J Studio

Does gold hedge against inflation? On average, the answer is no, Empirically speaking, the relationship between gold and inflation is complex. Any Blanket statements about its role in portfolio construction would be unwise.

In this blog post, Gold claims to be a reliable inflation hedge, but I have not tested it and do not dismiss its potential value as a diversifier for other reasons.

gold Rush

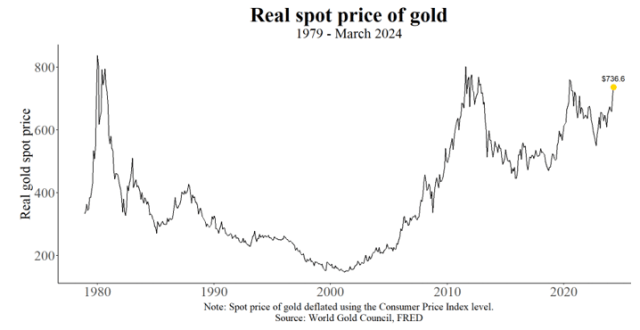

Gold Recent surge The real price of gold (adjusted for the Consumer Price Index) has reached its highest level since July 2020 (about $740 per ounce as of April 2024), but is still below its peak of about $840 in the early 1980s (Figure 1).

Appendix 1.

Recent high prices have sparked interest in gold as a portfolio diversifier, and in particular as an inflation hedge. In this blog we provide a visual and empirical examination of gold’s inflation hedging properties. Full results The R code is Online R Supplement.

What inflation hedging does and what gold doesn’t do

An inflation hedge should move with inflation – as inflation rises, so should the hedge – so the claim that gold hedges inflation is testable.

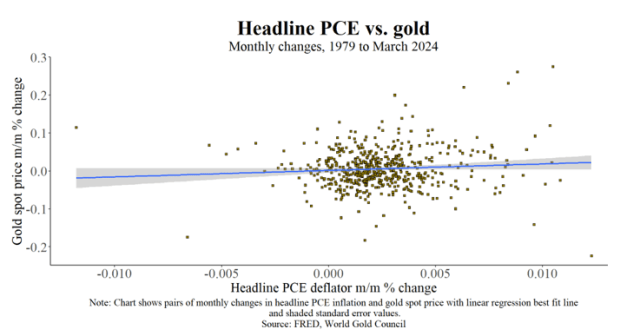

First, the scatter plot in Exhibit 2 shows the monthly change in gold price versus the spot price of gold from 1979 to 2024. This is the longest publicly available gold price series.

Appendix 2.

As can be seen from the random point scatter in Figure 2, changes in headline PCE inflation are, on average, not significantly correlated with changes in the spot price of gold (correlation coefficient confidence interval = -0.004 to 0.162), and the statistically best fit line (blue) is flat. Results are robust to using the Consumer Price Index for inflation, although in this case the lower limit of the confidence interval is marginally positive, as shown in the online R supplementary material.

However, the relationship between gold and inflation is not stable: sometimes the relationship between gold and inflation is positive and sometimes it is negative.

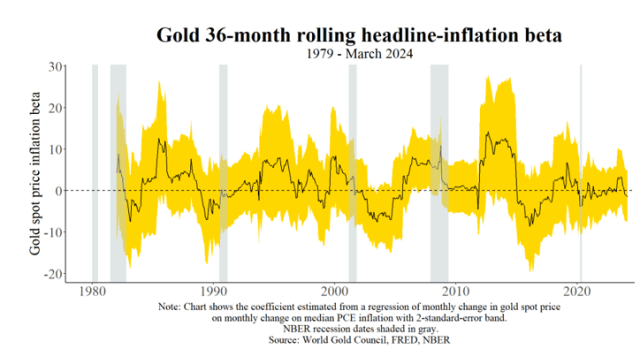

Figure 3 shows the 36-month “inflation beta,” estimated by regressing the monthly change in the gold spot price on the monthly change in headline inflation over the 36-month period.

Appendix 3.

The large error, indicated by the sign change (where the series crosses the dotted horizontal line in the graph above) and the expanded confidence interval (2 standard errors) ribbon that includes zero at almost every point, makes any general statement about the relationship impossible.

At the very least, the evidence does not support the idea that gold spot price movements reliably track inflation, although there are periods when they do track inflation, sometimes for long periods.

A cursory examination shows that the “relationship” between gold and inflation appears to be stronger during economic expansions (periods between the grey recession bars), with the exception of the Great Recession of 2007-2009. Perhaps this is because the strength of inflation influences its relationship with gold. We explore this possibility next.

Analysis of inflation using economic theory

Inflation can be decomposed into a temporary and a permanent part, as embodied in the Phillips curve model of the inflation process used by economists (Romer 2019). The permanent part is underlying or trend inflation. The temporary part is due to temporary shocks (think of a spike in oil prices) whose effects are The usual Disappear.

