Pgiam/iStock via Getty Images

Investment Overview

Continue My last publication Guardant Health, Inc.Nasdaq:G.H.) The stock price has remained stable, so it looks like a “hold” decision was the right one.

In that report, I mentioned several factors that I cited as contributing to GH stock’s continued weakness, particularly the price implications. Forecasts had priced GH’s stock price in the high earnings margins the market demanded, meaning the company had to deliver stellar results to wow investors: top-line growth was extremely strong and earnings had been growing linearly since 2021, which was a positive.

Since then, our investment discussions have been updated multiple times, which I will discuss in more detail today, as well as share with you the modifications we have made to our corporate model to incorporate these new developments.

Investors clearly recognize GH’s sales growth potential. As of this writing, the company’s stock is trading at more than five times sales, a valuation that reflects outsized growth projections of 22-24% over the next few years.

Overall, I continue to view GH favorably as a company and am encouraged by the company’s recent success in colon cancer testing. Unfortunately, this does not currently represent a successful investment based on the core investment principles I employ. As such, I rate GH as a hold based on fundamentals and valuation.

Recent developments

1. Vote to approve the Shield Blood Test

In late May, the F.D.A. majority committee convened Voted The GH secondary cancer (“CC”) screening test, the Shield blood test, is safe and effective for patients. according to According to the World Health Organization (WHO), CC is “the third most common cancer worldwide, accounting for approximately 10% of all cases,” and is also the second leading cause of cancer-related deaths worldwide.

The WHO also states that CC is often diagnosed at an advanced stage, leaving only a small minority of people with limited treatment options. Therefore, significant therapeutic and medical advances are needed in this area, and I believe this can be achieved through diagnosis. As early diagnosis is important, screening tests targeted at this point “upstream” of CC diagnosis are a natural fit in my opinion.

As such, this could spur sentiment in the short term and boost the company’s stock price, which was evident in the move following the announcement, with investors already increasing their capital by $2-3 per share after the vote.

“However, demand was already building as shares had begun to rise from lows of $15-16 per share well before the announcement. The company’s first quarter numbers (more on that below) were a big catalyst leading up to the Shield announcement; “Shield” was mentioned 29 times during the conference call; and, most importantly in my view, management’s updated guidance for 2024 (outlined below).”This does not include revenue contribution from screening, which is dependent on the timing of Shield FDA approval and reimbursement.“

The move comes as FDA officials Commented Earlier this month, we reported on the risk that Shield testing may miss detecting advanced adenomas (AA) in patients, which, for reference, are the main precursor lesions to CC.

However, the FDA supported the idea that shielding tests could improve screening rates and allow for earlier detection of CC in adults aged 45 years and older.

As a result, the Shield approval is a near-term catalyst for me to remain interested in the company and its stock. As of this writing, the stock has risen from the $16 range to the $31 range, and it would be unwise to remain on the sidelines ready to pull the trigger on 1) improving fundamentals (operating margins, etc.) and 2) a moderating valuation.

Figure 1.

Via TradingView and Seeking Alpha

Revenue outlook for Q1 2024

In terms of growth, Q1 2024 It was a strong period for the company. GH sales were $168 million, up 31% year over year. Growth was highlighted by a 20% increase in reported clinical tests to approximately 47,000 and a 37% increase in biopharmaceutical test sales to approximately 8,500. This resulted in gross margin of $103 million, removing 300 basis points of compression year over year to 61%, driven by improved price mix in both business segments.

Management revised its fiscal 2024 guidance following the quarter. The company now expects revenue to grow 20-21%, raising its sales forecast to $685 million, at the high end of the range, from $670 million previously. This will result in gross margins of 61-63%, up 100 basis points from the previous range. This will result in free cash flow of approximately $285 million, an improvement from the previous forecast of $330 million.

