Atitat Sinagowin/iStock via Getty Images

The stock market will start the week pricing in disappointingly strong May employment growth data due on Friday. While the public would like to see an economy with more jobs, the stock market would like to see a decline in employment. The central bank cuts interest rates.

Investors are anticipating two more economic indicators. On Wednesday morning, the BLS Inflation report for May 2024In my preview report, I expect clothing prices to rise, food prices to remain stable, and auto-related products to fall. At 2:00 p.m. on the same day, the Federal Open Market Committee (FOMC) will release a statement and announce its monetary policy interest rate decision.

Ahead of this meeting, the CME FedWatch tool lowered the odds of a rate cut following both meetings. June and July Federal Reserve meeting. Market expects interest rates to rise What insights will next week’s FOMC provide if interest rates are to remain unchanged for longer? Additionally, in September, the Fedwatch tool indicated an increasing likelihood that interest rates will remain unchanged. The probability rose to 51% from 31.3% on June 6, 2024.

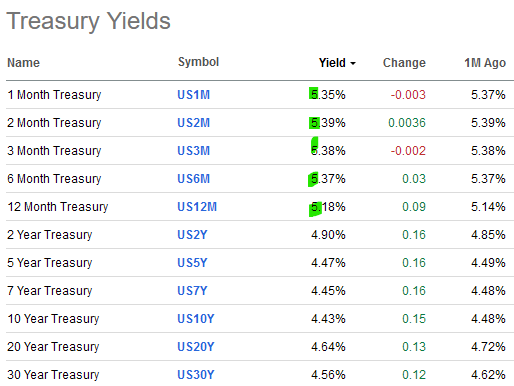

Readers should keep an eye on Treasury yields again after the meeting. The yield is almost the same Compared to interest rates a month ago, short-term interest rates are over 5.0% and are generally lower for those maturing within two years (US2Y) onwards.

Find Alpha

The FOMC may offer investors five insights into the stock market.

1/ Insights into Job Growth in May 2024

Nonfarm Payrolls in May 272,000 increaseThe market had expected the economy to add 182,000 jobs. The health care sector added 68,000 jobs in May. The government reopened and hired an additional 43,000 people. Leisure and hospitality employment increased by 42,000 in the month, while food service and restaurants added 25,000 jobs.

Within the realm of job growth, readers should discount government employment data. This is partially correlated with fiscal policy, which also puts pressure on inflation. Governments use such fiscal funds to hire civil servants, which results in stronger employment reports. The FOMC may deduct these jobs to assess the effectiveness of monetary policy. More importantly, banks want the economy to add jobs to the supply side of production. Since inflation is demand-driven and supply-constrained, adding jobs to production increases supply, mitigating inflation.

As for stock investment ideas, investors should continue to invest in the defense industry given the rise in government employment.RTTX 10.0For example, closed at an all-time high.

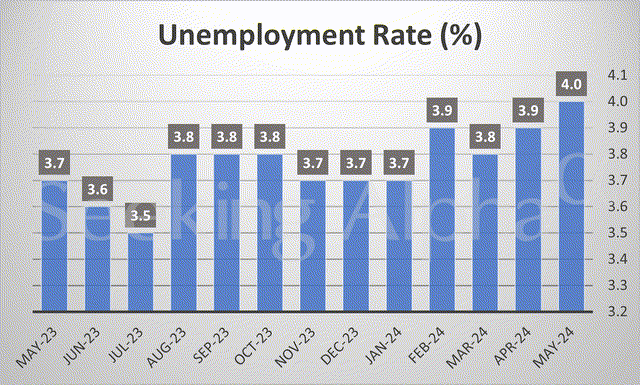

The FOMC: Rising unemployment rate The labor force participation rate fell to 62.5% in May from 62.7% in April, the highest level in two years. Highest price since May 2002However, the BLS reported that employment nearly doubled.

May 1st, 2024 Press ReleaseThe FOMC noted that job growth remains strong and the unemployment rate remains low. Given that job growth strengthened last month, the Committee should expect the employment impact to be small by leaving the current federal funds rate unchanged at 5.25% to 5.50%. The Committee will likely reiterate its statement that monetary policy is better balanced in achieving its employment and inflation objectives.

