Vertigo 3d

Like Leveraged ETFs GraniteShares 2x Long META Daily ETF (Nasdaq:FBL) is very scary and fascinating at the same time.Meta) 39% return, but when you look at how ETFs like this work, it’s scary. I’ve written quite a bit about About Leveraged ETFs Seeking Alpha goes into detail about the specific risks, so to save you time, you can read the details there. We’ll provide a high level overview here, but if you’re new to leveraged products, you’ll want to look into it more in-depth.

Overview of the risks of leveraged ETFs

You’ll want to eat the frog quickly so you can enjoy the rest of your meal. Essentially, these are the risks you need to be aware of.

-

Main risks A feature of such ETFs is that they reset daily. ETFs are designed to track the daily performance of the underlying asset, so they reset at the end of each trading day. In this case, if META falls 5%, your holdings will lose 10%. At the end of the day the fund resets or rebalances, so you’re essentially starting from zero the next day. This is more complicated than I’d like to say, but it’s the only way a leveraged or inverse ETF can reasonably achieve its objective of providing 1x, 2x, 3x or any inverse return.

-

Another risk associated with this daily reset is compound interest risk. With the daily reset, consecutive losses could theoretically be much larger than any single day’s loss. We won’t go into the math, but suffice it to say that the risk is large enough that FINRA has established specific rules for registered investment advisers and brokerage firms that handle institutional accounts. Currently,2111. ConformityThe rule states, in part:

The member or associated person must have reasonable grounds to believe that the recommended transaction or investment strategy relating to the security or securities is suitable for the client.

FINRA’s rules regarding leveraged products and SEC warning.

A closer look at FBL from a technical perspective

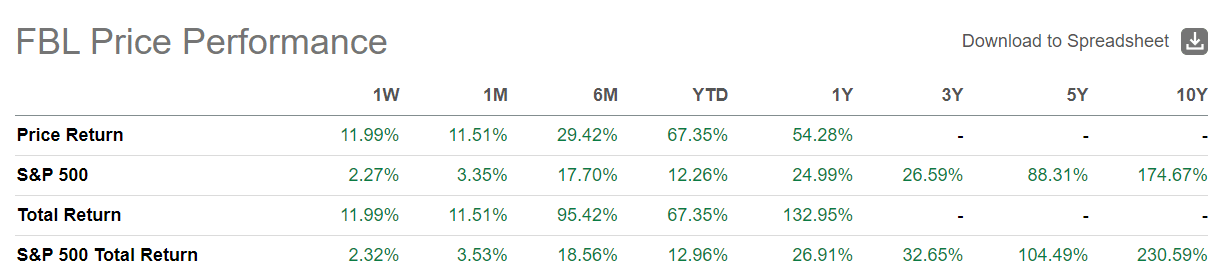

You may be wondering why FBL didn’t get anywhere near 80% of that, when META itself only returned half that amount. Shouldn’t this fund return twice as much as META? No, that’s not how it’s calculated. I’m sure you’ve figured it out by now in the risk section, but just to be clear, this is not an apples to apples comparison, just because they are both YTD numbers. This is the cumulative return if you are aiming for 2x daily returns, which is why holding periods should not exceed one trading day. If you are an experienced investor, a few days is the absolute maximum. You can’t get 2x returns more than every day because it resets every day.

