Evgeniy Akimenko/iStock Editorial via Getty Images

Dear subscribers,

In this article, I’ll be discussing a potential opportunity in the oil/gas market and biofuel segment in Europe that I consider to be attractive as an investment. I have covered Neste (OTCPK:NTOIY) before, but the company has seen decline in its share price based on shortfall In earnings and cash flows due to, among other things, biofuels not really turning out in the short term as the company expected them to.

This has left this €15B market cap company out of Finland, yielding over 6.3% at this time, in a situation where it is trading at a single-digit P/E, despite some fundamental upsides and safeties that make other energy companies look rather pale by comparison.

I believe the time has come to double down and expand on Neste, and I will show you in this article why this is something I intend to do here.

I’ll also provide this because it might be the first time some of you have heard or read about Neste – so I’ll show you why I like this company.

This article is in part a response to a subscriber request, but also an update for a company I spend a lot of time and capital investing in and looking at.

Neste – Why Finnish oil might be a good investment over the long term.

Despite the relatively unknown state of this business, it’s a €15B+ (and almost €30B at where I consider it properly valued) market cap oil business and is the global leader in all things biofuel. This is a potentially huge market, but one that over the last few years has taken a few hits on the chin due to some structural factors. Also, the crisis and the Russian invasion of Ukraine have not helped anything in Finland, because prior to this, the Finnish economy was fairly “intertwined” with the Russian economy in some areas, with prior to the war close to double-digit and double-digit export and import numbers respectively.

So for the Finns to wean themselves off Russia has been painful. There are plenty of company examples of this, with Nokian (OTCPK:NKRKY) and Fortum (OTCPK:FOJCF) being two of the primary examples.

Don’t mix up Neste and Nestle by the way. One is the global leading consumer goods brand – and the other is a Finnish oil major.

Neste has markets around the entire world, operates two large refineries in the Nordics which account for almost 20% of the Scandinavian production capacity, and has an appealing overall profile. I’ve been in and out of this investment at various junctures, but currently hold a respectable 0.9% portfolio position in the company – and one I intend to expand.

Neste was once part of the Finnish company Fortum, where I own a very large portfolio stake of over 2%, but was eventually split off going on 20 years ago. It’s still owned to 40%+ by the Finnish state, and as such, has a near-majority shareholder – and a positive one.

The company hasn’t applied for credit rating scores from any agency and thus holds none. The company carries minimal debt, around 0.15X net debt/EBITDA, with over 70% of borrowings in bonds at an average maturity of 3-4 years. From a long-term debt/cap perspective, the ratio is under 30%.

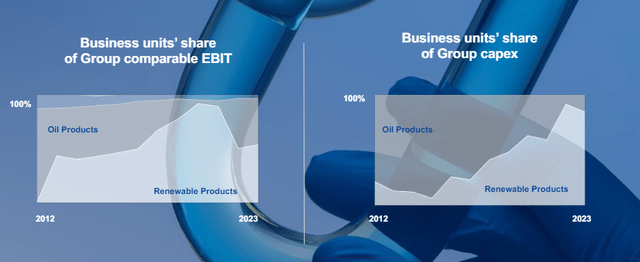

Neste is a story of a legacy transformation into renewable fuels. This can be expressed, and viewed in a couple of ways.

For its work, the company has received global acclaim and recognition among various ESG ratings and “pushes”, including CDP, MSCI, one of the only oil majors to reach an MSCI ESG rating of AAA.

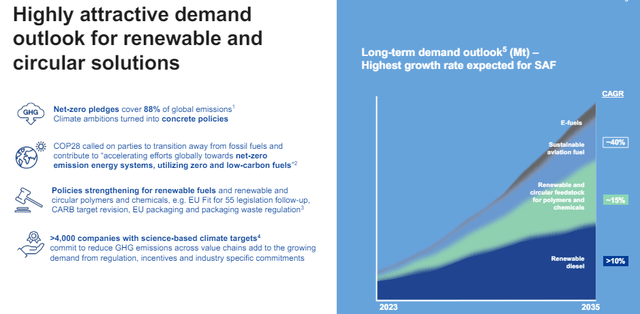

The company is essentially a play on the coming demand for renewable and circular fuel solutions, and it’s a hedge against the legacy oil/energy market without having to leave fossil or the sort of fuels behind entirely – because I do not believe this to be possible.

