Ratana 21

Invesco S&P Midcap 400 Revenue ETF (NYSEARCA:RWK) is one of those ETFs that takes a different approach than the most common stock indexes, such as the typical mid-cap index. While RWK’s performance has not been particularly impressive, Over the years, it has outperformed the S&P MidCap 400 Index. However, it has lagged the S&P 500, and this is because tech companies, in particular, have led the market for quite some time.

Nonetheless, RWK’s price-to-earnings ratio is relatively low at 12.3x, which is a positive for this ETF as the overall market is currently trading at a premium valuation. Overall, this ETF is an alternative for investors looking to diversify their portfolios and secure long-term returns in the stock market.

ETF Description and Highlights

RWK is an exchange-traded fund that tracks the S&P MidCap 400 Revenue Weighted Index. The securities that make up the S&P MidCap 400 Index are sorted according to company revenue. The constituents are rebalanced quarterly and the weight of each security is capped at 5% to prevent undue concentration in any single stock within the index.

As a result of this methodology, the index has a slightly different composition than the original S&P MidCap 400 index, with the top 10 stocks (TD Synnex, Performance Food, Arrow Electronics, US Foods, PBF Energy, AutoNation, HF Sinclair, and Avnet) primarily coming from the consumer discretionary defense, technology, and energy sectors. In contrast, the S&P MidCap 400 index includes five industrial stocks in its top 10, with no consumer discretionary defense or energy stocks.

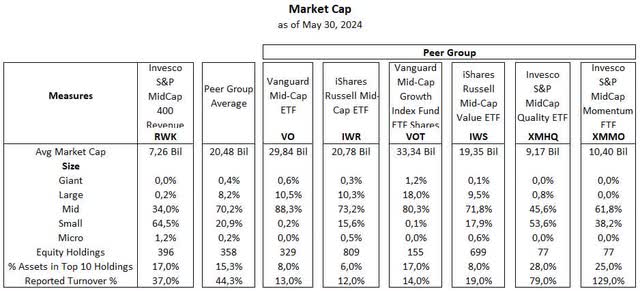

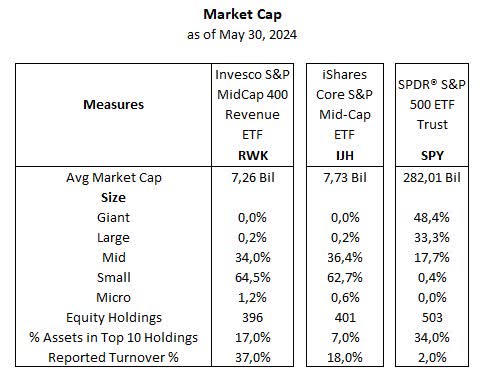

Compared to the original S&P MidCap 400 index (here the iShares Core S&P MidCap ETF), there is no significant difference in market capitalization distribution (IJH), with roughly one-third of its total assets classified as mid-cap stocks and two-thirds as small-cap stocks. At the same time, both RWK and IJH hold shares in the SPDR S&P 500 ETF Trust (spy).

Morningstar, Author Synthesis

Below is how the mid-cap focused ETFs compare to their peer group: The first two in the table (VO and IWR) are the largest in the mid-cap category in terms of market capitalization. VOT employs a growth-oriented strategy, while IWS employs a value strategy. The last two (XMHQ and XMMO) are also managed by Invesco, but employ specific stock selection methods such as quality and momentum.

As you can see, most of these ETFs are concentrated in mid-cap stocks, although the last two, managed by Invesco, have portfolios concentrated in fewer than 100 stocks, giving them a decent exposure to small caps, similar to RWK and IJH, and closer to the benchmark S&P MidCap 400 index.