As I mentioned earlier, these projections do not include screening revenues that have yet to be factored in following the May approval vote for SHIELD testing. Given the lack of clarity on this point, I do not want to speculate on the subject just yet and would prefer to wait until second quarter earnings are released to get a clearer picture.

Breakdown of first quarter sales by business division

-

Precision Oncology Revenues increased to $156 million from $113 million in the year-ago quarter, supported by a 40% increase in biopharmaceutical trial volumes. Management noted that this was due to a strong pipeline entering the year, and that it expects further growth in biopharmaceutical trial volumes for the remainder of the year.

-

Development Services In line with management’s expectations, sales came in at about $12.2 million. There were no notable gains from the division during the quarter.

Management also noted that they have been increasing the average selling price (ASP) for their Guardant360 liquid biopsy test for approximately 12 months now, and it is now in the $2,900-$2,950 range, above the expected range of $2,050-$2,900 outlined in the previous conference call. This could be a tailwind for future earnings, and I believe the fact that they are meeting demand at this price is good evidence of the product’s adoption in the market.

Despite the excitement surrounding 1) FDA approval of the company’s Shield trial, 2) continued sales growth, and 3) revised fiscal 2024 guidance, in my view, they are not yet enough to change the company’s fundamental economics. They do not fit my core investment thesis. More flesh needs to be put on the bones.

Fundamentals Support Hold Rating

In a previous GH publication, we discussed the divergence between revenue growth and operating profit growth over the past two years. For the company, this is not necessarily a negative. Given the efforts to establish a foothold in the market and introduce CC and liquid biopsy tests to the market, the goal of this name game is clearly revenue growth. More revenue means more tests/screens being shipped.

It’s interesting to see how management has embarked on this journey, but my expectation for a company focused on rapid top-line growth is to keep total asset value in check — in other words, assets should not grow faster than revenues.

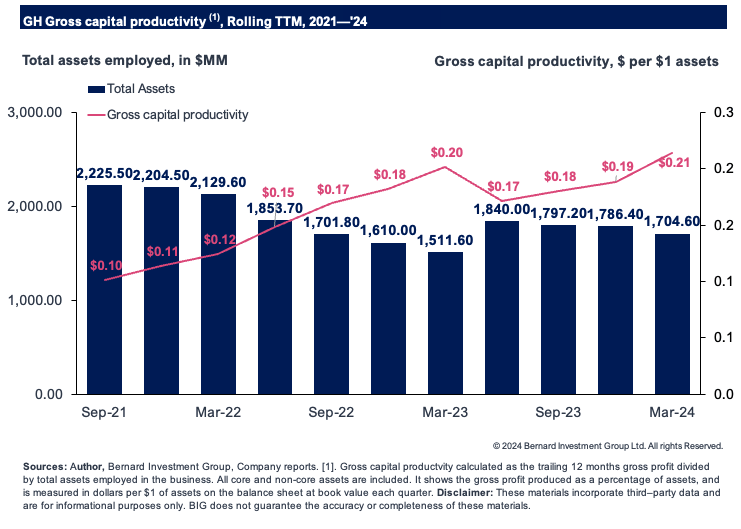

Next, we look at the amount of gross profit that is turned over from assets employed on the balance sheet. We did this for GH in Figure 2. As observed, the company turns over approximately $0.21 in gross profit for every $1 of assets employed in the company. This includes all operating and non-operating assets. On the positive side, the company is currently operating with fewer total assets than it is in 2021.

Figure 2.

Company filings, authors

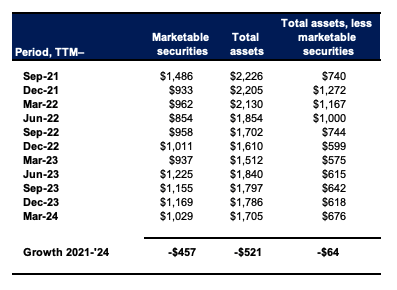

This is important because the company has a very high cash We calculate marketable securities as a function of total asset value. When we remove the capital tied up in marketable securities, the company becomes much “leaner” in terms of asset intensity.