What is really interesting for experts is how gold responds to rising underlying inflation, resulting for example from excess demand or rising inflation expectations — this kind of inflation is persistent and (economically) costly to contain — and this reaction can be tested.

To do so, we need a measure of underlying inflation. There is strong theoretical and empirical rationale for using an outlier-free statistic such as the median as a proxy for underlying inflation (see, for example, Ball et al. 2022). The Federal Reserve Bank of Cleveland calculates the median PCE and CPI inflation each month, and we use the former measure here, but as shown in the online R Supplementary Material, our results are robust to using the latter measure.

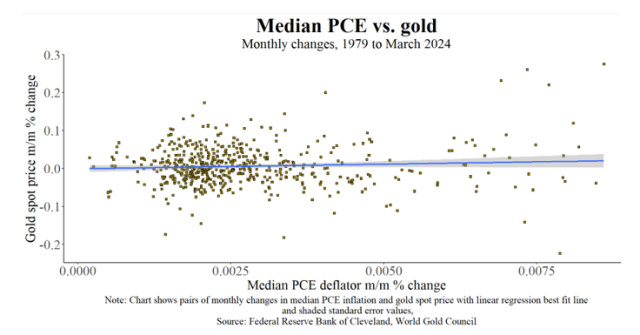

Regressing the monthly change in gold on the change in median PCE negates the relationship at conventional significance levels (t-value = 1.61), as can be seen in the scatter plot shown in Figure 4, where the line of best fit (in blue) is a shapeless collection of points.

Appendix 4.

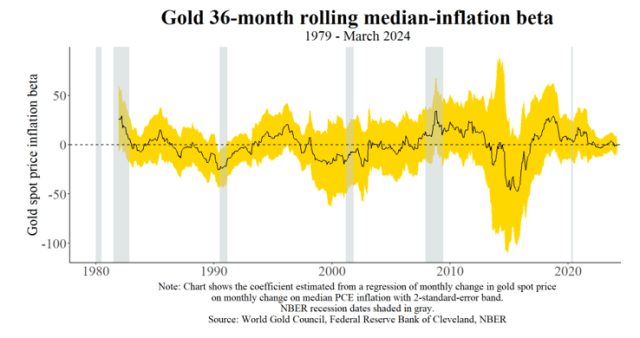

A 36-month rolling regression analysis of gold and median inflation shows similar results to headline inflation: the relationship is unstable and volatile (Figure 5).

Exhibit 5.

Interestingly, gold’s median inflation beta is much more volatile (about three times the standard deviation) and less persistent (as measured by autocorrelation) than headline inflation, meaning that the relationship between gold and underlying inflation appears to be weaker than its relationship with headline inflation (a regression analysis also confirms this; see the online R supplementary material).

One possible explanation is that gold may be a better hedge against the difference between headline and median inflation (sometimes called a “headline shock”) than underlying inflation. I won’t go into this further in this blog post, but I did a quick test of this idea in the online R supplement and found no evidence.

If underlying inflation captures the economic forces of excess demand and rising inflation expectations, as represented by the Phillips Curve model, then gold does not appear to be hedging against the price pressures they cause.

To confirm the relationship between gold and an overheating economy, we test another simple model. Using quarterly real gross domestic product (GDP) and potential GDP estimated by the Congressional Budget Office, we regress the change in the spot price of gold on the difference between actual and potential GDP as a measure of the economy’s slack — that is, we regress gold on the GDP “gap.”

Theoretically, if gold is a hedge against “demand-driven” inflation resulting from an accelerating or fast-growing economy, it should be positively correlated with changes in the gap. However, as shown in the online R supplement, we found no evidence of this.

Gold and inflation: a precarious relationship

An inflation hedge should respond positively to inflation. On average, gold does not. There is no denying that gold has a zero “inflation beta” whether inflation is measured by headline inflation (excluding food and energy) or by the median inflation rate excluding outliers. Also, I believe there is no relationship between gold and economic overheating. But gold’s relationship to these economic forces is shaky. There have been times when gold has hedged inflation very well.

Therefore, I do not interpret these findings to mean that gold does not hedge against inflation in some circumstances, or that it has no diversification effect more generally. Rather, I interpret the evidence as a warning against making blanket claims.

Just as bonds don’t necessarily hedge against stocks, gold has never been a reliable hedge against inflation and probably never will be.

References

Ball, L., Leigh, D., & Mishra, P. (2022). “Understanding U.S. Inflation in the COVID Era.” Brookings Economic Activity Paper, BPEA Conference Draft, September 8-9.

Romer, D. (2019). Advanced Macroeconomics. McGraw-Hill Education.

Disclaimer: Please note that the content on this site should not be construed as investment advice, and the opinions expressed do not necessarily reflect those of CFA Institute.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.