Jetta Productions, Inc./Digital Vision via Getty Images

When things go wrong in the market, it can be difficult to get your way. The longer the market goes against your valuation, the harder this situation becomes. After all, we only have a limited amount of time in life, and the more time we have to spend, the harder it becomes to get out of control. The longer you stay in a poorer position, the more opportunities you seem to miss. But I believe that in some cases, extreme patience is well worth it. A good example where I think this is the case is Dana Corporation (New York Stock Exchange:group).

For those of you who are not familiar with this company, it focuses on servicing various types of vehicles, including commercial vehicles and off-highway equipment. The company keeps these vehicles operational by selling axles, transmissions, drivetrain parts, and other related products. In May 2023, I wrote my latest article. article regarding Here’s an article about the company. In it, I acknowledged that the company’s stock price had underperformed relative to the overall market, but praised its sales growth even during a period of declining margins. The low price forced me to maintain my rating at “buy.”

Since then, things have not gone as I expected. The stock price has certainly risen, but only by 9.3%, which pales in comparison to the 28.6% rise recorded by the S&P 500 over the same period. Given this difference in returns, one might assume that the company is underperforming. In some ways, this would be an accurate representation. However, in other areas, such as earnings and cash flow, the picture is mixed but generally good. Management is also optimistic about the current fiscal year. Given this, plus the stock price is still very cheap, I believe patience will pay shareholders handsomely. Therefore, for now, I am keeping the company rated as “Buy”.

The stock price looks cheap

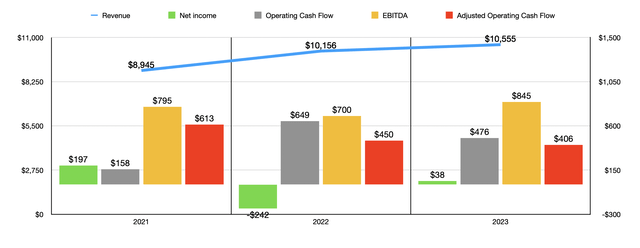

A lot has happened since I last wrote about Dana, so it may be wise to take a moment to look at the financial progress the company has made since then. First, 2023In 2020, the company’s sales were $10.56 billion. This was 3.9% higher than the $10.16 billion the company generated in 2022. While the company has a history of acquisitions, the fluctuations in sales during the period were not due to acquisitions or divestitures. Except for a $9 million hit from foreign exchange fluctuations, the company’s increase was entirely due to organic growth. Notably, the company benefited from a $491 million, or 16.1%, revenue increase related to its European operations. Of this increase, $460 million was due to organic growth, with demand for off-highway, mining, and construction driving strong growth. Management also noted a healthy increase in production of light trucks and medium/heavy trucks, which expanded 16% and 17%, respectively.

Author – SEC EDGAR Data

Not everything was smooth sailing. The company benefited from Asia-Pacific-related revenues, which increased by $136 million, or 9.8%, but both its North and South American divisions were hit. Labor strikes and lower light truck production levels in the fourth quarter of 2023 contributed to lowering total North American sales by $171 million. In South America, sales declined by about 7.2%. Excluding foreign exchange gains, the decline would have been even worse, at 8.6%. Management attributed the decline to a 32% plunge in medium and heavy truck production.

Along with the overall revenue increase, the company’s profits improved, turning from a net loss of $242 million to a net income of $38 million. There are multiple reasons for such a dramatic change. First, in 2022, the company recorded a goodwill impairment charge of $191 million. This compares to zero in fiscal 2023. Income tax expense also increased significantly in 2022, to $284 million. This compares to $121 million reported last year. Other profitability measures were mixed. For example, operating cash flow decreased from $649 million to $476 million. However, when adjusting for changes in working capital, the decrease is slightly smaller, from $450 million to $406 million. Meanwhile, EBITDA from operations actually expanded from $700 million to $845 million.

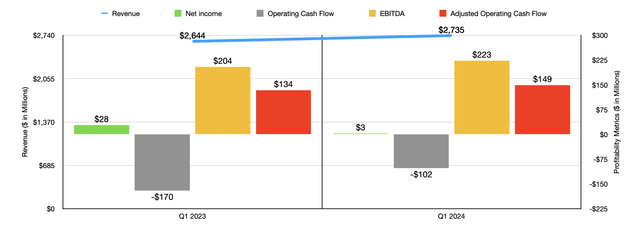

Author – SEC EDGAR Data

Towards fiscal 2024, First Quarter, things seem to be mostly improving. Revenues were $2.74 billion, 3.4% higher than the $2.64 billion reported for the same period in 2023. Nearly all of this growth was driven by light vehicle production, which increased an impressive 14.1% year-over-year from $962 million to $1.1 billion. Much of this strength came from North America, where revenues were $1.33 billion, 12.2% higher than $1.18 billion in the same period last year. Nearly all of this growth was driven by organic growth, with management attributing the increase in part to a quarterly increase in production for full-frame light truck customer programs, compared to only a production increase in the same period last year. Higher production levels for light vehicle engines and what management described as a “turnaround in sales backlog” also contributed to the increase. Sales declined in both Europe and Asia-Pacific. A slowdown in the construction, mining and agricultural machinery market negatively impacted sales in Europe, while lower sales of electric vehicle-related products in Asia Pacific also hurt the business. However, in South America, revenues increased from $168 million to $184 million. Increased production volumes of both medium and heavy vehicles contributed to this.