For example, in the fiscal year ending March 2024, total assets recorded on the balance sheet were $1.7 billion, with marketable securities at approximately $1 billion. Excluding the former, this translates to total liabilities of $1.6 billion and assets of $676 million (Figure 3). Given that the company has negative cash flows, it is natural to suspect that it is keeping this cash ratio high as a liquidity buffer.

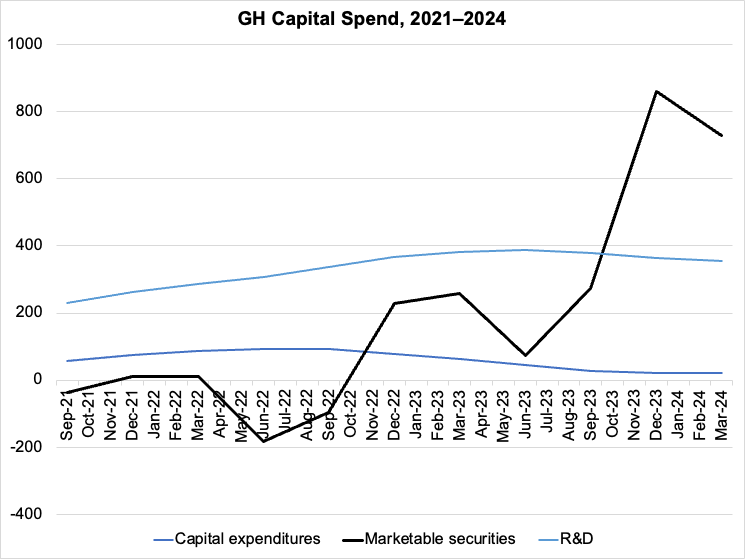

Yet, we do not believe that management has or has allocated capital favorably in any area other than 1) R&D and 2) securities. This is shown in Figure 4. As we enter the new interest rate cycle starting in 2022, we see that management has gradually begun to redirect cash into securities. At the same time, investments in R&D and capex are trending downward.

Figure 3. Most of the value of assets is tied up in cash and marketable securities

Company filings

Figure 4. Focus on the gap between cash, etc. and R&D expenses and capital investment amounts

Company filings

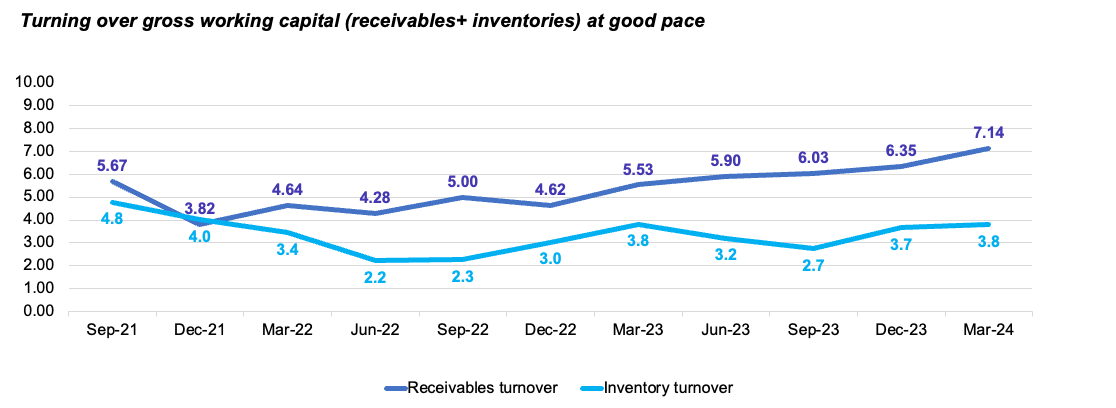

Incidentally, the company’s inventory and accounts receivable, on which it holds cash, are turning over relatively quickly. Figure 5 shows inventory and accounts receivable turnover for each trailing 12 months since 2021. As you can see, the company’s inventory is turning over about 3-4 times every 12 months. Accounts receivable turnover has increased from about 4x in 2022 to more than 7x over the past 12 months.

