Miscellaneous photos

I Started BUY rating CrowdStrike Holdings, Inc. (Nasdaq:CRWD) in March 2024, highlighting its integrated Falcon platform for cloud security. 1st Quarter of FY25 June 4th ResultsNumber rear At market close, annualized recurring revenue grew 33.5% and adjusted operating income grew 71.5%. Several software companies have expressed temporary weakness in enterprise demand as enterprise customers cut IT budgets and reallocate to AI-related workloads. Even in this macro environment, I am encouraged that CrowdStrike can still maintain strong growth momentum. I reiterate my Buy rating. My fair value per share is $410.

Expand your business with multiple modules

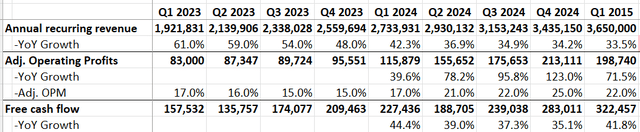

CrowdStrike saw its annualized recurring revenue (ARR) grow 33.5% and its free cash flow grow 41.8% in Q1 FY25. What impressed me most about the quarter was the significant increase in the number of deals using multiple modules.

CrowdStrike quarterly financial results

As noted in our previous report, CrowdStrike offers 28 modules on its Falcon platform. According to management, deals with 8 or more modules increased 95% year over year during the quarter. The significant increase in deals with multiple modules was driven by the following factors:

- Snowflake (snow) and ServiceNow (nowIn its recent quarterly earnings report, CrowdStrike revealed that enterprise customers are reallocating IT budgets to prioritize AI-related workloads. As a result, budgets allocated to software platforms are currently quite tight. CrowdStrike’s Falcon platform is an integrated cybersecurity system that allows enterprise customers to consolidate multiple vendors. Vendor consolidation can lead to reduced cybersecurity spending for customers. This makes CrowdStrike a beneficiary of the current IT spending environment.

- CrowdStrike’s 28 modules are best-in-class standalone products that address issues related to identity, access, endpoint, cloud and third-party connectivity, and enterprise customers can further save money by purchasing multiple modules on the same IT platform from the same vendor.

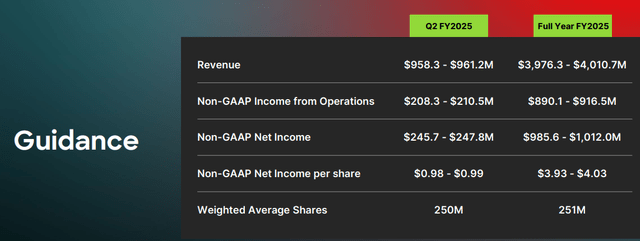

FY2013 Outlook

Following strong first quarter growth, CrowdStrike raised its full-year FY25 revenue guidance to 30% to 31% growth year over year.

CrowdStrike Investor Presentation

When it comes to short-term growth, we consider the following factors:

- Because CrowdStrike is a subscription-based business, ARR growth is a good leading indicator of future reported revenue growth. As mentioned above, CrowdStrike’s ARR has grown by over 30% over the past few quarters. It would be unsurprising to see CrowdStrike continue to grow revenue by over 30%.

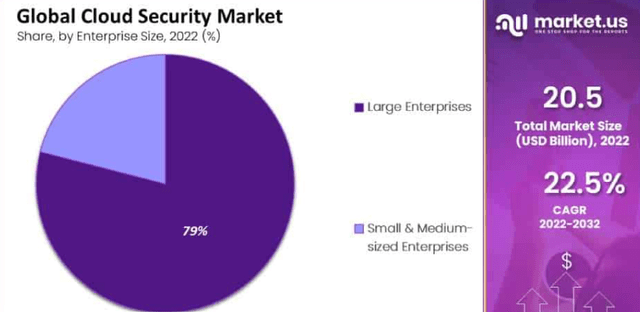

- Market.US We forecast the cloud security market to grow at a CAGR of 22.5% from 2022 to 2032, driven by significant growth in the identity and access management segment. CrowdStrike has a strong presence in the endpoint and identity market, and we believe that market growth will be fundamental for CrowdStrike’s future growth.

As such, CrowdStrike expects to continue growing at over 30% in FY25 and FY26.

Rating Update

While CrowdStrike expects to achieve 30%+ growth in the near term, revenue growth will likely slow in the future as the business expands. Global Market Insights The company projects that the global cybersecurity market will grow at a long-term compound annual growth rate of 15%. As CrowdStrike’s identity, endpoint, cloud security and security operating center businesses reach scale and maturity, it is reasonable to assume that the company will grow in line with the overall market.

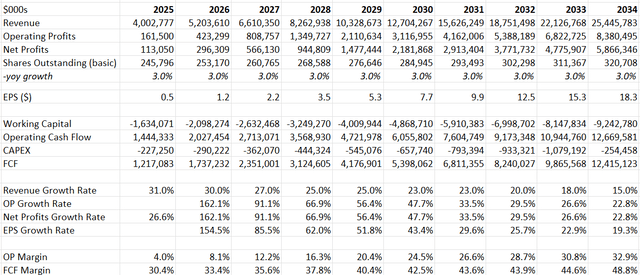

Therefore, the DCF assumes that earnings growth will gradually slow to 15% by FY34.

CrowdStrike’s margin expansion will be driven by the following factors:

- CrowdStrike sells 28 modules on the Falcon platform. Because the company’s sales force sells to the same customers, the additional costs associated with the modules are minimal. More deals using multiple modules will help CrowdStrike increase its profit margins over the long term.

- CrowdStrike is a fast-growing company and spent 20.7% of total revenue on stock-based compensation (SBC) in FY24. Going forward, we expect the ratio of SBC to total revenue to gradually decline, potentially boosting our reported operating margins.

As a software company, CrowdStrike expects to achieve operating margins of 30%+ in the future, in line with other mature software companies. Margin expansion assumes 100 bps of leverage from gross margins, 300 bps of leverage from SG&A, and 10 bps of expansion from R&D expenses.

CrowdStrike DCF – Author’s Calculations

The WACC is calculated to be 12.7% with the following assumptions:

- Risk-free rate: 4.25% (US 10-year Treasury yield)

- Beta: 1.56%. (Seeking Alpha)

- Equity risk premium: 7%, cost of debt 7%

- Equity capital: $2.3 billion, Debt: $742 million

- Tax rate: 30%.

Discounting all free cash flow, we calculate the fair value of the stock to be $410 per share.

risk

In the first quarter of fiscal year 25, CrowdStrike allocated $183 million to stock-based compensation, representing a 40% increase year over year. Earnings ReportThe company expects total shares outstanding to decrease 3% for the full year due to higher SBC expenses.

High spending on SBCs could jeopardize the margin expansion assumptions reported in our model, and we recommend investors closely monitor the company’s ongoing spending on SBCs.

Additionally, CrowdStrike is a high-beta stock with no dividends or share buybacks, which means it may not be a good fit for investors looking for steady growth or dividends.

Conclusion

CrowdStrike’s integrated Falcon platform and best-in-class modules enable enterprise customers to consolidate cybersecurity vendors and reduce overall security operational costs. We expect CrowdStrike to continue to grow larger transactions with multiple modules. We reiterate our Buy rating at a fair price of $410 per share.