Bennett Raglin

Citi Trends Inc. (Nasdaq:CTRN) is a specialty retailer focused on low-income African-American customers in the United States.

This article is based on the company’s Q1 FY24 result Earnings announcement. Results were mixed, with revenues slightly mixed and beating expectations. (Negative) EPS. Revenues have increased for two consecutive quarters, which is great progress. Gross margins also expanded year over year. However, the company still has operating and net losses.

The article also analyses recent company developments, such as the shareholders agreement with shareholders who hold 22% of the shares and the introduction of a new CEO.

I’ve covered Citi Trends before. February 2024 We have placed a Hold rating on the stock. The article contains more details about the company’s long-term outlook. The Hold rating is based on deteriorating business metrics and challenges to the model from ultra-low-cost retailers such as: Messrs. Tem and Shayne: The implicit discount to standardized earnings offered in Citi Trends’ valuation was insufficient to compensate for the risks of a fundamentally flawed model.

The company’s market cap is currently 15% lower than my last article and has seen two quarters of revenue growth. A 10x EV/NOPAT multiple for a potential recovery is reasonable, but not low enough to compensate for a downside scenario (which is likely). Therefore, I do not believe Citi Trends is an investment opportunity at the moment, but would reconsider at prices below $17.15.

Mixed positive data points in Q1

First-quarter results are not great, given that Citi Trends posted an operating loss, but there are some positive data points.

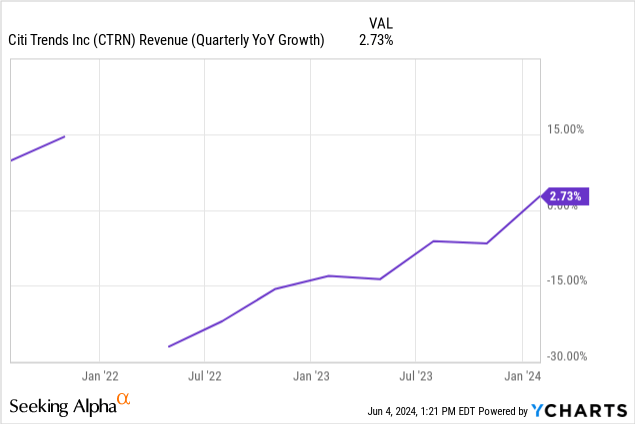

The most encouraging data point is revenue, which increased 3.7% year over year (compared to 3.1%). After nearly two years of dismal results, Q1 2024 marked the second consecutive quarter of revenue growth (the chart below ends with Q4 2023).

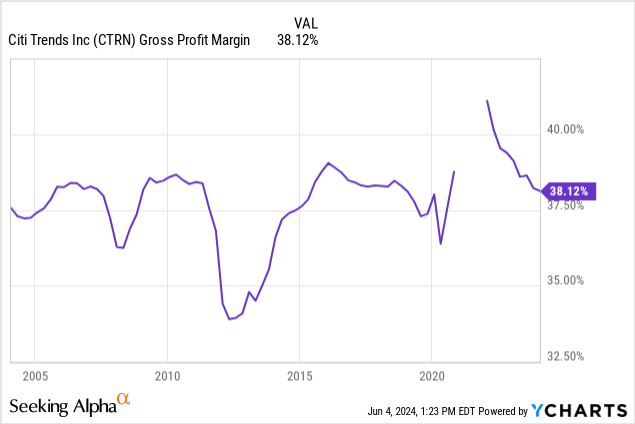

The second positive was a 160 basis point recovery in gross margins due to lower freight costs and fewer discounts (implying better merchandise management), which led to a 9% increase in gross margins year over year. The improved gross margins are also a positive after two years of margin declines (the chart below ends in Q4 2023).

Unfortunately, SG&A increased 4.8%, absorbing most of the improvement in revenue and gross profit. Operating income was still in the red about $7 million (-3.75% margin). The loss narrowed from $9.5 million (-5.2% margin) a year ago.

However, of the $3.4 million increased SG&A, $1.4 million was due to non-recurring charges (which I believe are related to the CEO transition and shareholder agreement, but management has not indicated this). Excluding this one-time charge, SG&A increased 2.8%, providing the company with much-needed operating leverage. In fact, excluding the one-time charge, the company was close to EBITDA breakeven (Adjusted EBITDA -$800,000). If this continues going forward, it will be a very positive development.

New Board, New CEO

In February, Citi Trends Shareholders Agreement Fund 1 Investments. The fund was able to nominate three of the nine directors proposed by the board of directors at the general meeting on June 20 (Proxy) Fund 1 owned 22% of the Company’s shares as of the proxy filing date and was permitted to purchase up to 30% of the shares without triggering a poison pill provision.

This means that the company will establish a board of directors in June, comprised of members nominated by major shareholders. Citi Trends did not have this capability before. I believe that having major shareholders who hold shares in the company play a key governance role is important for the long-term development of the company.

in Late MayThe company announced that its CEO would be stepping down. The new interim CEO is not connected to Fund 1, but we speculate that major shareholders had some room to weigh in on the decision. If not, a new permanent CEO could be announced after a new board is in place.

