Zoran

Consumer goods manufacturer Reckitt BenckiserOTCPK:RBGLY) have been through some very difficult times over the past few months.

I last covered this stock in November with a Hold rating. Reckitt Benckiser: Not a bargain despite potentialLondon stock prices have fallen since then. 17%, and this is true even after a 10% increase over the past few months.

At this point, I changed my rating from “Hold” to “Buy” and have actually purchased some shares for my portfolio over the past few months.

Investors’ main concerns

The main reason for the stock’s sudden drop this year is, surprisingly, concerns stemming from the Lernean hydra that is the company’s nutrition business. As numerous articles in recent years have attested, this business has been the source of major problems and huge losses for the company since it acquired the nutrition business from Mead Johnson in 2017.

In March news Adverse rulings have been issued in Illinois courts and numerous other cases are pending. announcement Reckitt made the statement in response to an Illinois court’s March award of $60 million in damages to necrotizing enterocolitis plaintiffs. Reckitt’s statement stressed that it was a single judgment and said the company would “pursue all options to overturn the judgment.”

Compare this to the final results statement released two weeks ago (emphasis mine):

Product liability lawsuits related to NEC have been filed against us or against us and Abbott Laboratories in state and federal courts across the United States. The lawsuits allege injuries related to NEC in preterm infants. The plaintiffs allege that preterm formulas containing human milk fortifiers (HMF) and bovine-derived ingredients cause NEC and that preterm infants should be fed breast milk exclusively. We deny key allegations in the lawsuits. We assert that our products are important tools for expert neonatologists to manage the nutritional management of preterm infants for whom breast milk alone is not nutritionally sufficient. The products are used under medical supervision. There are likely to be no potential costs associated with these actions. It is not possible to estimate with any certainty at this time.

I believe the decline in stock prices seen in response to the Illinois ruling reflects investor concerns about the potential costs of more widespread litigation like this, and that management may not be fully aware of the risks.

The stock price has plummeted, but for now the final cost of the litigation is unclear and investors continue to offer widely differing estimates. Give your opinion He said £2 billion was an “extremely worst case scenario” and that the figure was more likely to be between £100 million and £400 million.

Reckitt has pledged to fight the lawsuit, but it’s hard to imagine a scenario in which the company wouldn’t ultimately incur costs, even if it were to simply settle the case without admitting liability.

But in the longer term, I believe even a £2 billion loss (essentially the company’s annual free cash flow) would be manageable and not worth the share price drop we saw after the verdict.

Business performance is decent but not great

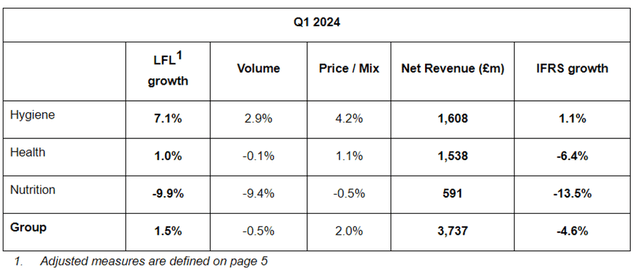

In April, the company First quarter trading situationThe headline “Good Q1 performance, on track for full year deliveries” did not seem accurate to me. At the very least, I would not want to see what management would consider to be poor performance if both volume and net revenue declines are considered “good.” Part of the blame was placed on foreign exchange fluctuations.

In my view, the health sector is not performing as well as the hygiene sector, but the nutrition sector, which has had problems for many years, remains a big challenge. I have covered why this is a problem in previous analyses and it remains the same.

Overall, the results for the quarter were disappointing to me. We saw volume declines in both our Health and Nutrition businesses, but that was offset by price and mix changes, at least for the Health segment.

The company said its nutritional products performed better than the previous year due to supply issues at a competitor at the time.

The company is undertaking its third £1 billion share buyback programme, which is due to complete in July.

Reckitt reaffirmed its full-year outlook, expecting net revenue growth of 2-4 percent year-on-year, and adjusted operating profit to exceed net revenue growth, with performance dependent on the second half of the year.