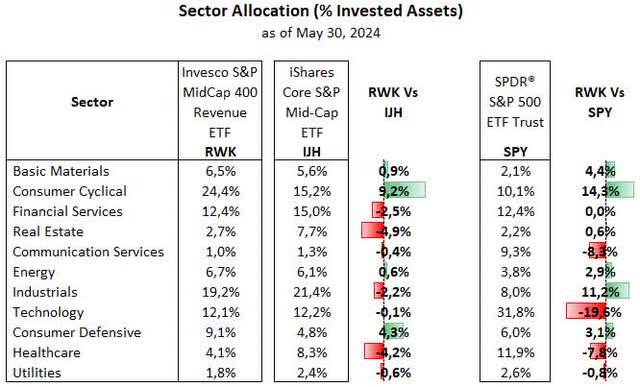

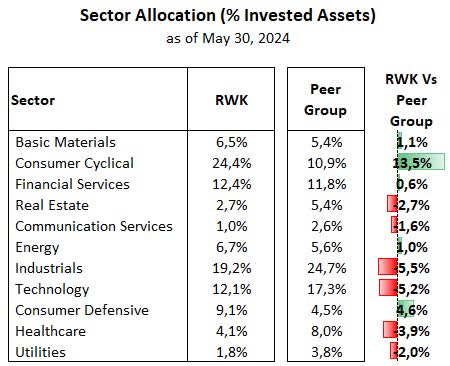

From a sector allocation perspective, as of May 30, 2024, RWKRWK’s largest allocation is to the Consumer Cyclical Goods sector, which accounts for 24.4% of total stocks, followed by Industrials 19.2%, Financials 12.4%, Technology 12.1%, Consumer Defense Goods 9.1%, Energy 6.7%, Materials 6.5%, Healthcare 4.1%, Real Estate 2.7%, Utilities 1.8% and Communication Services 1.0%. Relative to the S&P MidCap 400 Index, RWK is overweight Consumer Cyclical Goods (+9.2%) and Consumer Defense Goods (+4.3%), but is primarily underweight Real Estate (-4.9%) and Healthcare (-4.2%).

RWK is also overweight consumer cyclical stocks, but by a large margin (+13.5%), compared to its mid-cap ETF peer group, as well as consumer defensive stocks (+4.6%), but has underweight allocations to industrials (-5.5%), technology (-5.2%), and healthcare (-3.9%).

Morningstar, Author Synthesis

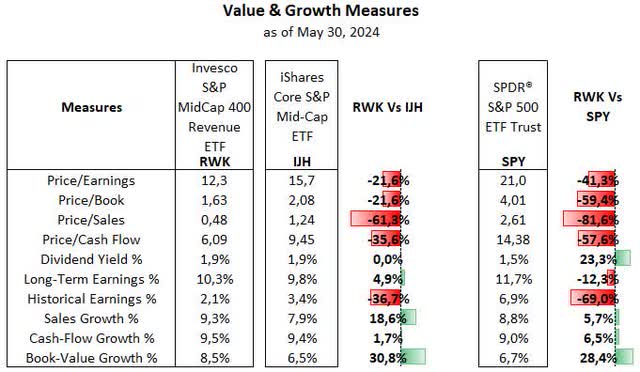

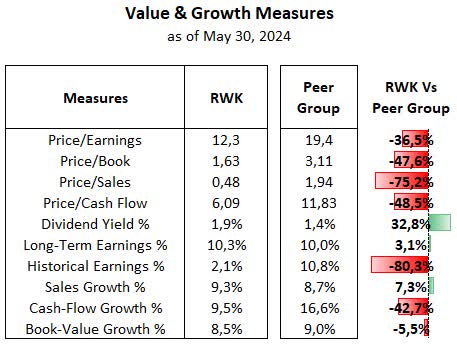

From a valuation perspective, RWK is not market-cap weighted and is therefore displayed at significantly lower multiples compared to the original S&P MidCap 400, including price-to-earnings, price-to-book and price-to-sales. Meanwhile, growth metrics are mixed, with RWK showing lower historical earnings growth but higher sales growth. This is not surprising, as companies with higher sales growth are expected to generate higher earnings in the long term.