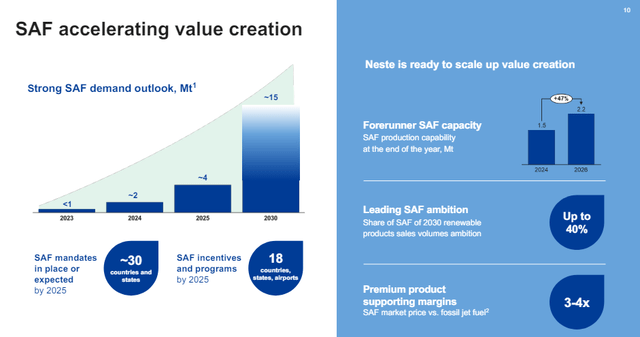

The company is, for this, being heavily punished by the market because the margins and costs for these types of products are less favorable than for legacy – but for the long term, the company believes this to turn around, with a strong outlook for SAF demand going into 2025-2030, more than quintupling in less than 7 years.

Why you would invest in Neste are essentially three reasons, as I see it.

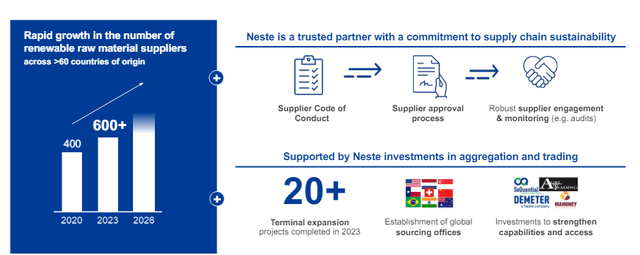

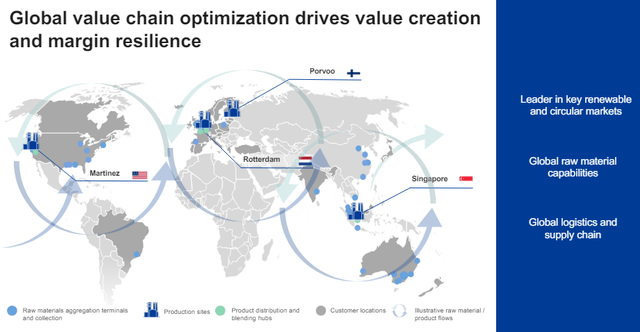

First, the company is the world leader in high-margin renewable and circular fuel products and services. It already has the know-how, the infrastructure, and everything necessary to make this work – and it has been pushing for this for over 10 years at this point.

Second, the company has deep global raw material capabilities, with plenty of sourcing in recyclables and renewables.

Third, the company has a very strong history of value-driven growth and innovation.

For many years, Neste has been synonymous with “renewable diesel”, as though the company equals only this. The company has slowly been growing its share of sustainable aviation fuel, or SAF, and renewable feedstocks for the petrochemical industry.

Going forward, this is expected to significantly improve and change to where SAF makes up with the renewables a combined 50% of sales, with renewable diesel becoming less and less important.

It is to me an undisputed fact at this point, that the market took out the company’s victory well in advance – with inflated valuation and dream-like multiples for several years, expecting the company to deliver results the company had, in my mind, no chance of really delivering.

