mbbirdy

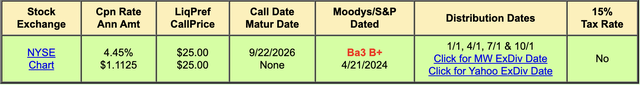

Vornado Real Estate Trust (New York Stock Exchange:Cryptocurrency) Series O Preferred Stock (New York Stock Exchange:VNO.PR.O) trades at a significant discount to its par value, offering one of the best risk/return profiles of any publicly traded REIT preferred series. With a yield of about 48%, the annual coupon is $1.1125, giving a yield on cost of 8.5%. The discount to face value means the preferred stock is effectively handing over for 52 cents on the dollar, despite being close to Vornado’s stronghold. Balance sheetthe favorable trends seen in Manhattan office real estate, and a resumption of declines in consumer inflation. Therefore, I swapped my Series N Preferred for O Preferred in order to capture any upside above par value as I expect my bull thesis to play out over the next decade.

Even after adjustment, this discount rate is not commensurate with the depth of the balance sheet. A low headline coupon rate of 4.45%. VNO’s preferred shares areBB-Although VNO lost its investment grade rating in August last year, it is rated ” ” by Fitch Ratings.

Manhattan office trends are expected to improve amid a collapse in new office development, with newly opened office square footage expected to fall. 1 million square feet Through 2029. This is as high interest rates disrupt the pipeline of new office developments while accelerating a broader flight to quality office space. Additionally, office properties are being blacklisted by institutional investors, reducing the liquidity available to developers in the sector and further reducing downstream supply. An IPO boom in 2025 could disproportionately benefit job creation in Manhattan. The Commons is down 16% since I November 2017. Last covered REITs.

Balance sheet depth and free cash flow

Vornado Realty Trust Supplemental Fixed Income Data

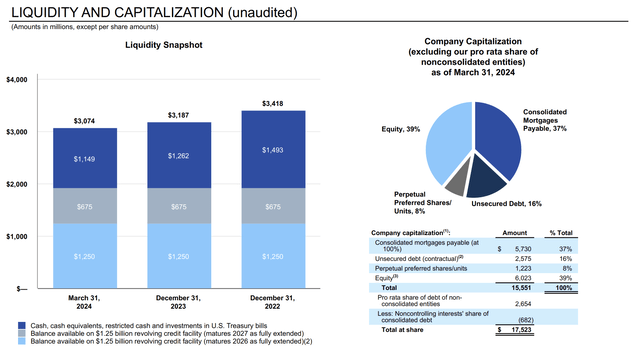

VNO liquidity at the end of the first quarter of fiscal year 2024 $3.07 billionThat’s down quarter-over-quarter from $3.19 billion, but still represents significant depth relative to the REIT’s market cap of $4.92 billion. This is great news for the Series O preferred stock, which requires annual coupon payments of $13.35 million, equivalent to 3.86% of VNO’s trailing 12-month leveraged free cash flow. $345.7 million As of the end of the first quarter. Coupon rates, federal funds rates, and the credit quality of the underlying issuer determine the preferred discount level. VNO Series O Preferred trading at 52 cents on the dollar and yielding 8.5% is odd given the free cash flow coverage and VNO’s extremely high quality Class A real estate portfolio located in one of the most dynamic and sought-after real estate markets in the United States.

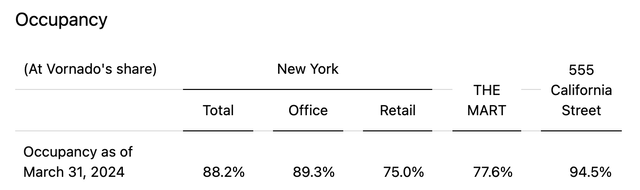

VNO’s total occupancy rate ended the first quarter at 88.2%, down from 89.4% in the previous quarter, with New York office occupancy at 89.3% at the end of the quarter. Declining occupancy rates are a big risk for VNO, and the REIT has yet to stabilize this figure. However, the company’s office occupancy rate is still well above the overall U.S. office vacancy rate. 18.3% April. REIT New York office leasing activity for the quarter was 291,000 sq. ft. Original rents were $89.23 per square foot, and the long-term weighted average lease term was 11.1 years. An additional 36,000 square feet of retail space was leased in New York during the quarter.