The new CEO is Q1 2024 CallIn my opinion, the two core areas are product and SG&A efficiencies. On the product side, he called for “putting more treasures into the product selection treasure hunt” and “sharpening the value equation.” I think this means offering cheaper products than competitors (e.g. Temu) or focusing on categories. On the SG&A efficiency side, he noted that “total sales are declining, but SG&A is steadily increasing,” and that “sales growth will help, but we also need to find cost efficiencies to offset inflationary pressures.”

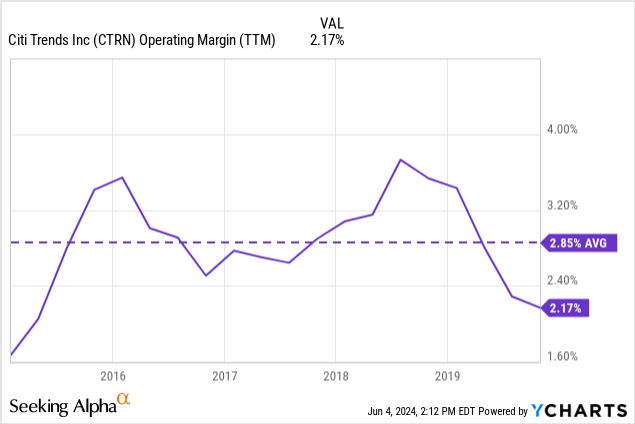

scenario

The first, most optimistic scenario, is a return to pre-pandemic profitability: with an operating margin of 2.85% (2015-2020 average, see below) and current TTM revenues of $753 million, the company would generate operating profit of $21.5 million, or NOPAT (using an effective tax rate of 25%) of $16 million.

Going forward, we expect fixed SG&A to be approximately $287 million with gross margins of 38%, which would result in Citi Trends posting revenues of $808 million and generating a NOPAT of $15.2 million, representing a 7.3% revenue increase over the trailing 12 month period.

Management’s guidance for the year (reaffirmed on the Q1’24 conference call) was for EBITDA to be between $4 million and $10 million. With D&A of about $20 million for the year (same for CAPEX), this implies negative operating margins. This is a middle-of-the-road scenario, with losses in the near term and potential operating margin recovery (possibly even to the second positive scenario above).

On the other hand, a pessimistic assumption is that the company will not be able to recover to profitability in the future and that its recent performance was a one-off. I believe this scenario remains quite likely given the challenge from discount retailers such as Temu, which focus on the same type of cheap, impulse, treasure-hunting shopping that the company offers. The company may ultimately decide to change its assortment model to avoid competing with Temu and Shein, but this is too speculative.

evaluation

Currently, Citi Trends is trading at a market cap of $210 million, but considering its cash holdings of $58 million and no debt, its EV is $152 million. We can compare this to a few scenarios.

In the first positive scenario (return to pre-pandemic profitability), the EV/NOPAT multiple is around 9.5x. In the second positive scenario (fixed SG&A and gross profits, revenue up 8%), the multiple is around 10x. Finally, in the negative scenario where the model is difficult and unrecoverable, there is no multiple and Citi Trends’ going concern value is low.

I believe an EV/NOPAT multiple of 10x for Citi Trends is reasonable, and given two quarters of growth of 2-3%, it’s not impossible to see revenue growing 7% over the next two years, although Citi Trends’ current EV already factors in this positive scenario.

Also, as I said above, I think the negative scenario remains likely. Off-price retailers on the Internet (e.g. Temu) and B&M (e.g. TJ Maxx) are not going away, so Citi Trends will need to find a niche where it can compete at lower prices than these big players. This will be difficult, but two consecutive quarters of growth is a good sign.

For these reasons, I do not believe that Citi Trends, Inc. stock is an opportunity at this price. However, given the information currently on hand, I would consider the stock an opportunity in a 7x positive EV/NOPAT scenario, i.e., a share price of $17.15 or less.

Conclusion

Citi Trends’ Q1 2024 results show promise, with two consecutive quarters of year-over-year growth in revenue, although margin challenges remain. A combination of revenue growth and operating leverage is exactly what the company needs to return to operating profitability.

In the longer term, the company needs to demonstrate that it can offer a value proposition to customers who have other options, such as PDD Holdings.PDDD) Tem or TJ Maxx (TxThe company’s new CEO seems to be pointing in that direction.

Valuation-wise, we believe it is not unlikely that Citi trends back to historical earnings levels, which would make the company’s current EV a reasonable 10x EV/NOPAT multiple. However, we also believe there is a high probability that the company’s model could be fundamentally shaken, so a higher discount rate on the positive side is needed to incur the risk of a negative scenario.

Therefore, I continue to consider Citi Trends, Inc. shares a Hold and would reconsider if the price drops below $17.15.