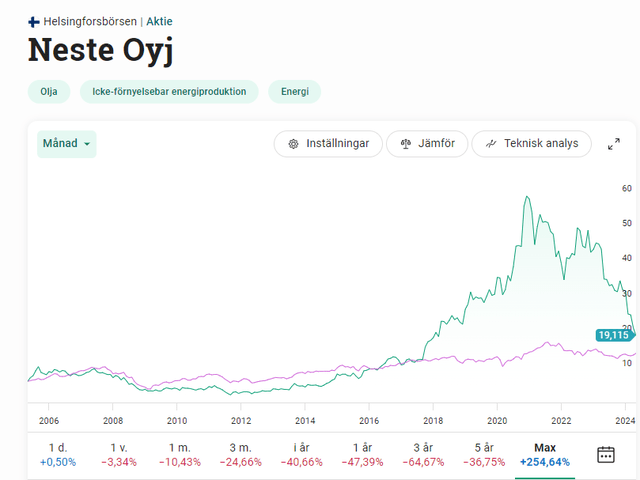

Neste Share Price Evolution (Neste Share Price Evolution – Avanza)

While long-term investors have done well, as you can see, short-term ones are in a loss position – that includes me. I too was too positive on this company.

However, at this time, I believe the market is being too negative.

The global petrochemical and fossil market is moving towards recycling, waste reduction, and other approaches where Neste is already a leader. Coupling this with SAF and other approaches, I see only one turnout for Neste over the long term, unless the company deteriorates entirely for some reason.

Neste already has the scale advantages necessary to really push this, and global sourcing and aggregation bring this to a sharp point.

The future for Nestle is being an ESG-friendly supplier of feedstock to the petrochemical industry, an ESG-friendly supplier of various types of fuels to both the aerospace/airplane industry as well as to anything running on diesel. Neste is continuing to invest in its assets, such as the Porvoo refinery, but it already has the global footprint necessary to eventually dominate this space in an even more “real” way.

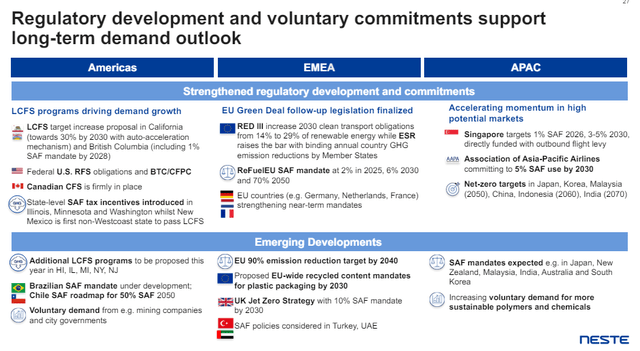

The regulatory environment for these sorts of solutions continues to be very positive, especially in the EU. Far better than explaining it piece by piece, here is a graphic that summarizes some of the emerging developments in the space.

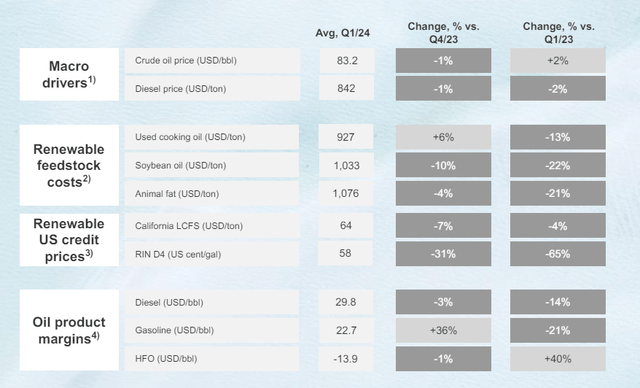

If you’re still unsure, let me show you 1Q results. You must (as I see it) expect that for this year, the company is going to be negative – because the realistic chance of this is extremely high. We’re talking a significant EPS decline. Group EBITDA for 1Q was down to €551M, with an almost halving in sales, and a slightly worsening margin.

This was despite a growth in the volume of renewable sales, but ROACE dropped by over 11%.