RWK’s valuation ratios are much lower than its mid-cap ETF peer group, which has a higher multiple relative to the S&P MidCap 400, but this is likely influenced by some ETFs in that group that are biased toward growth and momentum strategies.

Morningstar, Author Synthesis

Outperforming the S&P MidCap 400

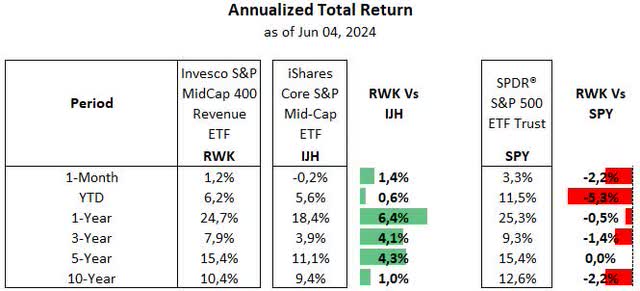

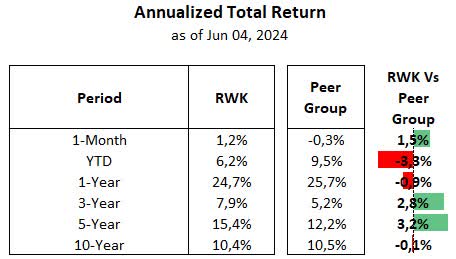

RWK has consistently outperformed the S&P MidCap 400, beating the benchmark across all time frames. However, this is not the case when compared to the S&P. RWK has underperformed the S&P across all time frames, but not by large margins.

On a relative basis, when compared to its mid-cap ETF peer group, RWK has performed slightly better than its peers on average. This is because total returns across mid-cap ETFs have been fairly mixed, with momentum and quality strategies outperforming while other strategies have lagged the S&P MidCap 400.

Morningstar, Author Synthesis

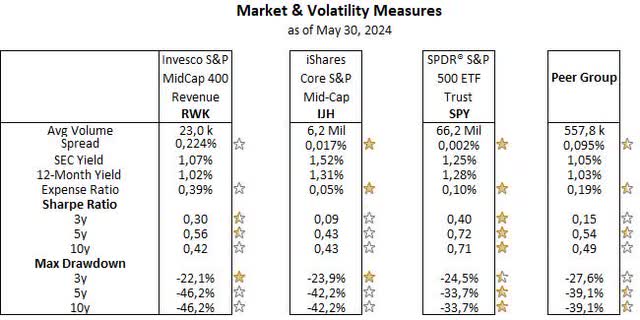

An analysis of risk-adjusted returns shows that RWK’s shape ratio is better than the S&P MidCap 400 but worse than the S&P 500, which is consistent with RKW’s total returns against both benchmarks. However, when comparing RWK to its mid-cap ETF peer group, the results are mixed. Additionally, RWK’s maximum drawdown is the highest over a three-year period, but the worst over longer periods at -46.2%.

The downside of RWK is that it has relatively low liquidity: only $23,000 trades on average per day, and the bid-ask spread is 0.22%, much larger than the IJH spread of 0.017% and the peer group average of 0.095%. This makes RWK less suitable for short-term trading, as you could lose a significant portion of your potential profits through the spread.

In summary, RWK appears to be an interesting option for adding exposure to mid-cap companies rather than using an ETF that simply tracks the S&P MidCap 400 Index (such as IJH, used here to represent the index), as RWK has delivered higher returns over time without adding significant additional risk, as shown by the Sharpe Ratio analysis.

Additionally, RWK’s relatively low valuation multiples are also favorable for the time being, as the broader market is trading at expensive valuations, especially at a time when interest rates remain a key driver of near-term price movement and earnings growth is essential to justify new higher prices.

That said, given that RWK is overallocated to the consumer sector at this time, I would recommend RWK as a diversifier for investors who are overallocated to sectors that are overly sensitive to economic growth and interest rate trends. In the meantime, wait for the stock price to fall and buy more shares at a better price.