jetcityimage

Market Dynamics and Industry Challenges

The auto sector is notorious for its competitive margins, and with the evolution towards electric vehicles (EVs), companies lagging in innovation are finding it particularly tough. Stellantis N.V. (NYSE:STLA), despite its efforts, is among those caught behind, which is evident from the struggle to compete with industry leaders like Tesla and BYD. This struggle is compounded by high interest rates, which depress the automotive market further, since most consumers rely on financing to purchase vehicles.

Currently, Stellantis is facing significant brand perception issues, particularly outside of Europe, in the American market, where the quality of its cars is frequently questioned. This sentiment is reflected in several recalls, which have not only impacted sales but also the brand’s reputation:

- Plug-in Hybrid Electric Vehicles (PHEVs) Recall: Stellantis has recalled over 90,000 vehicles across brands like Citroen, DS, Opel, and Peugeot due to fire risks associated with the drive battery support potentially leading to water damage and rust.

- Jeep Grand Cherokees Recall: This recall involves more than 354,000 vehicles globally due to improperly installed rear coil springs that could detach while driving, posing serious crash risks.

- Chrysler-Fiat Airbag Issue: In Canada, over 10,000 Chrysler 300 and Dodge Charger models from 2018 to 2021 have been recalled due to a defect in the side curtain airbag inflators, which could unexpectedly rupture and send metal fragments towards occupants.

These safety issues necessitate urgent attention and action from Stellantis, affecting consumer trust and potentially future sales.

Recent Performance and Market Reaction

The inventory levels reflect ongoing struggles, with unsold cars accumulating:

- Share Price Drop: Stellantis’ stock has plummeted by more than 24% in just over a month.

- Quarterly Financial Report: The Q1 report showed a 12% drop in net revenues year-over-year, shipments decreased by 10% to 1.3 million units, and a total new vehicle inventory rising to 1.39 million units.

- BEV and LEV Sales: There have been some positives as well, with battery electric vehicles (BEVs) and low-emission vehicles (LEVs) sales up by 8% and 13%, respectively.

Investment Potential

As a value investor, my focus is on areas that the majority might overlook, especially when they abandon quantitative evaluations. I aim to dig deeper into the numbers to quantify the market’s level of pessimism and to determine if the prevailing uncertainty has led to unrealistically low valuations. This could signal a potential buying opportunity. I’m aware that I’m not investing in a top-tier business, rather I’m betting on a mediocre business priced too low to ignore.

Despite the pessimism, which has led many traders and funds to steer clear of the sector, a deeper dive into Stellantis’ numbers suggests potential undervaluation:

- Financial Resilience: Stellantis boasts $19.5 billion in net positive cash and has increased its dividend to $1.65, yielding about 7.5% at the current stock price. This dividend is sustainable, supported by a robust balance sheet, valuing the company at $65 billion with earnings of $20.5 billion.

- Investment Strategy: The company’s commitment to reinvestment is evident from its billions of capital expenditure, aiming for a return to be competitive.

- A value investor might argue that this is not growth capex but essential spending because not investing in EVs means falling behind. I can agree with this viewpoint, which is why I do not include this in growth capex. Historically, this company achieved a ROIC of nearly 20% and, by reinvesting 50%, should theoretically generate 10% growth. This is evidenced by their new acquisitions and the 25 new models coming this year, so ignoring the impact of this substantial capex is quite a conservative stance.

Valuation and Financial Analysis

I’ve put together a rough valuation model, somewhat similar to the one I used for Meta. I’ve assumed a revenue decline of roughly 15% from the last year levels and a margin contraction to 9%, although the CFO recently reiterated that they expect to maintain double-digit margins. But, for a conservative approach, let’s stick with the more pessimistic margin.