The company saw a worsening in renewable products margins, and all of this resulted in a build-up of product and inventory – which is also a conscious strategy on part of Neste due to upcoming maintenance activities – so things here look fairly grim.

Furthermore, there was a non-trivial impact due to margin declines in the renewable diesel market, which showed lower sales, seasonally lower demand, and Martinez JV impact, diluting the Neste margin.

The only segment that really saw good trends was, ironically enough, the legacy oil products market. This is where Neste is transforming Porvoo. Short term and for the quarter, things are looking bad.

But, dear subscribers, under the hood, things are happening.

The company’s efficiency is improving, it has a far more streamlined set of operations, the company has secured cheap, green funding for up to €1.6B, and despite everything, risk management is in strong focus here. Despite the material increases in leverage, because at one point the company was debt-free, the company is meeting its ROACE targets of >15%.

The company’s plan is long-term – for at least the next 5 years or so. But for 2024, the company is planning a series of long maintenance for all of the company’s major assets, and coupled with the market macro, I think we’re in for a very poor 2024E in terms of performance.

But if there is one company investment in this space of renewable fuels that one should consider making, I believe that to be Neste. This is a company that goes fully against the grain of legacy and pushes ahead into markets, that are as of yet largely untapped.

If this is successful, I have no doubt investors who put money to work could see a 3-8x RoR on their invested capital – again, over the long term.

But even in the case of normalization in 2025-2026, there is the potential for triple-digit RoR, if the demand for sustainable/biofuels reaches the levels that I would expect them to reach based on current industry and company forecasts. There’s a current slump in both adoption and sales of the company’s products, as well as increased CapEx for further asset transformation (as well as maintenance downtime) which is weighing the company down – this is especially true for this fiscal of 2024E – but once those are “clear”, and we see more positive industry trends, normalization, in this case, means the company’s earnings “moving back up”, as you’ll see in the forecasts below.

Neste – Why I am positive and what my targets are.

Since my last article for Neste, I have moderated my investment targets – and I am not saying that right now is the best time to invest in Neste. I would probably wait to see the evolution of the company’s share price during this year because to put it frankly, we might get the company cheaper.

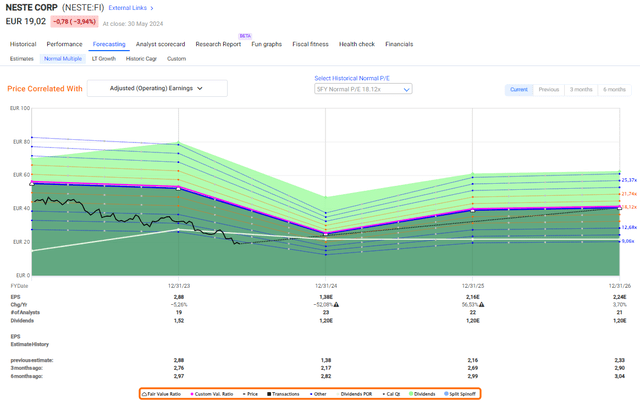

But the company is very attractive at this time. In my last article, I gave it a PT of €47/share – and I’m lowering this only to €42/share here to account for slight margin normalization and reversal once the company’s earnings turn around. The exact math of this includes me expecting a reversal from the company’s current share price of just south of €19/share, over time to a normalized P/E of around 16-18x. At a normalized level of earnings of around €2.25, which by the way is significantly below the 2023A level, not to mention the 2022A level, this implies that upside to a €42/share at the top-range end at around 18x. I justify this level, pointing to the company’s leadership in several crucial fields, the most significant of which are biodiesel and sustainable aviation fuel, which I believe will provide the catalyst for higher valuation, once this reverses.

Neste currently trades at a normalized P/E of below 8.5x, compared to an average of 15-20x P/E – so around half or even less. This is a cheap level, but it’s also a potentially justified level, given where the company is currently forecasted to go.

