Aydınmutur

National Grid (New York Stock Exchange:NG)(OTCPK:NGTF) has terminated the RIIO-ED1 compensation scheme. March 2023 It is currently ED2 and is working on the RIIO-T2 regime for the grid from 2021. ED2 was appealed and contested. Transmission and distribution operators are as frustrated as ever over the fact that compensation may not be enough for them, but not just now. In 2021 tooThe lower regulated cost of equity capital has actually caused National Grid to reduce its remuneration rates. Rights issues Countries that already have ample debt capacity at maximum will need to expand their finances to keep up with the electrification trend, perhaps to undertake grid improvements. We have highlighted this as a key issue. In the previous interviewYet, their major RAB growth and capital Investments have enabled growth on a constant currency (CC) basis. With a middling absolute valuation and relatively weak economics, it is not a business we are interested in, but it is worth noting that the valuation is higher than other regulated utilities that might be considered in an adverse operating environment.

Revenue Breakdown

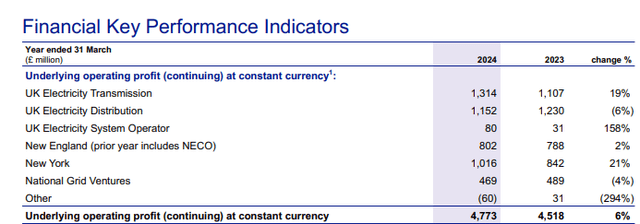

The CC numbers are as follows: All year round:

IS Highlights for the Year (Annual Public Relations)

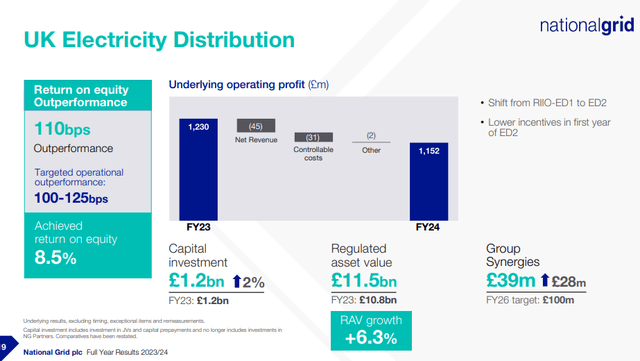

The lower baseline compensation under the RIIO-ED2 scheme has led to lower electricity distribution, which has not been offset by higher investments and higher RABs. In addition, it has increased the operational costs of the electricity grid. This is the ED2 scheme. Although it has the benefit of an inflation-linked RAB, the lower baseline remains a problem, even after being revised upwards from a crude first draft.

Distribution rights (Fiscal Year President)

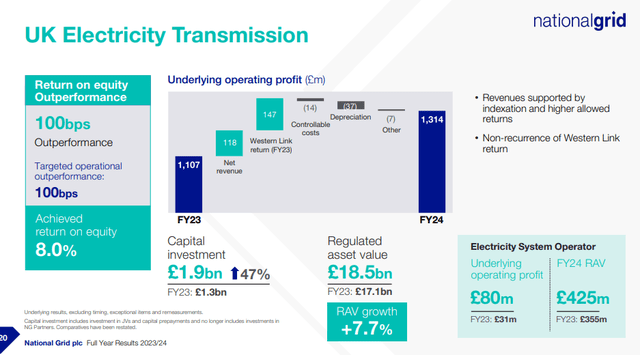

RIIO-T2 is The government also Complaints from operatorsBut at least it is indexed, so over the past few years it has been able to link rising capital costs to the current rate environment and increase compensation accordingly since the scheme came into force in 2021. Half of the growth in this segment is due to penalties from Western Link, a major project by UK regulated utilities to enable the export of clean energy from Scotland to the grid of England and Wales. This is a temporary positive effect and is linked to investigations into the timely delivery of the project.