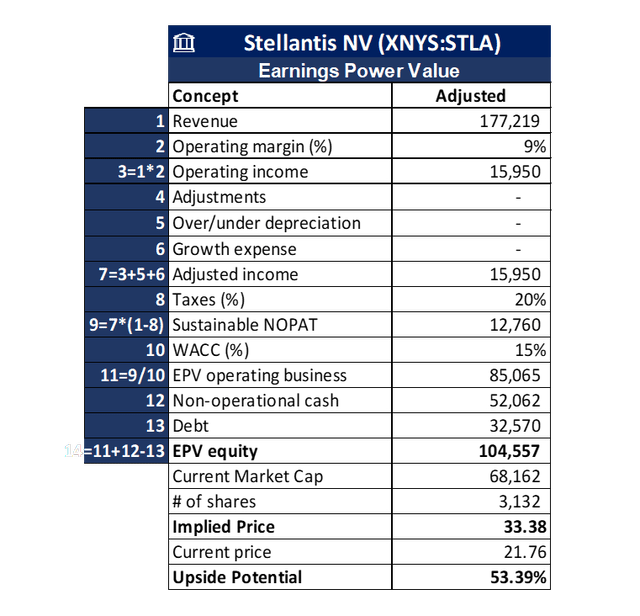

Earning Power Value (EPV)

The EPV model, developed by Professor Bruce Greenwald at Columbia University, is a staple in my value investing toolkit. It’s designed to calculate sustainable earnings value without growth. As per Greenwald’s research I should add the part of the capex which was spent for growth, however in a very conservative stance, I hypothesized that all growth capex, which is significant, is completely lost-like throwing money in the bin.

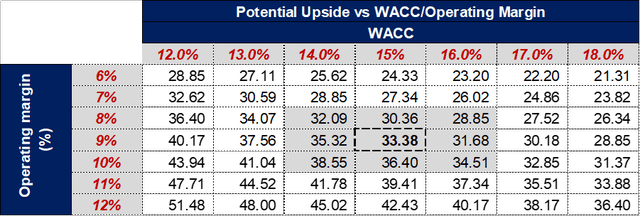

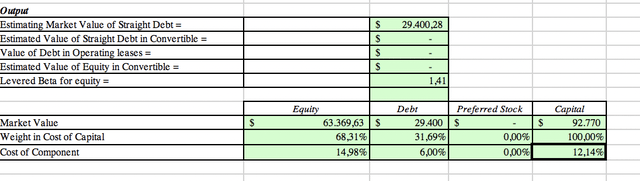

Despite such a severe assumption that the reinvestment rate at 20% ROIC would generally suggest a 10% EBIT growth, the market doesn’t see this as feasible, and neither do I. I prefer to side with the market’s wisdom and stay pessimistic. Using a leveraged beta of 1.41, I’ve calculated an equity premium of 7.8% over a WACC of 12%. Given the risks involved, I have added an extra layer of 3% discount over my cost of capital, bringing the total to 15%. Even with these conservative figures, I still see over a 50% upside potential.

An Intrinsic Valuation Perspective

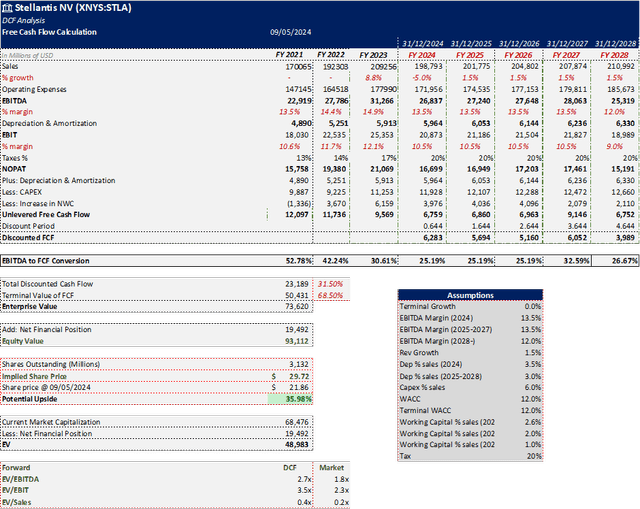

As a value investor, I typically avoid using DCF models because the number of assumptions required could create a false sense of security. However, it’s useful to understand the potential numbers that could appear in a DCF analysis, especially with assumptions that align with those used in Earning Power Value models, and to identify the drivers that could influence the valuation.

