Chip Somodevilla/Getty Images News

June FOMC Meeting

The FOMC is scheduled to meet next Wednesday, and it was widely expected that the Fed would begin lowering interest rates at its June meeting in the not-too-distant future. Next week, the Fed is scheduled to cut the federal funds rate — in fact, it could signal that it may not be able to cut rates at all in 2024.

Based on knowledge of FOMC meetings from the minutes, FOMC members first receive briefings from Fed staff on market developments and economic data between meetings. FOMC members then discuss the data in the context of the Fed’s mission of price stability and full employment.

Recent economic data has been shaky. Weak labor force in April report, Labor Report for May The economy was doing well in April, at least based on the headline new job creation numbers. Similarly, the PMI surveys have been choppy. On inflation, core PCE inflation rose 0.2% in April, and it would be good if this trend continues over the next 3-4 months. However, core CPI is still rising at 0.3/0.4% m/m, which is too high and needs to come down to 0.2% m/m on a consistent basis.

So, based on the recent growth/inflation data, the Fed is likely to continue to signal “patience” which the market will interpret as a “higher rates for longer” policy, or “keep rates high until recession” policy.

The June FOMC is their quarterly meeting, where the Fed will also release an overview of their economic outlook. Given recent data, the FOMC may 1) raise their 2024 inflation forecast, 2) raise their unemployment rate forecast, and 3) delay rate cuts by suggesting fewer than three rate cuts in 2024, or none at all.

The stock market’s reaction to the June FOMC meeting forecast is likely to be negative. Why? The longer the Federal Reserve maintains tight interest rate policy, the more likely a recession becomes, and therefore the more likely a recession-driven bear market becomes.

Changes in FOMC Statements

The FOMC communicates policy through its official statements after meetings, so any changes to its statements from the previous meeting may signal a change in policy. May FOMC Meeting stated:

Recent indicators indicate that economic activity continues to expand at a solid pace. Employment growth remains solid, and the unemployment rate remains low. Inflation has eased over the past year but remains elevated. Further progress toward the Committee’s 2 percent inflation objective has not been made in recent months.

That opening paragraph is likely to remain unchanged, as the data is too unstable and shows no signs of tipping one way or the other.

The policy guidance statement from the May Fed meeting stated:

The Committee does not expect it would be appropriate to lower the target range until it has greater confidence that inflation is moving sustainably toward 2 percent.

The policy guidance statement is also unlikely to change, meaning the first expected rate cut will indeed remain postponed indefinitely.

The FOMC statement is therefore unlikely to signal any change to the current “higher rates for longer” policy, likely to disappoint proponents of preemptive rate cuts and a soft landing scenario.

Changes to SEP forecasts

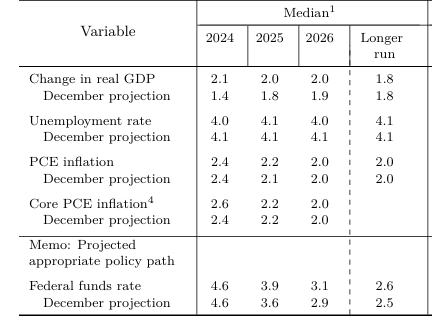

The FOMC: SEP prediction Released at its March meeting, based on these projections, the Fed expects the following:

- Real GDP to grow 2.1% in 2024Given the shaky recent data, the Atlanta Fed Current GDP Second-quarter GDP growth has fluctuated wildly, from over 4% to 1.8% to back to 2.6%, so the Fed is unlikely to change its GDP forecast until the data becomes clearer.

- Unemployment rate in 2024 will be 4%The unemployment rate is already at 4% as of May 2024 and is on the rise. Household surveys indicate a weakening labor market, which is supported by the PMI survey. Therefore, the Fed is likely to raise its unemployment rate forecast to 4.2%. This indeed indicates that a weakening labor market is needed to contain inflation.

- Core PCE inflation rate of 2.6% in 2024Core PCE is currently at 2.8%, but due to base effects, if monthly readings continue to trend at 0.2/0.3%, it will rise towards the end of 2024. Therefore, the Fed will likely raise its forecast for core PCE inflation to 2.8%.

September March (Fed)

Dot plot change

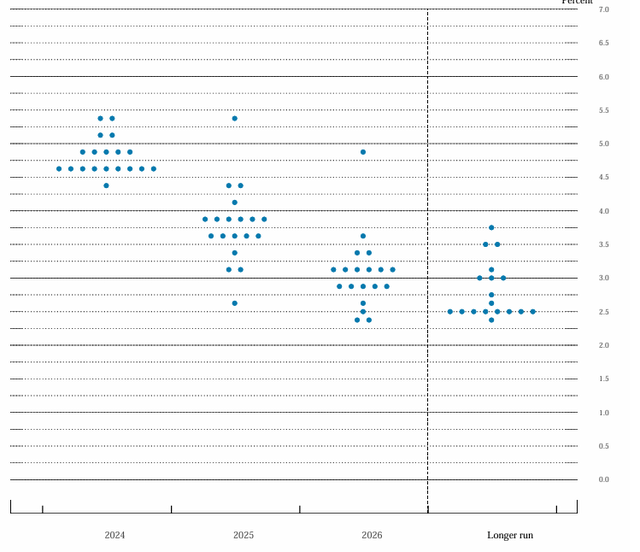

The FOMC also projected in March that it would cut interest rates to 4.6% in 2024, which would represent three 25-bps cuts.

Each FOMC member forecasts the federal funds rate, and the Committee ranks the individual forecasts from high to low and reports the median as the forecast federal funds rate.

There are 19 FOMC members, and each one reports their forecast as a “dot” on a “dot plot.” At the March meeting, nine predicted 3 rate cuts in 2024, five predicted 2 cuts, two predicted 1 cut, two predicted 0 cuts, and one predicted 4 cuts. The median forecast was 3 cuts, just one dot apart.

The dot plot for the June FOMC meeting will likely change significantly, as most FOMC members have become more hawkish since the March meeting based on their public statements.

The Fed is currently in a “patient” and “wait and see” data-dependent mode and will not cut rates until something changes. Therefore, most points are likely to move higher and indicate a more hawkish shift in direction. The median forecast is likely to be one rate cut in 2024. CME Fed Funds futures are currently pricing in one to two rate cuts in 2024.

Implications – Market Reaction

Financial markets will be paying most attention to the dot plot and the expected federal funds rate for 2024.

The dot plot likely suggests fewer than three rate cuts in 2024, but most likely only one, meaning essentially no rate cuts until a recession, which would likely be interpreted as a more hawkish shift by the Fed.

S&P 500 (SP500) should react negatively to this hawkish revision of the dot plot. First, the interest rate (TLT) is likely to rise, so the dollar (UP) is likely to strengthen and financial conditions are likely to become tighter. Second, the longer the Fed keeps interest rates tight, the greater the likelihood of a recession.

However, the S&P 500 is currently being driven by non-systematic factors such as the GenAI theme and meme stocks. Euphoric stageA hawkish Fed shift would likely “kill the euphoria” unless there are signs of a rate hike, which seems unlikely. Painful trading is a continuation of the uptrend, but selling the euphoria is a smart strategy, even if it means short-term pain.

After all, the S&P 500 is facing a bear market caused by a recession that the Fed has caused through its “high interest rates for longer” policy, but the timing is unclear, especially given recent shaky economic data.

It’s important to note that this is how the normal cycle plays out, with the Fed tightening policy and beginning to cut rates as the economy slows.