Overall, I think this update confirms what we’ve seen at Reckitt over the past few years: a company that was once a growth machine has turned into one that needs to work to stay relevant. But overall, the company has seen it through. The company still has a strong set of brands and, in my opinion, is more strategically focused than it has been in almost a decade, so the fundamentals for future success remain intact.

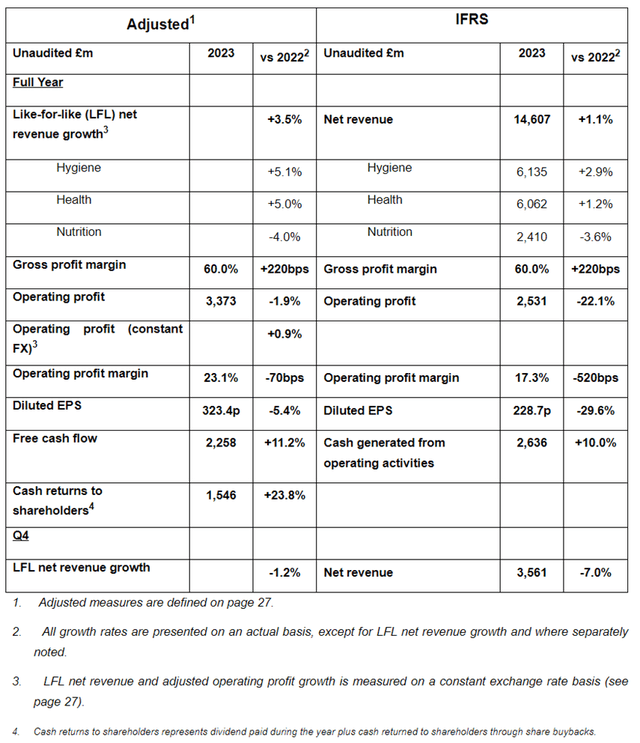

This is on top of last year’s full year performance, which was more workmanlike than strong given the ongoing inflationary environment (although free cash flow performance was strong).

But it’s important to remember that Reckitt’s hygiene brands have boomed during the pandemic and continue to grow in two of its three divisions despite its high base: revenue last year was 14% higher than in 2019, for example.

So while the business doesn’t have a particularly exciting vibe right now, I believe it’s poised for solid performance over the next few years. Reckitt’s forecast of 2-4% net revenue growth this financial year is not something to take lightly, especially given ongoing issues in its nutrition business (which expects net revenue to decline in the mid-to-high single digits this year) and the economic downturn in many markets, which is putting pressure on demand for premium branded consumer products.

Negative rumors

I don’t use Reckitt products regularly, but I recently bought their Vanish detergent in a Spanish supermarket and was disappointed to find that the large container was less than half full. Some settling can occur during shipping and the container size is limited to reduce complications, but the low fill level really soured my impression of Vanish, and Reckitt, as a consumer.

I don’t know if this is an isolated incident or a sign of a broader approach the company is taking to impacting shelves, but I can say it has negatively impacted my view of the company — making shoppers feel like they’ve lost out is not how a company can thrive in the long run.

I bought at an attractive valuation

However, recent performance has been mixed, and while the potential for nutritional debt is certainly a risk, I feel the stock has been overly depressed. I have purchased shares of the company over the past few months and upgraded my rating to “buy.”

The current P/E ratio is 14. Compare that to UK peer Unilever’s P/E of 20.UL), and its US rival Procter & Gamble (PG). I think some thought still needs to be given to the uncertainty surrounding Reckitt in the wake of the US ruling (which has lessened in recent months) and the company’s general recent weakness in performance.

But don’t go overboard. The company owns a number of well-known brands with good pricing power, including Lysol and Durex. Revenues last year were at a record high. The company’s profits after tax were £1.6 billion. Adjusted free cash flow last year was £2.3 billion. Net debt is higher than I would like, but it was reduced to £7.3 billion last year. This means Reckitt is worth less than £40 billion. Even taking into account legal uncertainty, I think this is a good value for a company with brand equity and long-term proven profitability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.