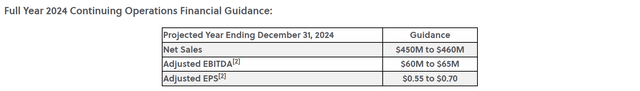

However, while the company’s first quarter 2024 adjusted EBITDA improved year-over-year, its full-year 2024 guidance states: decline Adjusted EBITDA will increase to $60 million to $65 million (Figure 7).

I believe the main reason ZIMV’s stock price has slumped since its first quarter earnings release is due to the company’s guidance, in which ZIMV provided guidance for full-year 2024 revenue of $450-460 million and adjusted EBITDA of $60-65 million, or an adjusted EBITDA margin of approximately 13.7% (Figure 7).

Figure 7 – ZIMV 2024 Guidance (Company Report)

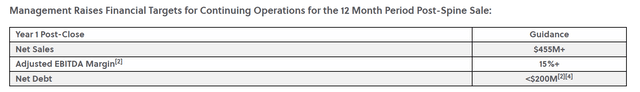

Moreover, the revenue outlook is in line with the figures released by ZIMV, February When ZIMV released its 2023 financial results, its adjusted EBITDA margin guidance appeared significantly lower at just 13.7% compared to the previously guided run-rate of over 15% (Figure 8).

Figure 8 – ZIMV Historical Run Rate Guidance (Company Reports)

Valuations are no longer attractive

In my previous post, my initial thoughts after the HIG deal was announced were that ZIMV is attractively valued, trading at 6x pro forma Fwd EV/operating profits, with the key assumption being that ZIMV’s operating profit run rate will be similar to $94M in 2022.

However, with the company’s fiscal 2023 financial results and fiscal 2024 guidance now out, and the company’s adjusted EBITDA guidance of just $60 million to $65 million, my thoughts on ZIMV’s valuation have changed.

With the HIG transaction closing on April 1, ZIMV’s pro forma enterprise value will be approximately $620 million as the company will receive $315 million in cash from HIG. The $620 million pro forma enterprise value implies a Fwd EV/EBITDA of 9.9x compared to the company’s adjusted EBITDA guidance of $62.5 million.

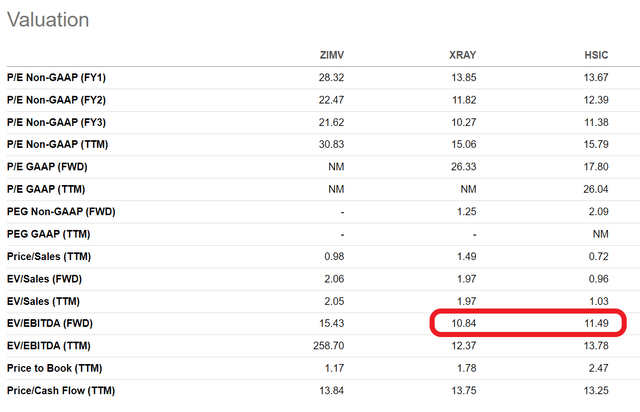

Based on pro forma results, ZIMV is expected to outperform its closest peer, DENTSPLY (X-rays) and Henry Schein (HSIC) are trading at 10.8x and 11.5x Fwd EV/EBITDA, respectively (Figure 9).

Figure 9 – ZIMV Peer Ratings (Seeking Alpha)

Given ZIMV’s poor quality earnings (we significantly adjusted for restructuring charges to arrive at the adjusted EBITDA figure), we believe a valuation discount of 9.9x for ZIMV is justified compared to 10.8x or 11.5x.

Risks to ZIMV

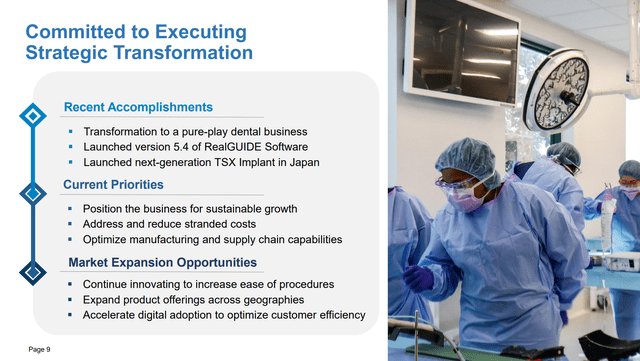

In my opinion, the biggest risk in the ZIMV story is a lack of growth. Although the company has touted big plans to put its dental business back on a growth trajectory by expanding market opportunities in new geographies and driving innovation (Exhibit 10), so far dental sales have been declining in the low single digits (“LSD”) for the year.

Figure 10 – ZIMV has ambitious goals to put its dental business back on the growth track (ZIMV Investor Presentation)

Moreover, although ZIMV has bought itself some time by selling its spine business, its remaining debt burden is not insignificant: With pro forma net debt of $168 million, the company’s net debt/adjusted EBITDA ratio is still at 2.7x (Figure 11).

Figure 11 – ZIMV Net Debt of $168 million (ZIMV Investor Presentation)

Conclusion

It appears that I was premature in upgrading ZIMV to a buy recommendation in December. After analyzing the company’s recent Q1 2024 financial results, I have become more cautious on ZIMV’s valuation as the company appears fairly valued at approximately 10x Fwd EV/adj. EBITDA. I am particularly concerned by the continued decline in sales in the dental business.

While ZIMV gained some breathing room with the sale of its spine business, its debt balance remains large, leaving the margin of error for turning around the dental business.Until we see further signs of a revenue recovery, I am downgrading ZIMV to Hold.