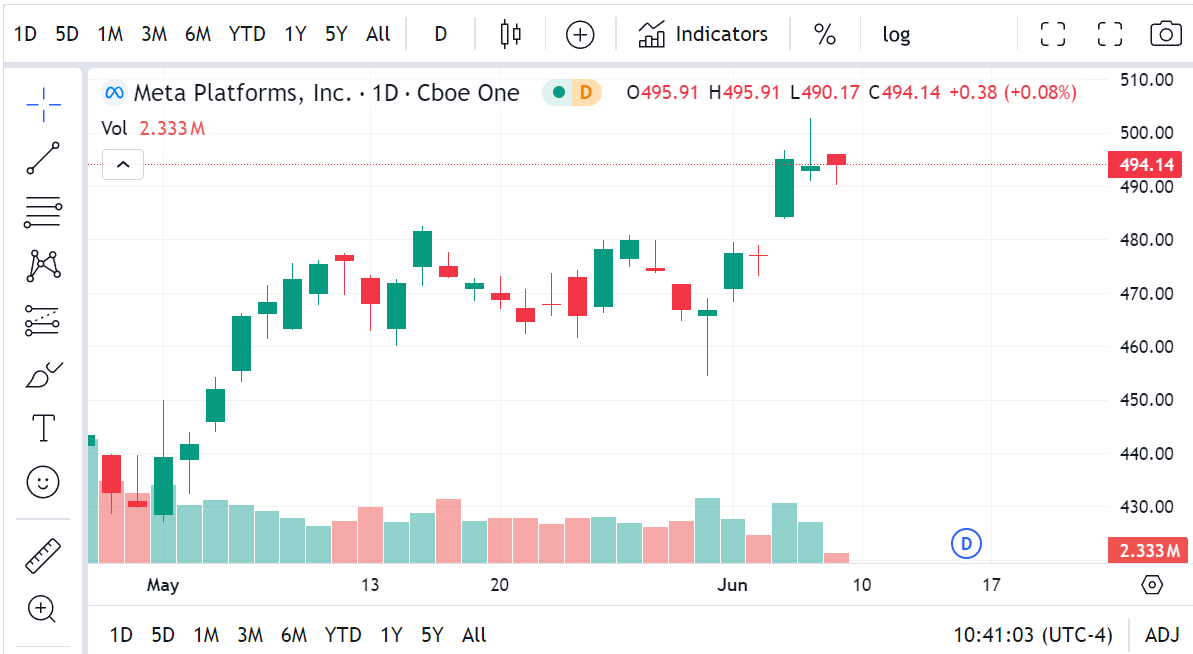

My suggested strategy is to hold FBL for 1-3 days at a time, but only if momentum indicators are clearly bullish. I’ve covered this in previous articles, but it’s worth mentioning again. To this end, let’s take a look at the daily movement of META over the past month.

South Africa

Judging from the big picture, we can see that the first week of May was a good time to enter and exit FBL positions. But there are also some strong one- and two-day momentum opportunities on this chart that we need to look for. The problem is that all of this is backward looking. How do we know if the momentum we saw today is sustainable for the next one, two or more days? This is where momentum indicators come in to help.