The company’s only weakness from a profitability perspective was net income. The company’s profits fell from $28 million in the first quarter of 2023 to $3 million in the same period this year. This was mainly due to a $29 million loss on the disposal of certain assets that were to be sold at the time. However, other factors also contributed, such as an increase in interest expense from $34 million to $39 million. Meanwhile, other profitability measures were strong during the period. Operating cash flow decreased from negative $170 million to negative $102 million. Adjusted for changes in working capital, it increased from $134 million to $149 million. Meanwhile, the company’s EBITDA expanded from $204 million to $223 million.

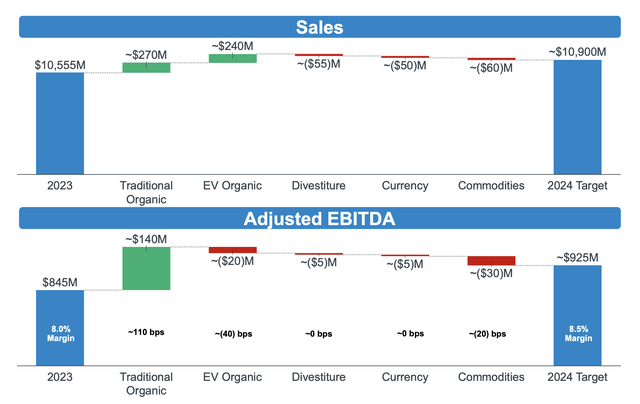

While results have been wildly mixed for a while, management seems optimistic about 2024. For example, they expect sales to be between $10.65 billion and $11.15 billion. At the midpoint, this would be 3.3% higher than last year’s sales. Earnings per share should be between $0.35 and $0.85, and at the midpoint, net income would be $86.9 million. But honestly, the extreme range of estimates given by management is practically worthless in my opinion. At the low end, net income would be just $50.7 million. At the high end, it would be $123.1 million. However, other profitability measures don’t have this issue. Operating cash flow is expected to be between $500 million and $550 million. Meanwhile, management expects EBITDA to be between $875 million and $975 million. No estimates for adjusted operating cash flow were provided. However, if we take the median operating cash flow and assume adjusted operating cash flow grows at the same rate year over year, we get to $448 million.

Dana Corporation

The company provided a basic estimate as well as a more detailed one. image Above you can see the expected bridge for revenue from 2023 to 2024. The company should benefit from organic growth of about $270 million year over year. This is focused solely on conventional products. Meanwhile, organic growth in electric vehicles is supposed to add another $240 million to sales. Offsetting this are $55 million in divestitures, $50 million in foreign exchange fluctuations, and $60 million in commodity price fluctuations. The same figure also shows a similar bridge leading to the midpoint of the EBITDA guidance. Despite the increase in organic revenue related to electric vehicle sales, profits should take a hit. This is not that surprising to me. As I detailed in another article, the average price of electric vehicles is falling rapidly compared to conventional vehicles. This will put pressure on profit margins for any company in this space. Fortunately, conventional organic products should increase profits by about $140 million.

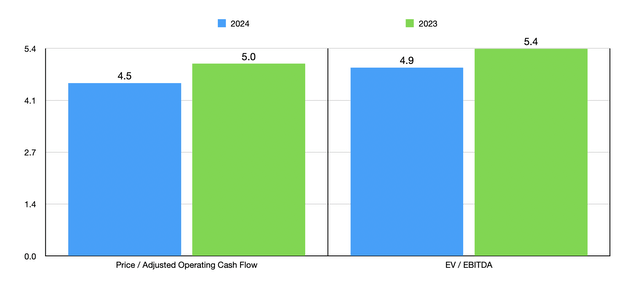

Author – SEC EDGAR Data

Using these figures, we were able to value the company as shown in the chart above. We also used last year’s financial performance to value the company. It’s great to see the company’s stock trading in the low to mid single digit range. Compared to similar companies, the stock looks attractively priced. In the table below, we compared it to five similar companies. On a price to operating cash flow basis, only one of the five was cheaper than Dana Incorporated. However, using an EV to EBITDA approach, our candidate was the cheapest of the group.

| company | Price / Operating Cash Flow | EV/EBITDA |

| Dana Corporation | 5.0 | 5.4 |

| LCI Industries (LCII) | 6.1 | 12.2 |

| Patrick Industries (Patok) | 5.6 | 9.5 |

| Dorman Products (Dormitory) | 12.3 | 11.0 |

| Standard motor products (Hmmmm) | 5.7 | 7.3 |

| Garrett Motion (GTTX) | 4.1 | 6.0 |

remove

Fundamentally speaking, Dana Incorporated is not the best company to own. The company’s financial results, especially its bottom line, have been very volatile. This creates uncertainty and additional risk. And these mixed results likely contribute to its below-average performance relative to the overall stock market. That being said, even using 2023 earnings, the company’s stock is incredibly cheap. This is true both in absolute terms and relative to peers. Given this, I think it’s wise to keep the company rated “Buy” and that it will ultimately pay off.