Landscape and nature photographer based in upstate New York

Introduction and Investment Thesis

Chipotle Mexican Grill Inc. (NYSE:New York Stock Exchange:CMGB) operates restaurants serving burritos, burrito bowls, quesadillas, tacos and salads made with fresh, high-quality ingredients, and the company’s stock price has outperformed the S&P 500 and Nasdaq 100 year to date. The company: Revenues in the first quarter of FY24 Through April 24, sales and operating income increased 14.1% and 20%, respectively, year over year, driven by increased volume and scale from improved throughput, relevant brand campaigns and menu innovations. Additionally, same-store sales increased 7.0% year over year, and the company opened 47 new restaurants, 43 of which were Chipotlanes, bringing the total restaurant count to 3,479.

Management raised its outlook for same-store sales growth to mid- to high-single-digit percent but also warned that selling costs, such as raw materials, may rise. Rising prices for produce such as avocados and rising wage inflation could pressure near-term margins. While the company has thus far been successful in passing on costs to consumers without weakening its growth outlook, I believe a weakening labor market and macroeconomic uncertainty increase the risk of a consumer spending recession that could hurt Chipotle’s top and bottom lines. Furthermore, given the outlook for future earnings growth, I believe investor optimism is rising, increasing vulnerability to a significant near-term price correction. Assessing both the “good” and “bad” points, I believe near-term valuation risks outweigh the upside potential, making it a “sell” at current levels.

Pros: Strong first quarter revenue driven by increased volume and scale; higher throughput and menu innovations drive customer engagement; improving unit economics

Chipotle reported first-quarter fiscal 2024 results, reporting revenues of $2.7 billion, up 14.1% year over year. This was driven by strong same-store sales growth of 7% year over year, the opening of 47 new restaurants and 43 Chipotle Lanes, which increased store capacity, as well as increased awareness from successful marketing campaigns and menu innovations, including a spotlight on Barbacoa and the limited-time return of Chicken Al Pastor.

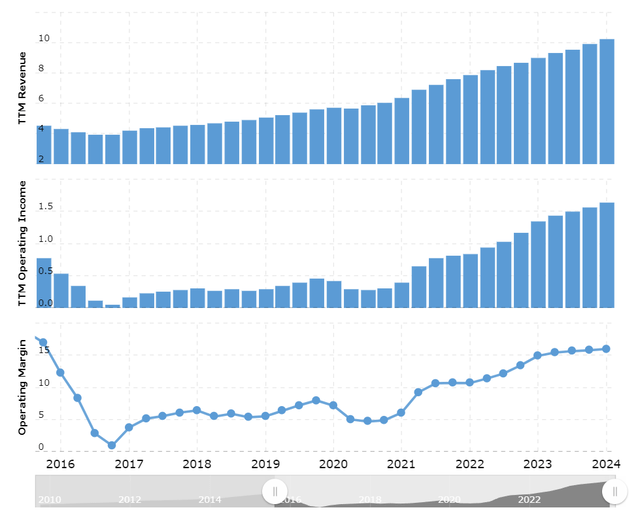

Macro Trend: Revenue and Operating Margin Growth

Between Earnings ReportBrian Nicol highlighted several key strategies that are helping the company win in a challenging macroeconomic environment. The company continues to see strong foot traffic, with brick-and-mortar sales up 19% year over year, and a growing digital presence, with digital sales accounting for 37% of first quarter sales. In this article, we discuss three key strategies the company uses to attract and retain customers to evaluate its long-term investment thesis.

The first strategy I want to talk about is that they are focused on running successful restaurants by serving great food and giving their customers a great in-store and digital experience. The company takes great pride in preparing healthy, delicious food to the highest standards, but they also care about throughput. Compared to last year, they can now serve nearly two entrees in 15 minutes, and they are dedicating resources to better training their team so they can meet demand without stress. I believe that the speed of service in their restaurants plays a key role in enhancing the guest experience. As the company continues to improve throughput, they will benefit from increased business volume and lower turnover, while at the same time reducing customer wait times and delivering hotter, fresher food faster.

The second strategy I want to talk about is their go-to-market program to build compelling and relevant brand campaigns and menu innovations. Aside from the continued success of their “Behind the Foil” brand campaign, which showcased the team handcrafting their fresh ingredients across all media channels, including the NFL playoffs, they also launched a promotion for their Braised Beef Barbacoa, highlighting the recipe for the dish and successfully driving transactions and spend. At the same time, they also brought back one of their most requested new menu items, Chicken Al Pastor, allowing the brand to connect customers with a relevant food experience with seamless execution. At the same time, I love how they are leveraging the digital reach of their 40 million rewards members to roll out targeted promotions to increase purchase frequency and spend while also driving new sign-ups.

