Prime Image

In this article, Western Asset Diversified Income Fund (New York Stock Exchange:WDIThe fund recently raised its distribution again as its net income rose to an all-time high. Its latest coverage figures are: Just below 99%. WDI is trading at a 7.6% discount and currently yields 12.5%.

In addition to record net income and ample coverage, the fund also has a modest duration of 4.7, a very attractive feature for two reasons. First, nominal and real Treasury yields remain elevated. Second, all else being equal, duration securities are more protective against unexpected growth shocks (i.e., economic downturns) because Treasury yields typically fall in such environments.

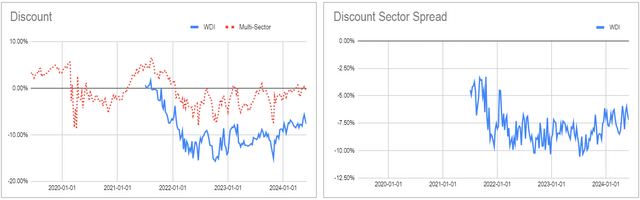

Finally, the fund continues to trade at a significant discount, both in absolute terms (left chart) and relative to other multi-sector credit CEFs (right chart).

Fund Snapshot

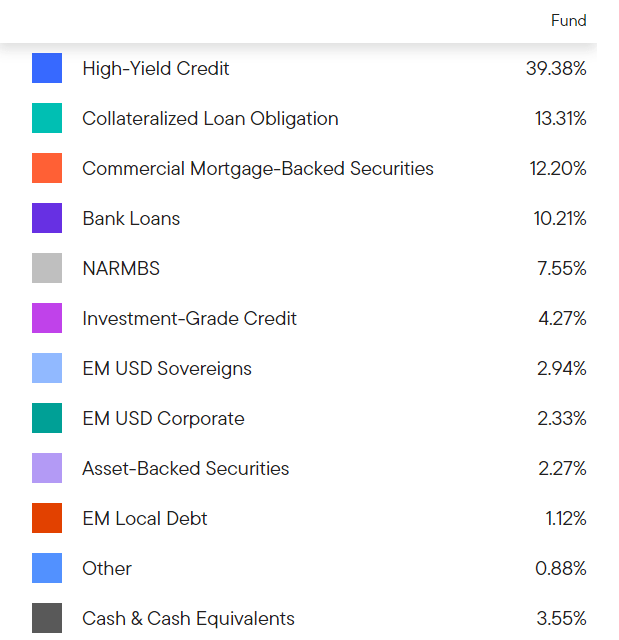

WDI is a multi-sector credit fund with roughly half of its portfolio allocated to corporate bonds, primarily high-yield (i.e. below investment grade) corporate bonds.

The remainder of the portfolio is allocated to mortgage-related securities (both residential and commercial) and bank loans and CLOs (mostly floating rate). This allocation is little changed from last year, with high yield bonds and loans positions decreasing slightly and CLOs and non-agency RMBS increasing slightly.

Western Asset

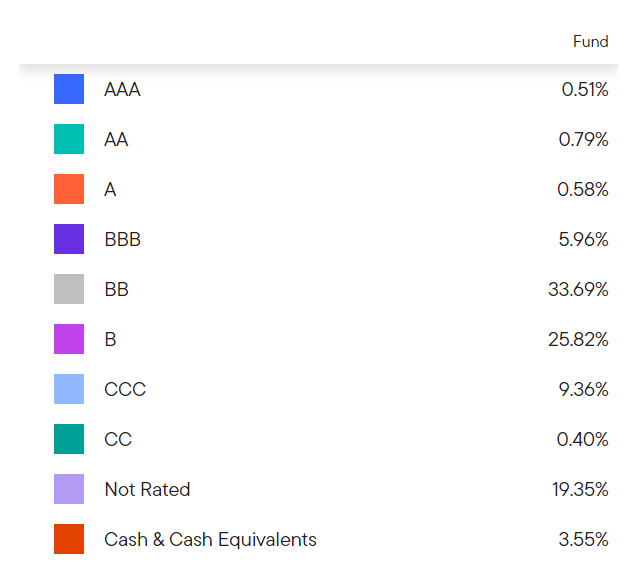

The fund’s credit exposure sits firmly in below investment grade territory, although it’s not at the bottom, with less than 10% exposure rated CCC or below. Over the past year, the fund has reduced its CCC rating bucket and moved into the single B rating bucket, a small but welcome improvement in quality.

Western Asset

Income Profile

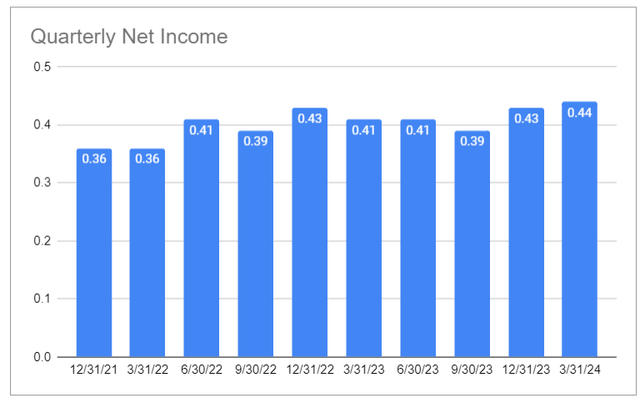

WDI’s net income is positively impacted by rising short-term interest rates because roughly half of the company’s assets are floating rate, primarily bank loans, CLOs, and CMOs. Specifically, roughly $600 million of total assets (out of $1.2 billion) are floating rate. Compared to $370 million in floating rate borrowings, net floating rate assets are $230 million, or roughly 28% of NAV. In other words, for every 1% increase in short-term interest rates, net income increases by roughly 0.3%.

The chart below shows that quarterly net income has increased steadily (with some fluctuations) as short-term interest rates have risen over the past few years. However, with short-term interest rates remaining flat, we would not expect a significant increase in net income.

Over the past year, the fund’s leverage has decreased slightly from 31.6% to 30.7%, as a result of both increasing asset values and reducing the fund’s repos. This is fairly low leverage for a credit CEF, which puts the fund in a somewhat defensive stance compared to other credit CEFs. It also provides some dry powder in case asset prices fall again.

There are three headwinds to the fund’s net income. The first is a slight decline in borrowings despite lower leverage (which would have been lower without the decline in borrowings due to higher portfolio valuations). The impact of this factor is mitigated by narrowing spreads across credit markets and an inverted yield curve.

Second, the fund’s ratings have improved slightly, replacing some of its CCC-rated securities with B-rated securities. Lower-rated securities do not necessarily trade at higher yields than higher-rated securities, but that is usually the case. Third, assuming the Fed does not raise rates further, the positive stimulus to net income from short-term interest rates has been completely exhausted. All of this means that we would not be surprised to see a slight decline in the fund’s net income, especially once the Fed starts cutting rates.

We continue to hold WDI across our core and high-income portfolios, as its combination of adequate coverage, high yield, somewhat defensive stance and attractive valuation remains attractive.