Vornado Realty Trust First Quarter 2024 Results

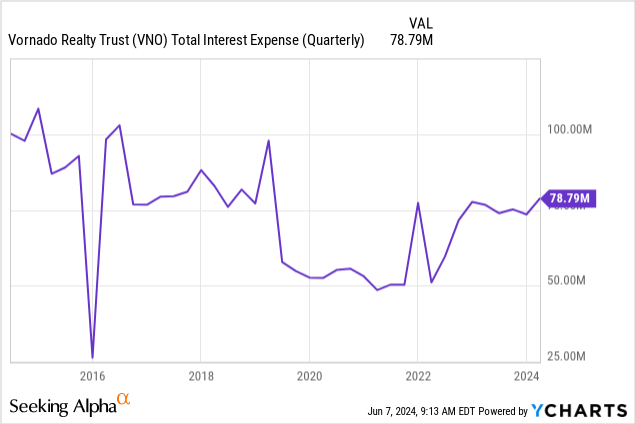

VNO reported first quarter earnings $436.38 millionFFO declined 2.1% year over year to $0.55 per share from $0.63 in the fourth quarter. The decrease in FFO reflects a significant increase in the REIT’s total interest expense due to rising base interest rates, which was $78.8 million in the first quarter, the highest level since 2019 and is expected to rise further as VNOs refinance maturing debt at higher interest rates on the back of rising long-term interest rates.

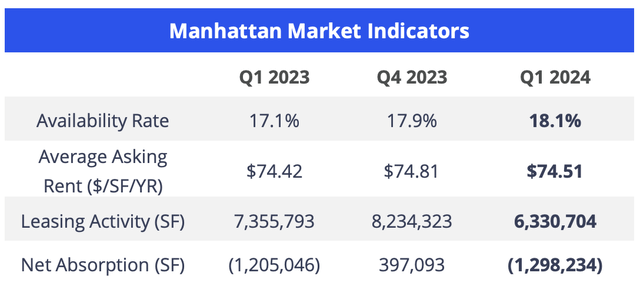

Manhattan Office Real Estate

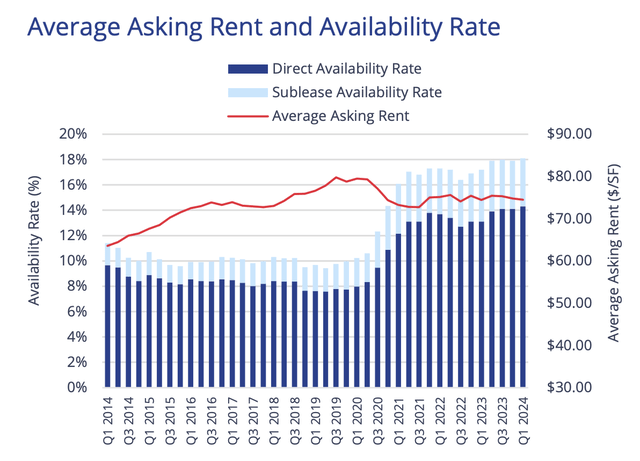

As Manhattan continues to recover from the effects of the pandemic, VNOs are seeing an improving real estate environment. The average asking price per square foot is $74.51 Vacancy rates increased 9 cents year-over-year in the first quarter of 2024, with the vacancy rate increasing from 17.1% to 18.1%. Net absorption was negative at 1,298,234 square feet, but the vacancy rate plateaued and is now plateauing.

VNO could face a reversal of its currently depressed occupancy rates if the collapse in new office supply and underlying positive trends in demand for Class A office properties outweigh the fallout from the pandemic impacts. I believe the Series O Preferred Stock represents the best way to gain exposure to VNO and a brighter outlook for Manhattan Class A office owners.