A final strategy to note is the company’s culture of investing in technology and innovation to improve productivity. This includes the automated digital make line and Autocado, which will be rolled out to restaurants during the profitable half. We believe these technologies will drive greater consistency, especially in our higher volume restaurants, further driving overall improvements and increasing customer engagement and business volume.

Shifting gears to improve profitability, the company spent 28.8% of sales on food, beverage and packaging, down 40 basis points year-over-year. This was primarily driven by menu price increases effective October 2023 due to rising food prices, such as beef and produce. At the same time, labor costs also decreased 20 basis points year-over-year to 24.4%, as increased sales force driven by higher transaction volume and higher spend per customer helped offset wage inflation. Meanwhile, the company posted GAAP operating income of $441 million, with a 16.3% margin, up 20% year-over-year, benefiting from improved unit economics due to higher transaction and order volumes, as well as lower delivery and marketing expenses.

The bad: As consumer spending slows, fluctuating food prices and wage inflation could put pressure on profit margins.

While the company raised its guidance for full-year same-store sales growth to mid-to-high single digits, comments made by management on the earnings call raised concerns about overall near-term profitability. During the earnings call, management suggested wage inflation could rise to about 6% as a result of the California minimum wage increase, along with possible increases in the price of some raw materials, such as avocados. Thus far, the company has seen solid consumer demand due to a strong labor market and stable financial conditions, and has been successful in passing on incremental costs to consumers in the form of higher menu prices without hurting sales. However, if food price volatility and wage inflation remain elevated, this could change over the next few quarters, making it less likely that the company will be able to pass on costs to consumers. This would be the case if the company saw weak labor market conditions and worsening overall macroeconomic conditions that would likely lead customers to visit Chipotle less frequently and spend less.

At the same time, the company has had successful international expansion in the Middle East, Europe and Canada, with Canada leading the way in key operational metrics such as throughput, but there is uncertainty about replicating a similar growth story in all international markets, which could lead to increased marketing and other operational expenses, while at the same time pressuring overall profit margins.

In summary, Chipotle is overvalued at current levels.

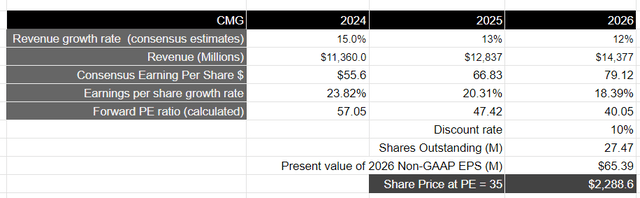

From now on, Consensus Estimates To arrive at a fair value for Chipotle, we need revenue and profit growth over the next three years. Therefore, assuming revenue growth in the low to mid teens over the next three years, which we believe can be achieved by increasing throughput through investments in training and technology, attracting customers with relevant brand campaigns and menu innovations, and expanding internationally, it should generate revenue of $14.37 billion by FY27.

From a profitability perspective, the consensus estimate for FY27 non-GAAP EPS of $79.12 is expected to grow faster than overall revenue growth. This will be possible as the company improves its unit economics during the period, barring a significant increase in food prices and wage inflation. This equates to a present value of $65.39 in EPS, discounted at 10%.

Seeking Alpha: EPS consensus estimates

photograph S&P 500 as a proxySo, with companies growing earnings at an average of 8% over a 10-year period and trading at a price-to-earnings multiple of 15-18x, I believe Chipotle’s stock should trade around 2x earnings given its earnings growth over this period. This equates to a P/E of 35x, below the current expected P/E of 40, or a price target of $2,288, 27% below current levels.

my Previous article Wingstop (NASDAQ:wing), I believe Chipotle has managed very well in stimulating consumer demand during a time when an uncertain macroeconomic environment has forced it to increase inflationary menu prices. Fundamentally, the company is well positioned to drive continued growth going forward, focusing on enhancing the in-store and digital customer experience in the U.S. and internationally, while simultaneously improving throughput to increase volume and scale, and serving healthy, delicious meals prepared to the highest standards. However, I believe consumer spending will likely slow from current levels, especially if the labor market weakens and we enter a volatile environment where food and wage price inflation could reduce near-term profit margins. Assessing both the “good” and “bad” sides, I believe the stock is vulnerable to a near-term downside and a “sell” as investor optimism rises at current levels.

Conclusion

While I am impressed with the company’s performance to date, I am not planning on initiating a position at current levels and will wait for a better entry point. Until then, I rate the stock a Sell at current levels.