Neste Forecast F.A.S.T Graphs (Neste Forecast F.A.S.T Graphs)

As I said, 2024 is not expected to be a great year. However, at this point I want to emphasize that historically speaking, Neste beats estimates more than 10% almost 80% of the time, and hits them 8.33% of the time, meaning the company does not negatively miss forecasts on a 2-year basis more than 15% of the time (Paywalled Source F.A.S.T graphs).

The implication here is that Neste has the potential to outperform confirmed based on historical trends.

The company is a very long-term sort of renewables play. It’s easily one of the longest-timeframe investments I currently hold in my portfolio. Barring no deterioration in fundamentals, I am not touching this investment until at least 2030, or until it goes above €50/share for the native, at which point I’d sit on a 100% RoR or above.

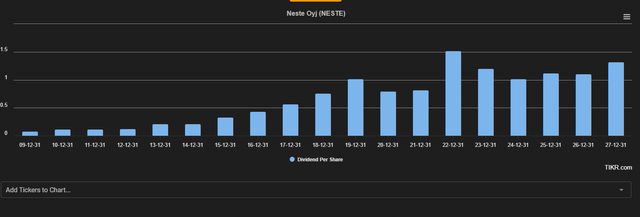

The current dividend payment also means that the yield for this company at this time is over 6.3%. What happens in 2024 is anyone’s guess – but here is the history and S&P Global forecasts for exactly that.

Neste Dividend Forecast TIKR.com (Neste Dividend Forecast TIKR.com)

So while we’re going down, I would agree with the forecast that we’re not going far below €1, or even maybe below €1/share. This means a yield of at least 5%, even if only implied, and potentially growing again as early as 2025-2026E.

This means that even just based on a 15x P/E forecast based on estimates and forecasts that Neste has positively beaten more than 70% of the time, the company has an annualized upside of at least 28% per year, and close to triple digits for the 2026E period.

In the case of normalization, that upside goes up to well beyond 30% per year, or in the triple digits.

Other analysts call this company a “BUY” as well. 22 S&P Global analysts follow Neste, and they are at a range from €19.5 to €45/share, which means that the cheapest-considered share price target is now being “beaten” by the company in terms of a downturn, and the average for these 22 analysts is roughly €30/share with 12 analysts t a “BUY” or “Outperform” rating on the company. Only 1 analyst is at a “SELL” out of 22. (Paywalled TIKR.com Source)

This implies a 50%+ upside from today’s share price for the company. My previous target of €47/share was calculated based on estimating a somewhat higher earnings level due to higher levels of adoption of biofuel, including Biodiesel, but the decisions by some nations, including Sweden, to slow down this adoption has caused me to moderate my expectations for Neste here – which is why you see the drop to €42/share.

Based on everything mentioned above, I have now added more to my position and may add more in the near term or if I see more weakness here. The company is too “good” in my view for the price that is being put on the shares here, and I go into June of this year 2024 with the following thesis and targets.

The obvious risk to the thesis that I present here is that the normalization or the adoption of biofuels, including sustainable aviation fuel does not go as planned, or within the timeframe or possibilities presented by the company or by me. If this happens, then this company would be, (and remain) a niche player in an industry where few could find appeal. But I view the risk of such a development as remote (or I wouldn’t be investing here).

Thesis

- Neste is perhaps one of the most interesting oil/energy companies in Europe. They’ve found their niche, and they’ve pivoted at what I view as exactly the right time to serve a market that’s going to need their products for the next few decades at the very least.

- Neste has strong financials and very strong potential. Even if the yield today isn’t that impressive, future returns could easily go into high double or low triple digits, and the capital appreciation potential is quite massive.

- Neste stock is a “BUY” with a price target of €45 here, and I’m sticking to this price as of June of 2023, with the most recent drop in the company’s valuation – even with the most recent biofuel mandate and further reductions in credits.

- I view the company as a positive potential investment for 2024-2030E.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company now fulfills all of my criteria for investing in a business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.