2/How to read the Core Personal Consumption Expenditures Price Index

The Fed is due to comment on the PCE price index excluding food and energy. April saw a 2.8% increase This is roughly in line with the past three months.

|

Change from a year ago |

|

|

April 2024 |

2.80% |

|

March 2024 |

2.80% |

|

February 2024 |

2.80% |

|

January 2024 |

2.90% |

Data source: https://www.bea.gov/

The Federal Reserve likes this index because it excludes food and energy. By excluding price fluctuations, the Federal Reserve experiences persistently high inflation above its 2.0% target rate. The Federal Reserve comments on the prices of services. 3.9% increaseis the main contributor to the index. In comparison, commodity prices rose 0.1%.

3/ Timing of interest rate cuts

Markets initially ignored Friday’s strong jobs report and rose in the morning. Selling accelerated in the early afternoon.Hehehehe) ended the week up 2.72%.International Hydrology) fell 1.17% on Friday and is down 2.22% for the week. Small businesses are sensitive to interest rate levels. This group is not interested in rates remaining unchanged in June. Instead, they will be listening to any changes in the FOMC policy statement and Fed Chairman Powell’s choice of words during the question and answer session.

The Fed and stock market will also likely react to the CPI report due next Wednesday morning, which should show inflation trending steadily downwards towards 2.0%.

Although unlikely, a strong May CPI reading would rekindle fears that the Fed might raise interest rates. Still, it is unlikely that the Fed Chairman would signal a change in his wait-and-see approach. Since September 2023, the Fed has signaled that interest rates will remain steady and may cut a few times. A sudden reversal of policy could destabilize the market bull market.

4. Explaining GameStop, meme stocks, and speculation

The media may question Fed Chairman Powell about the rampant stock speculation at companies like GameStop.global) and AMC Entertainment (AMC). Powell is expected to deny that the two failed businesses have any influence on monetary policy. Also, the trading range of GME shares between $9.95 and $65 is a matter for the Securities and Exchange Commission. Valuations of both companies will likely be adjusted downwards as management takes advantage of market folly and the stock price surge to sell shares to retail investors.

GameStop took advantage of the market’s blind optimism by selling shares twice. The company filed for sale. Up to 75 million shares June 7. May 24 Sold 45 million shares to raise $933.4 million.

Trump Media (David) is another example of extreme speculation. Sales revenue of $770,500 The adjusted EBITDA loss was $12.1 million, but the company’s market cap is $7.88 billion.

The stock market needs more than rising interest rates to tighten credit conditions. Until then, stocks at crazy valuations will be isolated moves between speculators and short sellers. In that scenario, companies are effectively the “house” in the casino. The house almost always wins.

5. Bond Yields

Treasury yields rose on Friday following a strong employment report. They could spike again after inflation data. Wednesday’s FOMC statement will have the most impact on bond yield prices. In a press release last month, the committee said it would “slow the pace of decline in its holdings by lowering the monthly maturity limit on Treasury securities from $60 billion to $25 billion.” It also said it would “maintain the monthly maturity limit on agency debt and agency mortgage-backed securities at $35 billion.”

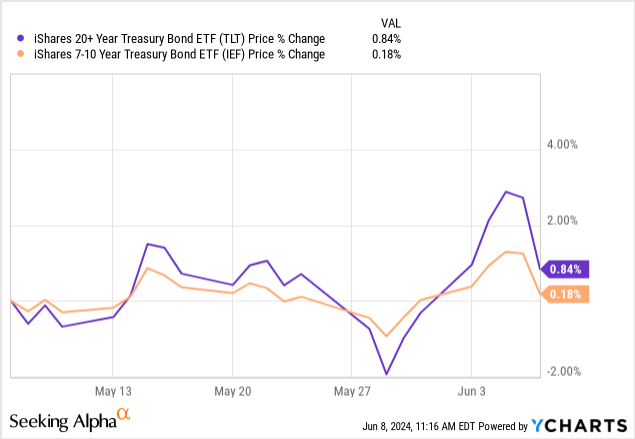

Last month, the 20+ year old U.S. Treasury bondTLT) rose 0.84%, while 7-10 years rose 0.18% (IEF).

Your takeaway

Stocks will not have a clear direction until the FOMC meeting is over. The market is already expecting interest rates to remain on hold. This will hurt the euro.FXE) and the Canadian Dollar (FXC) will lower import costs in the coming months, benefiting the U.S. economy.

Speculative stock trading volume is expected to continue. Long-term investors should ignore the noise. In fact, unchanged interest rates make short-term bonds more attractive (SingaporeHe also argues that there is profit to be made from bubble sectors such as the Nasdaq.Hehehehe) and the S&P 500 (SP500).