JHVEPhoto/iStock Editorial via Getty Images

The stock price Intel Corporation (Nasdaq:International Trade Commission) Since I made a small investment in the chip company in January of this year, its shares have fallen 30%, mainly due to: Why me? First position Self-driving technology developer Mobileye had its best year ever in terms of sales, and Intel issued a strong profit outlook for the first quarter of 2024.

I believe Intel’s stock price decline is completely out of touch with the underlying reality of this semiconductor company’s performance. Also, with earnings multiples expected to shrink next year, the risk profile is likely to improve. Here, I would like to explain what the catalysts are for Intel and whether investors might double down on their investments.

With stocks cheap, multiple pressure reliefs could be imminent. With the major AI chip product generating significant attention, I am changing my classification of the stock to “Strong Buy.”

New AI product launch sparks reversal in stock price trend

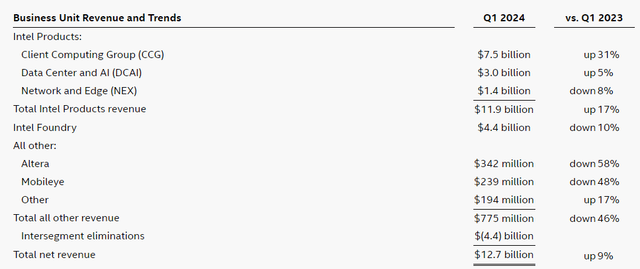

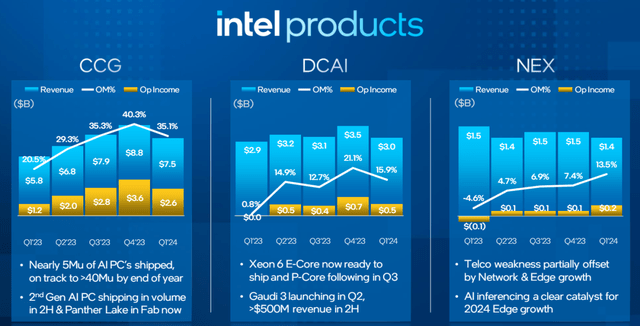

Intel’s processor business, Client Computing, was hit hard last year as consumer demand for computers and laptops waned, but the division has seen a sizeable recovery recently. In the first quarter of 2024, Client Computing drove a 17% rise in group sales, reflecting a new way for the chip company to compile its financial performance.

Intel recently changed its reporting format amid its ongoing restructuring, combining client computing with data center and network/edge into one segment. The new reporting unit, “Intel Products,” posted total revenue of $11.9 billion in the first quarter of 2024, with growth buoyed by increased shipments in its PC business being strong enough to offset weakness in Intel’s network and edge segments.

Business Segment Revenues and Trends (Intel Corp)

But Intel’s future path is far more exciting, especially given the dramatic collapse of its stock price in recent months.

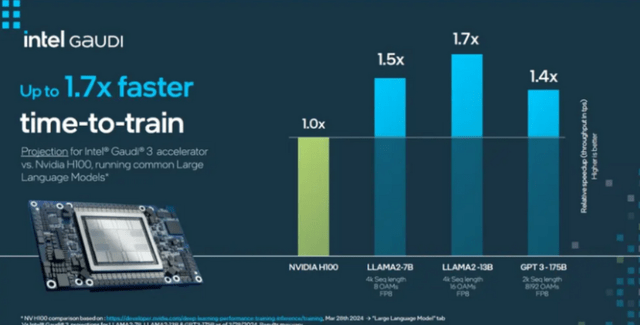

Intel is making some big moves in the data center space, including the launch of its newest AI chip, Intel’s new AI accelerator, Gaudi 3. This is NVIDIA Corporation (NVDA).

Nvidia completely crushed its competitors with its H100 GPU, a graphics processing unit used in data centers around the world to handle demanding workloads such as training large-scale language models.

The Intel Gaudi 3 AI accelerator is expected to ship in the second quarter (which is now), and in some tests it has achieved up to 40% speed advantage It’s better than Nvidia’s H100 processor.

Intel’s AI accelerators also appear to be superior in terms of LLM training performance, inference, and efficiency, making Intel Gaudi 3 at least a very attractive option for companies (mainly large US companies) investing in LLM capabilities.

Intel has made initial projections for Gaudi 3 AI accelerator sales, expecting them to hit around $500 million in the second half of the year. Intel plans to ramp up shipments more aggressively from June onwards. With major companies lining up to get their hands on AI-enabled processors, Intel can definitely smash expectations with its Gaudi 3 AI processors, especially if the performance claims hold up in the market. Importantly, with Nvidia charging top dollar for the H100, Intel will have a price advantage, which could accelerate sales from the launch date.