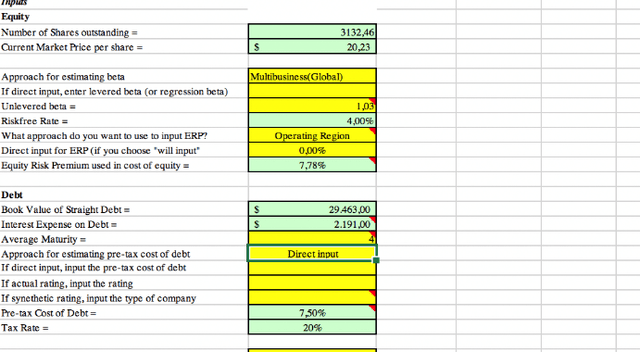

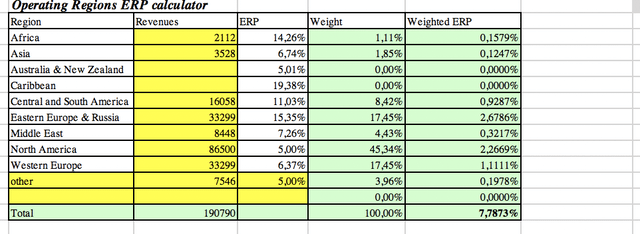

Markets estimates indicate a clear decrease in EBIT and an absolute lack of growth. Initially, I thought the WACC might have been inaccurately calculated. As Stellantis operates internationally, it’s crucial to consider the risks associated with global operations, sometimes even if the cost of capital isn’t a dominant consideration for some investors.

In the past, I have discerned how different assumptions about the WACC can significantly alter stock valuations, impacting the attributed equity premium or beta. This is not the case here, but it is why I wanted to have a thorough analysis of the beta and WACC and, therefore, I have written a session only to approach these elements which you will find below in the report.

So far, the WACC is not the issue, I believe the market is currently overstating the impact of slowness in growth on the stock.

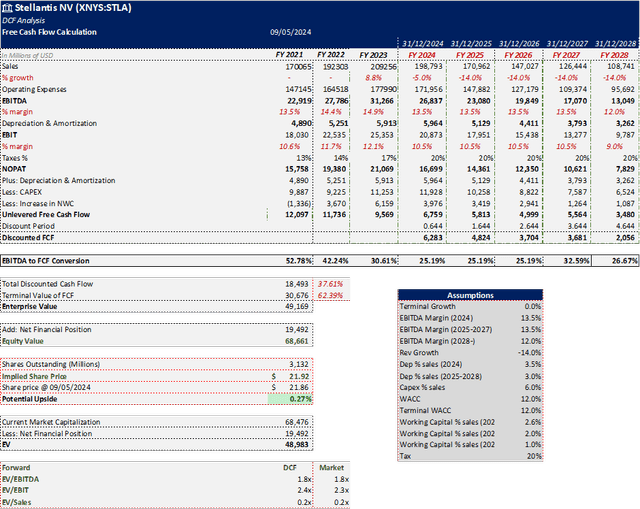

I am presenting the first DCF model in which I’ve maintained some assumptions similar to those in my EPV analysis. I’ve considered a minimal growth of 1.5% up to 2028 and no growth beyond that date. The WACC used is 12%.

We are again very close to the Earning Power Value and also to the stock value before the last earnings call. However, the current market price implies a substantial 14% annual drop in revenues, which seems at odds with the company’s high reinvestment rate. Stellantis’ strategy involves reinvesting heavily more than 11 billion annually, representing a 50% reinvestment rate. Such a significant commitment to reinvestment typically does not align with the narrative of a steep decline in growth prospects. If the revenue drop persists, it may compel the company to reassess its reinvestment strategy. They might either reallocate these funds more effectively or adopt new measures to enhance value distribution to shareholders and implement cost-cutting strategies to improve long-term EBIT. Under the leadership of Carlos Tavares, an expert manager, Stellantis is equipped with top-tier, highly reliable management that is well-prepared to navigate these challenges.

WACC 12%

Value investors traditionally dislike using beta and calculating the WACC. I understand their perspective but also think that when performing an intrinsic valuation of a stock, it’s crucial to carefully reflect on the value of risk. Additionally, when deriving an Earning Power Value it’s essential to have a defendable, objective cost of capital, otherwise the EPV would lack credibility.

You might disagree with defining risk as volatility based on standard deviation from historical movements, in that case you could use other approaches, like bottoms up beta.

I aim not to bore the reader with different WACC calculations and their methodologies in this research, but rather to present the information, I’ve collected. We start with the fact that the 10-year Treasury rate is not risk-free and includes the default risk, that’s why we have used 4% rather than the actual rate of the 10-year. We then compile the revenue information geographically and assign a weighted average premium to each region. This step is crucial, especially for a company operating globally, including potentially volatile and emerging markets. A lower WACC could significantly impact the valuation. Historical discrepancies in risk perception have sometimes caused dramatic drops in stock prices when the market adjusts.

