SlavkoSereda/iStock via Getty Images

Investors often diversify their portfolios by dollar-cost averaging into index ETFs. The most popular ETFs include the SPDR S&P 500 ETF (spy) and Vanguard S&P 500 ETF (Vaux), both It tracks the S&P 500 as its underlying index. Tracking the top 500 companies in the U.S. stock market, the S&P 500 is often the first choice for most ETF investors due to its strong portfolio and past performance. In this article, we will be looking at the VanEck Morningstar Wide Moat ETF (Bat:moat), and explain why it’s worth a look.

Underlying Index

As with other index ETFs, the MOAT’s underlying index is Morningstar Wide Moat Focus Index (MWMFTR)is made up of companies that meet two main criteria.

1. The company has a significant and sustainable competitive advantage in its industry. In the long run.

2. The company’s valuation is close to its intrinsic value.

Like an economic moat, the index aims to provide investors with access to a portfolio of the best performing and most attractively valued companies in each sector. The portfolio is reconstituted twice a year on a quarterly basis to ensure the index is frequently rebalanced based on investment objectives. The MOAT ETF is an investment vehicle for those who believe in the long-term growth of this underlying index.

Fund Performance

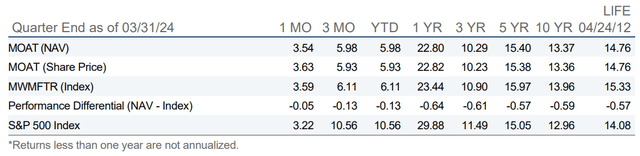

MOAT ETF Fund Performance vs. MWMFTR and S&P 500 (Van Eck)

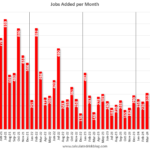

Since its inception in late April 2012, the MOAT ETF has seen impressive growth of 14.17% annualized. The corresponding return for the S&P 500 over the same period was 13.58%. This is undoubtedly a good indicator of MOAT ETF’s fund performance, as very few funds have managed to outperform the S&P 500 over a 10-year period. That said, the ETF has not been around for that long, and it remains to be seen whether the MOAT ETF can maintain its performance amid potential future economic headwinds. In particular, many economists are skeptical of an economic “soft landing” given other factors such as the U.S. debt crisis and the ongoing war situation. It remains to be seen whether MOAT’s holdings can weather a potential economic storm.

Portfolio holdings and sector allocation

MOAT ETF Top 10 Stocks and Sector Allocation (Van Eck)

Top 10 SPY ETFs (State Street Global Advisors)

SPY ETF Sector Allocation (State Street Global Advisors)

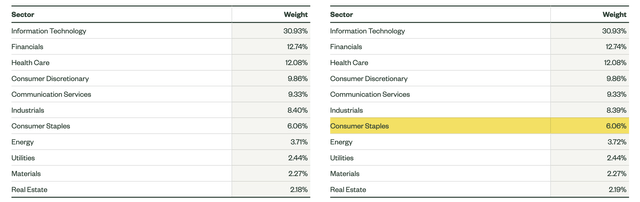

Next, let’s look at the MOAT ETF’s major holdings and sector weightings.Google), RTX Corp (RTX) and Teradyne (Tell) as a top holding in the portfolio. It is noteworthy that the weights (as a % of net assets) of various stocks in the MOAT ETF’s portfolio are fairly evenly distributed. Even within the top 10 stocks, the weights of each stock range from 2.54% to 3.04%. In contrast, the SPY ETF’s portfolio has only NVIDIA Corp (NVDA), apple (AAPL) and Microsoft (MSFT) As shown in the table above, almost a third of the SPY ETF’s portfolio is invested in information technology, with much less in other sectors. The case of the MOAT ETF is quite different, with its sector allocation being fairly evenly spread across the most profitable industries today. It is difficult to say whether there is a strictly superior portfolio allocation between the two, but the MOAT ETF’s portfolio structure appears to be more diversified, while the SPY ETF’s portfolio appears to be biased towards technology, with a number of large technology companies in its portfolio. This is an important point to consider when deciding which ETF is the better investment.

evaluation

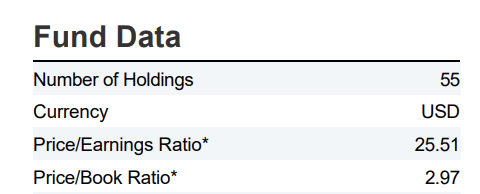

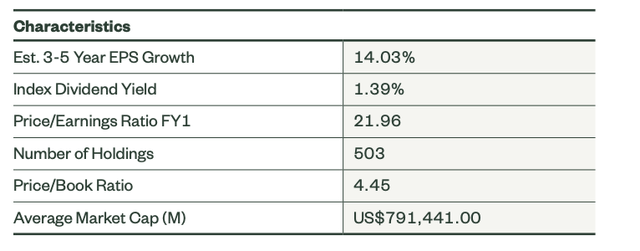

MOAT ETF Evaluation Index (Van Eck)

SPY ETF Evaluation Index (State Street Global Advisors)

We can see that the MOAT ETF has a higher P/E ratio than the SPY ETF, but a lower P/B ratio. If you dollar-cost average both ETFs, the difference is not that great, but if you invest in a lump sum, both ETFs are trading at relatively high multiples. Notably, the long-term average P/E ratios of the SPY and MOAT ETFs are 17.6 and 20.1, respectively, so the current multiples could be a sign of overvaluation (although that’s not always the case).

Fund-related expenses

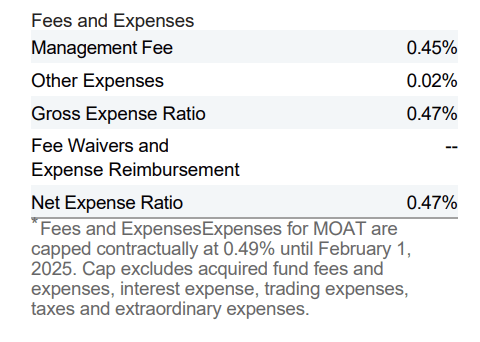

MOAT ETF Fund Related Fees (Van Eck)

SPY ETF Fund Related Fees (State Street Global Advisors)

Because the MWMFTR index that the MOAT ETF tracks rebalances frequently, the fund’s expense ratio is significantly higher than the SPY ETF’s because its higher management costs of 0.45% are factored into its total expense ratio. As an investment, if the returns of both funds were matched, the MOAT ETF would significantly underperform the SPY ETF.

Performance Difference

MOAT ETF Performance Difference (Van Eck)

One thing to be concerned about is the rather large performance differential between the MOAT ETF and the MWMFTR Index. The performance differential, which is the difference in annualized returns when comparing the ETF’s net asset value to its underlying index, is -0.59% since inception, and the one-year differential is actually even worse, at -0.64%. This indicates that to some extent the MOAT ETF is significantly underperforming its underlying index.

Investment decision

Overall, the MOAT ETF is a great option worth considering if you want to invest in a fund made up of high-profit companies with dollar-cost averaging. However, the fund does have issues in terms of keeping fees low and replicating the performance of the underlying index. That being said, the fund’s impressive returns since inception cannot be underestimated. The MOAT ETF also offers sector diversification compared to the tech-biased SPY ETF. As such, I believe it is a good alternative to ETFs tracking the S&P 500. You could also consider investing in both to maximize your portfolio diversification. My analysis concludes with a “Buy” rating for the MOAT ETF.