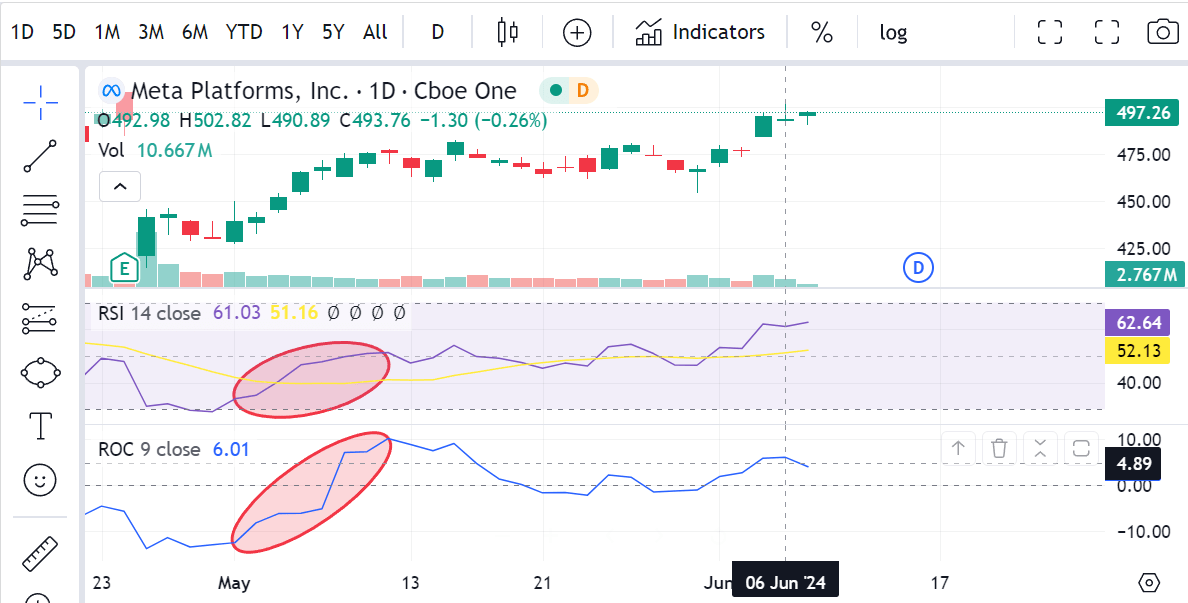

There are several well-known indicators that can be used, such as RSI and ROC. These basically measure the closing price against historical data for a certain period of time and show whether a stock is overbought or oversold and how rapidly that price movement is occurring. Let’s see how they are used in this context.

South Africa

Please note that I am not necessarily recommending this strategy. This is just an example of how such indicators can help you gauge the positive momentum of the underlying asset, which is a prerequisite when dealing with leveraged ETFs. The same applies to the opposite direction reverse leveraged exchange traded products and reverse leveraged exchange traded products. These indicators should be closely monitored so that you can time your exit. The moment the relative strength weakens or the price volatility slows down, it is better to exit and fight again.

Similar to what we have highlighted in the chart above, you will notice there are other occasions where the RSI and ROC have clearly indicated positive price momentum lasting for more than a day. These are entry point indicator signals and we can see several of these on the chart just after May 21st.

Of course, this does lead to additional risk in the form of costs above and beyond the ETF’s expense ratio, which in this case is fairly high at 1.15%, but is reasonable given the type of leverage gains you can enjoy if you do this correctly. You also need to consider trading costs and short-term capital gains. But overall, many investors believe that the additional costs and risk are worth it if the result is a significant gain on the underlying asset (META in this case).

Other momentum indicators you can use include the ADX (Average Directional Index), which compares price ranges to historical periods, the CCI (Commodity Channel Index), which identifies range breaks, and the very popular MACD (Moving Average Convergence Divergence Index). All are based on sound mathematical principles and have been tested and back-tested countless times by technicians, but learning how to read them in a way that helps you identify entry and exit points is a skill that can only be mastered over time.

Now, on to the fundamental side of things.

While TA professionals take pride in their past concrete results, many investors are accustomed to measuring performance based on fundamental analysis, or a combination of both. Both are equally effective in the right hands, and the choice is mainly a matter of prioritizing the nuances of one or the other. I recommend a mixed approach, whereby one signal is verified or denied by the other. I value signals that refute a hypothesis built on other signals more than those that confirm it. This is to avoid falling victim to the confirmation bias that many often fall victim to.

When it comes to fundamentals, META is strong in almost every aspect.