In terms of total revenue, I think Gaudi 3 AI accelerator revenue could easily exceed $500 million (which would be about 7% of the estimated $6.9 billion in revenue for the second half of the year). Next year’s revenue could easily exceed $1 billion, since the chips will be available throughout the year and this estimate does not take into account the impact of revenue growth.

Intel products (Intel Corporation)

Thus, Intel has the potential for a significant re-rating for three reasons.

- The launch of Intel’s Gaudi 3 AI accelerator will contribute positively to revenue in the second half of 2024.

- The market will factor sales of the Gaudi 3 AI accelerator into revenue and profit forecasts, and there is a good chance that profit forecasts will be revised upwards.

- The introduction of Intel’s AI chips into the burgeoning data center market at a time when demand is surging could restore confidence in Intel’s stock price.

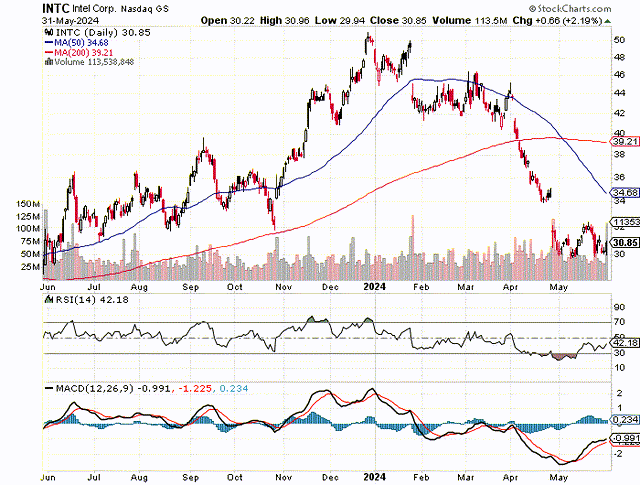

Chart images now look creepy

Intel’s stock has performed quite poorly from a purely technical valuation standpoint, with its share price falling 30% since January, but that doesn’t mean it isn’t an attractive and promising investment. Intel’s stock price fell below both its 50-day and 200-day moving averages in April, signaling a significant change in investor sentiment toward the chip company compared to the beginning of the year.

However, the launch of the Gaudi 3 AI accelerator puts Intel into one of the hottest markets in the PC/datacenter industry, which alone could help change investor interest in Intel. At around the $30 price level, Intel has had a lot of support so far and I think the downside here is very limited.

Guidance and Profit Multiples

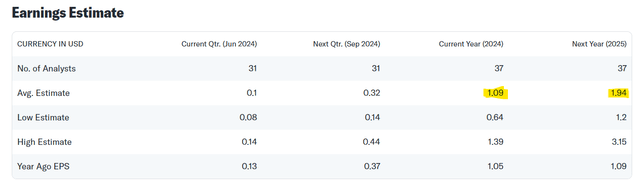

Intel is currently expecting second-quarter earnings per share of $0.10, which is one of the reasons why its stock price has been trending downward. These earnings are expected to be achieved on total revenue of $12.5 billion to $13.5 billion, reflecting expectations of little year-over-year revenue growth.

That’s likely to change next year, however, as Intel’s data center positioning improves. Next year, Intel is expected to see its earnings per share increase 80% to $1.94 thanks to Gaudi 3. This means Intel’s earnings multiple will fall from 28.3 this year to 15.9 based on next year’s expected earnings.

The company has great potential to reignite market interest while also seeing a significant upside in its stock price through the release of new GPUs in the data center market, and I believe the expected earnings recovery is underestimated.

Revenue forecast (Yahoo Finance)

Why investment theories fail to deliver

The big unknown here is whether Intel’s Gaudi 3 will be accepted and adopted. If the release flops and Intel’s AI chips turn out to not be as good as advertised, Nvidia will have made and continue to make a ton of money while Intel will see only modest profits.

That being said, Intel is an experienced chip company and has put Gaudi 3 through rigorous testing, and to Intel’s advantage, demand for AI chips is so high that the company should have no problem selling processors to enterprises in the second half of 2024 if prices are low enough.

My conclusion

Intel is currently in the bad graces of investors, and its stock price reflects that. With a return of -38% year to date, Intel has been a surprisingly poor investment. This poor performance is especially painful considering that its main competitor in the chip industry, Nvidia, has returned 121% in the same period.

But short-term weakness could cloud investors’ view of Intel as a viable semiconductor player, as the company is expected to see a strong profit recovery next year. This could cut the company’s current price-to-earnings multiple in half, which could help investors realize benefits from a revaluation if they see an improvement on the earnings front.

I think the risk/reward dynamics for Intel at its 52-week lows are very compelling. I may have gotten a little early on the Intel trade last time, but I’m confident that if Gaudi 3 is successful, Intel will be well on its way to a sustained recovery.