Figure 5.

Company filings, authors

Update on future forecasts

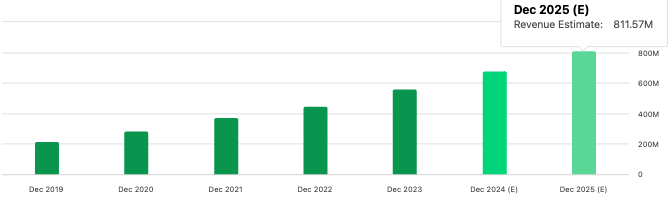

consensus expect The company expects to achieve strong revenue growth over the next three years, averaging roughly 20% per year, with similar growth in profits, which would put the company’s sales at $680 million this year and $811 million in 2025. If the consensus is correct, that’s a steep increase in revenue, as you can see below.

Figure 6.

Find Alpha

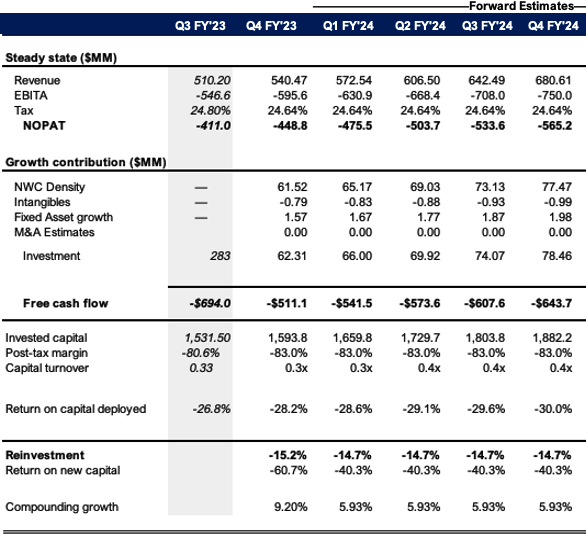

Based on the company’s first quarter numbers (Figure 7), I have revised the model as follows: It is in line with consensus expectations to achieve $680 million in sales by the end of this year. In my view, this would require an investment of $80 million, which would amount to $160 million at a capital turnover ratio of 0.4x.

The problem is, if the consensus numbers (and my own numbers) are what’s priced into GH’s current market value, then there’s little room to expect investors to have mispriced the company. In other words, my numbers are not out of line with Wall Street’s numbers and therefore do not represent a different stance than what’s already priced in. I take a neutral view.

Figure 7.

Author’s Estimates

evaluation

The stock is still priced for exceptional growth, and the current multiple of 5x trailing sales of $564 million implies high expectations. If the company achieves the expected revenue growth rate outlined in this report (~21%), that same 5x multiple (high in my opinion) would value the company today to us at about $3.4 billion, a slight increase from the current trading price (5×680 = $3,400).

Furthermore, if the multiple were to shrink to the sector median of 3.7x, even if the company achieves its forecasted strong growth numbers, it would be worth only $2.5 billion to us under these assumptions (3.7 x 680 = $2,516).

This indicates that valuations are biased to the downside. With multiples shrinking despite very high growth, a 26% drop in multiples would translate into roughly a 25% decline in market valuation. Each of these factors supports a Neutral rating in my opinion.

Conclusion

Having reviewed the company’s recent developments and latest financial statements, we have neutralized GH’s rating due to its current high valuation and it remains on hold. At 5x sales, it is highly vulnerable to multiple compression and a fall to the sector multiple of 3.7x could compress the company’s market value by as much as 25%.

So, despite the impressive growth in units and dollar sales, and the projections of high growth going forward, it is my opinion that this is fully reflected in the current market value, with only minimal room for further upside expected from the price. Again, I advocate a Hold.