UK Transmission Rights (Fiscal Year President)

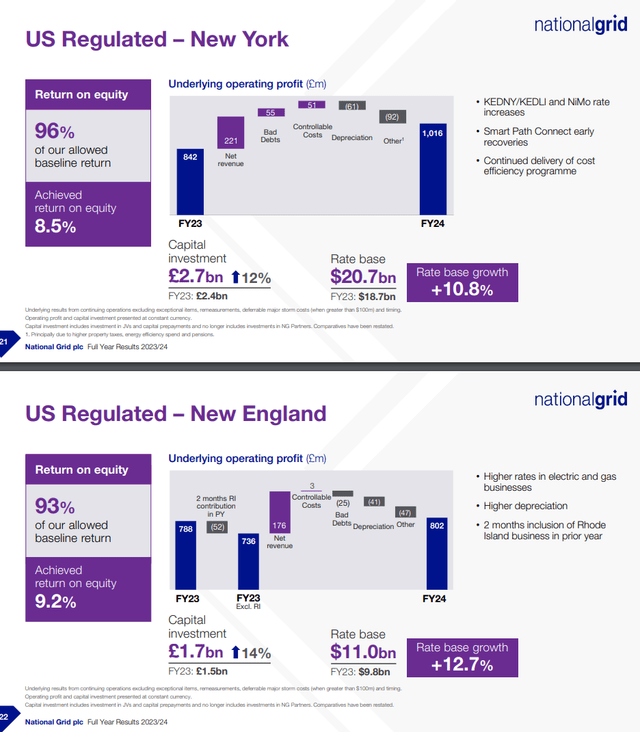

Regulatory pressures were less severe in the United States because electrification was introduced later, and NG was able to negotiate tariff increases with utility authorities, achieving fairly large tariff increases in New England and New South Wales. In New YorkThese U.S. concessions, which typically represent around 40% of operating profits, are attractive from a regulatory perspective.

US Concessions (Fiscal Year President)

Conclusion

Ofgem has reduced its cost of equity to a level nominally consistent with low-beta equity returns. Low assumed interest rate of approximately 5.23% in totalis hitting the distribution business. RIIO-T1 was previously unusually attractive for transmission concessions, but the change to T2 in 2021 has brought things back to reality. Taken together, these have been the last few years of increasing regulatory pressure and virtually no excess returns on infrastructure investments. Of course, NG receives less volatile cash flows in return, but the situation in the UK concessions is not much better and there are concerns, especially in an inflationary environment, whether extensive indexation will fully compensate operators who have to bear the risk of operating networks at rising costs. US concessions do not have that problem, accounting for nearly 50% of their business on a standardized basis.

Technically it is still a growth business as there is a lot to do in terms of expanding the RAB and meeting consumer grid demand, but if that additional investment is made at around the right price, there is no room for significant value creation in the economic setup of the UK concession. Again, US concessions have more freedom.

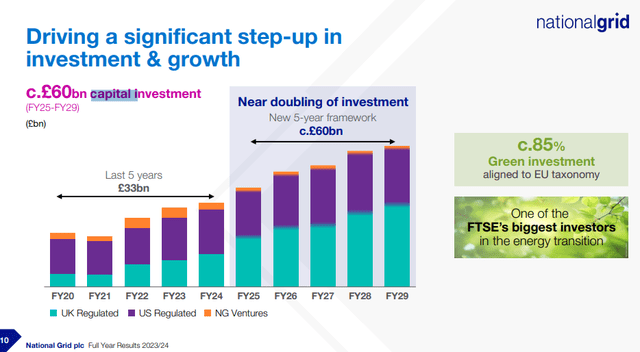

Highlighting the problem is the issue of stock acquisition rights, which increased the number of shares by around 30%. This is of course dilutive and may also reflect peaking of debt capacity, with net debt at around 10 times underlying operating profit and cash flow. The need for this external financing at a time when debt capacity is at its peak reflects the lack of a compounding engine, so it was not surprising that the market reacted somewhat negatively. Revenues will gradually fall below the cost of these funds, but NGG is fundamentally obliged to make improvements. This is all on top of the rapid growth of assets it currently maintains, which are almost entirely biased towards the UK rather than US concessions.

CAPEX Mount (Scheduled for FY2023)

These are all negative factors and are also why I am not very interested in the stock at a multiple of 13x due to the relatively weak absolute earnings yield, despite expected EPS growth of 6-8% even after the rights issue. However, I note that on average, the stock is in a much better position than peers such as Redeia (OTCPK:RDEIY). Spain’s CNMC has always taken a tougher stance than UK regulators on compensation, and NGG has made concessions in the US. Still, Redeia trades at about 17 times PE on a forward basis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.