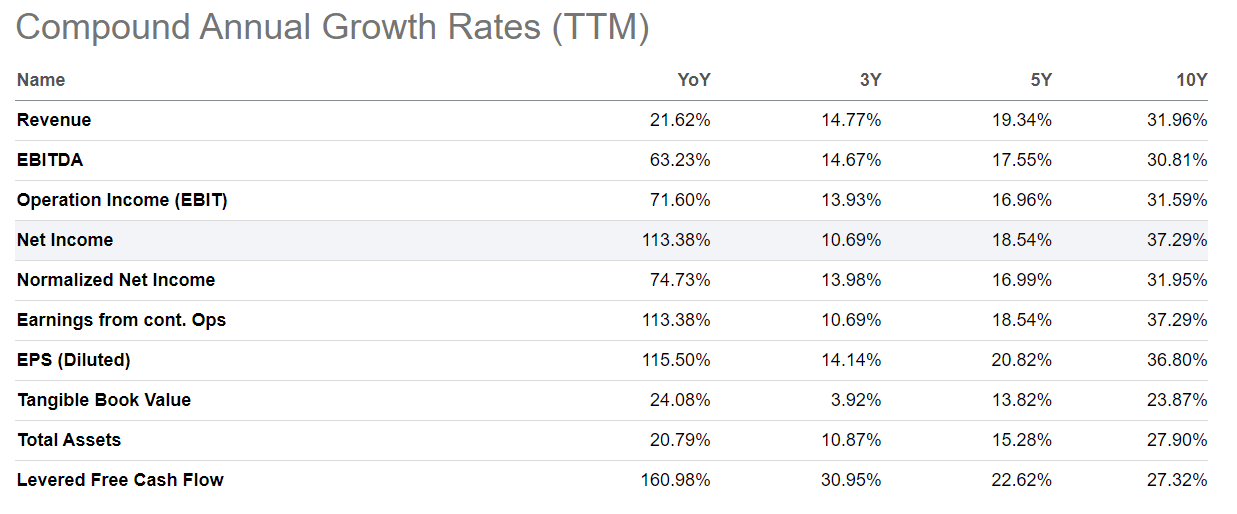

For example, revenue growth projections for the next few years show healthy double-digit growth at the top in FY24 and FY25. In the most recent quarter, META saw revenue growth of 27%. That’s surprising for a company with a market cap of $1.25 trillion, but it is real. On an annualized basis, META has doubled its revenue from FY2019 to the TTM period, which is not bad growth over 4+ years by any standards.

In terms of bottom line, META has also shown incredible resilience, with net profit margins for the TTM period currently standing at 32% compared to 26% in FY19. The company experienced a decline in profitability in FY22 but has recovered very well.

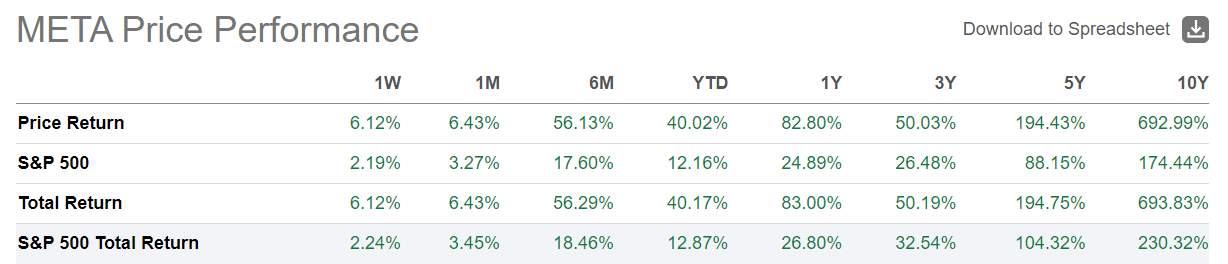

As a result, we can see that META’s price momentum is outperforming the market across all time frames.

South Africa

Investors are clearly rewarding the company handsomely, perhaps not just for the company’s heavy investments in advanced technology, but certainly for the phenomenal growth it has demonstrated in the face of nearly every adversity, including a certain amount of market skepticism. Strong growth profile Overall, this is a megacap to keep an eye on and probably buy.

South Africa

So, should you take the risk with FBL?

While I am recommending a buy here, I do not want this to be interpreted as part of a buy-and-hold strategy. The buys here are made specifically in the context of using leverage in the least risky way possible by letting the experts at GraniteShares do the hard work in exchange for a reasonable expense ratio.

South Africa

FBL’s price and total return profile is attractive, which, if leveraged well, could yield returns as high as 4-5x the overall market return. For more details, Street analysts said: Barron’s reportedthe average price target is around $522 and the stock is trading at $496 at the time of writing, so there is room for about 5% upside. While this is not very promising, 48 of 66 analysts at Barron’s still rate META a Buy, with an upper price target of $600, so a much more optimistic upside scenario of +20%. Optimistic or not, if you choose to trade FBL, be aware of the risks and make sure you don’t bet what you can’t afford to lose. That’s all for now.

Thank you for reading and I look forward to your comments. I hope you understand that all opinions expressed here are my own and that in addition to any recommendations regarding specific securities, readers should conduct their own due diligence.