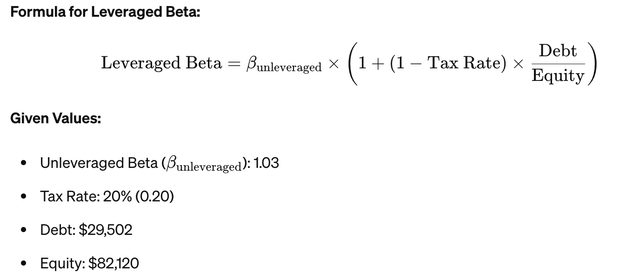

For the unleveraged beta, I’ve used the industry average, and then adjusted for Stellantis’s debt-to-equity ratio. You can find the formula below for reference.

WACC calculation using Damodaran’s model

Moat Investing Moat Investing Moat Investing Moat Investing

Liquidation Value Considerations

Rather than examining each asset, I opted for a quicker, yet quite realistic approach to estimate the liquidation value. If Stellantis were to liquidate today, here’s how the numbers would look:

- Tangible Book Value: $15.76 per share.

Goodwill and Intangible Assets: I looked into the $30 billion of goodwill and intangible assets and identified that only $15 billion is directly related to the brand value. These brands would hold value even if Stellantis were to liquidate.

- Inventory Valuation: With $22 billion in inventory, applying a 30% discount for quick sales gives us a rough current market value.

I don’t see Stellantis facing bankruptcy within the next three years. To justify the current valuation at 3.74 times earnings, revenues would have to significantly decline over 30% annually, which seems unlikely. Even at the existing capex levels, which would no longer make sense if growth stalls, Stellantis could still generate 50% of the current market cap in free cash flow in the next 3 years and maintain a residual liquidation value at today’s prices.

Rate of Return

I’m not counting on Stellantis to suddenly turn around and fulfill its ambitious plans for 2030 under CEO Carlos Tavares. If it does, the stock will be a multi bagger for sure, but that’s not where I’m placing my bets. I’m interested in the company’s real worth, which seems overlooked. I am going to use a simple value formula to derive the value.

Formula = R t,t+1 = Dt/Vt + gt,t+1 + (1+gt,t+1) * ht,t+1

Where

Dt = share repurchase + Dividend + Net debt repayment + Interest rate

Gt,t+1 = Marginal ROIC * Reinvestment rate

Reinvestment rate = Growth Capex / Adj. NOPAT

ht,t+1 = Multiples Expansion/Compression

For this instance, I am going to assume a zero growth and not debt repayment

- Dividend Yield: 7.5%

- Buyback Yield: 3.5%

- Growth (gt): 0% (assumption of no growth)

- Initial P/E Ratio: 3.3

- Target P/E Ratio: 5.0

Where:

- Dt (Total returns from dividends and buybacks): 7.5% + 3.5% = 11%

- Gt,t+1 (Growth rate): 0%

- ℎ+1ht,t+1 (Multiples expansion): (53.3−1)=51.52%(3.35−1)=51.52%

Plugging these into the formula, the expected rate of return, considering the multiple expansion, is approximately 62.52%.

To calculate the annualized return:

Annualized Return=(1+Total Return)(Number of Years1)−1

The annualized return over a 3-year period, based on the initial single-year return estimate of approximately 62.52%, is about 17.57% per year.

In understanding this valuation, it’s important to note that it includes an assumption of multiple expansion, which might seem too optimistic. However, we’re in a high-interest rate environment, and it’s reasonable to expect rates to drop over the next three years. If you set aside the multiple expansion, the stock could still offer an annual return of 11%. This is not bad, considering it also gives you a free shot at additional gains if CEO Carlos Tavares even partially achieves his goals. It’s a situation where if things go well, you win; and if they don’t, you don’t really lose much – tails you win, heads you don’t lose that much.”

Conclusion

Stellantis, despite its current challenges, presents a value buy opportunity. The potential for significant upside and a robust dividend yield makes it a compelling investment in a market that may be undervaluing its fundamentals.

I then rate Stellantis a Buy.