Yannick 88

what’s new

After several months of macroeconomic surprises, May appeared to be a relatively quiet month, with inflation data trending downwards again after causing some concern in April.

This has led to a decline in government bond yields, This would boost stock prices through the first half of the month. Interestingly, both interest rates and the markets took a turn in mid-May, with rising interest rates weighing on major US indexes.

Still, U.S. stocks rose at the end of the month, with the S&P 500, Dow Jones Industrial Average and Nasdaq rising 4.96%, 2.58% and 6.39%, respectively.

Government bond yields also fell over the same period.

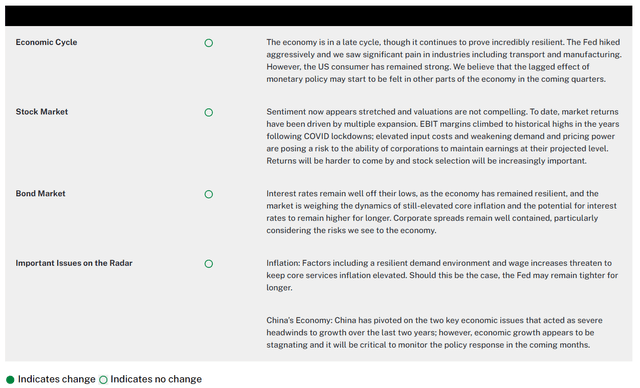

If we take a step back and ignore some of the noise, the overall picture remains largely the same: The data continues to suggest that the U.S. economy is slowing.

Now, it’s natural to wonder what will ultimately happen So are we heading for a tougher landing or are we simply coming out of unsustainably high growth levels?

At this point, the latter is certainly a possibility, but the former cannot be ruled out either. Inflation is trending down, but as we have seen, the decline may not be smooth and upside risks clearly remain.

This complicates the Fed’s task and pushes hopes of a rate cut until later this year. Meanwhile, political rhetoric is starting to heat up with expectations of getting even more heated in the near future, and geopolitical tensions remain elevated.

Given these rising risks, the U.S. market continues to look very expensive. We have said that stock prices across several industries are at perfect levels and we continue to believe this is the case.

In fact, we have seen several companies aggressively sell off shares despite relatively strong earnings due to expectations priced into their valuations. In this environment, risk management must remain a key focus.

Our Perspective

We believe our proactive approach to investment management will enable us to continue to identify investment opportunities while avoiding parts of the market that we see as increasingly risky in the future.

It remains to be seen whether the Fed can bring inflation down from historical levels without causing significant economic hardship, leaving questions about whether a soft landing can be achieved and when the first rate cut of the year might come.

With cracks showing in the U.S. economy, the slowdown that prompted the Fed to cut interest rates is likely to hit corporate earnings hard. However, the continued resilience of the U.S. economy and a downward trend in inflation make a more benign outcome more likely. Meanwhile, valuations are far from attractive across the board, raising the question of what many market participants are trading for.

As we adopt a defensive strategy in our core portfolio and prioritize risk management, we will continue to closely monitor for signs of weakness and what it might mean for the onset of a rate cutting cycle.

The 2024 election: What we think about the markets

With the election less than six months away, it’s natural to be concerned about how the outcome will impact markets. After all, the economy is threatening to slow and inflation to remain elevated, something financial markets seem fully priced into. Could the election be the final straw? Read the article for our full thoughts.

Our take

Source: Bloomberg

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.